Company Overview: The Backbone of American DIY

The Home Depot, Inc. is the largest home improvement retailer in the United States, providing tools, construction products, appliances, and services. It operates over 2,300 stores across North America and caters to both DIY customers and professional contractors. Founded in 1978, the company has become a mainstay in residential renovation and commercial building supply. It has also expanded into digital services and supply chain innovations to improve customer experience. Home Depot’s market leadership and scale provide it with a robust moat in the retail hardware and construction materials sector.

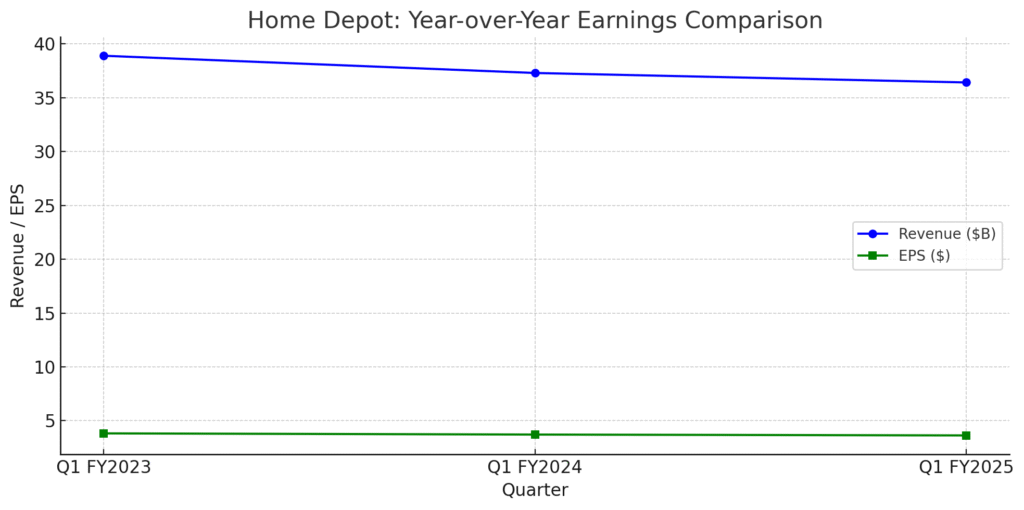

Most Recent Earnings (Q1 FY2025: Reported May 14, 2025)

Home Depot reported Q1 FY2025 earnings on May 14, 2025. Earnings per share (EPS) came in at $3.63, beating analyst expectations of $3.60, while revenue totaled $36.42 billion, narrowly missing consensus estimates of $36.66 billion. Comparable sales declined 2.8% year-over-year, reflecting continued weakness in big-ticket discretionary purchases. For fiscal 2025, the company reaffirmed its full-year guidance, projecting sales growth of approximately 1% and EPS growth in the low-single digits. Home Depot expects modest improvements in professional demand and stabilization in consumer spending by the second half of the year.

Founding, Funding, and Business Overview

Home Depot was founded in 1978 by Bernie Marcus and Arthur Blank, with the first stores opening in Atlanta, Georgia. Their vision was to create a one-stop shop with a warehouse-style format that offered a vast selection of home improvement goods at competitive prices. The company went public in 1981 and quickly expanded across the U.S. and into Canada and Mexico. Unlike tech startups, Home Depot was built organically through real estate growth and operational scale rather than venture capital funding.

Home Depot’s product lines include building materials, plumbing, paint, hardware, and garden supplies, along with in-store and virtual services like installation and rentals. The company also supports a strong professional contractor (Pro) segment, which accounts for nearly half of its revenue. HD’s digital channel has grown significantly, with over 50% of online orders now fulfilled via stores.

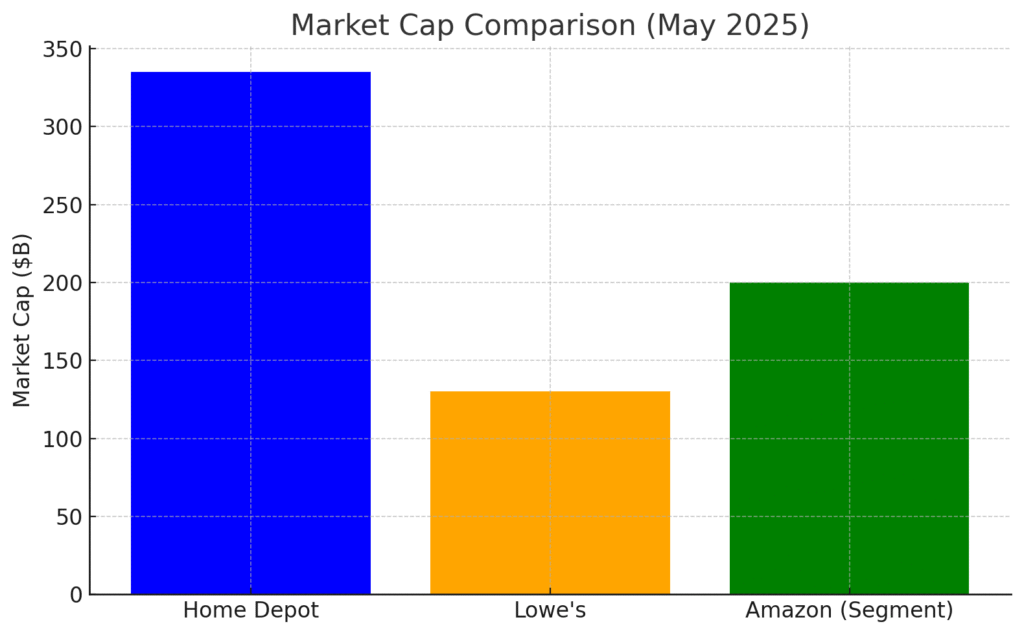

Headquartered in Atlanta, Georgia, Home Depot competes directly with Lowe’s, Menards, and regional hardware chains. In professional services, it also faces indirect competition from supply aggregators and digital platforms like Amazon Business and Build.com.

The Home Improvement Market Outlook

Home Depot operates in the $1 trillion+ North American home improvement and building supply market. The market saw major pandemic-fueled demand in 2020–2022, which has since normalized, though long-term structural tailwinds remain. Factors like aging U.S. housing stock, increasing home ownership, and the rise of remote work support long-term demand for renovation and maintenance.

According to Grand View Research and other analysts, the global home improvement market is projected to reach $1.5 trillion by 2030, growing at a CAGR of around 6.4% from 2023 to 2030. The Pro contractor segment is expected to outpace DIY as millennials and Gen Z increasingly opt to hire rather than do it themselves.

Competitive Landscape: Traditional Rivals and Digital Entrants

Home Depot’s primary competitor is Lowe’s, the second-largest home improvement chain in the U.S. While both companies overlap heavily in product assortment, Lowe’s has traditionally had more exposure to rural areas and fewer professional contractor relationships. Menards, a privately held Midwestern chain, is another key brick-and-mortar competitor with strong regional loyalty.

In digital and logistics, Amazon poses an ongoing challenge—especially for commodity items, tools, and bulk supplies. While Amazon lacks the physical infrastructure for materials delivery and Pro services, its pricing and speed appeal to smaller-scale DIYers. Other emerging players include Wayfair for home décor and specialty online retailers.

Differentiation: Scale, Services, and Supply Chain

Home Depot’s most powerful advantage is its scale—over 2,300 stores that double as logistics hubs. This infrastructure enables 90% of Americans to access same-day or next-day delivery for major items. HD also leads in serving professional contractors, offering dedicated Pro Desks, tiered loyalty programs, and robust B2B fulfillment.

Additionally, HD has invested heavily in interconnected retail, blending e-commerce with store pickup and delivery. Its One Supply Chain initiative has optimized regional warehouses, delivery capabilities, and inventory replenishment, reinforcing its ability to fend off digital-first competitors.

Management Team

Ted Decker, CEO and President since 2022, has been with Home Depot for over 20 years. Formerly EVP of Merchandising, he played a pivotal role in reshaping the company’s omnichannel approach. His leadership emphasizes operational execution and digital transformation.

Richard McPhail, EVP and CFO, joined Home Depot in 2005 and became CFO in 2019. He has helped the company navigate macro pressures through disciplined capital deployment and a conservative financial posture.

Ann-Marie Campbell, EVP of U.S. Stores and International Operations, oversees all store operations and has held multiple leadership roles since joining HD in 1985 as a cashier. She is key to driving Pro customer growth and store performance.

Financial Performance (5-Year View)

Home Depot has delivered resilient financial results over the last five years, with revenue growing from ~$108 billion in FY2020 to ~$152 billion in FY2024, representing a CAGR of ~8.9%. The 2020-2022 period saw especially strong growth due to pandemic-driven home improvement spending.

Net income grew from $11.2 billion in FY2020 to $17.1 billion in FY2024, with an earnings CAGR of roughly 11.1%. This was supported by margin expansion, Pro segment growth, and improved inventory productivity.

Home Depot has maintained a healthy balance sheet with consistent share repurchases and strong cash flows. As of Q1 FY2025, it holds over $3 billion in cash, $45 billion in total assets, and a debt-to-equity ratio below 2.0x. The company has prioritized dividend growth, increasing its payout annually for more than a decade.

Bull Case for Home Depot

- Dominant Pro customer base: Recurring, high-value purchases and service stickiness drive long-term revenue stability.

- Omnichannel leadership: Blending e-commerce with store pickup and supply chain speed differentiates HD from both digital and traditional rivals.

- Aging housing stock: Structural demand from older homes needing frequent renovation supports sustained top-line growth.

Bear Case for Home Depot

- Macroeconomic sensitivity: High-interest rates and reduced home sales can depress renovation demand and big-ticket purchases.

- Stagnant DIY demand: Post-pandemic normalization and generational shifts may reduce growth in the DIY segment.

- Looming eCommerce threats: Amazon and newer digital marketplaces could erode margins on commoditized items over time.

The stock is on a stage 4 bearish markdown on the monthly chart, and attempting a stage 1 reversal and consolidation on the weekly chart. The daily chart is in stage 2 markup (bullish), and should head to $400 range soon.