Executive Summary:

Dollar General Corporation is a prominent discount retailer chain headquartered in Goodlettsville, Tennessee. The company focuses on providing a wide range of everyday essentials, including food, health and beauty products, cleaning supplies, apparel, and seasonal items, at low prices. Dollar General aims to serve customers with convenient locations, particularly in rural and underserved communities.

Dollar General Corporation’s net sales increased by 5.0% to $10.2 billion compared to the same quarter in the previous year, driven by new store openings and a 1.3% increase in same-store sales. Expecting diluted EPS to be in the range of $5.50 to $5.90.

Stock Overview:

| Ticker | $DG | Price | $71.47 | Market Cap | $15.72B |

| 52 Week High | $168.07 | 52 Week Low | $66.43 | Shares outstanding | 219.9M |

Company background:

Dollar General Corporation is a prominent discount retailer chain that has become a ubiquitous presence in the American retail landscape. Founded in 1939 by James Luther Turner and his son Cal Turner in Scottsville, Kentucky, the company initially operated as J.L. Turner and Son, a wholesale dry goods business. In 1955, they transitioned to a retail model, opening the first Dollar General store in Springfield, Kentucky. This marked the beginning of their journey to becoming one of the largest discount retailers in the United States.

Their product range encompasses various categories, including food and beverages, health and beauty products, cleaning supplies, apparel, home décor, seasonal items, and even basic automotive supplies. This diverse offering caters to a broad customer base, particularly in rural and underserved communities where access to affordable goods may be limited. The company’s commitment to convenience is evident in its extensive network of stores, strategically located to be easily accessible to shoppers.

Dollar General’s business model is built on efficiency and cost-effectiveness. They maintain a lean operational structure, which allows them to keep prices low while maintaining profitability. The company also focuses on optimizing its supply chain and inventory management to minimize costs and ensure products are readily available on shelves.

The company’s key competitors include other discount retailers such as Dollar Tree, Family Dollar, and Walmart, as well as larger grocery chains and pharmacies. Despite the competition, Dollar General has carved out a strong position in the market by catering to a specific customer segment and consistently delivering value. Their headquarters are located in Goodlettsville, Tennessee, a testament to their growth from a small family business to a major player in the retail industry.

Recent Earnings:

Dollar General Corporation achieved net sales of $10.2 billion, marking a 5% increase from the previous year, which exceeded analysts’ expectations of $10.14 billion. However, the earnings per share (EPS) came in at $0.89, falling short of the forecasted $0.95, representing a 29.4% decline year-over-year.

Dollar General’s same-store sales increased by 1.3%, driven primarily by a rise in average transaction amounts, despite only a slight increase in customer traffic of 0.3%. The company’s gross profit margin decreased to 28.8%, down from the previous year, reflecting ongoing challenges in cost management and competitive pressures within the retail sector. Operating profit saw a significant decline of 25.3%, amounting to $323.8 million, further indicating the financial pressures faced by the company.

Dollar General projected net sales growth between 4.8% and 5.1% and same-store sales growth ranging from 1.1% to 1.4%. The company adjusted its EPS guidance to a range of $5.50 to $5.90, down from previous expectations, as it continues to navigate a challenging retail environment characterized by decreased consumer spending and heightened competition.

The Market, Industry, and Competitors:

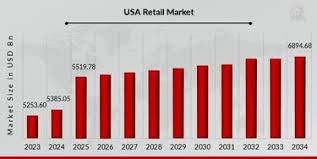

Dollar General Corporation operates primarily in the discount retail market in the United States, focusing on providing a variety of everyday items at low prices. This market has seen significant growth, driven by changing consumer behaviors that favor value-oriented shopping, especially during economic downturns. As of early 2025, Dollar General has established over 20,000 stores, positioning itself as a leader in this segment.

Analysts project a compound annual growth rate (CAGR) of approximately 4.8% to 5.1% in revenue through the end of the decade. This growth is attributed to the company’s strategic expansion plans, including new store openings and enhancements to its product offerings to attract a broader customer base. The increasing focus on e-commerce and digital sales channels is expected to contribute to overall revenue growth, as more consumers seek convenient shopping options.

Dollar General’s revenue is anticipated to reach around $49.6 billion, reflecting its ongoing commitment to capturing market share in the discount retail space. The company’s ability to maintain competitive pricing while managing operational efficiencies will be crucial in achieving these growth targets. With a solid foundation and strategic initiatives in place, Dollar General is well-positioned to navigate the evolving retail landscape and capitalize on the growing demand for affordable shopping options.

Unique differentiation:

Dollar General faces stiff competition in the discount retail market, vying for the attention and dollars of value-conscious consumers. One of its most direct competitors is Dollar Tree, another major player in the dollar store segment. Both companies offer a wide range of low-priced goods, but they have slightly different approaches. While Dollar General focuses on a broader assortment of everyday essentials, Dollar Tree historically emphasized items priced at $1 or less.

Dollar General also competes with larger retail giants like Walmart. Walmart’s expansive product offerings and low prices make it a formidable competitor, particularly in categories where there is overlap, such as groceries, household goods, and apparel. While Walmart often operates larger stores with a wider selection, Dollar General’s smaller store format and convenient locations can be an advantage for customers seeking quick trips and everyday necessities. Additionally, regional grocery chains and pharmacies also pose competition, especially for consumable goods and health and beauty products.

Hyper-Focus on Convenience: Dollar General has mastered the art of convenient shopping. Their stores are typically smaller than those of major competitors, making them quick and easy to navigate. They strategically locate stores in rural areas and underserved communities, often where larger retailers aren’t present, filling a crucial gap in access to everyday essentials. This focus on convenience is a major draw for time-pressed shoppers and those in areas with limited retail options.

Operational Efficiency: Dollar General is known for its lean and efficient operations. They maintain a streamlined supply chain, optimize inventory management, and control costs meticulously. This allows them to offer competitive prices while maintaining profitability, a key differentiator in the discount retail space.

Strong Private Label Offerings: Dollar General has developed a robust portfolio of private label brands that offer quality comparable to national brands at lower prices. This provides customers with value-driven alternatives and enhances Dollar General’s profitability.

Management & Employees:

Todd Vasos: Serves as the Chief Executive Officer. He has been with Dollar General for many years, holding various leadership positions before becoming CEO. His experience with the company and in the retail industry makes him a key figure in Dollar General’s continued growth.

Steve Deckard: Serves as the Executive Vice President, Store Operations and Development. He leads the operations of Dollar General’s extensive store network and is responsible for the company’s store development initiatives. His extensive experience in store operations, including his time at Walmart, makes him a key leader in this area.

Financials:

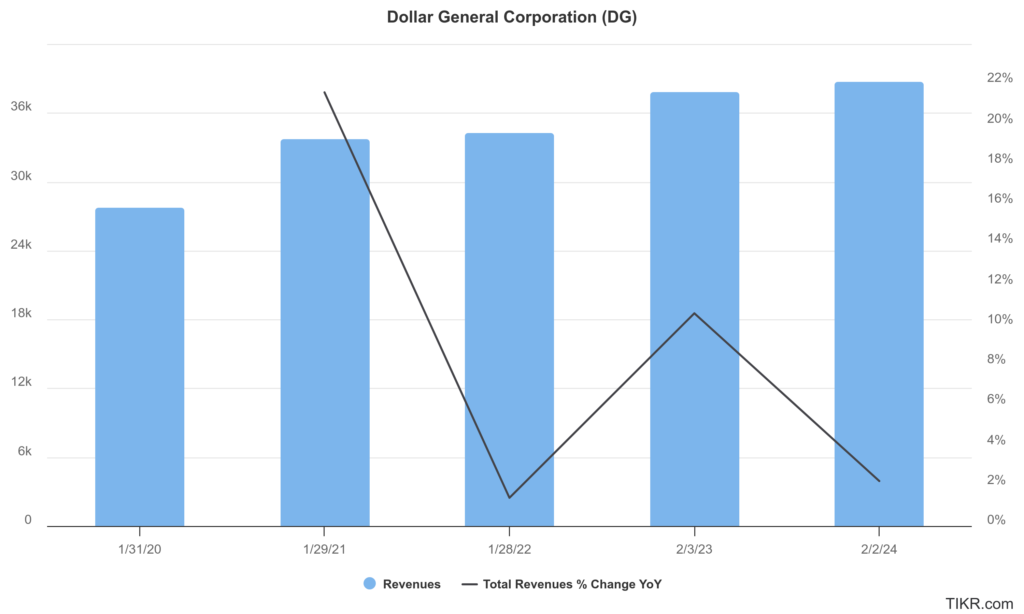

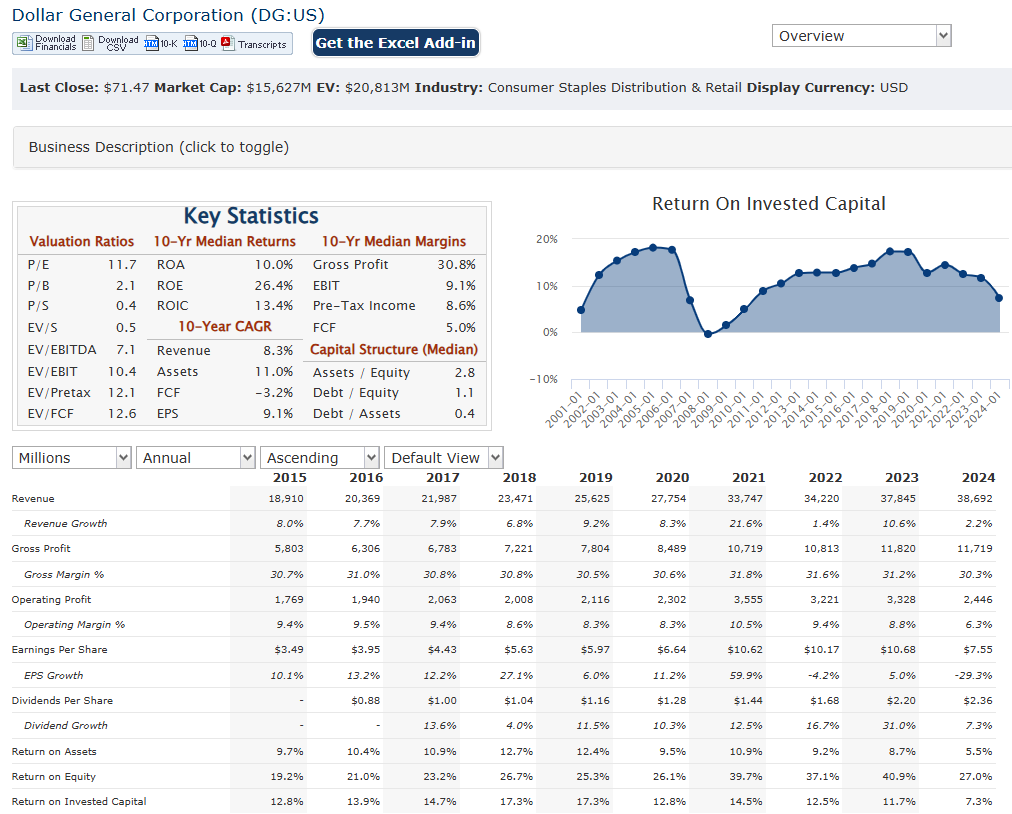

Dollar General Corporation has net sales increased from approximately $27.8 billion to $38.7 billion, reflecting a CAGR of about 9.3%. This growth trajectory has been driven by strategic store expansions, enhanced product offerings, and a focus on value that resonates with budget-conscious consumers, especially during economic uncertainties.

Net income rose from $1.7 billion in 2020 to around $1.7 billion in 2024, indicating fluctuations in profitability despite increased sales. The CAGR for net income during this timeframe is approximately 0%, highlighting challenges such as rising operational costs and competitive pressures that have impacted margins. Earnings per share (EPS) also experienced volatility, peaking at $10.68 in 2023 before declining to $7.55 in 2024 due to factors such as increased expenses and lower operating income.

The company’s debt-to-EBITDA ratio increased from 0.94x in 2020 to approximately 1.96x in 2024, reflecting higher debt levels relative to earnings as it invested heavily in expansion and modernization initiatives. Dollar General’s liquidity remains strong, with adequate cash flow generation supporting its operational needs and capital expenditures.

The company faces challenges such as inflationary pressures and changing consumer behaviors, its strategic initiatives and market positioning suggest potential for continued growth. Dollar General’s ability to navigate these challenges while capitalizing on the ongoing demand for affordable retail options, indicates that the company is well-equipped for future performance improvements as it adapts to market dynamics.

Technical Analysis:

The stock is in a stage 4 markdown (bearish) on the monthly and weekly charts. The daily chart is range bound with support in the $67 area. The near term outlook is negative on the chart with a move likely down again to the $67 range.

Bull Case:

Resilient Business Model: Dollar General caters to a value-conscious customer base, particularly in rural and underserved communities, that is less sensitive to economic fluctuations. This makes their business model relatively resilient even during economic downturns, as consumers prioritize essential spending and seek out affordable options.

Strong Same-Store Sales Growth: Even excluding new store openings, Dollar General has consistently demonstrated strong same-store sales growth. This indicates that their existing stores are performing well, attracting more customers and increasing sales.

Dividend and Share Repurchases: Dollar General has a history of returning value to shareholders through dividends and share repurchases. This can be attractive to investors seeking both income and capital appreciation.

Bear Case:

Changing Consumer Preferences: Consumer preferences are constantly evolving, with trends like e-commerce and online shopping becoming increasingly important. If Dollar General fails to adapt to these changes and invest in its online presence, it could lose market share to competitors.

Inflationary Pressures: Rising inflation can squeeze profit margins by increasing the cost of goods sold and operating expenses. If Dollar General is unable to offset these costs through price increases or cost-cutting measures, it could negatively impact profitability.

Debt Levels: While Dollar General generally maintains a healthy balance sheet, increasing debt levels could become a concern if the company faces unexpected challenges or if interest rates rise.