Executive Summary:

Old Dominion Freight Line, Inc. is a leading less-than-truckload (LTL) motor carrier in North America, providing regional, inter-regional, and national LTL services through a single integrated, union-free organization. The company offers a wide range of services, including expedited transportation, through an expansive network of service centers across the continental United States. In addition to its core LTL services, the company offers a range of value-added services such as container drayage, truckload brokerage, and supply chain consulting.

Old Dominion Freight Line reported an EPS of $1.43, which beat the consensus estimate of $1.42 by $0.01. Quarterly revenue was $1.47 billion, below the consensus estimate of $1.49 billion.

Stock Overview:

| Ticker | $ODFL | Price | $199.03 | Market Cap | $42.49B |

| 52 Week High | $233.26 | 52 Week Low | $165.49 | Shares outstanding | 213.5M |

Company background:

Old Dominion Freight Line, Inc. (ODFL) is a leading less-than-truckload (LTL) motor carrier in North America, providing regional, inter-regional, and national LTL services through a single integrated, union-free organization. Founded in 1934 by Earl Congdon Sr. and Lillian Congdon, ODFL has grown into one of the largest LTL carriers in the United States, with an expansive network of service centers across the country. The company’s headquarters are located in Thomasville, North Carolina.

ODFL offers a range of value-added services in addition to its core LTL services, including expedited transportation, container drayage, truckload brokerage, and supply chain consulting. The company is known for its strong customer service, on-time delivery performance, and efficient operations. ODFL’s commitment to innovation and technology has enabled it to maintain a competitive edge in the industry, and the company has consistently ranked high in customer satisfaction surveys.

ODFL’s key competitors in the LTL market include YRC Worldwide, Saia, Inc., and XPO Logistics. The company faces challenges such as rising fuel costs, driver shortages, and increased competition from other transportation modes. ODFL’s strong financial performance, efficient operations, and focus on customer service have enabled it to navigate these challenges and maintain its position as a leading player in the LTL industry.

Recent Earnings:

Old Dominion Freight Line, Inc. (ODFL) reported a total revenue of $1.47 billion, representing a 3.0% decline from the previous year’s $1.52 billion. This drop was attributed primarily to a 4.8% decrease in LTL tons per day, although partially offset by a 1.5% increase in LTL revenue per hundredweight.

Old Dominion reported $1.43, slightly surpassing analysts’ expectations of $1.42 but down from $1.54 in the same quarter last year, marking a 7.1% decrease year-over-year. The results were consistent with the Zacks Consensus Estimate, reflecting a cautious optimism among analysts regarding the company’s ability to maintain profitability despite declining revenues. The company’s market share and volume trends remained stable, supported by strong customer retention and operational efficiencies.

The operating ratio increased by 210 basis points to 72.7%, indicating that costs were rising as a percentage of revenue due to lower sales volumes affecting fixed expenses. The company managed to maintain an impressive 99% on-time service rate and a cargo claims ratio of just 0.1%, showcasing its commitment to service quality even in a downturn.

The company continues to focus on disciplined pricing strategies to enhance yields and manage cost inflation while investing in capacity and technology to support long-term growth objectives. While the third quarter presented challenges, Old Dominion’s strong operational foundation and market position provide a solid basis for navigating the current economic landscape.

The Market, Industry, and Competitors:

Old Dominion Freight Line, Inc. operates in the less-than-truckload (LTL) trucking market in North America. This market involves the transportation of freight that is too large or heavy to be shipped via parcel services but not large enough to fill an entire truck. The LTL market is a fragmented industry with numerous regional and national carriers competing for market share.

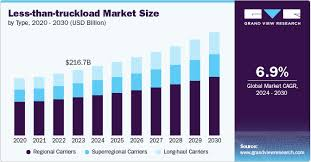

The LTL trucking market is expected to experience growth including the increasing demand for e-commerce, the growth of the manufacturing sector, and the expansion of the global economy. The global LTL market is projected to grow at a compound annual growth rate (CAGR) of 6.9% from 2024 to 2030, reaching a market size of USD 342.09 billion by 2030.

Old Dominion Freight Line is well-positioned to benefit from the growth of the LTL market due to its strong brand reputation, extensive service network, and efficient operations. The company has a history of outperforming the industry average in terms of revenue growth and profitability. ODFL also faces challenges such as rising fuel costs, driver shortages, and increased competition from other transportation modes.

Unique differentiation:

YRC Worldwide: YRC Worldwide is one of the largest LTL carriers in North America, with a network of service centers across the United States and Canada. The company offers a wide range of LTL services, including regional, inter-regional, and national transportation.

Saia, Inc.: Saia is another major LTL carrier with a strong presence in the southern and eastern United States. The company focuses on providing regional and inter-regional LTL services, as well as specialized services such as expedited freight and final-mile delivery.

XPO Logistics: XPO Logistics is a global logistics provider that offers a range of transportation and logistics services, including LTL, truckload, intermodal, and freight forwarding. The company has a large network of service centers worldwide and is a major player in the North American LTL market.

These companies compete with ODFL on several fronts, including price, service quality, and network coverage. ODFL’s competitive advantages include its strong brand reputation, efficient operations, and high customer satisfaction ratings.

Operational Excellence: The company is known for its efficient operations, including a well-maintained fleet, optimized service centers, and a skilled workforce. This translates into faster transit times, reduced costs, and improved overall service quality.

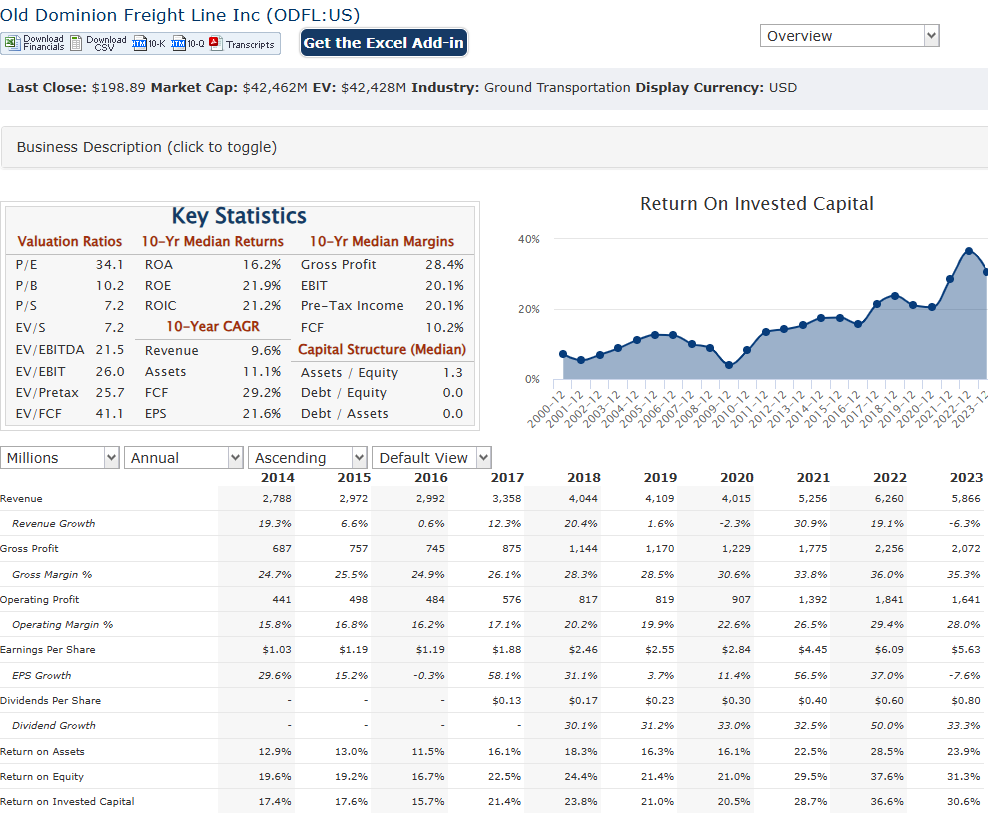

Strong Financial Performance: ODFL has a history of strong financial performance, with consistent revenue growth, high profitability margins, and a solid balance sheet. This financial strength allows the company to invest in its business, expand its service network, and weather economic downturns.

Management & Employees:

David Congdon: Executive Chairman of the Board

Kevin Freeman: President and Chief Executive Officer

Ross Parr: Senior Vice President of Legal Affairs

Clayton Brinker: VP of Accounting & Finance and Principal Accounting Officer

Sam Faucette: Vice President of Safety & Compliance

Financials:

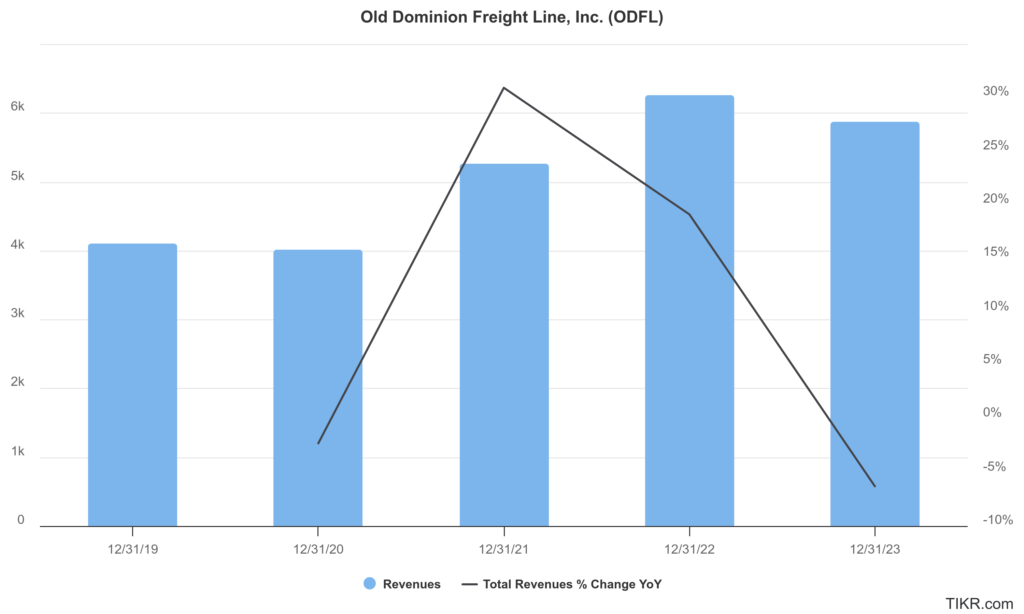

Old Dominion Freight Line, Inc. (ODFL) has reported a revenue of $4.11 billion, which saw a decline to $4.015 billion in 2020 due to the pandemic’s impact on freight demand. A robust recovery with revenue soaring to $5.256 billion, reflecting a 30.91% increase year-over-year. This upward trajectory continued into 2022, when revenue reached $6.26 billion, representing a 19.1% growth. ODFL faced headwinds as revenue declined to $5.866 billion, a decrease of 6.29% compared to 2022. The compound annual growth rate (CAGR) for revenue over these five years stands at approximately 3.6%.

ODFL reported an EPS of $5.06, which increased to $6.03 in 2020 despite the revenue drop, showcasing effective cost management and operational efficiency. The EPS further climbed to $8.32 in 2021 and reached $10.25 in 2022, reflecting substantial earnings growth driven by increased demand for freight services during the economic recovery from the pandemic. EPS fell to $9.22, marking a decline of 10% from the previous year. The CAGR for EPS over the last five years is approximately 7%, indicating overall growth despite recent challenges.

The company reported net debt of approximately -$354 million, indicating a net cash position that has improved from previous years, particularly from a net debt of -$632 million in 2020. This robust balance sheet reflects ODFL’s disciplined capital management and ability to generate substantial free cash flow, which was reported at $811.8 million for 2023.

Old Dominion’s management remains focused on navigating the current economic environment while continuing to invest in capacity and technology to support long-term growth objectives. The company’s operational metrics remain strong, with high service quality and customer retention rates providing a solid foundation for future performance improvements as market conditions stabilize.

Technical Analysis:

The stock is in a stage 2 markup (bullish) on the monthly chart, but bearish on the weekly and daily charts (stage 4)and support exists in the $177 range. The long term outlook is neutral in the consolidation area.

Bull Case:

Industry Tailwinds: The less-than-truckload (LTL) trucking market is expected to experience continued growth, driven by factors such as e-commerce expansion, reshoring of manufacturing, and the overall growth of the global economy. This provides a favorable backdrop for ODFL’s business.

Favorable Industry Dynamics: The recent bankruptcy of Yellow Corporation, a major competitor, could create opportunities for ODFL to gain market share and benefit from potential pricing increases as the industry consolidates.

Bear Case:

Rising Fuel Costs: High fuel costs can significantly impact ODFL’s profitability, as fuel is a major expense for trucking companies.

Driver Shortages: The ongoing driver shortage in the trucking industry could increase costs and disrupt operations for ODFL.

Regulatory Changes: Changes in government regulations, such as stricter emissions standards or safety regulations, could increase costs for ODFL.