Executive Summary:

Arthur J. Gallagher & Co. is an international insurance brokerage and risk management services company. The company offers insurance coverage for property, fire, commercial auto, marine, fine arts, aviation, cyber liability, directors’ and officers’ liability, disability, and health and welfare. It offers its products and services to commercial, industrial, captive and public entities, and not-for-profit entities. Gallagher operates its brokerage operations through a network of sales and service offices in the US and other countries. The company acts as a brokerage wholesaler and as a managing general agent (MGA) or managing general underwriter (MGU) for insurance carriers.

Arthur J. Gallagher & Co. reported its Q3 2024 earnings. The company reported EPS of $2.26, meeting analysts’ expectations. Revenue increased 13% to $2.77 billion, slightly below analysts’ expectations of $2.78 billion.

Stock Overview:

| Ticker | $AJG | Price | $286.54 | Market Cap | $71.58B |

| 52 Week High | $316.72 | 52 Week Low | $223.43 | Shares outstanding | 249.8M |

Company background:

Arthur J. Gallagher & Co. is a leading global insurance brokerage and risk management services provider. Founded in 1927 by Arthur James Gallagher in Itasca, Illinois, the company has grown significantly through a combination of organic growth and strategic acquisitions. Gallagher offers a wide range of insurance products and services, including property, casualty, and specialty insurance; employee benefits consulting; and risk management solutions. The company serves a diverse client base, including businesses of all sizes, government entities, and not-for-profit organizations.

Gallagher’s key competitors in the insurance brokerage industry include Marsh McLennan, Aon, and Willis Towers Watson. These companies compete with Gallagher on a global scale, offering similar products and services to a wide range of clients. Gallagher has established a strong presence in the United States and has expanded its international operations through a network of offices in various countries.

Gallagher is headquartered in Rolling Meadows, Illinois. The company has a long history of success and has consistently demonstrated strong financial performance. Gallagher’s focus on client service, innovation, and strategic acquisitions has driven its growth and positioned it as a leading player in the insurance brokerage industry.

Recent Earnings:

Arthur J. Gallagher & Co. announced its financial results for the third quarter of 2024. The company reported revenue of $2.77 billion, representing a 13% increase compared to the same period in the previous year. This revenue growth was driven by a combination of organic growth and acquisitions.

Gallagher’s earnings per share (EPS) for the quarter reached $2.26, meeting the consensus estimate of analysts. This reflects a solid performance across the company’s various business segments.

While revenue growth slightly missed analyst expectations, which were around $2.78 billion, Gallagher’s overall financial performance remained strong. The company’s operational metrics, such as its adjusted EBITDAC margin, also demonstrated improvement.

Looking ahead, Gallagher provided positive forward guidance. The company expects continued growth in its core brokerage and risk management businesses, driven by factors such as increasing insurance rates and a strong demand for risk management solutions. Gallagher also anticipates further expansion through strategic acquisitions.

Overall, Gallagher’s third-quarter 2024 earnings results highlight the company’s continued success and its ability to navigate the evolving insurance market. The company’s strong financial performance, combined with its positive outlook, positions Gallagher for continued growth in the years to come.

The Market, Industry, and Competitors:

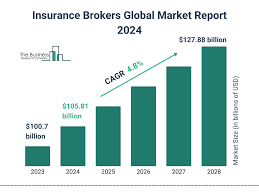

Arthur J. Gallagher & Co. operates in the global insurance brokerage and risk management services market. This market is characterized by increasing complexity and volatility, driven by factors such as economic uncertainty, climate change, and evolving cyber threats. These factors are creating a growing demand for sophisticated risk management solutions and insurance products.

The insurance brokerage market is expected to experience significant growth in the coming years. According to industry analysts, the global insurance brokerage market is projected to reach a market size of over $1 trillion by 2030, with a compound annual growth rate (CAGR) of around 4.5-7% during this period. This growth will be driven by several factors, including increasing global economic activity, rising insurance penetration rates in emerging markets, and the growing complexity of risk exposures.

Gallagher is well-positioned to capitalize on the growth opportunities within this market. The company’s strong market position, diversified service offerings, and global reach provide it with a competitive advantage. Gallagher’s focus on innovation, client service, and strategic acquisitions is expected to drive continued growth and market share expansion in the years to come.

Unique differentiation:

- Marsh McLennan: A global leader in insurance brokerage, risk management, and human capital consulting. Marsh McLennan operates through several subsidiaries, including Marsh, Guy Carpenter, and Mercer.

- Aon: Another major player in the insurance brokerage and risk management market, offering a wide range of services to clients around the world. Aon is known for its expertise in risk management consulting, insurance brokerage, and reinsurance brokerage.

- Willis Towers Watson: A global advisory, broking, and solutions company that provides a range of risk management, insurance, and human capital solutions to clients.

These companies compete with Gallagher on a global scale, offering similar products and services to a wide range of clients. The competitive landscape in the insurance brokerage market is dynamic and constantly evolving, with companies competing on factors such as service quality, pricing, innovation, and client relationships.

Client-centric Approach: Gallagher emphasizes building strong, long-term relationships with clients and providing personalized service. This focus on client satisfaction is a key differentiator in a competitive market.

Focus on Organic Growth and Strategic Acquisitions: Gallagher has a proven track record of both organic growth and strategic acquisitions. This dual-pronged approach allows the company to expand its market share and service offerings while maintaining a strong focus on client relationships.

Strong Culture and Employee Engagement: Gallagher fosters a strong company culture that emphasizes employee engagement and development. This culture contributes to high employee satisfaction and retention rates, which in turn benefits clients.

Specialization and Expertise: Gallagher has deep expertise in a wide range of insurance and risk management areas, allowing the company to provide specialized solutions to clients across various industries.

Management & Employees:

The management team of Arthur J. Gallagher & Co. is led by J. Patrick Gallagher, Jr., who serves as Chairman and CEO. Other key members of the management team include:

- Thomas J. Gallagher, President

- Patrick M. Gallagher, Chief Operating Officer

- Douglas K. Howell, Corporate Vice President and Chief Financial Officer

- Scott R. Hudson, Corporate Vice President, President and Chief Executive Officer, Risk Management Services

- Walter D. Bay, Corporate Vice President, General Counsel and Secretary

- Mark H. Bloom, Corporate Vice President and Global Chief Information Officer

- Christopher E. Mead, Corporate Vice President and Chief Marketing Officer

- Susan E. Pietrucha, Corporate Vice President and Chief Human Resource Officer

- William F. Ziebell, Corporate Vice President and President, Employee Benefit Consulting and Brokerage

Financials:

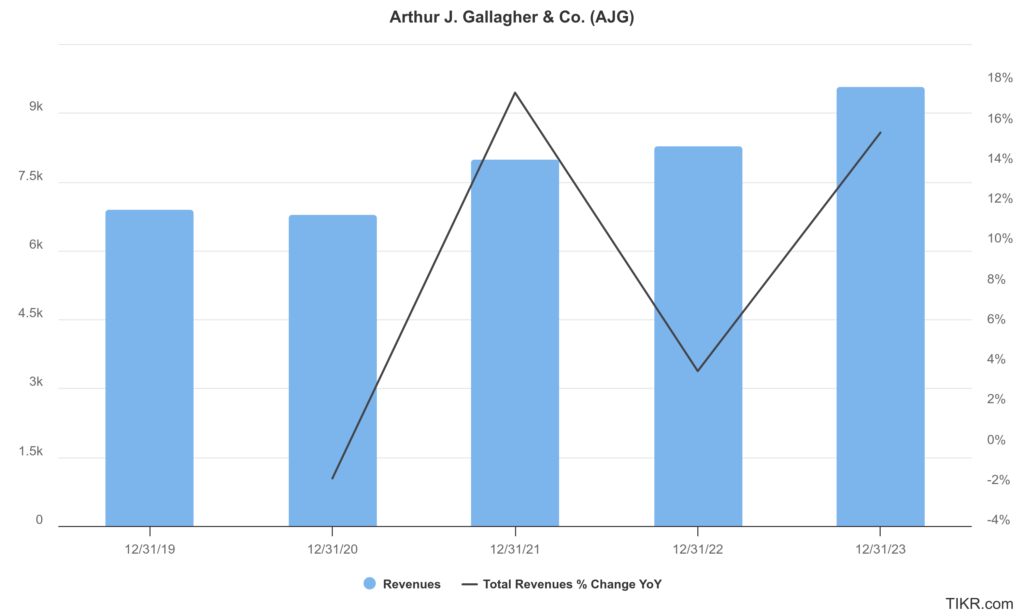

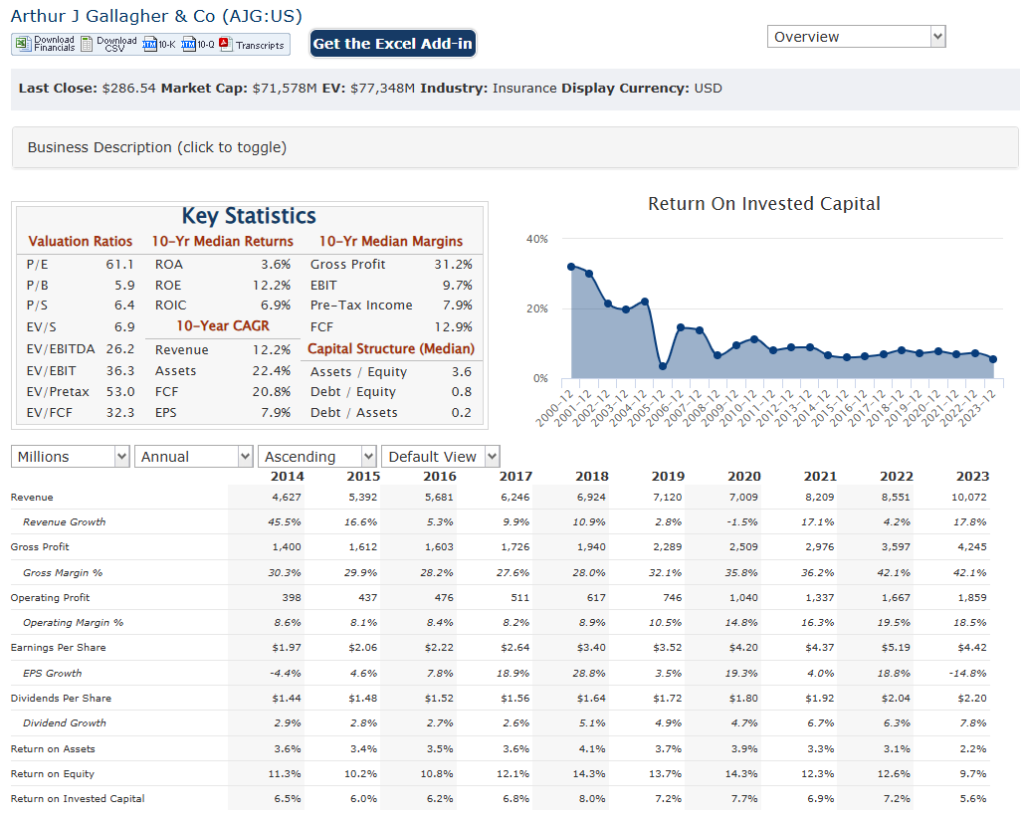

Arthur J. Gallagher & Co. has demonstrated robust financial performance over the past five years, characterized by steady revenue and earnings growth. For the fiscal year ending September 2024, the company reported revenues of approximately $10.67 billion, reflecting a compound annual growth rate (CAGR) of about 9.5% since 2019. This growth trajectory has been bolstered by strategic acquisitions and organic revenue increases, with organic growth rates averaging around 8% in recent quarters. The company’s brokerage and risk management segments have been particularly strong, contributing significantly to this revenue expansion.

In terms of earnings, Arthur J. Gallagher has achieved an average annual earnings growth rate of approximately 11% over the last five years. The net income for the year ending September 2024 was reported at $1.2 billion, showcasing a consistent upward trend in profitability. This performance is indicative of effective cost management and operational efficiencies, as evidenced by an adjusted EBITDAC margin that has improved over the years. The company’s ability to integrate acquisitions effectively has also played a crucial role in enhancing its earnings potential.

From a balance sheet perspective, Arthur J. Gallagher maintains a solid financial position with approximately $2 billion in cash and a manageable level of debt, which stood at around $1.7 billion as of September 2024. The company’s return on equity (ROE) is reported at 9.6%, with net margins holding steady at around 11%. These metrics reflect the company’s strong operational performance and its capacity to generate shareholder value while maintaining liquidity.

Overall, Arthur J. Gallagher & Co.’s financial performance over the past five years underscores its strategic focus on growth through acquisitions and organic development, coupled with prudent financial management that supports sustained profitability and a robust balance sheet.

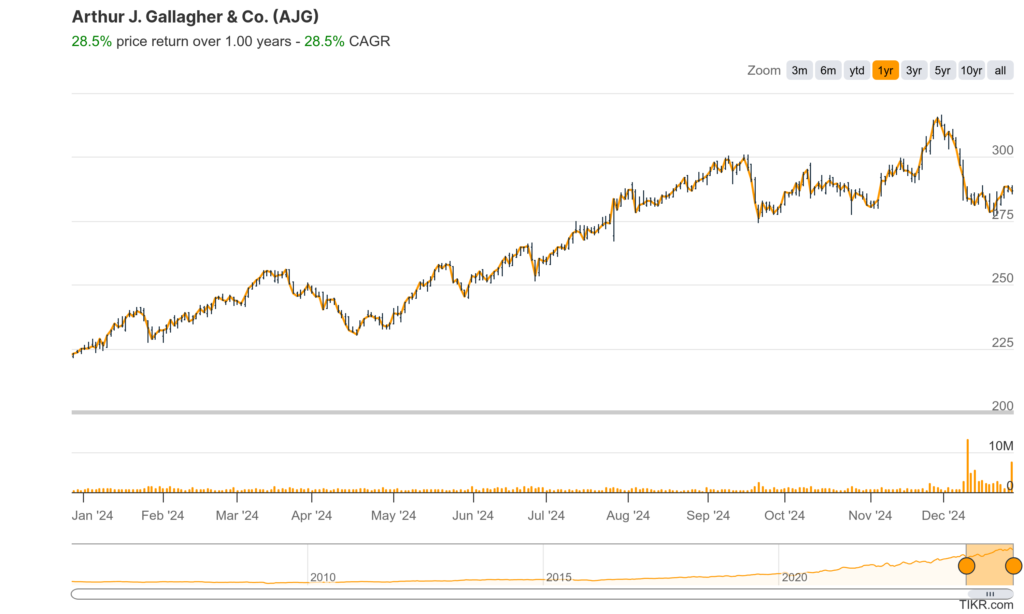

Technical Analysis:

The stock is on a stage 2 markup on the monthly and weekly charts. Strongly bullish. The daily chart shows a bear flag which indicates a move lower to the $273 range before we wait for a reversal. This is a strong, steady performer over the years.

Bull Case:

Industry Tailwinds: The insurance brokerage market is expected to experience significant growth in the coming years, driven by factors such as increasing global economic activity, rising insurance penetration rates in emerging markets, and the growing complexity of risk exposures. This provides a favorable backdrop for AJG’s continued expansion.

Strong Execution: AJG has a history of strong execution, consistently delivering solid financial results and expanding its market share through a combination of organic growth and strategic acquisitions. The company’s focus on client service, innovation, and operational excellence is expected to drive continued growth.

Acquisition Strategy: AJG has a proven track record of successful acquisitions, which have been a key driver of its growth. The company’s disciplined approach to acquisitions, combined with its ability to integrate acquired businesses effectively, positions it well for continued expansion through this strategy.

Diversified Revenue Streams: AJG has a diversified revenue base, with operations across various business segments, including property and casualty insurance, employee benefits consulting, and risk management services. This diversification helps to mitigate risk and provides a more stable revenue stream.

Strong Balance Sheet: AJG maintains a strong balance sheet, providing the financial flexibility to pursue growth opportunities, such as acquisitions and investments in technology and innovation.

Bear Case:

Economic Recession: A potential economic downturn could negatively impact client demand for insurance and risk management services, leading to slower revenue growth and lower profitability.

Increased Competition: The insurance brokerage market is highly competitive, with major players like Marsh McLennan, Aon, and Willis Towers Watson vying for market share. Increased competition could put pressure on pricing and profitability.

Regulatory Changes: Changes in insurance regulations, such as those related to data privacy or cybersecurity, could increase compliance costs and impact the company’s operations.

Integration Risks: AJG’s growth strategy relies heavily on acquisitions. Successful integration of acquired businesses can be challenging and may not always meet expectations.

Valuation Concerns: AJG’s stock price may be at a premium relative to its peers, potentially limiting upside potential.