Executive Summary:

Park Hotels & Resorts Inc. is a prominent American real estate investment trust (REIT) specializing in upscale and luxury hotel properties. The company strategically focuses on prime domestic markets within the United States. Its portfolio consists of a collection of high-quality hotels and resorts, situated in major urban and convention destinations. Park Hotels & Resorts aims to deliver value to its shareholders through the ownership of premier lodging assets.

Park Hotels & Resorts Inc. posted an earnings per share (EPS) of $0.32, significantly exceeding the forecasted $0.07. The company’s revenue reached $625 million, also outperforming the anticipated $610.3 million.

Stock Overview:

| Ticker | $PK | Price | $9.12 | Market Cap | $1.83B |

| 52 Week High | $17.78 | 52 Week Low | $8.62 | Shares outstanding | 201.86M |

Company background:

Park Hotels & Resorts Inc. was established in 2017 as a spin-off from Hilton Worldwide Holdings Inc. This separation was designed to allow Hilton to focus on its core hotel management and franchising business, while Park Hotels & Resorts would specialize in owning and managing the real estate assets. As a spin-off, there were no traditional “founders” in the startup sense; rather, the company was created through the strategic restructuring of Hilton. The initial funding for Park Hotels & Resorts came from the assets transferred from Hilton’s real estate portfolio.

Park Hotels & Resorts primarily focuses on owning and operating upscale and luxury hotels and resorts. Its product is essentially the high-quality lodging experience offered at these properties. The company’s portfolio encompasses a wide range of well-known hotels and resorts located in major urban and resort destinations across the United States. These properties often include significant meeting and convention spaces, making them attractive to business travelers and large events.

Key competitors for Park Hotels & Resorts include other real estate investment trusts (REITs) that specialize in hotel ownership, such as Host Hotels & Resorts, and Ryman Hospitality Properties. These companies operate in the same market segment, owning and managing large, upscale hotel properties. Competition centers around attracting guests, managing operating expenses, and optimizing the value of their real estate portfolios. Park Hotels & Resorts distinguishes itself through its focus on prime, high-demand markets and its concentration on the upper-upscale and luxury segments.

The headquarters of Park Hotels & Resorts Inc. is located in Tysons Corner, Virginia. The company’s presence in this location supports its operations and facilitates its management of a geographically diverse portfolio of hotel properties.

Recent Earnings:

Park Hotels & Resorts Inc. has reported revenue of $625 million in its fourth-quarter 2024 earnings, surpassing analyst expectations. It is necessary to examine the specific factors that contributed to these variations, such as changes in occupancy rates, average daily rates (ADR), and overall market conditions.

Park Hotels & Resorts exceeded analysts’ EPS forecasts, posting $0.32 compared to the expected $0.07. It is important to look at the yearly trends of the EPS, to see the overall health of the company’s profitability.

The company’s performance notably exceeded analysts’ projections for both revenue and EPS, signaling a positive deviation from market consensus.

The company is also undertaking significant capital investments, like the $100 million renovation at the Royal Palm Resort in Miami, which are expected to influence future performance. Park hotels & resorts has also given guidance on adjusted EBITDA, and adjusted FFO per share for the coming financial year. The company is also planning on non core asset sales, in the range of 300 to 400 million dollars.

The Market, Industry, and Competitors:

Park Hotels & Resorts operates within the U.S. lodging sector, specifically focusing on the upscale and luxury segments of major urban and resort markets. This market is highly sensitive to economic cycles, influenced by factors such as GDP growth, consumer spending, and business travel. The industry is also impacted by seasonal fluctuations and regional economic conditions. Recent trends indicate a gradual recovery in travel demand post-pandemic, with a noticeable increase in leisure travel and a more gradual return of business and group travel. The competitive landscape includes other REITs specializing in hotel ownership, as well as major hotel brands that also own and manage properties.

The U.S. lodging market is expected to continue growing, driven by increasing travel demand, both domestically and internationally. Growth expectations are tied to several factors, including the expansion of the middle class, rising disposable incomes, and the ongoing recovery of business travel. The industry is also adapting to evolving consumer preferences, such as the growing demand for experiential travel and personalized services. While precise CAGR (Compound Annual Growth Rate) projections vary, industry analysts anticipate a moderate to strong growth trajectory, potentially ranging from 3% to 6% annually, depending on economic conditions and market dynamics. However, factors such as economic downturns, geopolitical instability, and unforeseen events, like future pandemics, could impact these growth projections.

Unique differentiation:

Park Hotels & Resorts operates in a competitive landscape within the hospitality real estate sector. Its primary competitors are other Real Estate Investment Trusts (REITs) that specialize in owning and managing upscale and luxury hotel properties.

- Host Hotels & Resorts: This is a major competitor, also specializing in owning luxury and upper-upscale hotels. They have a significant portfolio of properties in prime locations, similar to Park Hotels & Resorts. This overlap in target markets and property types creates direct competition for guests and investment opportunities.

- Ryman Hospitality Properties: While also a hotel REIT, Ryman Hospitality has a more specialized focus on group-oriented hotel properties, particularly those with large convention and meeting spaces. This makes them a key competitor for Park Hotels & Resorts, which also caters to the convention and group travel market.

- Other Hospitality Companies: In addition to REITs, Park Hotels & Resorts competes with large hotel chains that own and manage their own properties, such as Marriott International, and Hyatt Hotels Corporation. These companies often have extensive brand recognition and loyalty programs, which can influence customer choices.

The competition within this sector is intense, with a focus on factors such as property location, quality of amenities, brand reputation, and overall guest experience. Companies compete to attract both leisure and business travelers, as well as large groups and convention attendees.

Park Hotels & Resorts Inc. distinguishes itself within the competitive hotel REIT landscape through a focused strategy centered on high-quality, prime-location assets.

- Focus on Prime U.S. Markets: Park Hotels & Resorts strategically concentrates its portfolio in major U.S. urban and resort destinations with high barriers to entry. This focus on premier markets allows them to capitalize on strong demand and achieve higher RevPAR (Revenue Per Available Room) compared to competitors with more diversified portfolios. They heavily weigh their portfolio to central business district and resort locations. This allows them to focus on the most profitable markets.

- Emphasis on Upscale and Luxury Segments: The company’s portfolio is heavily weighted towards the upscale and luxury hotel segments. This allows them to capture a more affluent clientele and generate higher revenue per property. This focus on higher end properties, allows them to have a greater profit margin.

- Strategic Asset Management: Park Hotels & Resorts employs an active asset management strategy, continually evaluating and optimizing its portfolio. This includes strategic acquisitions, dispositions, and capital investments to enhance the value of its properties. They have shown that they are willing to sell non core assets to improve profitability.

Park Hotels & Resorts differentiates itself by owning a concentrated portfolio of high-quality hotels in prime U.S. markets, focusing on the luxury and upper-upscale segments, and employing a proactive asset management strategy.

Management & Employees:

Thomas J. Baltimore, Jr., President and Chief Executive Officer: Mr. Baltimore is the driving force behind Park Hotels & Resorts, providing strategic leadership and direction. He has a long track record in the real estate and hospitality industries, bringing considerable expertise to the company.

D. Michael Hawkins, Executive Vice President and Chief Operating Officer: Mr. Hawkins is responsible for the operational performance of the company’s hotel portfolio. His focus is on optimizing property performance, enhancing guest experiences, and driving operational efficiency.

Robert J. Tanenbaum, Executive Vice President and General Counsel: Mr. Tanenbaum provides legal counsel and guidance to the company, overseeing all legal matters and ensuring compliance with regulatory requirements.

Financials:

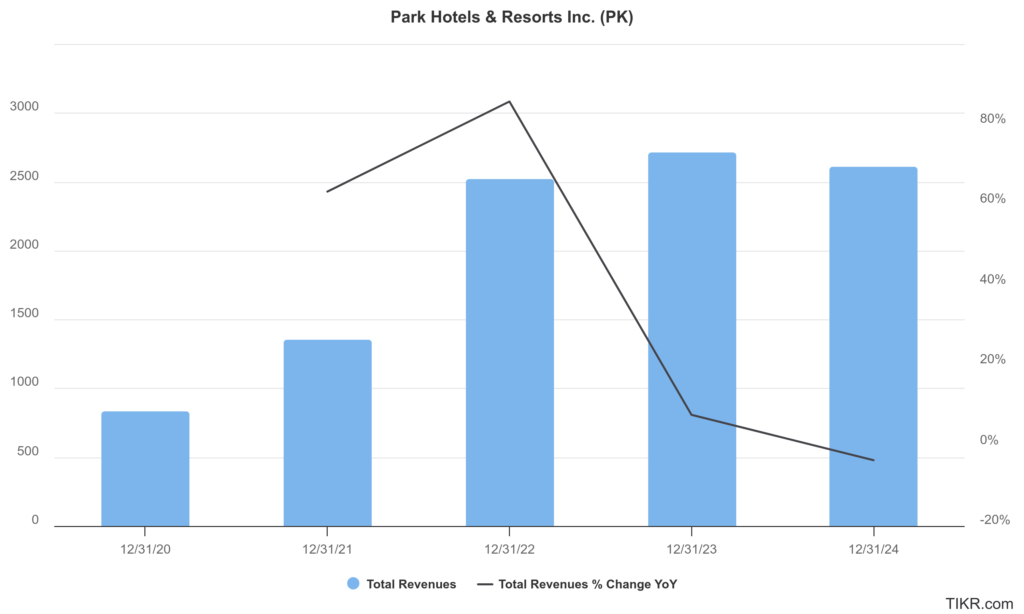

Park Hotels & Resorts Inc. revenue has been impacted by various factors, including the COVID-19 pandemic and recent labor strikes. Park Hotels has seen improvements in group demand, particularly at its resort hotels that have undergone renovations. Comparable group revenues increased by over 8% year-over-year, driven by growth at properties like the Waldorf Astoria Orlando and Casa Marina Key West.

The company reported a net income of $226 million in 2023, which decreased to $73 million in the fourth quarter of 2024 due to operational challenges. However, earnings per share (EPS) have seen a notable increase, with a diluted EPS of $1.01 for the full year 2024, up from $0.44 in 2023. The compound annual growth rate (CAGR) for earnings over the past few years reflects this volatility, with significant fluctuations due to external factors.

The company’s net debt has generally decreased over the years, with a slight increase projected for 2025. The leverage ratio, measured as debt to EBITDA, has improved significantly from negative levels in 2020 to around 5.83 times in 2025, indicating better financial health. The company’s capital expenditures (CAPEX) have increased to support renovation projects, which are expected to enhance future profitability.

Park Hotels & Resorts anticipates continued strength in group demand, with comparable group revenue pace expected to increase nearly 6% in 2025. This growth is supported by projected increases in average comparable group rates and room bookings. The company’s strategic investments in renovations and its diverse portfolio position it for potential long-term growth in the hospitality sector.

Technical Analysis:

The stock is in a stage 4 bearish markdown in all 3 timeframes and not worth a review yet.

Bull Case:

Strategic Asset Management and Portfolio Optimization: PK’s active asset management strategy, including renovations, upgrades, and potential non-core asset sales, could enhance the value of its properties and improve profitability. The company’s focus on prime, high-demand markets positions it to capitalize on strong lodging demand.

Strong Performance in the Luxury and Upscale Segments: PK’s concentration on the luxury and upscale segments allows it to capture a more affluent clientele, leading to higher average daily rates (ADR) and RevPAR (Revenue Per Available Room). The ability to have higher profit margins due to the higher end nature of their properties.

Bear Case:

Slow Recovery of Business and Group Travel: If the recovery of business and group travel is slower than anticipated, PK’s revenue and profitability could be negatively affected. Continued uncertainty regarding large gatherings and corporate travel budgets could pose a risk.

High Debt Levels and Interest Rate Risk: Like many REITs, PK carries a significant amount of debt, which could become a burden in a rising interest rate environment. Increased interest expenses could reduce profitability and limit the company’s ability to invest in growth.

Non core asset sales: If the company is unable to sell non core assets at the expected price point, it could negatively impact the companies financial situation.