Executive Summary:

Humana Inc. is a leading health insurance provider in the United States, offering a range of medical, dental, vision, and other health and wellness services. The company is committed to improving the health and well-being of its members through innovative programs and services. Humana is also actively involved in community outreach and philanthropic initiatives.

Humana Inc. reported a loss of $2.26 per share for the quarter, compared to a loss of $0.11 per share in the same quarter last year. The company is projected to recover with a 3.4% year-over-year EPS growth in fiscal 2025, reaching $16.68. An adjusted EPS of $4.16 and revenue of $29.3 billion.

Stock Overview:

| Ticker | $HUM | Price | $274.33 | Market Cap | $33.03B |

| 52 Week High | $406.46 | 52 Week Low | $213.31 | Shares outstanding | 120.41M |

Company background:

Humana Inc. is a prominent health insurance provider in the United States, offering a wide array of medical, dental, vision, and other health and wellness services. Founded in 1961 by David Jones Sr. and Wendell Cherry as a nursing home company called Extendicare, it later transitioned into the health insurance market. While the company initially focused on nursing homes, it strategically shifted its focus to health insurance, particularly Medicare Advantage plans, becoming a major player in the industry. Humana has grown both organically and through acquisitions, expanding its product offerings and geographic reach.

Humana’s core business revolves around providing health insurance benefits, primarily through government-sponsored programs like Medicare Advantage and Medicaid. They offer a variety of Medicare Advantage plans, including HMOs, PPOs, and Special Needs Plans, catering to different needs and demographics. Humana also provides pharmacy benefits management services, home health services, and other healthcare-related offerings. Their focus is on integrated care, aiming to improve the health and well-being of their members through coordinated services and personalized care management.

Humana faces stiff competition from other major health insurance companies, including UnitedHealthcare, Anthem, Aetna (CVS Health), and Cigna. These companies offer similar health insurance products and services, competing for market share in the growing healthcare sector. The competitive landscape is driven by factors such as plan benefits, pricing, network coverage, and customer service. Humana distinguishes itself through its focus on member engagement, technology-driven solutions, and a strong commitment to value-based care.

Humana’s headquarters is located in Louisville, Kentucky. This is where the company’s executive leadership and many of its corporate functions are based. Humana oversees its nationwide operations, serving millions of members across the United States.

Recent Earnings:

Humana Inc. reported adjusted EPS of $4.16, exceeding analysts’ expectations. This strong performance was driven by increased Medicare Advantage membership and higher premiums. Revenue for Q3 2024 was $29.3 billion, also surpassing expectations.

Analysts currently expect Humana to report a loss of $2.26 per share. This compares to a loss of $0.11 per share in the same quarter last year. Analysts project an EPS of $16.11, down from $26.09 in fiscal 2023. However, the company is expected to recover with a 3.4% year-over-year EPS growth in fiscal 2025, reaching $16.68. The company also made progress in its cost-containment efforts, with a projected decrease in the adjusted operating cost ratio.

The company has previously emphasized its focus on Medicare Advantage growth and improving the quality of care for its members. Humana’s management team will likely provide further insights into its strategic priorities and financial outlook during the upcoming earnings release and subsequent conference call.

The Market, Industry, and Competitors:

Humana Inc. operates within the dynamic and highly competitive health insurance industry, with a significant presence in the Medicare Advantage segment. This market is characterized by a growing aging population, creating opportunities for Humana to expand its senior-focused products and services. The industry also faces regulatory challenges and is subject to changes in government policies, particularly concerning Medicare reimbursement rates. Humana’s main competitors include UnitedHealth Group, Anthem Inc., Aetna Inc., Cigna Corporation, and Kaiser Permanente, all offering a diverse range of health insurance products and services.

The company is implementing strategies to improve care delivery efficiency through analytics, medicine, and integrated care, which is expected to lead to better health outcomes and reduced healthcare expenses. Humana also focuses on expanding its CenterWell business, including primary care clinics, home health services, and pharmacy benefits. Humana intends to open 30 to 50 new CenterWell locations each year through 2025. Humana anticipates adjusted profit growth at an annual rate of 14% over the three years following 2022.

Unique differentiation:

- UnitedHealthcare: A dominant force in the industry, UnitedHealthcare offers a wide range of health insurance products and services, including Medicare Advantage plans, employer-sponsored plans, and Medicaid coverage. It boasts a vast network of providers and a strong financial position, making it a formidable competitor for Humana.

- Anthem (now Elevance Health): Another major health insurer, Anthem focuses on providing health benefits through various channels, including employer-sponsored plans, individual plans, and government programs. It has a significant presence in the Medicare Advantage market and competes with Humana for members.

- Cigna: Cigna offers a diverse portfolio of health insurance products and services, including medical, dental, vision, and pharmacy benefits. It caters to individuals, families, and employers, competing with Humana across multiple segments of the health insurance market.

Competition is based on factors such as plan benefits, pricing, provider networks, customer service, and brand reputation. Humana strives to differentiate itself through its focus on member engagement, technology-driven solutions, and integrated care models.

Focus on integrated care: Humana emphasizes a holistic approach to healthcare, aiming to coordinate various aspects of a member’s health journey. This includes not only health insurance benefits but also access to primary care, pharmacy services, and other wellness programs. By integrating these services, Humana strives to improve health outcomes and provide a more seamless experience for its members.

Commitment to value-based care: Humana is actively involved in value-based care models, which reward healthcare providers for delivering high-quality care and improving patient outcomes. This approach aligns incentives to prioritize preventive care, manage chronic conditions effectively, and reduce overall healthcare costs.

Emphasis on technology and innovation: Humana leverages technology to enhance the member experience and improve operational efficiency. This includes digital tools for accessing health information, telehealth services, and data analytics to personalize care management.

Management & Employees:

Jim Rechtin: President and Chief Executive Officer. Mr. Rechtin joined Humana in January 2024. He has extensive experience in the healthcare industry, previously serving as President and CEO of Envision Healthcare and President of OptumCare.

Dr. Vishal Agrawal: Chief Strategy and Corporate Development Officer. Dr. Agrawal is responsible for Humana’s corporate strategy, mergers and acquisitions, and joint ventures.

Financials:

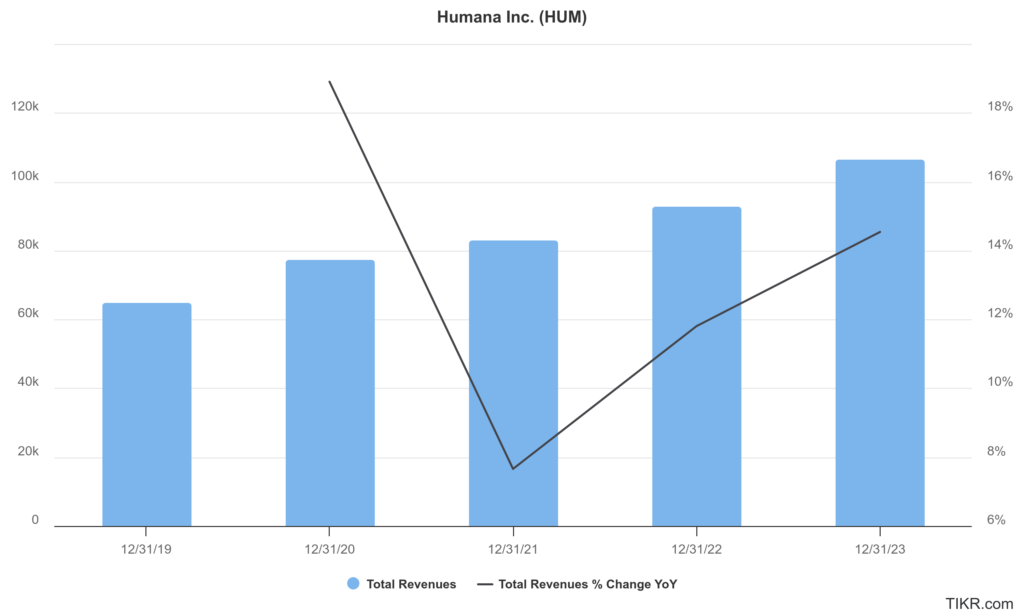

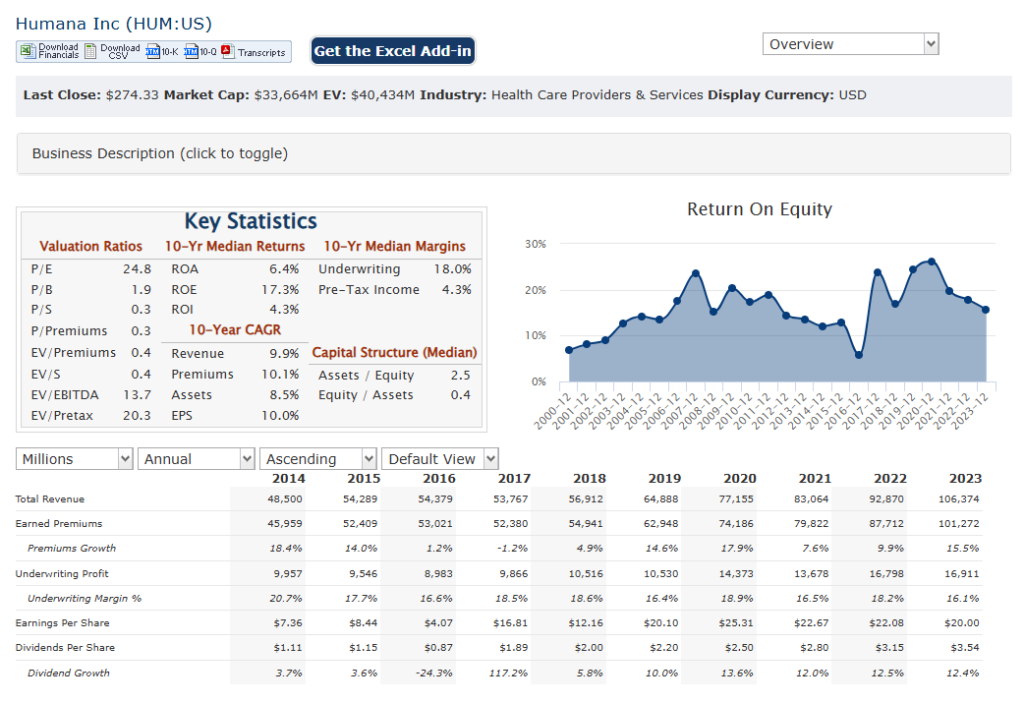

Humana Inc. revenue has increased steadily, reflecting strong membership growth and effective management of healthcare costs. Humana’s focus on providing value-based care and enhancing its integrated care delivery model has contributed to its ability to attract and retain members, driving top-line growth. Humana’s financial reports indicate a positive trajectory, with consistent year-over-year increases.

The company’s ability to manage medical costs, improve operational efficiency, and drive membership growth has contributed to its earnings growth. Humana’s adjusted earnings per share (EPS) have generally increased, reflecting the company’s underlying profitability and effective capital allocation strategies. Humana maintains a strong balance sheet, characterized by a healthy mix of assets and liabilities.

The company’s cash flow from operations has been consistently positive, providing financial flexibility to invest in growth opportunities, return capital to shareholders, and manage its debt obligations. Humana’s debt-to-total capitalization ratio has remained within a reasonable range, indicating a balanced approach to financial leverage. The company’s strategic investments in healthcare services and technology have enhanced its competitive position and long-term growth prospects.

Technical Analysis:

The stock is in a stage 4 decline (Bearish) on the monthly and weekly charts. The daily chart has a head and shoulders pattern which indicates a move lower to the support at $250 – $260 range. We would avoid any position yet.

Bull Case:

Medicare Advantage Growth: The most significant driver of Humana’s growth is the expanding Medicare Advantage market. As the population ages, more individuals become eligible for Medicare, and a growing percentage are choosing Medicare Advantage plans over traditional Medicare. Humana’s strong position in this market, combined with its focus on offering competitive plans, positions it well to capture a significant share of this expanding market. This translates to increased membership and revenue.

Value-Based Care: Humana’s commitment to value-based care is seen as a long-term positive. By focusing on quality of care and patient outcomes, Humana aims to reduce healthcare costs and improve efficiency. Success in value-based care models can lead to better financial performance and a stronger competitive position.

Potential Acquisitions: Humana has a history of strategic acquisitions to expand its reach and service offerings. Future acquisitions could further accelerate growth and strengthen its market position.

Bear Case:

Healthcare Cost Inflation: Rising healthcare costs are a significant concern for all health insurers, including Humana. If medical costs increase faster than expected, it could squeeze profit margins, even if membership grows. Controlling medical costs is crucial for Humana’s financial performance.

Integration Challenges: As Humana grows, both organically and through acquisitions, it faces the challenge of integrating different systems and operations. Difficulties in integration could lead to inefficiencies and disruptions, impacting financial performance.

Cybersecurity Risks: As a healthcare company, Humana holds sensitive personal and medical information. Cybersecurity breaches could lead to data loss, reputational damage, and regulatory fines. Protecting this data is a critical priority and requires ongoing investment.