Executive Summary:

FormFactor, Inc. is a leading provider of essential test and measurement technologies for the semiconductor industry, enabling chipmakers to develop and produce high-performance integrated circuits. The company designs, manufactures, and supports a range of products, including probe cards, analytical probes, probe stations, metrology systems, and cryogenic solutions used across the full semiconductor product lifecycle. FormFactor’s innovative MEMS technology is integral to their advanced wafer probe cards, which are crucial for testing the electrical performance and reliability of semiconductor devices.

FormFactor, Inc. reported Earnings Per Share (EPS) on a non-GAAP basis was $0.27, which was $0.02 lower than the analysts’ consensus estimate of $0.29, representing a negative surprise of 6.9%. The company’s revenue for the quarter was $189.5 million, slightly below the analysts’ expectation of $189.9 million, indicating a negative revenue surprise of 0.3%.

Stock Overview:

| Ticker | $FORM | Price | $24.64 | Market Cap | $1.9B |

| 52 Week High | $63.63 | 52 Week Low | $22.58 | Shares outstanding | 77.08M |

Company background:

FormFactor, Inc. was founded in April 1993 by Dr. Igor Y. Khandros, a former IBM researcher, in a small lab in Elmsford, New York. Khandros’ initial work focused on developing innovative products for the semiconductor industry, leading to the foundational wire-bonded MicroSpring technology. This technology proved crucial for various semiconductor applications, including sockets, packaging, and probe cards. FormFactor’s early days were marked by a focus on practical innovation to help semiconductor manufacturers keep pace with Moore’s Law.

FormFactor has evolved into a leading provider of essential test and measurement technologies for the entire semiconductor product lifecycle. Their comprehensive product portfolio includes advanced wafer probe cards for high-performance testing of integrated circuits, analytical probes for on-wafer characterization, and probe stations for precise device testing and measurement. The company offers metrology systems, thermal control solutions, and cryogenic test and measurement systems for quantum computing applications. FormFactor’s MEMS-based probe technology is a core differentiator, enabling accurate and reliable testing of increasingly complex semiconductor devices. These products cater to a wide range of applications, from research and development to high-volume production testing in the computing, communications, automotive, and other technology sectors.

Key competitors for FormFactor in the semiconductor test and measurement industry include companies such as Advantest Corporation, MKS Instruments (which includes Electro Scientific Industries – ESI), and Cohu. These companies offer various testing solutions, including probe cards, test handlers, and automated test equipment. The company’s ability to provide solutions for both engineering characterization and high-volume production gives it a competitive edge in serving the diverse needs of semiconductor manufacturers.

FormFactor’s corporate headquarters is located in Livermore, California. This location serves as the central hub for the company’s management, research and development, and administrative functions. These include design centers, manufacturing sites, sales offices, and service and support centers, allowing the company to effectively serve its international customer base and maintain close collaboration with semiconductor companies worldwide.

Recent Earnings:

FormFactor, Inc. reported revenue for the quarter reached $189.5 million, representing a 12.7% increase compared to the $168.2 million reported in the fourth quarter of fiscal year 2023. This growth was primarily driven by a significant increase in High Bandwidth Memory (HBM) revenue, which more than quadrupled compared to the previous year due to the adoption of generative AI technologies. However, the reported revenue slightly missed the analysts’ consensus estimate of $189.9 million.

FormFactor reported a non-GAAP Earnings Per Share (EPS) of $0.27 for the fourth quarter of 2024. This figure was lower than the $0.35 EPS reported in the third quarter of the same fiscal year and higher than the $0.20 EPS in the fourth quarter of the previous year. The reported EPS also fell short of the analysts’ expectations, which had projected $0.29. The company’s non-GAAP gross margin for the quarter was 40.2%, a decrease from the 42.2% in the prior quarter and 42.1% in the same quarter of the previous year. This margin was impacted by the product mix, with a higher proportion of DRAM probe card revenue.

The company noted a forecasted reduction in Foundry & Logic probe card revenue, which contributed to the sequential decline in overall revenue and profitability. FormFactor anticipates revenue in the first quarter of fiscal year 2025 to be in the range of $165 million to $175 million. The company expects non-GAAP EPS to be between $0.03 and $0.11 for the same period. The company cited continued slow demand in high-volume markets like client PCs and mobile handsets as a contributing factor to this outlook, although they anticipate an overall demand increase for their products throughout 2025.

The Market, Industry, and Competitors:

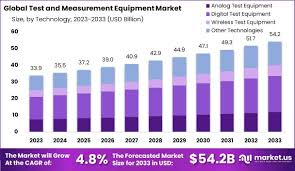

FormFactor, Inc. operates within the semiconductor test and measurement equipment market. This market is crucial for ensuring the quality, reliability, and performance of integrated circuits throughout their lifecycle, from research and development to high-volume manufacturing. The demand for semiconductor test and measurement solutions is intrinsically linked to the advancements and growth of the broader semiconductor industry, which is driven by increasing demand for electronics across various sectors, including computing, communications, automotive, healthcare, and artificial intelligence. As semiconductor devices become more complex and feature sizes shrink, the need for sophisticated testing and measurement equipment becomes even more critical to identify defects and ensure optimal functionality.

A Compound Annual Growth Rate (CAGR) in the range of 4.6% to 7.7% between 2024/2025 and 2030/2034. This growth is fueled by several factors, including the increasing complexity of semiconductor designs, the rising adoption of advanced packaging technologies, and the growing demand for semiconductors in emerging applications like 5G, IoT, and electric vehicles. The continuous push for higher performance and energy efficiency in electronic devices necessitates stringent testing procedures, further driving the demand for FormFactor’s specialized probe cards, analytical probes, probe stations, and metrology systems.

The global semiconductor market is projected to reach a staggering USD 1 trillion by 2030, according to some industry analysis. This exponential growth in the semiconductor industry will directly translate to increased demand for testing and measurement equipment to support the production and quality assurance of these chips. The company’s focus on innovative MEMS-based probe technology and its ability to cater to both engineering characterization and high-volume production testing provide a strong foundation for future expansion in this dynamic market.

Unique differentiation:

FormFactor, Inc. operates in a highly competitive semiconductor test and measurement equipment market. One of its primary competitors is Advantest Corporation, a major Japanese manufacturer of automatic test equipment (ATE) for the semiconductor industry. Advantest offers a broad range of testing solutions, including memory testers and system-on-chip (SoC) testers, and has a significant global presence. While specific recent market share data is not readily available, Advantest has historically been a dominant player in certain segments of the ATE market, often competing directly with FormFactor in advanced testing applications.

Another key competitor is MKS Instruments, which expanded its presence in the semiconductor test and measurement space through its acquisition of Electro Scientific Industries (ESI). MKS offers a variety of process and analytical solutions, including laser processing systems used in semiconductor manufacturing and testing. While not all of MKS’s portfolio directly overlaps with FormFactor’s probe card-centric business, their presence in adjacent areas of semiconductor manufacturing and testing makes them a relevant competitor, particularly as testing needs evolve with advanced packaging and integration techniques.

Cohu is also a notable competitor in the semiconductor test handling and interface solutions market. While FormFactor focuses more on the wafer probe card segment, Cohu provides equipment for the subsequent stages of semiconductor testing, including test handlers and contactors. However, there can be some overlap in the broader context of enabling overall semiconductor testing workflows. Additionally, FormFactor has also noted competition from probe card vendors based in Asia, such as Japan Electronic Materials Corporation and Micronics Japan Co., Ltd., particularly in price-sensitive segments of the market. These competitors offer lithographically patterned probe cards, similar to some of FormFactor’s offerings.

FormFactor, Inc. differentiates itself from its competitors in several key ways, establishing a strong position in the semiconductor test and measurement market. A primary differentiator is its leading expertise and innovation in MEMS (Micro-Electro-Mechanical Systems) probe technology. FormFactor is recognized as the world’s leading manufacturer of MEMS probes, which are integral to their advanced wafer probe cards. This technology enables the creation of probes with micron-level precision, crucial for testing the increasingly fine-pitch and high-pin count requirements of leading-edge semiconductor devices and advanced packaging. Their composite-metal MEMS technology allows for millions of reliable contact cycles, or touchdowns, demonstrating superior durability and accuracy compared to traditional probe technologies.

FormFactor’s customized solutions and broad product portfolio. Unlike competitors who might offer more off-the-shelf products, FormFactor designs its probe cards to fit the unique chip designs and testing requirements of its customers. This ability to tailor solutions for specific wafer and chip layouts, as well as electrical voltage needs, provides a significant advantage in handling complex and expensive semiconductors without damage. Furthermore, FormFactor offers a diverse range of products beyond just probe cards, including analytical probes, probe stations, metrology systems, thermal control, and cryogenic solutions. This “Lab to Fab” portfolio allows them to serve customers across the entire semiconductor product lifecycle, from research and development to high-volume production, providing a more comprehensive partnership than competitors with narrower focuses.

FormFactor benefits from its strong customer relationships and global support infrastructure. The company has consistently received high ratings for customer satisfaction, technical support, and performance from industry analysts and customers alike. Their significant investment in research and development, coupled with a global network of facilities including design centers, manufacturing sites, and service and support centers across Asia, Europe, and North America, ensures they can effectively meet the evolving needs of semiconductor manufacturers worldwide. This commitment to customer collaboration and comprehensive support, combined with their technological leadership and broad product range, creates significant barriers to entry and sustains FormFactor’s competitive edge.

Management & Employees:

Michael D. Bruzzone serves as the Chief Executive Officer (CEO) and President of FormFactor. He joined the company in June 2023. With extensive experience in the semiconductor and technology industries, Bruzzone is responsible for leading the company’s overall strategy, operations, and growth initiatives. His background includes leadership roles focused on driving innovation and market expansion.

Amy K. Leong is the Senior Vice President, Corporate Marketing and Investor Relations. She joined FormFactor in August 2014. Leong is responsible for the company’s global marketing strategy, brand management, corporate communications, and investor relations program. Her role involves communicating FormFactor’s strategy and performance to the investment community and managing the company’s public image.

Klaus Rinnen serves as the Senior Vice President and General Manager, Products. He joined FormFactor in May 2017. Rinnen leads the company’s product strategy and development across its various business lines, including probe cards, analytical probes, and systems. His deep understanding of the semiconductor test market and technology trends is crucial for driving product innovation and market competitiveness.

Charles G. Robillard holds the position of Executive Vice President, Global Operations. He joined FormFactor in November 2018. Robillard is responsible for the company’s worldwide manufacturing operations, supply chain management, and quality control. His focus is on optimizing operational efficiency and ensuring the timely delivery of high-quality products to FormFactor’s global customer base.

Financials:

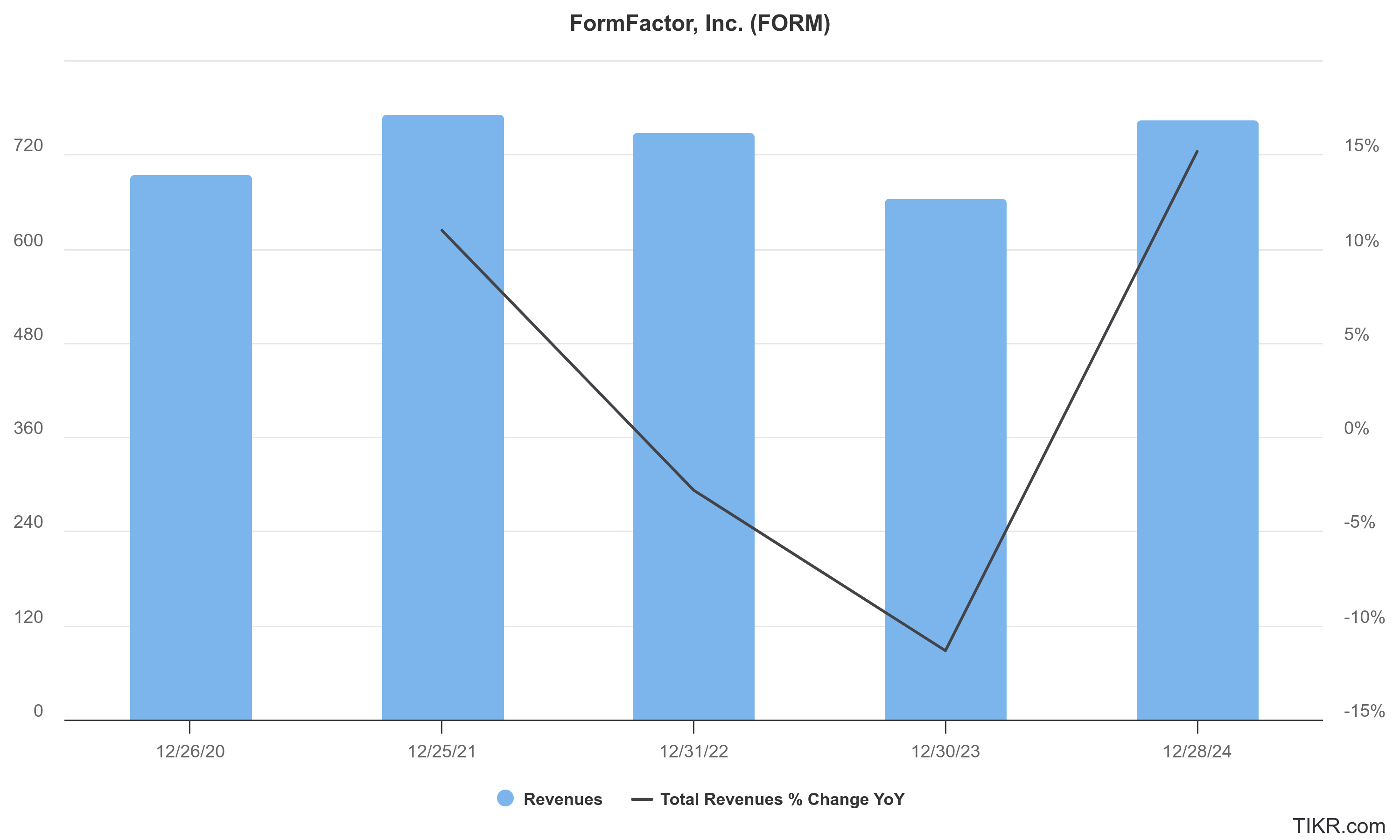

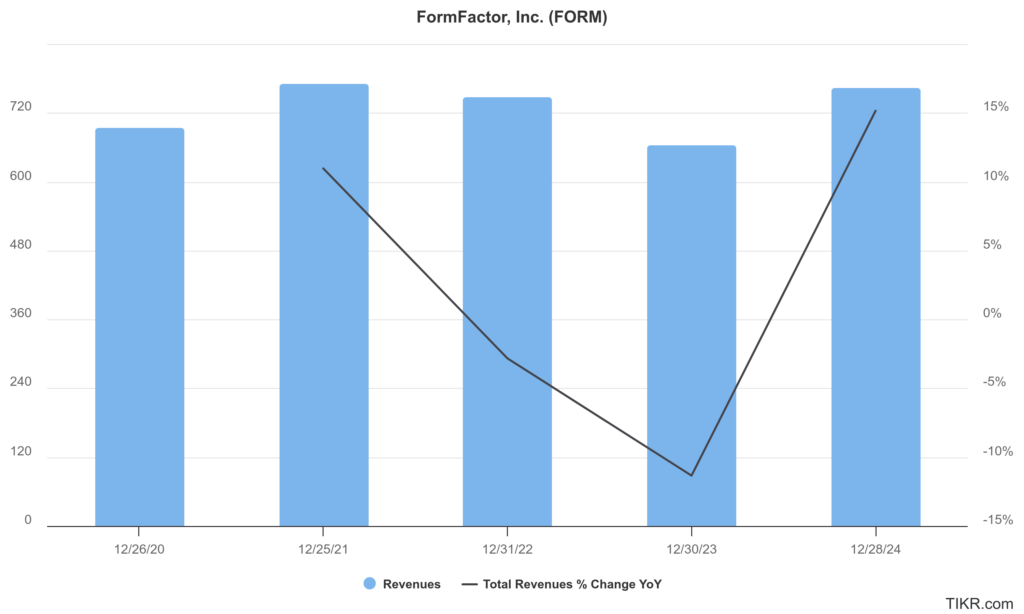

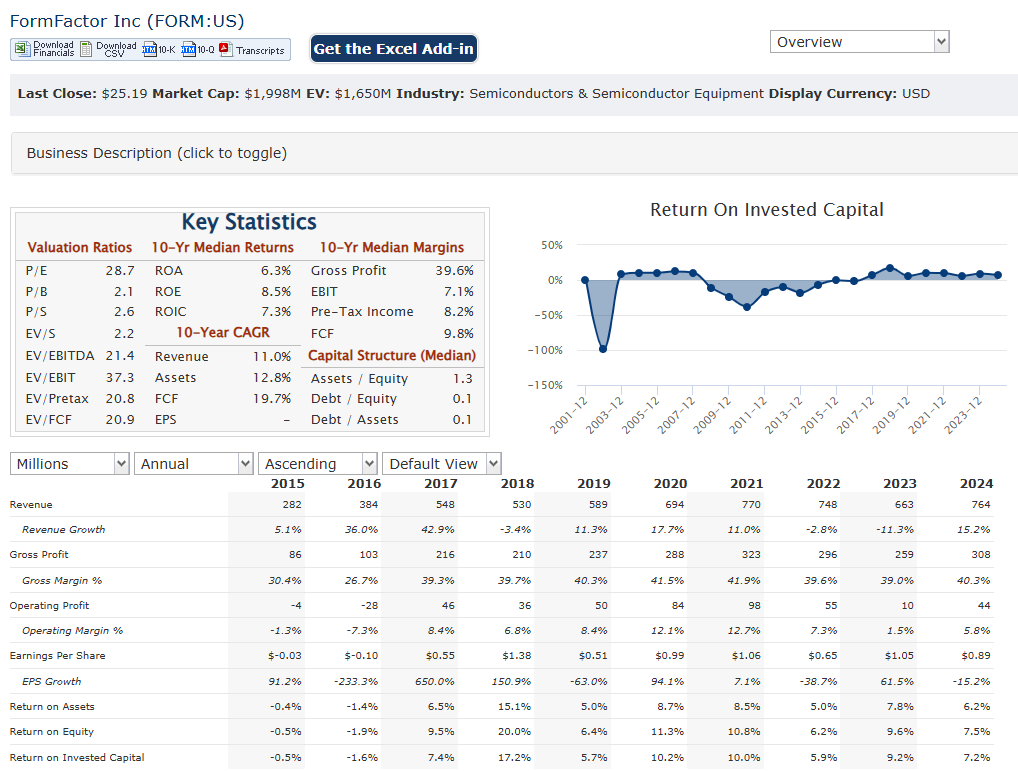

FormFactor Inc. has revenue increased from approximately $694 million in 2020 to $764 million in 2024, representing a compound annual growth rate (CAGR) of about 2.4%. When revenue rose by 15.2% year-over-year, driven by robust demand in high bandwidth memory (HBM) and advanced packaging markets. Net income fluctuated, with a high of $82.4 million in 2022, a dip to $69.6 million in 2023, and a rebound to $75.8 million in 2024. Over the five-year period, the net income CAGR is roughly -1.6%, reflecting both industry cyclicality and one-time gains, such as the gain on the sale of a business in 2022 and 2023.

Earnings per share (EPS) also mirrored this trend, with diluted EPS ranging from $0.99 in 2020 to $0.97 in 2024, peaking at $1.05 in 2022. Operating margins have compressed in recent years, with the GAAP operating margin falling from around 12% in 2020 to 8.5% in 2024. Book value per share increased from $9.61 in 2020 to an estimated $13.3 in 2024, reflecting steady asset growth and retained earnings.

The company consistently generated positive operating cash flow, with $117.5 million in 2024, up from $64.6 million in 2023, supporting ongoing investments in research and development and capital expenditures. The company’s ability to generate cash and maintain low leverage provides flexibility for future investments and positions it well to capitalize on emerging semiconductor trends

Technical Analysis:

The stock is in a bearish stage 4 on all 3 timeframes and looks like it should head lower to $16 – $22 range for a reversal. It is not a stock we are interested in currently.

Bull Case:

FormFactor is exceptionally well-positioned to benefit from the burgeoning demand for High Bandwidth Memory (HBM), which is crucial for artificial intelligence (AI) applications and high-performance computing. As generative AI continues its rapid adoption, the demand for HBM is expected to surge, and FormFactor’s leading probe card technology is essential for testing these advanced memory chips.

FormFactor’s expertise in MEMS-based probe technology provides a significant competitive advantage in testing these advanced chips with finer pitches and higher pin counts. This technological leadership allows them to command premium pricing and maintain strong relationships with leading semiconductor manufacturers. Furthermore, their “Lab to Fab” portfolio diversification into analytical probes, probe stations, metrology systems, and cryogenic solutions for quantum computing expands their total addressable market and reduces reliance on a single product category.

Bear Case:

A downturn in the broader semiconductor market, driven by macroeconomic factors or shifts in end-market demand (like PCs and mobile), could lead to reduced orders for FormFactor’s products, impacting their revenue and earnings. The company’s recent forward guidance, indicating lower-than-expected revenue for the upcoming quarter due to continued slow demand in some high-volume markets, highlights this cyclical vulnerability.

The ramp-up of HBM production and testing could face delays or be more concentrated among a few key customers, creating customer concentration risk. Furthermore, if the adoption of generative AI or other technologies driving HBM demand slows down, it could negatively impact FormFactor’s projected growth in this crucial segment.