Executive Summary:

The Simply Good Foods Company is a consumer packaged food and beverage enterprise focused on developing, marketing, and selling nutritional snacking products. The company is known for its prominent brands, including Atkins, Quest, and OWYN, which cater to consumers seeking high-protein, low-sugar, and low-carb food options. Their product range spans protein bars, shakes, snacks, and meal replacements, distributed across various retail and e-commerce channels. .

The Simply Good Foods Company reported net sales of $341.3 million, compared to $308.7 million in the previous year. Earnings per diluted share (EPS) of $0.38, versus $0.35 in the prior year. Adjusted Diluted EPS of $0.49 versus $0.43.

Stock Overview:

| Ticker | $SMPL | Price | $33.75 | Market Cap | $3.41B |

| 52 Week High | $40.53 | 52 Week Low | $31.25 | Shares outstanding | 101.03M |

Company background:

The Simply Good Foods Company is a prominent player in the nutritional snacking and meal replacement industry. It was formed through the merger of Atkins Nutritionals, Inc. and Conyers Park Acquisition Corp. in 2017. Atkins Nutritionals was initially founded by Dr. Robert Atkins in the 1980s, who popularized the Atkins diet. The merger with Conyers Park Acquisition Corp., a special purpose acquisition company (SPAC), facilitated its public listing and expansion.

The company’s core product portfolio centers around high-protein, low-sugar, and low-carb offerings. Key brands include Atkins, known for its meal replacements and snacks designed for low-carb lifestyles; Quest Nutrition, famous for protein bars, cookies, and chips; and more recently OWYN (Only What You Need), which expands their offerings into plant-based protein products. These products are distributed through a wide range of retail channels, including grocery stores, mass merchandisers, club stores, and e-commerce platforms.

Simply Good Foods operates in a competitive landscape, facing off against major players in the health and wellness food sector. Key competitors include companies like General Mills (with its Fiber One and Nature Valley protein bars), Kellogg’s (with Special K protein products), and various other brands specializing in protein bars and shakes, such as RXBAR and ONE Brands. The company’s headquarters are located in Denver, Colorado, a strategic location that allows them to effectively manage their national distribution and operations.

The merger with Conyers Park Acquisition Corp. provided the initial capital for public listing, and subsequent growth has been funded through ongoing operations and strategic financial management. The company focuses on innovation, expanding its product lines, and strengthening its brand presence to maintain and enhance its market share within the competitive nutritional snacking industry.

Recent Earnings:

The Simply Good Foods Company reported net sales of $341.3 million, marking a notable increase compared to $308.7 million in the same period of the previous year. The company has shown consistent revenue growth.

The company’s earnings per diluted share (EPS) for the first quarter of fiscal year 2025 were $0.38, up from $0.35 in the prior year. Adjusted diluted EPS was $0.49 compared to $0.43. Analyst estimates for that quarter are around a EPS of $0.35.

Simply Good Foods has provided forward guidance for fiscal year 2025, anticipating net sales growth of 8.5% to 10.5%. The company also provided guidance for the OWYN net sales, expecting those sales to be between 135 to 145 million dollars. They are also projecting Adjusted EBITDA to increase 4% to 6%. These projections reflect the company’s confidence in its continued growth trajectory. The company has pointed out that the 53rd week in the 2024 fiscal year, creates about a 2 percentage point headwind for both net sales and adjusted EBITDA growth.

The Market, Industry, and Competitors:

The Simply Good Foods Company operates within the dynamic and expanding market of nutritional snacking and meal replacements, a segment driven by increasing consumer awareness of health and wellness. This market encompasses a broad range of products, including protein bars, shakes, snacks, and meal replacement options, catering to diverse dietary needs and lifestyle choices. Key drivers of this market include the growing prevalence of health-conscious consumers, rising obesity rates, and the increasing popularity of high-protein, low-sugar diets. The demand for convenient, on-the-go nutritional solutions is also a significant factor, as consumers seek healthier alternatives to traditional snacks and meals. This market is also being driven by an increase in plant based protein options, and the general increase in people looking for healthy snacks.

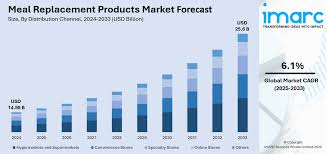

The nutritional snacking and meal replacement market is projected to experience substantial growth. Factors such as continued innovation in product formulations, expanding distribution channels, and effective marketing strategies are expected to contribute to this expansion. Market research indicates that the global protein bar market, a key segment for Simply Good Foods, is anticipated to grow at a Compound Annual Growth Rate (CAGR) of approximately 6-8% through 2030. The broader nutritional snacking market is expected to witness robust growth, driven by the ongoing shift towards healthier lifestyles. The company’s strategic focus on high-growth categories and its ability to innovate and adapt to evolving consumer preferences position it well to capitalize on these market trends.

Unique differentiation:

The Simply Good Foods Company faces competition from a diverse range of players within the nutritional snacking and meal replacement market. These competitors vary in size, product focus, and distribution strategies, creating a dynamic and competitive landscape. Major competitors include large food conglomerates like General Mills and Kellogg’s, which offer protein bars and related products under their established brands such as Fiber One, Nature Valley, and Special K. These companies possess extensive distribution networks and strong brand recognition, posing significant competition. The market includes specialized nutrition companies like RXBAR and ONE Brands, which focus exclusively on protein bars and snacks, often emphasizing clean ingredients and unique flavor profiles.

Simply Good Foods also contends with emerging brands and private-label offerings that cater to specific dietary needs or preferences, such as plant-based protein or organic snacks. The increasing popularity of these niche markets creates additional competition and necessitates continuous innovation and product differentiation. The rise of e-commerce and direct-to-consumer sales has lowered barriers to entry, allowing smaller brands to reach a broader audience.

The Simply Good Foods Company distinguishes itself from competitors through a combination of established brand recognition, strategic portfolio diversification, and a targeted approach to the health and wellness market.

- Strategic Portfolio Diversification: Simply Good Foods has strategically expanded its product portfolio to cater to a wide range of consumer needs. High-protein, low-carb products.

- Focus on Nutritional Snacking: The company’s core focus on nutritional snacking and meal replacements allows them to specialize and excel in this specific market segment. This specialization enables them to develop products that meet the evolving needs of health-conscious consumers, with a strong emphasis on high-quality ingredients and nutritional value.

Simply Good Foods leverages its brand heritage, diversified product offerings, and focused approach to nutritional snacking to maintain a competitive edge in the dynamic health and wellness market.

Geoff E. Tanner: He holds the position of President, Chief Executive Officer, and Director. He has a substantial background in the food industry, with prior experience at companies like The J.M. Smucker Company. His expertise encompasses strategy, business development, operations, brand building, and innovation.

Timothy Kraft: He is the Chief Legal and Corporate Affairs Officer.

Stuart Heflin: He is the Senior Vice President and General Manager Quest.

Mark Olivieri: He is the Senior Vice President and General Manager OWYN.

Ryan Thomas: He is the Senior Vice President and General Manager Atkins.

Alex Wittenberg: He is the Senior Vice President, Corporate Strategy & Business Development.

Financials:

The Simply Good Foods Company has revenue grow from $816.64 million to $1.336 billion, reflecting a compound annual growth rate (CAGR) of approximately 13.1%. This growth was driven by increased consumer demand for nutritional snacking products, strategic acquisitions like OWYN in 2024, and effective marketing initiatives. Earnings also saw significant improvement, rising from $108.6 million in 2020 to $175.2 million in 2024, with a CAGR of about 12.7% over this period.

Simply Good Foods reported a cash position of $132.5 million and a net debt-to-adjusted EBITDA ratio of 1.0x, indicating strong financial stability. The acquisition of OWYN contributed meaningfully to the company’s performance in 2024, adding approximately $135–145 million in annualized revenue and expanding its footprint in the plant-based protein segment.

Gross margin stood at 37.6%, slightly higher than the prior year. Adjusted EBITDA has consistently grown alongside revenues, reflecting operational efficiency and effective cost management.

The company expects net sales growth in the range of 8.5% to 10.5%, driven by volume increases and continued integration of OWYN. Adjusted EBITDA is projected to grow at a slightly lower rate due to anticipated input cost inflation, but the company plans to offset these challenges through productivity initiatives and cost savings measures.

Technical Analysis:

The stock has been in a consolidation stage 1 neutral zone on the monthly and weekly charts and is on a stage 4 bearish markdown on the daily chart. Not worth reviewing yet.

Bull Case:

Strategic Acquisitions and Innovation: The company’s strategic acquisitions, like OWYN, show a commitment to expanding its product offerings and entering new market segments. Continued innovation in product development can lead to new revenue streams and maintain a competitive edge.

Growing Health and Wellness Trend: The increasing focus on health and wellness among consumers creates a favorable environment for Simply Good Foods’ products. The demand for high-protein, low-sugar, and convenient nutritional options is expected to continue growing.

Potential for Increased Profitability: If the company can continue to optimize its supply chain and operational efficiencies, there is potential for increased profitability.

Bear Case:

Consumer Preference Shifts: Consumer dietary trends and preferences can change rapidly. A decline in the popularity of low-carb or high-protein diets could negatively impact demand for the company’s products. The company must adapt quickly to changing consumer tastes.

Supply Chain Disruptions: Like many food companies, Simply Good Foods is vulnerable to supply chain disruptions, including ingredient shortages, transportation issues, and rising costs. These disruptions could lead to increased production costs and reduced profitability.

Integration Risks: The integration of acquired companies, like OWYN, carries inherent risks. If the integration is not successful, it could lead to financial losses and operational inefficiencies.