Executive Summary:

Polaris Inc. is a leading manufacturer of power sports vehicles, including snowmobiles, all-terrain vehicles (ATVs), motorcycles, and boats. The company strongly focuses on customer satisfaction and is committed to providing its customers with the best possible experience.

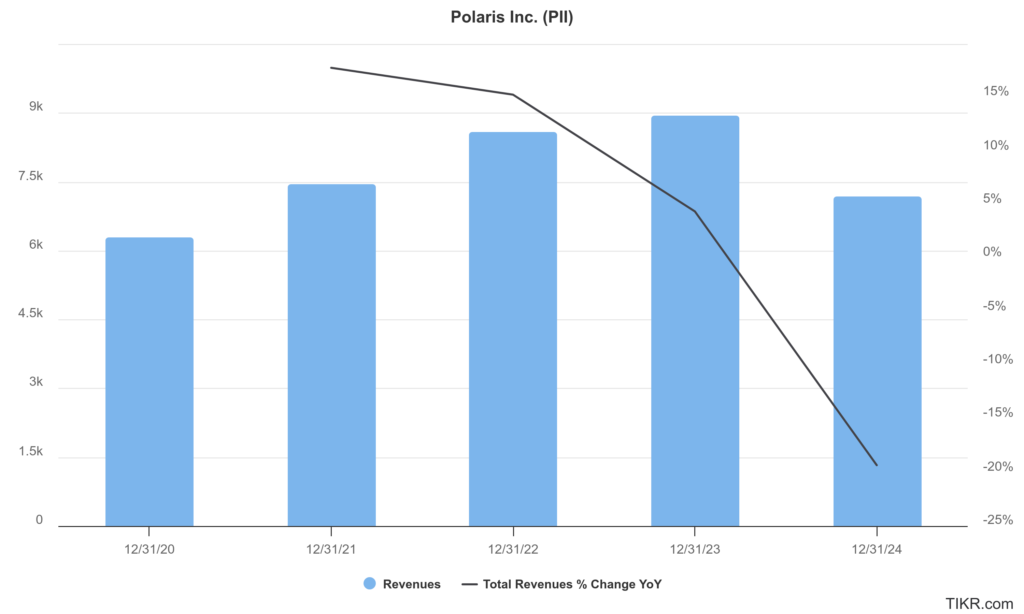

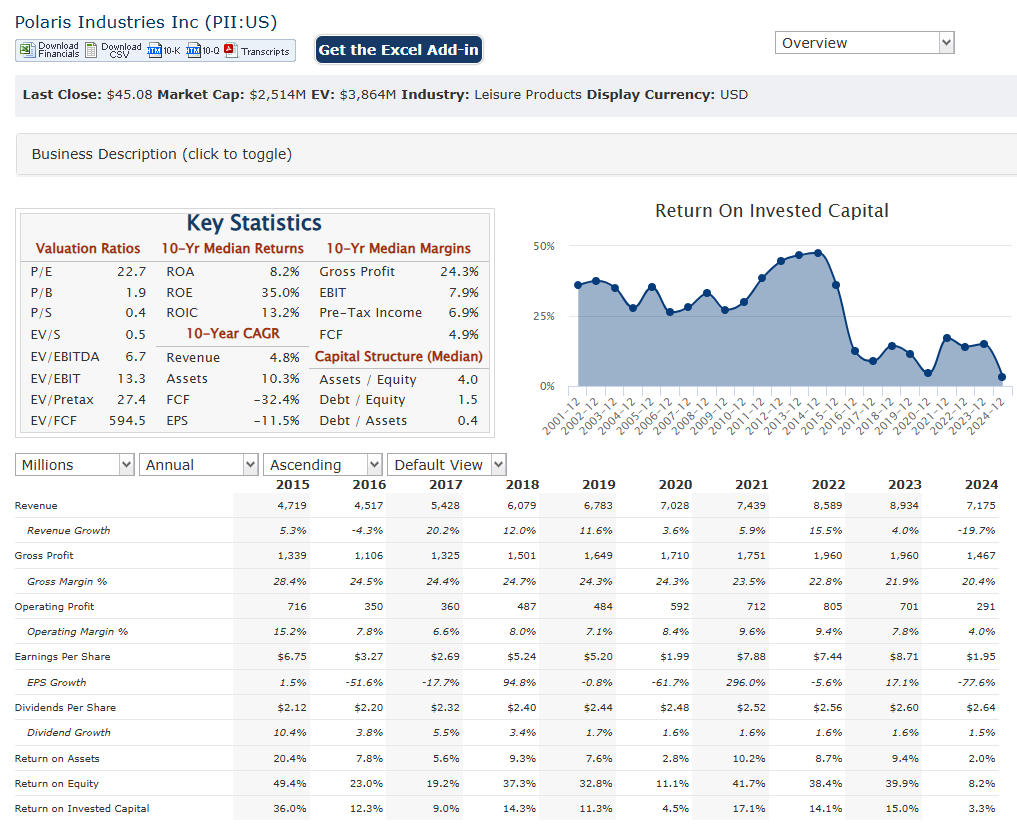

Polaris Inc. reported sales of $7,175 million, a 20% decrease compared to the previous year. Diluted earnings per share (EPS) stood at $1.95, down 78% from last year. In the fourth quarter, sales were $1,755 million, a 23% decline year-over-year. The reported diluted EPS for the quarter was $0.19, a 90% drop, and the adjusted diluted EPS was $0.92, which was down 54%.

Stock Overview:

| Ticker | $PII | Price | $45.08 | Market Cap | $2.51B |

| 52 Week High | $100.91 | 52 Week Low | $42.85 | Shares outstanding | 55.77M |

Company background:

Polaris Inc., formerly known as Polaris Industries, is a prominent American manufacturer of power sports vehicles. Founded in 1954 in Roseau, Minnesota, by Allan Hetteen, David Johnson, and Edgar Hetteen, the company initially focused on developing snowmobiles. Polaris diversified its product portfolio to include all-terrain vehicles (ATVs), side-by-side vehicles, motorcycles, and boats.

The company’s initial funding came from its founders, it has grown over the years through reinvestment of profits and strategic acquisitions. Some notable acquisitions include Indian Motorcycle in 2011 and Beneteau in 2018, expanding its presence in the motorcycle and boating industries, respectively.

Polaris offers a wide range of products catering to various consumer needs. Their product lineup includes snowmobiles (like the Indy and RMK models), ATVs (such as the Sportsman and Scrambler), side-by-side vehicles (like the RZR and Ranger), motorcycles (under the Indian Motorcycle brand), and boats (under the Beneteau and Godfrey brands). These products are sold through a vast network of dealers and distributors across North America, Europe, and Australia.

Polaris faces intense competition from other major players in the power sports industry.

- In the ATV and side-by-side market: Honda, Yamaha, Kawasaki, Can-Am (BRP), and Arctic Cat.

- In the motorcycle market: Harley-Davidson, Honda, Yamaha, Kawasaki, and BMW.

- In the snowmobile market: Arctic Cat and Ski-Doo (BRP).

Polaris Inc. is headquartered in Medina, Minnesota, and has manufacturing facilities in various locations across the United States and Mexico. The company has a strong focus on innovation and customer satisfaction, continually developing new products and technologies to meet the evolving demands of the powersports market.

Recent Earnings:

Polaris Inc. reported sales of $7,175 million, a 20% decrease compared to the previous year. This decline was primarily driven by lower volumes across all segments, increased promotional activity, and unfavorable product mix. Diluted earnings per share (EPS) stood at $1.95, down 78% from last year, reflecting the impact of lower sales and increased costs.

In the fourth quarter, sales were $1,755 million, a 23% decline year-over-year. The reported diluted EPS for the quarter was $0.19, a 90% drop, and the adjusted diluted EPS was $0.92, which wasdown 54%. While the fourth quarter EPS beat analysts’ expectations of $0.88, the overall results reflect a challenging year for the power sports industry.

The company expects sales to decline by 1-4% and adjusted EPS to decrease by approximately 65% compared to 2024. Polaris plans to focus on operational efficiency and cost control measures to mitigate the impact of these challenges.

Polaris remains committed to innovation and investing in its brands. The company believes that its strong market position and diversified product portfolio will enable it to navigate the current downturn and emerge stronger in the long term.

The Market, Industry, and Competitors:

Polaris Inc. operates primarily in the powersports vehicle market, which encompasses a wide range of products including all-terrain vehicles (ATVs), motorcycles, snowmobiles, and marine vehicles. The company is a significant player in this sector, holding an estimated 40.8% market share in the ATV manufacturing industry in the United States. Polaris’s product offerings are diverse, with segments dedicated to off-road and on-road vehicles, as well as marine products. The company has established a strong distribution network through dealers, distributors, and e-commerce platforms, enabling it to reach customers both domestically and internationally.

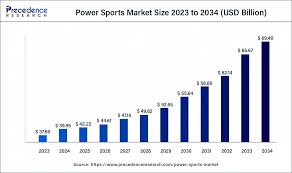

Polaris is expected to experience growth driven by several factors, including increasing consumer interest in recreational activities and a push toward electric vehicle innovation within the power sports sector. Analysts anticipate that Polaris will focus on expanding its customer base by 50% over the next decade, enhancing its market presence through strategic initiatives and new product developments. The Compound Annual Growth Rate (CAGR) for the power sports industry is projected to be robust, reflecting a broader trend towards outdoor recreation and adventure sports. The overall market dynamics suggest a favorable growth environment for the company as it adapts to changing consumer preferences and technological advancements.

Unique differentiation:

Polaris Inc. operates in a highly competitive powersports market, facing off against a range of established players. One of their main rivals is BRP Inc. (Bombardier Recreational Products), a Canadian company that manufactures and distributes snowmobiles, all-terrain vehicles, side-by-side vehicles, motorcycles, and personal watercraft. BRP, with its popular Ski-Doo snowmobiles and Can-Am ATVs, directly competes with Polaris in several key segments.

Another significant competitor is Honda Motor Co., Ltd., a Japanese multinational conglomerate known for its diverse range of vehicles, including motorcycles, ATVs, and side-by-side vehicles. Honda’s reputation for reliability and quality makes it a formidable opponent for Polaris, particularly in the ATV and motorcycle categories. Additionally, Polaris faces competition from Yamaha Motor Co., Ltd., another Japanese company that produces motorcycles, ATVs, side-by-side vehicles, and snowmobiles. Yamaha’s strong presence in the powersports market, especially with its popular motorcycle lineup, poses a challenge to Polaris’s market share.

Beyond these major players, Polaris also competes with other companies like Kawasaki Motors Corp., U.S.A. (motorcycles, ATVs, side-by-side vehicles), Arctic Cat (snowmobiles, ATVs, side-by-side vehicles), and Harley-Davidson, Inc. (motorcycles).

Diverse Product Portfolio: Polaris offers a wide array of powersports vehicles, spanning snowmobiles, ATVs, side-by-side vehicles, motorcycles, and boats. This breadth allows them to cater to a wider customer base and capture demand across various segments of the market.

Focus on Innovation: Polaris has a history of pioneering new technologies and features in their vehicles. They continuously invest in research and development to improve performance, enhance rider experience, and introduce new models that meet evolving customer needs.

Extensive Dealer Network: Polaris has a vast network of dealers and distributors across North America and beyond. This extensive reach ensures that customers have easy access to their products and services, contributing to their strong market presence.

Management & Employees:

Michael T. Speetzen: Serves as the Chief Executive Officer and Director. He has been with Polaris since 2015, previously holding positions such as Executive Vice President and Chief Financial Officer. Speetzen has a strong background in finance and has played a crucial role in the company’s growth and strategic initiatives.

Victor M. Koelsch: Serves as the Chief Information Officer and Chief Digital Officer. Koelsch joined Polaris in 2020 and is responsible for leading the company’s digital transformation efforts and overseeing its information technology infrastructure. He has a strong background in technology and has held leadership positions at various companies.

Tony J. Kinsman: Is the Chief Technology Officer and Vice President of Off-Road Engineering. Kinsman has been with Polaris for several years and has held various engineering and product development roles. He is responsible for leading the company’s technology initiatives and overseeing the development of new products.

Financials:

Polaris Inc. has reported net sales of approximately $6.78 billion, which increased to about $8.93 billion by 2023, reflecting a compound annual growth rate (CAGR) of around 6.7%. This growth has been driven by strong demand for its power sports vehicles, despite some volatility in sales due to external factors such as supply chain disruptions and economic conditions. The company’s revenue peaked in 2023, but projections indicate a potential decline in 2024, with expected sales of $7.17 billion, before a rebound to $7.33 billion in 2025.

The net income rose from $324 million in 2019 to approximately $503 million in 2023, showcasing an impressive earnings growth trajectory with a CAGR of about 15.5% during this period. The earnings were impacted by sharp declines in 2020 and again in 2024, where net income is projected to drop to around $110 million.

The debt-to-EBITDA ratio improved from 2.07x in 2019 to around 1.51x in 2023, indicating better management of debt relative to earnings before interest, taxes, depreciation, and amortization (EBITDA). Projections for 2025 suggest a rise back up to 3.31x, which could raise concerns among investors about financial stability if not managed carefully. Polaris continues to innovate and respond to market trends within the powersports industry while managing its financial health effectively.

Technical Analysis:

The stock is in a stage 4 markdown (bearish) on the monthly and weekly charts. The daily chart is showing signs of a reversal in the $43 zone, the momentum of which should help it move higher to close the gap in the $48 zone.

Bull Case:

Innovation and New Products: Polaris continues to invest in research and development, introducing innovative new products and technologies. This focus on innovation is likely to attract customers and drive future growth. Their electric vehicle initiatives and advancements in rider experience could be key catalysts.

Expanding Market Reach: Polaris has a strong presence in North America and is expanding its reach in international markets. This global expansion provides opportunities for growth and diversification.

Operational Efficiency: Polaris is focused on improving operational efficiency and reducing costs. These efforts are likely to enhance profitability and improve the company’s financial performance.

Bear Case:

Weakening Economy: A significant economic downturn could further dampen consumer spending on discretionary items like powersports vehicles. This would directly impact Polaris’ sales and profitability. Even a mild recession could prolong the current industry slump.

Supply Chain Disruptions: Continued supply chain issues, including component shortages and logistical challenges, could hinder Polaris’ ability to produce and deliver its products, impacting sales and revenue. These disruptions are difficult to predict and can arise quickly.

Increased Costs: Rising input costs, including raw materials, labor, and transportation, could put pressure on Polaris’ margins. The company may find it difficult to pass these costs on to consumers in a competitive market.