Executive Summary:

Spirit AeroSystems is a major global manufacturer of aerostructures for commercial airplanes, defense platforms, and business/regional jets. The company specializes in complex assemblies made from both aluminum and advanced composite materials. Their primary products include fuselages, wings, pylons, and nacelles, serving key customers like Boeing and Airbus.

Spirit AeroSystems reported Earnings Per Share (EPS) was $(5.38), while the adjusted EPS was $(4.22). The company’s revenue for the quarter was $1.7 billion. The adjusted EPS of $(4.22) missed the analysts’ consensus estimate of $(1.86) per share.

Stock Overview:

| Ticker | $SPR | Price | $33.83 | Market Cap | $3.97B |

| 52 Week High | $37.08 | 52 Week Low | $27.00 | Shares outstanding | 117.27M |

Company background:

Spirit AeroSystems Holdings Inc. was founded in 2005 when Boeing divested its Wichita Division and Oklahoma operations. This includes the Stearman Aircraft Company, which moved to Wichita in 1927 and was later acquired by Boeing, and Short Brothers, a UK aircraft manufacturer dating back to 1908 that became part of Bombardier. The formation of Spirit AeroSystems marked a strategic shift for the Wichita facility from being a single-source supplier under Boeing to an independent, global provider of aerostructures.

The spin-off from Boeing in 2005 essentially served as the initial funding for Spirit AeroSystems. Spirit AeroSystems has secured financial support from its major customers, Boeing and Airbus, in the form of advance payments and credit lines to navigate financial challenges and ensure operational stability amidst production rate changes and other industry headwinds. Boeing provided up to $350 million in advance payments, and Airbus extended a $107 million line of credit in early 2025.

Spirit AeroSystems is a major global manufacturer of aerostructures for commercial airplanes, defense platforms, and business/regional jets. Its core products include fuselages (complete aircraft bodies or sections), integrated wings and wing components (like leading and trailing edges, spars, and control surfaces), pylons (structures that connect engines to wings), and nacelles (engine housings). The company has expertise in both aluminum and advanced composite manufacturing. They supply these critical components to major aircraft manufacturers worldwide, with programs including parts for the Boeing 737, 747, 767, 777, and 787, as well as the Airbus A220, A320, A350, and A380 families. They also serve the aftermarket for commercial and business/regional jets.

Key competitors for Spirit AeroSystems include other large aerostructures manufacturers and suppliers to the aerospace industry. These include companies like GKN Aerospace, Airbus Atlantic (formerly STELIA Aerospace), Triumph Group, Safran, and Kawasaki Heavy Industries. These firms compete on factors such as technological capabilities, manufacturing efficiency, product quality, and their ability to meet the demands of major aircraftOriginal Equipment Manufacturers (OEMs) like Boeing and Airbus. The competitive landscape is also influenced by the trend of OEMs increasingly looking to consolidate their supply chains.

Spirit AeroSystems Holdings Inc. is headquartered in Wichita, Kansas, in the United States. This location has a long and rich history in aviation manufacturing, dating back to the early days of the industry. This global footprint allows the company to support its international customer base and leverage different regional capabilities.

Recent Earnings:

Spirit AeroSystems reported revenue was $1.7 billion, a decrease of 9% compared to the $1.8 billion reported in the same period of 2023. This decline was primarily attributed to the impacts of the Boeing Memorandum of Agreement (MOA), which included favorable pricing adjustments on the Boeing 787 program and the reversal of a potential claim related to Boeing. The revenue increased by 4% to $6.3 billion, up from $6.0 billion in 2023, driven by higher Boeing 737 deliveries and the timing of working capital.

Spirit AeroSystems reported a net loss per share (EPS) of $(5.38) for the fourth quarter of 2024, compared to an EPS of $0.66 in the fourth quarter of 2023. The adjusted EPS for the quarter was $(4.22), which excludes certain items like the incremental deferred tax asset valuation allowance, compared to an adjusted EPS of $0.62 in the prior year. The net loss per share was $(18.32), and the adjusted net loss per share was $(13.92).

The reported adjusted EPS of $(4.22) for the fourth quarter missed the analysts’ consensus estimate, which was $(1.86). The revenue of $1.7 billion was in line with analysts’ expectations of $1.65 billion. Spirit AeroSystems saw a notable increase in deliveries during the fourth quarter of 2024 compared to the previous quarter, with Boeing 737 deliveries doubling, Airbus A220 deliveries increasing by 37%, and Airbus A350 deliveries rising by 15%. The company recognized net forward losses of $440 million during the quarter, mainly driven by the Boeing 787, Airbus A220, and Airbus A350 programs due to production performance issues and rising labor and supply chain costs.

They highlighted progress in process improvement initiatives leading to increased delivery quality and quantity. Despite securing advance payments and credit lines from Boeing and Airbus in 2024 to bolster liquidity, the company anticipates continued operating losses in the near term and acknowledges the need for additional funding to sustain operations until the acquisition is finalized.

The Market, Industry, and Competitors:

Spirit AeroSystems operates within the global aerospace industry, primarily focusing on the aerostructures market. This market encompasses the design, manufacture, and assembly of major structural components for aircraft, including fuselages, wings, pylons, and nacelles. The aerospace industry is broadly segmented into commercial aviation, military and defense, and business and general aviation. Spirit AeroSystems has a presence in the commercial aviation sector, serving major OEMs like Boeing and Airbus, and also has involvement in the defense and business jet markets.

A Compound Annual Growth Rate (CAGR) for the broader aerospace and defense market in the range of 6% to 9% between 2023/2024 and 2030. Factors driving this growth include increasing global air passenger traffic, a rising middle class in emerging economies, the need to replace aging aircraft with more fuel-efficient models, and growing investments in defense and military aerospace. Their projections indicate a CAGR of around 7% to 7.5% during the forecast period of 2024-2030, with the market size expected to reach over $130 billion by 2030.

The increasing demand for commercial aircraft, particularly narrow-body and wide-body jets, where Spirit is a key supplier, suggests a strong need for their products. Furthermore, the rising focus on sustainable aviation and the use of lightweight composite materials, an area where Spirit has expertise, could present additional opportunities. The company’s future performance will also depend on its ability to improve operational efficiencies, manage supply chain challenges, and successfully integrate or operate within Boeing’s structure post-acquisition.

Unique differentiation:

Spirit AeroSystems operates in the highly competitive global aerospace industry, specifically within the aerostructures market. This segment involves the design, manufacture, and assembly of critical structural components for aircraft. The competitive landscape includes a mix of large, established players and smaller, more specialized companies. These competitors vie for contracts from major aircraft manufacturers like Boeing and Airbus, as well as for defense and business jet programs. Key areas of competition include technological innovation, cost-effectiveness, production efficiency, quality, and the ability to meet the demanding delivery schedules of OEMs.

These include GKN Aerospace, which has a broad portfolio of aerostructures and systems; Airbus Atlantic (formerly STELIA Aerospace); and Triumph Group, which offers a range of aircraft structures and components. Other notable competitors include Safran, which, while also involved in engines and other systems, has a substantial aerostructures business, and Kawasaki Heavy Industries, a Japanese conglomerate with a significant aerospace division producing aircraft structures.

Beyond these direct aerostructures manufacturers, Spirit AeroSystems also faces competition from companies that offer alternative materials or manufacturing processes, as well as those providing broader aerospace services or components that could be integrated or offered as part of a larger package to OEMs. Companies in this market continuously invest in research and development to offer advanced, lightweight, and cost-efficient solutions to meet the evolving needs of the aerospace industry, particularly the growing demand for fuel-efficient and sustainable aircraft.

Heritage and deep-rooted expertise in large, complex aerostructures, particularly fuselages, are significant. Originating from Boeing’s Wichita division, Spirit has decades of experience in designing, engineering, and manufacturing these critical aircraft components, establishing a strong foundation of technical know-how and production capabilities that are not easily replicated.

Innovation in materials and manufacturing processes sets them apart. They have demonstrated a commitment to developing and implementing advanced technologies, such as their proprietary Joule Form™ process for titanium fabrication and advancements in composite manufacturing. These innovations can lead to more cost-effective, lighter, and higher-performance aerostructures, providing a competitive edge in meeting the evolving demands of the aerospace industry for fuel efficiency and advanced materials.

Management & Employees:

Patrick M. Shanahan: The President and Chief Executive Officer. He brings extensive experience from his long tenure at Boeing and his service as the U.S. Deputy Secretary of Defense.

Irene Esteves: Executive Vice President and Chief Financial Officer in June 2024. Her background includes significant financial roles at Time Warner Cable and XL Group plc.

Sean Black: The Senior Vice President of Engineering and R&T, and Chief Technology Officer.

Kailash Krishnaswamy: Senior Vice President and Chief Procurement Officer

Justin Welner, Senior Vice President, Chief Administration & Compliance Officer.

Financials:

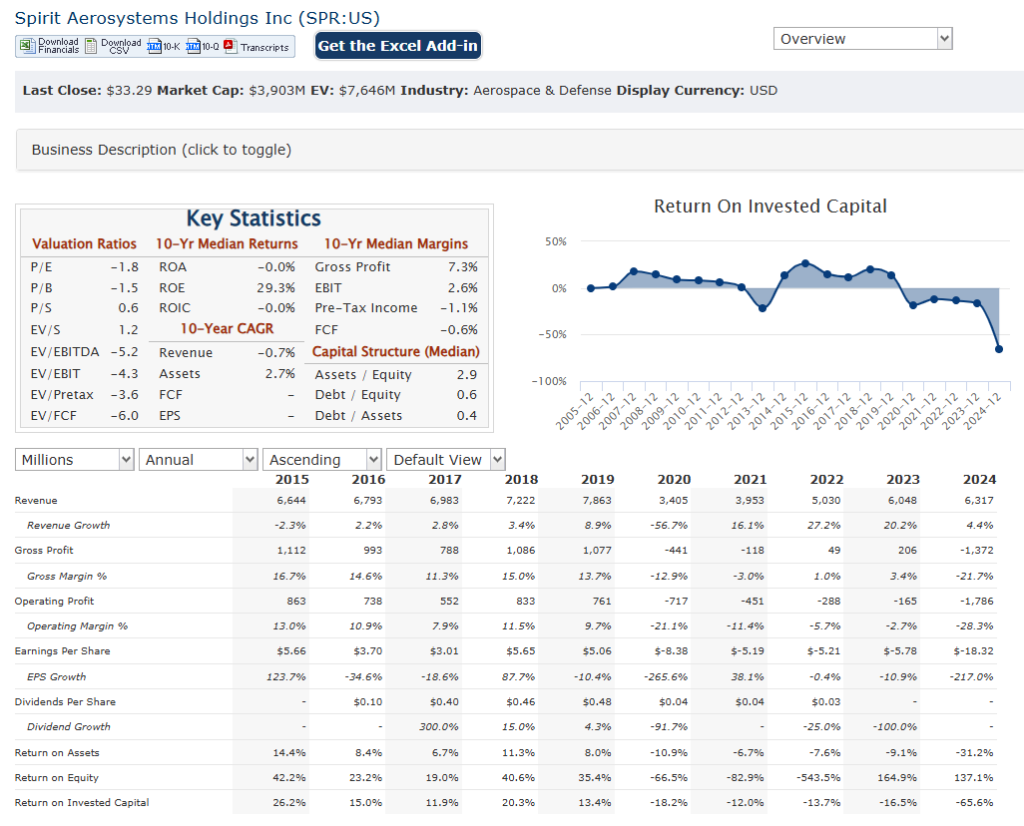

Spirit AeroSystems Holdings Inc has annual revenues increasing from around $3.95 billion in 2021 to approximately $6.32 billion in 2024. This represents a compound annual growth rate (CAGR) of about 4.2% to 4.4%. The company’s revenue growth has been supported by increased deliveries on key programs like the Boeing 737 and Airbus A220 and A350, although recent quarters showed some revenue declines due to pricing adjustments and production changes related to Boeing agreements.

The company has been unprofitable for the past five years, with net losses accelerating at an average annual rate of approximately 35.4%. Earnings per share (EPS) also declined sharply, reflecting operational difficulties, cost pressures, and unfavorable adjustments on major programs such as the Boeing 787 and Airbus models. The company reported a loss of $2.14 billion, with a fourth-quarter EPS of $(5.38), down from positive earnings in prior years. These losses have been driven by production inefficiencies, labor and supply chain cost increases, and excess capacity expenses.

Spirit AeroSystems has faced liquidity pressures, leading to reliance on advance payments and credit lines from major customers Boeing and Airbus. As of the end of 2024, the company held a cash balance of around $537 million, supported by $200 million advanced from Boeing and $70 million from Airbus. Despite these measures, the company’s liabilities exceed its assets, complicating traditional profitability metrics like return on equity.

Spirit AeroSystems has demonstrated consistent revenue growth with a CAGR near 4.2%, but this has been overshadowed by steep and increasing losses, with earnings declining at over 35% annually. The company is currently navigating operational restructuring and preparing for an acquisition by Boeing.

Technical Analysis:

The stock is range bound (large range from $16 to $37) on the monthly and weekly charts, but the daily chart is in stage 2 of a dramatic reversal from its lows of $27 to $35 in 4 sessions. This usually means the stock should see a move lower to the resistance and has some support in the $33 range.

Bull Case:

Acquisition price and structure provide a degree of downside protection and potential upside for current Spirit shareholders. The all-stock transaction, valued at approximately $37.25 per share based on Boeing’s stock price at the time of the announcement, offered a premium to Spirit’s trading price. While the final value will fluctuate with Boeing’s stock, the agreed-upon terms provide a clear exit strategy for investors.

Operational improvements and the strong aerospace market outlook: The company has been implementing process improvement initiatives that have shown some positive results in delivery numbers and quality. With the broader aerospace market projected to grow significantly by 2030, driven by increasing air travel demand, Spirit’s fundamental business as a key aerostructures supplier remains well-positioned for long-term growth, regardless of the Boeing deal.

Bear Case:

Spirit’s precarious financial situation: The company has reported significant net losses and negative cash flow, coupled with a substantial debt burden. While Boeing and Airbus have provided some financial support, the long-term viability of Spirit as an independent entity was questionable, which was a key driver for the acquisition. Until the deal closes, Spirit remains vulnerable to operational disruptions, further financial deterioration, and the need for additional financing, which could dilute existing shareholders’ equity if the Boeing deal falls through.

The integration process and potential liabilities: Boeing’s acquisition is partly motivated by the need to address quality issues originating from Spirit. Integrating Spirit’s operations and culture into Boeing’s could be a complex and time-consuming process, potentially leading to further disruptions and unexpected expenses. The net forward losses recognized by Spirit on key programs also highlight underlying operational inefficiencies that Boeing will need to address.