Executive Summary:

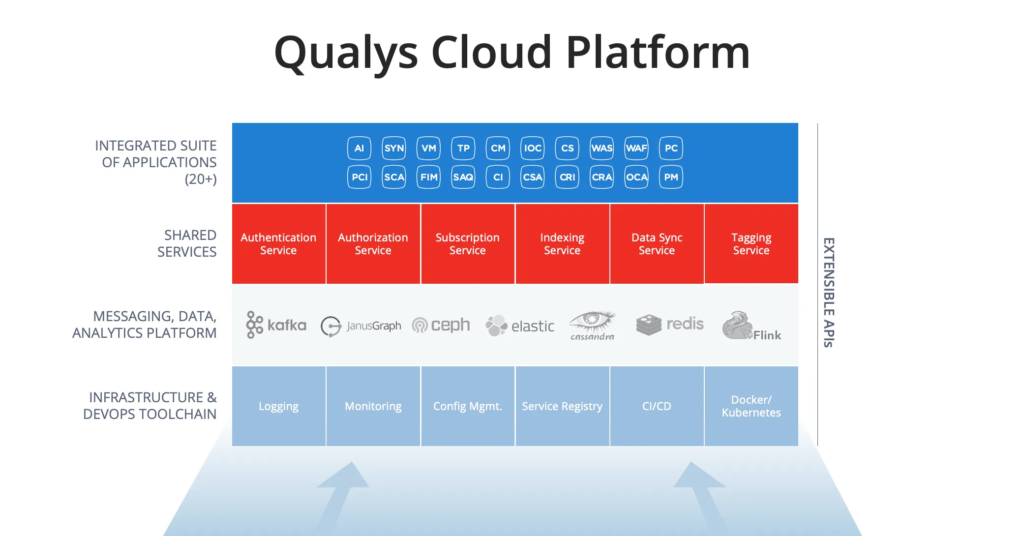

Qualys, Inc. is a leading provider of cloud-based security and compliance solutions, helping organizations of all sizes protect their IT infrastructure and web applications. With a comprehensive suite of tools, Qualys enables businesses to identify vulnerabilities, ensure compliance, and manage their security posture across on-premises, cloud, and endpoint environments. The Qualys Cloud Platform offers a wide range of solutions, including vulnerability management, asset discovery, web application scanning, and malware detection.

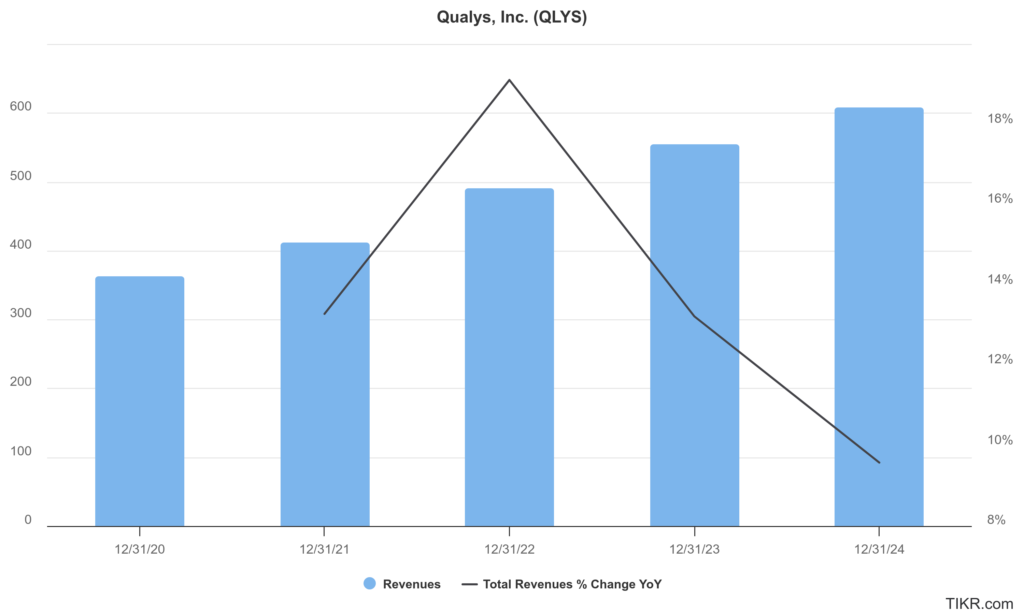

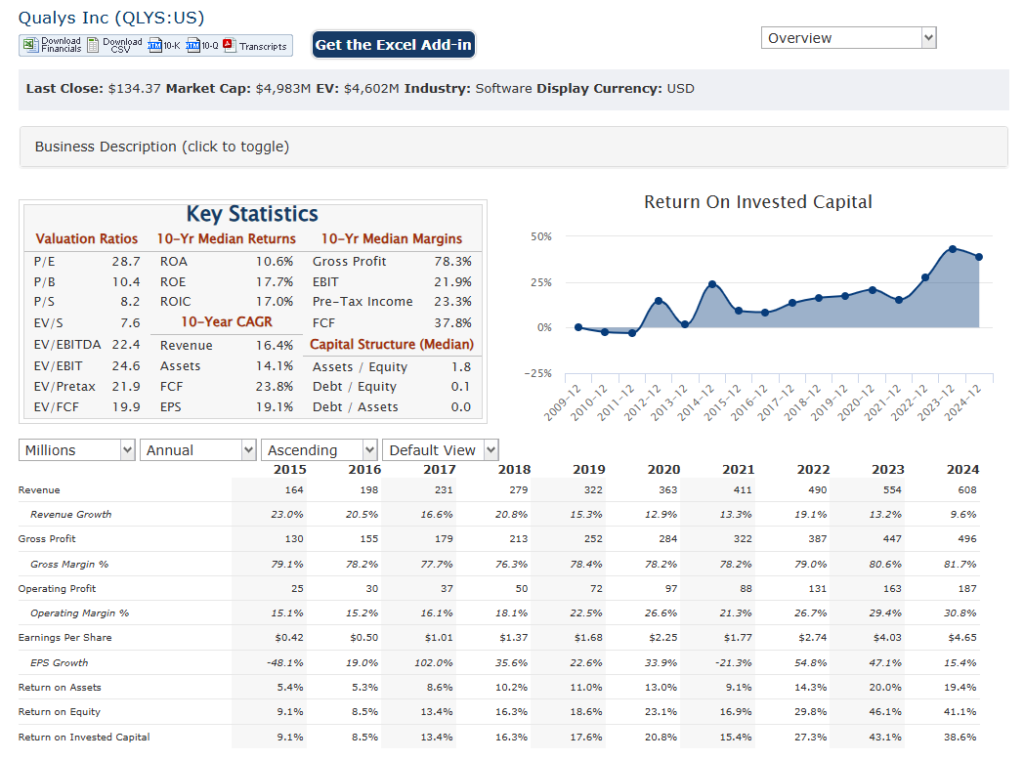

Qualys, Inc. reported revenue of $607.6 million, representing a 9.6% increase from fiscal year 2023. Earnings per share (EPS) reached $4.72, exceeding analysts’ expectations by 5.7% and showing a 15% growth from the previous year. The strong EPS performance was driven by increased profitability, with net income rising 15% to $173.7 million.

Stock Overview:

| Ticker | $QLYS | Price | $134.37 | Market Cap | $4.9B |

| 52 Week High | $174.31 | 52 Week Low | $119.17 | Shares outstanding | 36.59M |

Company background:

Qualys, Inc. was founded in 1999 by Philippe Courtot, who served as Chairman and CEO until his passing in 2021. The company emerged from Courtot’s vision of a world where security vulnerabilities could be identified and addressed proactively, leveraging the power of the internet. This early focus on cloud-based vulnerability management proved prescient, positioning Qualys as a pioneer in the then-nascent cybersecurity Software-as-a-Service (SaaS) market.

Qualys offers a broad suite of cloud-based security and compliance solutions. Their core offering revolves around vulnerability management, enabling organizations to discover and prioritize security weaknesses across their IT infrastructure. Their platform encompasses asset discovery and inventory, web application scanning, malware detection, compliance monitoring, and endpoint security. These integrated tools provide a holistic view of an organization’s security posture, facilitating proactive risk mitigation and compliance adherence. T

Key competitors include companies like Rapid7, Tenable, and CrowdStrike, all of whom offer various combinations of vulnerability management, security assessment, and endpoint protection solutions. These companies often compete on features, pricing, and specific market segments. Qualys differentiates itself with its comprehensive platform approach, breadth of solutions, and long-standing experience in the cloud-based security space.

Qualys is headquartered in Foster City, California, in the heart of Silicon Valley. This location provides access to a rich talent pool and positions the company within a vibrant technology ecosystem.

Recent Earnings:

Qualys, Inc. reported revenue reaching $607.6 million, a 9.6% increase from fiscal year 2023. This growth reflects the continued demand for Qualys’ cloud-based security and compliance solutions. Earnings per share (EPS) reached $4.72, exceeding analysts’ expectations by 5.7% and showing a 15% growth from the previous year. This strong EPS performance was driven by increased profitability, with net income rising 15% to $173.7 million.

Gross profit margins expand slightly to 82%, indicating efficient cost management. The company continued to invest in research and development, ensuring its platform remains at the forefront of cybersecurity innovation. These investments are crucial for Qualys to maintain its competitive edge and address evolving security threats.

The company anticipates continued revenue growth, driven by expanding customer base and increasing adoption of its comprehensive security platform. Qualys expects to maintain its profitability, although it acknowledged potential challenges from increased competition and macroeconomic uncertainties. The company’s guidance reflects its confidence in its long-term growth prospects and its ability to capitalize on the growing demand for cybersecurity solutions.

The company’s forward guidance suggests continued positive momentum, although it remains cautious about potential challenges. Qualys’ focus on innovation and its comprehensive platform approach position it well to capitalize on the growing cybersecurity market and deliver long-term value to its shareholders.

The Market, Industry, and Competitors:

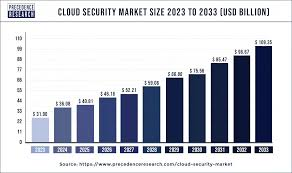

Qualys operates in the rapidly expanding cybersecurity market, specifically within the segments of vulnerability management, security assessment, and compliance solutions. This market is driven by the increasing complexity of IT environments, the rise of sophisticated cyber threats, and the growing regulatory requirements for data protection. Organizations across all sectors are facing an uphill battle to secure their networks, applications, and data, leading to a surge in demand for effective cybersecurity tools and services. The shift towards cloud computing, the proliferation of IoT devices, and the increasing reliance on remote work have further amplified the need for comprehensive security solutions, creating a robust and dynamic market for companies like Qualys.

The cybersecurity market, including the segments Qualys focuses on, is projected to experience substantial growth. Factors such as the continued digitalization of businesses, the escalating frequency and impact of cyberattacks, and the ever-evolving regulatory landscape will continue to fuel this expansion. While precise growth rates can vary depending on different market research firms and specific segments, it’s reasonable to expect a healthy compound annual growth rate (CAGR) for the overall cybersecurity market through 2030. Many analysts project double-digit CAGR figures, with some estimates placing it in the range of 10-15% or even higher. The specific CAGR for Qualys’ niche might be slightly different depending on competitive pressures and technological advancements, but it’s likely to be within or above the broader cybersecurity market growth range.

Unique differentiation:

- Rapid7: A provider of vulnerability management, security analytics, and incident response solutions. Rapid7’s InsightVM product competes directly with Qualys’ vulnerability management offerings.

- Tenable: Another major player in the vulnerability management space, Tenable offers a comprehensive platform for identifying and prioritizing security risks. Tenable.io is a key competitor to the Qualys Cloud Platform.

- CrowdStrike: While known primarily for its endpoint security solutions, CrowdStrike also offers vulnerability assessment capabilities, competing with Qualys in the broader security market.

- Microsoft: With its extensive security product portfolio, Microsoft competes with Qualys in various areas, including endpoint security, vulnerability management, and cloud security.

These companies often compete on factors such as the breadth of solutions offered, the accuracy of vulnerability detection, the ease of use of their platforms, and pricing. Qualys differentiates itself with its comprehensive cloud-based platform, its long-standing experience in the vulnerability management space, and its focus on providing integrated security solutions.

Comprehensive Cloud Platform: Qualys offers a broad suite of security and compliance solutions delivered through a single, unified cloud platform. This integrated approach allows organizations to manage various aspects of their security posture from one central console, simplifying operations and improving efficiency. Unlike some competitors that focus on specific niches, Qualys provides a more holistic solution.

Pioneering in Cloud-Based Security: Qualys was an early innovator in cloud-based security, giving them a significant head start in developing and refining their platform. This experience translates into a mature and robust solution with a proven track record.

Focus on Vulnerability Management: Qualys is particularly well-known for its strength in vulnerability management. Their solutions excel at identifying and prioritizing security weaknesses across IT infrastructure, providing organizations with critical insights into their risk exposure.

Management & Employees:

Sumedh Thakar: President and CEO. Sumedh has been with Qualys since 2003, rising through the ranks to lead the company. He has played a crucial role in expanding Qualys’ platform from vulnerability management to broader areas of security and compliance.

Dilip Bachwani: CTO and SVP, Enterprise TruRisk Platform. Dilip leads global product development, data and platform engineering, DevOps, site reliability engineering, cloud operations, and customer support.

Bruce Posey: Chief Legal Officer. Bruce leads the Qualys legal team and oversees regulatory and governmental relations efforts.

Financials:

Qualys Inc. has demonstrated a strong financial performance, particularly in terms of revenue growth. The company’s revenue has consistently increased, with a five-year average annual growth rate of approximately 16.6%. This growth is attributed to its innovative cloud-based IT, security, and compliance solutions, which have been increasingly adopted by customers seeking to enhance their cybersecurity capabilities.

The earnings per share (EPS) without non-recurring items have grown at a compound annual growth rate (CAGR) of about 31% over the past five years. This robust earnings growth reflects the company’s ability to maintain profitability while expanding its operations and investing in new technologies.

The company reported $233.38 million in cash and equivalents, up from $206.37 million in the previous year. This liquidity provides Qualys with the flexibility to invest in strategic initiatives and expand its product offerings. The company has announced a $200 million increase to its share repurchase program, further demonstrating its commitment to shareholder value.

The company’s strategic focus on its Enterprise TruRisk Platform and other innovative solutions has positioned it well for long-term growth. With a strong financial foundation and a growing customer base, Qualys is poised to maintain its competitive edge and continue delivering sustainable growth in the future.

Technical Analysis:

The stock is in a stage 4 decline on the monthly and weekly charts. The daily chart is on a stage 4 decline as well (bearish) and does have support in the $130 range, but could head lower to more support in the $119 range. Waiting for a reversal is the best approach to trade this stock.

Bull Case:

Expanding Product Portfolio: Qualys has been actively expanding its product portfolio beyond its core vulnerability management offerings. This diversification into areas like cloud security, endpoint protection, and compliance solutions broadens its addressable market and creates opportunities for cross-selling and upselling to existing customers.

Scalability and Profitability: Qualys’ cloud-based platform is highly scalable, enabling it to efficiently serve organizations of all sizes. The company has demonstrated strong profitability, with healthy margins and consistent earnings growth. This financial strength provides resources for further investment and expansion.

Potential for Consolidation: The cybersecurity market remains fragmented, and Qualys could be a potential acquirer of smaller players with specialized technologies. This could accelerate its growth and further enhance its platform capabilities.

Bear Case:

Dependence on Cloud Platform: Qualys’ business is heavily reliant on its cloud platform. Any significant disruption or security breach affecting its cloud infrastructure could have a severe impact on its operations and reputation, leading to customer churn and loss of revenue.

Integration Challenges: As Qualys expands its product portfolio through acquisitions or internal development, there’s a risk of integration challenges. Integrating new technologies and teams can be complex and time-consuming, potentially leading to delays and cost overruns.