Cava Group, Inc. (NYSE: CAVA) is a U.S.-based fast-casual restaurant chain specializing in Mediterranean cuisine.Founded in 2006 as Cava Mezze, the company has grown to operate over 370 locations across the United States. Cava offers customizable bowls, pitas, and salads, emphasizing fresh ingredients and bold flavors. In addition to its restaurant operations, Cava sells a line of dips, spreads, and dressings in grocery stores nationwide. Headquartered in Washington, D.C., Cava has positioned itself as a leader in the Mediterranean fast-casual dining segment.

In its most recent earnings report for the first quarter of 2025, Cava reported earnings per share (EPS) of $0.22, surpassing analysts’ expectations of $0.14. Revenue for the quarter was $328.5 million, a 28% increase year-over-year, slightly above the anticipated $327 million. The company opened 15 new locations during the quarter, and same-restaurant sales increased by 10.8%, supported by a 7.5% rise in customer visits. Looking ahead, Cava plans to open up to 68 new restaurants in 2025 and expects 6% to 8% same-store sales growth. The company also announced it has no plans to raise menu prices for the remainder of 2025, emphasizing its commitment to value amid economic uncertainties.

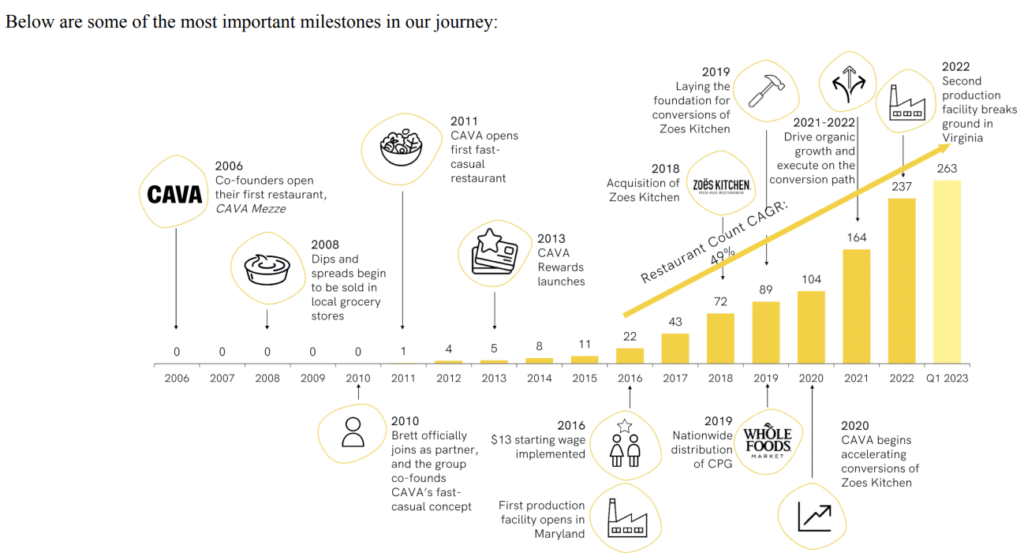

Cava was founded in 2006 by Ted Xenohristos, Ike Grigoropoulos, and Dimitri Moshovitis, who opened the first Cava Mezze restaurant in Rockville, Maryland. In 2010, Brett Schulman joined as a co-founder and CEO, helping to transition the brand into a fast-casual concept. The company has since expanded rapidly, acquiring Zoës Kitchen in 2018 to accelerate growth and convert locations into Cava restaurants. Cava’s product offerings include a variety of Mediterranean-inspired dishes, with an emphasis on fresh, customizable meals. Key competitors in the fast-casual dining space include Chipotle Mexican Grill, Shake Shack, and Sweetgreen. Cava is headquartered in Washington, D.C., and continues to focus on expanding its footprint across the United States.

The fast-casual dining market in which Cava operates has experienced significant growth in recent years, driven by consumer demand for healthier, customizable dining options. Industry analysts project continued expansion in this segment, with expectations of a compound annual growth rate (CAGR) of approximately 10% through 2030. Cava’s focus on Mediterranean cuisine positions it well within this trend, as consumers increasingly seek diverse and flavorful alternatives to traditional fast food. The company’s commitment to fresh ingredients and customizable meals aligns with evolving consumer preferences, supporting its growth prospects in the competitive fast-casual landscape.

Cava faces competition from several established and emerging players in the fast-casual dining sector. Chipotle Mexican Grill remains a dominant force, offering customizable Mexican-inspired dishes with a strong emphasis on fresh ingredients. Shake Shack and Sweetgreen also compete in the space, focusing on high-quality ingredients and innovative menu offerings. Additionally, Cava contends with regional Mediterranean chains and other health-focused fast-casual concepts seeking to capture market share. To differentiate itself, Cava emphasizes its Mediterranean roots, diverse menu, and commitment to value, aiming to carve out a unique niche in the crowded fast-casual market.

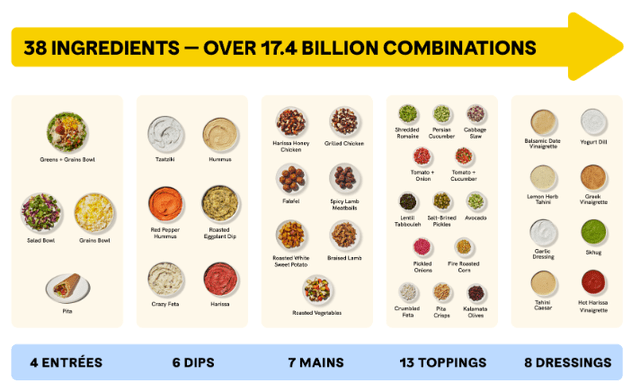

Cava’s unique differentiation lies in its focus on Mediterranean cuisine, offering a diverse and customizable menu that sets it apart from competitors. The company’s commitment to fresh, high-quality ingredients and bold flavors appeals to health-conscious consumers seeking alternatives to traditional fast food. Cava’s strategic expansion, including the acquisition and conversion of Zoës Kitchen locations, has accelerated its growth and increased brand visibility. By maintaining competitive pricing and avoiding menu price increases in 2025, Cava reinforces its value proposition, further distinguishing itself in the fast-casual dining landscape.

The management team at Cava is led by CEO Brett Schulman, who co-founded the company in 2010 and has been instrumental in its growth and transformation into a fast-casual powerhouse. Tricia K. Tolivar serves as Chief Financial Officer, bringing extensive experience in financial management and strategic planning. Jennifer Somers holds the position of Chief Operations Officer, overseeing the company’s restaurant operations and ensuring consistent execution across locations. Together, the leadership team focuses on driving growth, innovation, and operational excellence to support Cava’s continued success.

Over the past five years, Cava has demonstrated strong financial performance, marked by consistent revenue growth and strategic expansion. The company’s acquisition of Zoës Kitchen in 2018 significantly increased its restaurant count and market presence. Cava’s revenue has grown steadily, with a notable 28% year-over-year increase reported in the first quarter of 2025. The company’s focus on operational efficiency and cost management has contributed to improved profitability, with earnings per share rising from $0.12 in the prior year to $0.22 in the latest quarter. Cava maintains a solid balance sheet, supporting its ongoing growth initiatives and positioning it well for future expansion.

Bull Case for CAVA Stock:

- Continued strong same-store sales growth driven by increasing consumer demand for healthy, customizable dining options.

- Strategic expansion through new restaurant openings and conversions of former Zoës Kitchen locations, enhancing market presence.

- Commitment to value pricing and operational efficiency, supporting profitability and customer loyalty.

Bear Case for CAVA Stock:

- Intensifying competition in the fast-casual dining sector, potentially impacting market share and growth.

- Economic uncertainties and inflationary pressures could affect consumer spending and operational costs.

- Challenges in maintaining consistent quality and customer experience amid rapid expansion.

Recent Income Statement and Balance Sheet:

As of the first quarter of 2025, Cava reported revenue of $328.5 million, a 28% increase year-over-year, and earnings per share of $0.22. The company’s balance sheet reflects a strong financial position, with sufficient liquidity to support its growth initiatives. Cava’s strategic focus on operational efficiency and cost management has contributed to improved profitability and a solid foundation for future expansion.

Market Capitalization vs. Peers:

Cava’s market capitalization stands at approximately $11.5 billion, positioning it competitively among fast-casual dining peers. The company’s growth trajectory and strategic initiatives have contributed to its robust market valuation, reflecting investor confidence in its long-term prospects.

Valuation Metrics:

- Price-to-Earnings (P/E) Ratio: Approximately 87.9x

- Enterprise Value (EV): Approximately $11.5 billion

- EV/Revenue: Approximately 6.24x

- EV/EBITDA: Approximately 61.6x

These valuation metrics indicate a premium valuation, reflecting investor expectations for continued growth and profitability.

The stock is in a stage 2 bullish markup on the weekly chart and the cup pattern is somewhat bullish. We would wait for the confirmed handle to ensure this is a good buy. On the daily chart, the stock is in a stage 3 consolidation with a move lower likely to reverse in the $89 range.