Executive Summary:

UWM Holdings Corporation (UWM) is a leading wholesale mortgage lender in the United States, primarily operating through independent mortgage brokers. UWM focuses on providing technology and support to empower these brokers. The company has demonstrated significant growth in loan origination volume, particularly in purchase loans, and has also shown strong improvement in net income. UWM utilizes proprietary technology to streamline the mortgage lending process, aiming for efficient and rapid loan processing.

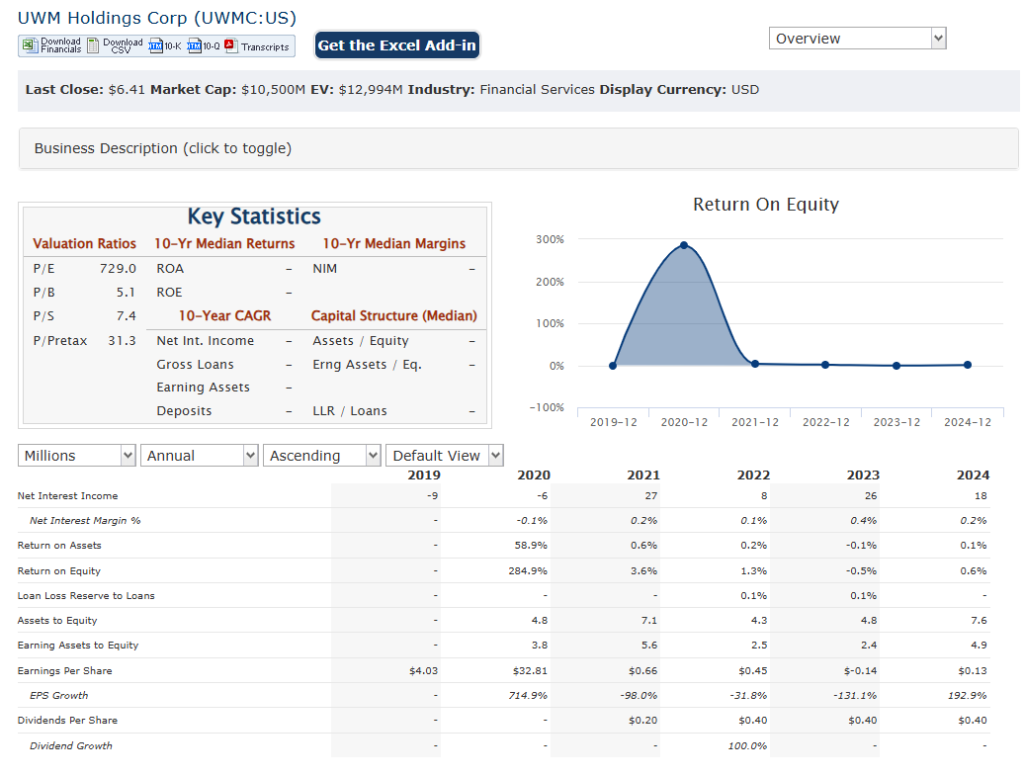

UWM Holdings Corporation reported an earnings per share (EPS) of -$0.2695, which fell short of the forecasted $0.0766. The reported revenue for the quarter was $560.21 million, also below the expected $645.47 million. UWM achieved a 29% year-over-year increase in full-year production, reaching $139.4 billion.

Stock Overview:

| Ticker | $UWMC | Price | $6.91 | Market Cap | $10.25B |

| 52 Week High | $9.74 | 52 Week Low | $5.31 | Shares outstanding | 157.98M |

Company background:

UWM Holdings Corporation, operating as United Wholesale Mortgage (UWM), is a prominent player in the U.S. residential mortgage lending sector. Founded in 1986 by Mat Ishbia, the company is headquartered in Pontiac, Michigan. UWM focuses on the wholesale mortgage channel, working exclusively with independent mortgage brokers.

UWM’s core business revolves around providing mortgage loans through these independent brokers. Their product offerings primarily consist of conventional and government loans, catering to a wide range of homebuyers. UWM’s operations is its investment in proprietary technology, notably the “BOLT” platform, designed to streamline the mortgage process for brokers. This technology aims to enhance efficiency, reduce loan processing times, and improve the overall experience for both brokers and borrowers.

UWM’s key competitors include other major lenders such as Rocket Mortgage, and other large wholesale lenders. UWM’s strategy centers on empowering independent mortgage brokers with technology and support, which differentiates them in the market.

Recent Earnings:

UWM Holdings Corporation reported an EPS of -$0.2695, significantly lower than the anticipated $0.0766. Additionally, revenue came in at $560.21 million, falling short of the projected $645.47 million. UWM reached $139.4 billion, a 29% increase from the previous year. This growth was particularly driven by record purchase originations, highlighting UWM’s strong position in the purchase market. The company maintained its status as the largest mortgage lender in the U.S. Key operational metrics included a total loan origination volume of $38.7 billion for the fourth quarter, and a full year net income of $329.4 million, a very strong turnaround from the previous year net loss. The gain margin for 2024 was 110 basis points, an increase of 19% from 2023.

UWM anticipates production to be in the range of $28 to $35 billion, with a gain margin of 90 to 115 basis points. This guidance reflects the company’s outlook on the near-term mortgage market. UWM leadership has indicated that they are well positioned to handle fluctuations in interest rates and are focusing on technology and operational improvements to drive future growth.

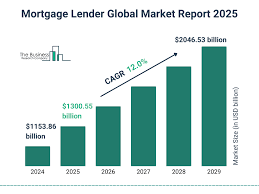

The Market, Industry, and Competitors:

UWM Holdings Corporation operates in the residential mortgage lending market in the United States, focusing exclusively on the wholesale channel. The company is the largest wholesale mortgage lender and has maintained this position for nine consecutive years. UWM’s business model involves partnering with over 13,000 independent mortgage broker businesses across the U.S., leveraging its proprietary technology platforms to enhance client experience and maintain a competitive edge in the industry. With total loan origination volume reaching $139.4 billion, a nearly 30% increase from the previous year.

The company’s ability to triple its refinance volume in 2024, unfavorable interest rates demonstrates its resilience and adaptability. UWM’s focus on innovation, particularly through AI-powered solutions like ChatUWM, is expected to enhance operational efficiency and support further expansion. The mortgage industry’s recovery and potential policy changes could further support UWM’s expansion plans.

The company’s leadership in the wholesale mortgage market and its strong relationships with independent brokers provide a solid foundation for expanding market share. However, uncertainties in the macroeconomic environment and intensified competition within the industry could impact growth rates. UWM anticipates production between $28-35 billion with gain margins of 90-115 basis points, indicating a cautious yet optimistic outlook for the near term.

Unique differentiation:

UWM Holdings Corporation operates in a highly competitive mortgage lending landscape, with key competitors spanning both retail and wholesale channels. One of its most prominent rivals is Rocket Mortgage (part of Rocket Companies), a major player known for its direct-to-consumer digital mortgage platform. Rocket Mortgage commands a significant market share and competes with UWM for overall loan origination volume. Other significant competitors include large banks like JPMorgan Chase and Wells Fargo, which offer a wide range of mortgage products and have established customer bases.

UWM competes with other lenders that also focus on partnering with independent mortgage brokers. These competitors include companies like Homepoint and LoanDepot, which also provide technology and support to brokers. The competitive dynamics involve offering competitive pricing, efficient loan processing, and strong technology platforms to attract and retain brokers. The landscape is further influenced by smaller regional lenders and credit unions that also participate in the mortgage market, contributing to the overall competitive intensity.

Exclusive Focus on Wholesale: UWM’s dedication to working exclusively with independent mortgage brokers sets it apart. While many competitors operate in both retail and wholesale channels, UWM’s singular focus allows them to provide specialized support and technology tailored to brokers’ needs. This creates very strong relationships with those brokers.

Technology and Support for Brokers: UWM heavily invests in proprietary technology, such as its “BOLT” platform, to streamline the mortgage process for brokers. This technology aims to enhance efficiency, reduce loan processing times, and improve the overall experience. They also invest heavily in training and support for those brokers.

Commitment to the Broker Channel: UWM has taken very strong stances to support the broker channel, sometimes to the point of controversy. This strong support has created very strong loyalty from many independent mortgage brokers.

Management & Employees:

Mat Ishbia, Chairman and Chief Executive Officer: Mat Ishbia has been at the helm of UWM since 2013, driving its growth to become a leading wholesale mortgage lender. He is a strong advocate for independent mortgage brokers and has significantly shaped the company’s strategic direction.

Andrew Hubacker, Chief Financial Officer: Andrew Hubacker oversees UWM’s financial operations, including accounting, reporting, and financial compliance. He brings extensive financial expertise, with a background that includes experience at Deloitte & Touche LLP.

Melinda Wilner, Chief Operating Officer: Melinda Wilner is responsible for UWM’s operational efficiency. She has held various leadership roles within the company, contributing to its operational effectiveness.

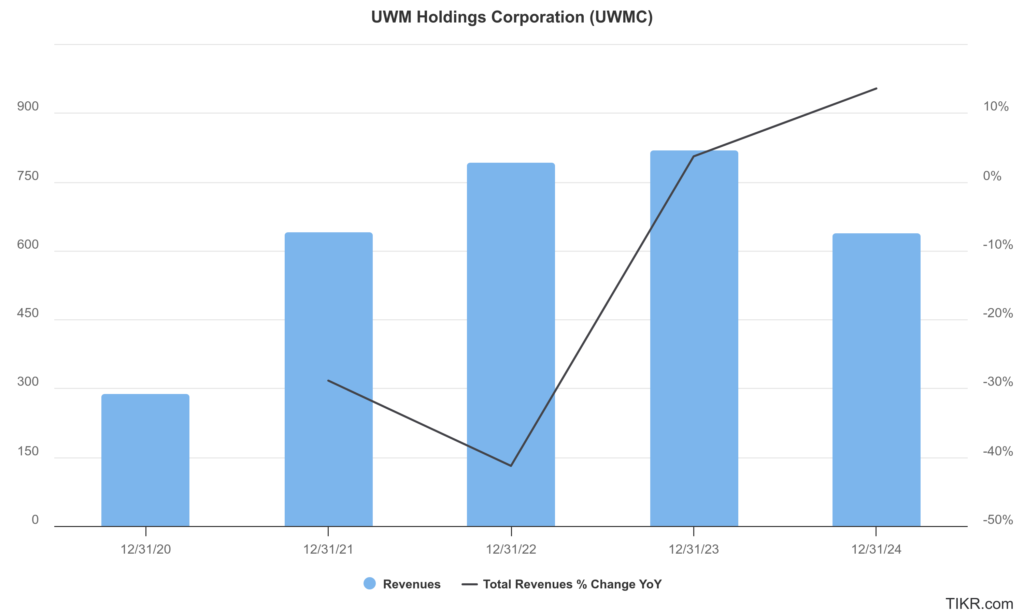

Financials:

UWM Holdings Corporation has reported a remarkable annual revenue of $4.939 billion, which was a peak during this period. Revenue had dropped to $2.373 billion, reflecting a challenging environment for mortgage lenders. UWM Holdings rebounded in 2024 with a revenue of $2.164 billion, marking a 65% increase from 2023.

The recent recovery in 2024 indicates potential for future growth. Earnings growth has also been impacted by market conditions. In 2020, UWM reported a net income of $3.38 billion, which was an exceptional year. In contrast, 2023 saw a net loss, but the company rebounded with a net income of $329.4 million in 2024.

The company’s ability to return to profitability in 2024 is a positive indicator. UWM Holdings’ focus on operational investments and technological advancements aims to position the company for long-term success, despite short-term earnings volatility.

UWM Holdings had total equity of $2.1 billion and approximately $500 million in cash. Additionally, UWM held a mortgage servicing rights (MSR) portfolio with a fair value of about $4 billion, indicating a substantial asset base.

Technical Analysis:

A failed cup and handle in a stage 1 consolidation on the monthly and weekly chars, followed by a reversal stage 2 markup (bullish) on the daily chart, means the stock is still trying to move higher and clear the multiple resistances at $6.7 range which it should but still a stock to avoid for the short term.

Bull Case:

Dominance in the Wholesale Channel: UWM’s exclusive focus on the independent mortgage broker channel provides a distinct advantage. If the broker channel continues to gain market share, UWM is well-positioned to capitalize on that growth.

Potential for Refinance Boom: If interest rates decline, a wave of mortgage refinances could occur. UWM’s extensive network of brokers and efficient processing capabilities could enable it to capture a substantial portion of this refinance activity.

Bear Case:

Interest Rate Sensitivity: The mortgage industry is highly sensitive to interest rate fluctuations. Rising rates can significantly reduce loan origination volume, particularly refinances, which can negatively impact UWM’s revenue.

Earnings Volatility: The company’s earnings can be volatile, and it has, in recent times, missed analyst expectations.