Executive Summary:

TechnipFMC plc is a global leader in energy projects, technologies, systems, and services. The company provides its clients with expertise across subsea and surface projects. TechnipFMC operates in three main segments: Subsea, Surface, and New Energy.

TechnipFMC plc reported an adjusted EPS of $0.64. Revenue for the quarter was $2.35 billion, slightly exceeding expectations and showing a 14.2% increase year-over-year.

Stock Overview:

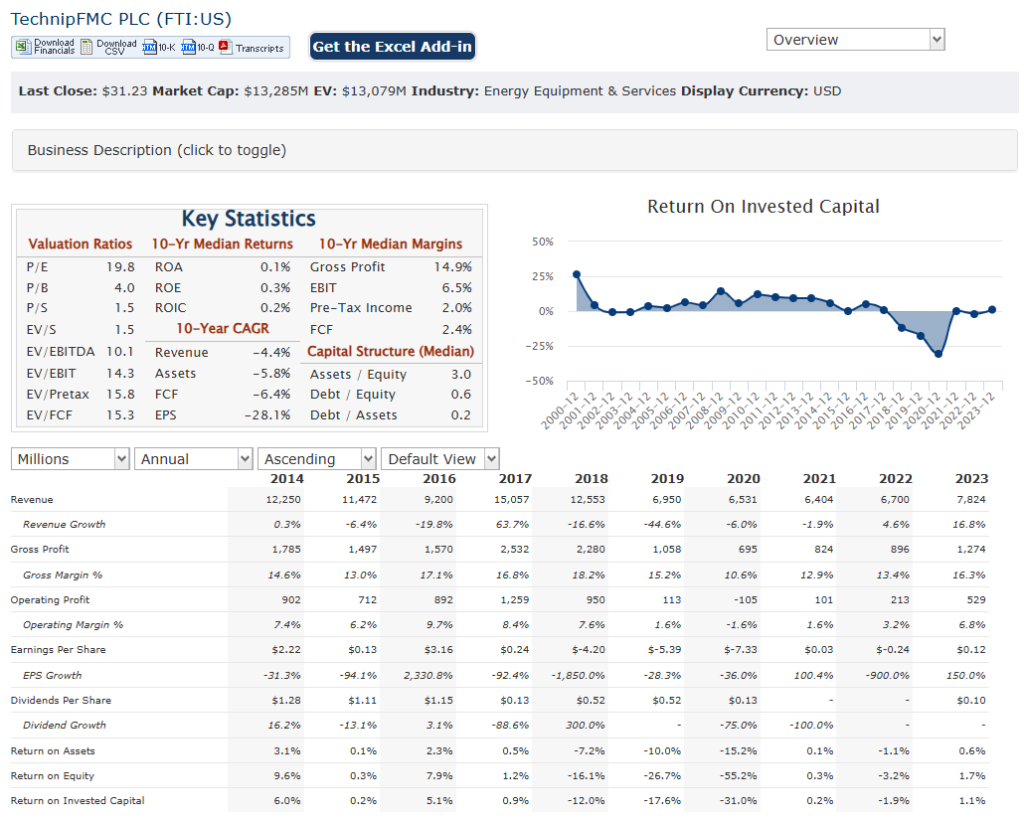

| Ticker | $FTI | Price | $31.23 | Market Cap | $13.29B |

| 52 Week High | $33.45 | 52 Week Low | $18.78 | Shares outstanding | 425.42M |

Company background:

TechnipFMC plc is a global leader in energy projects, technologies, systems, and services. The company provides its clients with expertise across subsea and surface projects. TechnipFMC was formed in 2017 through the merger of FMC Technologies and Technip. The company has its headquarters in Houston, Texas, and is listed on the New York Stock Exchange. TechnipFMC operates in three main segments: Subsea, Surface, and New Energy.

TechnipFMC’s Subsea segment offers a wide range of solutions for offshore oil and gas production, including subsea production systems, umbilicals, risers, and flowlines. The company’s Surface segment provides equipment and services for onshore and shallow water oil and gas operations, including wellheads, pressure pumping equipment, and flowback services. TechnipFMC’s New Energy segment focuses on developing and commercializing new technologies for the energy transition, such as offshore wind, hydrogen, and carbon capture.

TechnipFMC’s key competitors include other major players in the energy services industry, such as Schlumberger, Halliburton, and Baker Hughes. The company has a strong track record of innovation and is committed to developing new technologies to meet the evolving needs of the energy industry. TechnipFMC is also committed to sustainability and has set ambitious targets for reducing its environmental footprint.

Recent Earnings:

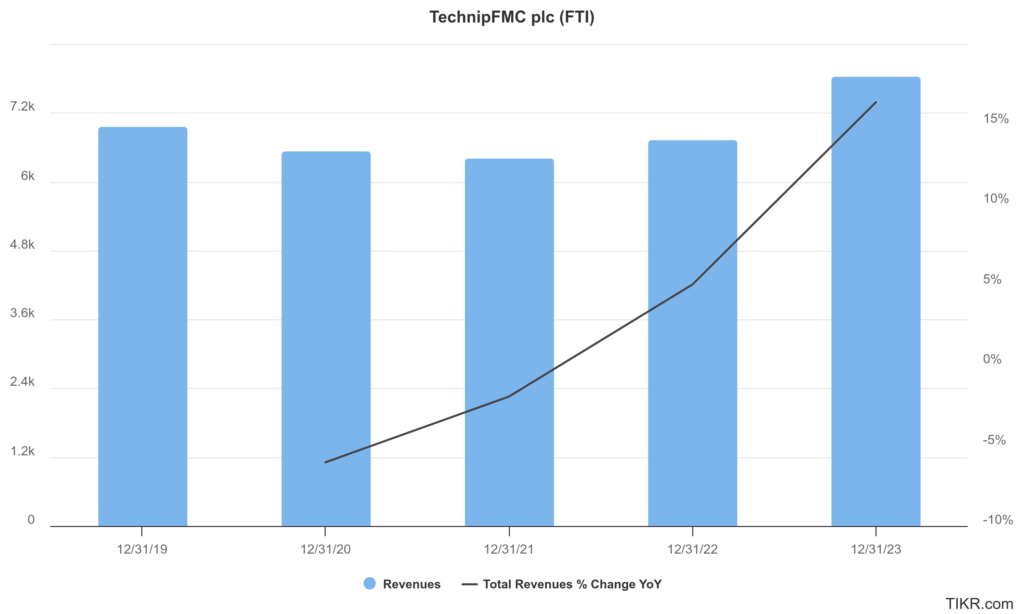

TechnipFMC plc reported revenue of $2.35 billion, exceeding analysts’ expectations and showing a 14.2% increase compared to the same period last year. This growth was primarily driven by the robust performance of the Subsea segment, which benefited from increased demand for subsea solutions and strong project execution.

Earnings per share (EPS) for the quarter reached $0.64, significantly surpassing analysts’ consensus estimate of $0.39. This represents a substantial increase compared to the $0.21 EPS reported in the third quarter of 2023.

The company achieved record order intake in the Subsea segment, resulting in a substantial backlog. This strong order book provides good visibility for future revenue and profitability. The company also made progress in its New Energy segment, securing new contracts and advancing its technologies in areas such as offshore wind and carbon capture.

The company expects revenue to be in the range of $9.0 billion to $9.5 billion, and adjusted EBITDA to be between $1.5 billion and $1.6 billion. This positive outlook is based on the company’s strong performance in the first three quarters of the year, as well as favorable market conditions and continued growth opportunities in its key segments.

The Market, Industry, and Competitors:

TechnipFMC PLC operates in the oil and gas industry, providing technologies, systems, and services, including subsea services and surface technologies. They offer integrated platform solutions for oil and gas production, measurement, flow treatment, surface wellhead systems, and flow metering. The company has a presence in over 45 countries and employs more than 35,000 workers. TechnipFMC is headquartered in London, England.

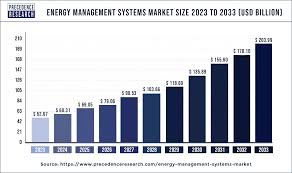

The company is poised to capitalize on the energy transition through involvement in offshore wind and carbon capture and storage initiatives. The company aims to cut Scope 1 and Scope 2 GHG emissions by 50% by 2030. TechnipFMC expects continued market strength, driven by the energy demand and a shift in capital flows to offshore and Middle East markets. They anticipate an increased role for new technologies and subsea services due to growing and aging infrastructure.

TechnipFMC anticipates a more diverse mix of opportunities, including Subsea 2.0 equipment and iEPCI projects, along with continued growth from Subsea Services.

Unique differentiation:

- Schlumberger: A global leader in oilfield services, providing a wide range of technologies and services for reservoir characterization, drilling, production, and processing. Schlumberger competes with TechnipFMC across various segments, particularly in subsea and surface technologies.

- Halliburton: Another major player in the oilfield services industry, offering a comprehensive suite of solutions for exploration, drilling, completion, and production. Halliburton is a key competitor for TechnipFMC in areas like pressure pumping, well completion, and subsea systems.

- Baker Hughes: A technology company that provides equipment and services for the oil and gas industry, as well as for the energy transition. Baker Hughes competes with TechnipFMC in various segments, including subsea production systems, surface technologies, and new energy solutions.

- NOV: A leading provider of equipment and technologies to the oil and gas industry, with a broad portfolio that includes drilling equipment, subsea solutions, and completion tools. NOV is a significant competitor for TechnipFMC in the subsea and surface markets.

The company faces intense competition based on factors such as technology, price, and project execution capabilities. TechnipFMC strives to differentiate itself through its integrated solutions, technological expertise, and focus on innovation to maintain its competitive edge.

Integrated Solutions: TechnipFMC offers a unique, fully integrated approach to project execution, particularly in its Subsea segment. Its iEPCI (integrated Engineering, Procurement, Construction, and Installation) model allows the company to manage projects from concept to completion, including design, engineering, manufacturing, and installation. This integrated approach simplifies project management for clients, reduces risk, and can accelerate time to first production.

Subsea Focus: TechnipFMC has a particularly strong position in the subsea market, where it is a leading provider of subsea production systems, umbilicals, risers, and flowlines. The company’s Subsea 2.0 offering, a pre-engineered configure-to-order system, provides clients with flexible and cost-effective solutions.

New Energy Transition: TechnipFMC is actively involved in the energy transition, leveraging its expertise to develop solutions for offshore wind, hydrogen, and carbon capture. This focus on new energies positions the company to capitalize on the growing demand for cleaner energy solutions.

Management & Employees:

Douglas J. Pferdehirt: As Chairman and Chief Executive Officer, Mr. Pferdehirt provides overall leadership and strategic direction for TechnipFMC. He has extensive experience in the energy industry, having previously served as President and CEO of FMC Technologies and held various leadership positions at Schlumberger.

Thierry Conti: As President of Surface Technologies, Mr. Conti leads TechnipFMC’s surface business segment. He has held various senior management positions within the company and has a strong background in subsea and surface technologies.

Financials:

TechnipFMC announced a total company revenue of $2,325.6 million. Net income attributable to TechnipFMC was $186.5 million, or $0.42 per diluted share. Adjusted net income was $188.9 million, or $0.43 per diluted share. Adjusted EBITDA, excluding pre-tax charges and credits, reached $361.4 million, with an adjusted EBITDA margin of 15.5 percent. Excluding the after-tax impact of foreign exchange, net income was $204.3 million, and adjusted EBITDA was $379.1 million.

In the third quarter of 2024, TechnipFMC reported a total Company adjusted EBITDA of $389 million, excluding the impact of foreign exchange. The company’s inbound orders totaled $2.8 billion, with a backlog of $14.7 billion. Cash flow from operations reached $278 million, and free cash flow improved to $225 million.

The company’s adjusted EBITDA guidance for 2024 is approximately $1.25 billion, which represents a 33% increase compared to 2023. TechnipFMC has also increased its Subsea inbound expectations to $30 billion over the three-year period ending in 2025.

Technical Analysis:

The stock is in a great base building and stage 2 markup (bullish) on the monthly chart, and on a stage 2 markup on the weekly chart. The daily chart shows weakness in a stage 4 markdown to the $28 zone where there is some support.

Bull Case:

Technology Leadership and Innovation: TechnipFMC’s commitment to research and development and its track record of innovation provide a strong foundation for future growth. The company’s advancements in subsea technologies, such as its Subsea 2.0 offering, enable it to deliver cost-effective and efficient solutions to its clients.

Financial Strength and Shareholder Returns: TechnipFMC has a strong financial position, with a healthy balance sheet and a track record of generating solid cash flow. The company’s recent share repurchase program signals confidence in its future prospects and a commitment to returning value to shareholders.

Bear Case:

Cyclical Nature of Oil and Gas: TechnipFMC’s business is heavily tied to the oil and gas industry, which is inherently cyclical. Economic downturns or periods of lower oil prices can lead to reduced capital spending by oil and gas companies, impacting demand for TechnipFMC’s services and equipment.

Geopolitical Risks: Geopolitical events, such as political instability in key regions or changes in government regulations, can disrupt energy projects and impact TechnipFMC’s operations.

Debt Levels: While TechnipFMC’s financial position is generally strong, the company does carry a certain level of debt. This debt could become a burden if the company’s financial performance deteriorates.