Executive Summary:

Interactive Brokers Group Inc. is a leading global electronic brokerage firm offering direct access to trade execution and clearing services. It provides a comprehensive platform for investors and traders to access a wide range of financial instruments, including stocks, options, futures, currencies, bonds, and more. The company’s focus on advanced technology and low-cost trading solutions has made it a popular choice for both individual and institutional clients.

Interactive Brokers Group Inc. reported diluted earnings per share (EPS) of $1.81, surpassing analysts’ expectations of $1.70. The company’s revenue for the quarter came in at $1.365 billion. EPS grew by 16% and revenue increased by 20%.

Stock Overview:

| Ticker | $IBKR | Price | $179.50 | Market Cap | $75.84B |

| 52 Week High | $193.42 | 52 Week Low | $78.93 | Shares outstanding | 108.88M |

Company background:

Interactive Brokers Group Inc., founded in 1977 by Thomas Peterffy, is a leading global electronic brokerage firm. Interactive Brokers offers a comprehensive trading platform that provides direct access to a wide range of financial instruments, including stocks, options, futures, currencies, bonds, and more. It caters to both individual investors and institutional clients, emphasizing low-cost trading and advanced tools.

Key competitors of Interactive Brokers include Charles Schwab, TD Ameritrade, and E*TRADE Financial. These firms also offer online brokerage services but may have different strengths in terms of product offerings, customer service, and trading platforms.

Interactive Brokers Group Inc. is headquartered in Greenwich, Connecticut, United States. The company has a global presence with offices in major financial centers around the world.

Recent Earnings:

Interactive Brokers Group Inc. reported revenue for the quarter reached $1.365 billion, marking a 20% increase year-over-year. This growth was driven by increased customer activity and higher trading volumes across various asset classes.

Diluted earnings per share (EPS) for the quarter came in at $1.81, surpassing analyst estimates of $1.70. This represents a 16% year-over-year increase. The company’s strong performance was attributed to efficient cost management and higher interest income.

Customer accounts increased by 28% to 3.12 million, and customer equity grew by 46% to $541.5 billion. Total DARTs (Daily Average Revenue Trades) increased by 42% to 2.70 million. The company anticipates a sequential increase in revenue and EPS, driven by seasonal factors and ongoing market volatility.

The Market, Industry, and Competitors:

Interactive Brokers Group Inc. (IBKR) operates within the highly competitive financial services sector, specifically focusing on electronic brokerage and trading services. The company caters to a diverse clientele that includes retail investors, institutional clients, and hedge funds, providing access to a wide range of financial instruments such as stocks, options, futures, and cryptocurrencies. With a robust technological infrastructure, IBKR enables direct market access across over 150 market destinations globally, which positions it as a leader in trade execution and clearing services. The firm has demonstrated significant growth in account acquisition, with year-over-year increases reported between 28% and 29%, highlighting its expanding market presence and customer base.

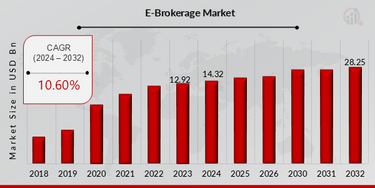

Analysts project a compound annual growth rate (CAGR) of approximately 10% for the brokerage industry overall, with IBKR potentially outperforming this average due to its innovative product offerings and strategic initiatives such as entering the election prediction markets. The firm’s ability to leverage economies of scale and improve operational efficiency as its user base grows is expected to bolster profit margins over time. The interest rates impacting net interest margins and competition from other brokers will require ongoing innovation and effective management strategies to sustain growth momentum.

Unique differentiation:

Interactive Brokers faces competition from several established players in the online brokerage industry. Key competitors include Charles Schwab, TD Ameritrade, and E*TRADE Financial. These firms offer a wide range of investment products and services, including stocks, bonds, options, mutual funds, and ETFs. They often target a broader range of investors, from beginners to experienced traders, and may have a stronger focus on customer service and user-friendly platforms.

Interactive Brokers excel in providing advanced trading tools and low-cost execution, these competitors may have advantages in terms of brand recognition, broader product offerings, and a larger customer base. Newer entrants like Robinhood have gained popularity by offering commission-free trading and simplified investing experiences, targeting younger, less experienced investors.

Interactive Brokers must continue to innovate its platform, expand its product offerings, and enhance its customer experience. By focusing on its strengths in advanced trading tools, low-cost execution, and global reach, Interactive Brokers can differentiate itself from competitors and attract a diverse range of investors.

Advanced Trading Platform:

- Powerful Tools: Provides a sophisticated trading platform with advanced tools and charting capabilities, catering to experienced traders and institutional investors.

- Customization: Offers a high degree of customization, allowing users to tailor the platform to their specific needs and preferences.

- Direct Market Access: Enables direct market access (DMA), giving traders direct connection to exchanges and market makers, often leading to lower trading costs and faster execution speeds.

Low-Cost Trading:

- Competitive Pricing: Offers competitive pricing and fee structures, making it an attractive option for cost-conscious investors.

- Tiered Fee Structure: Provides tiered fee structures that reward high-volume traders with lower costs.

Management & Employees:

- Milan Galik: As the CEO, President, and Director, Galik oversees the company’s overall strategy and operations. He has been instrumental in driving the company’s growth and technological advancements.

- Earl H. Nemser: As the Vice Chairman, Nemser provides strategic guidance to the company’s leadership team. He brings a wealth of experience in the legal and financial industry.

- Thomas Peterffy: The Founder and Chairman of the Board, Peterffy is a visionary leader who has shaped Interactive Brokers into a leading global electronic brokerage firm.

Financials:

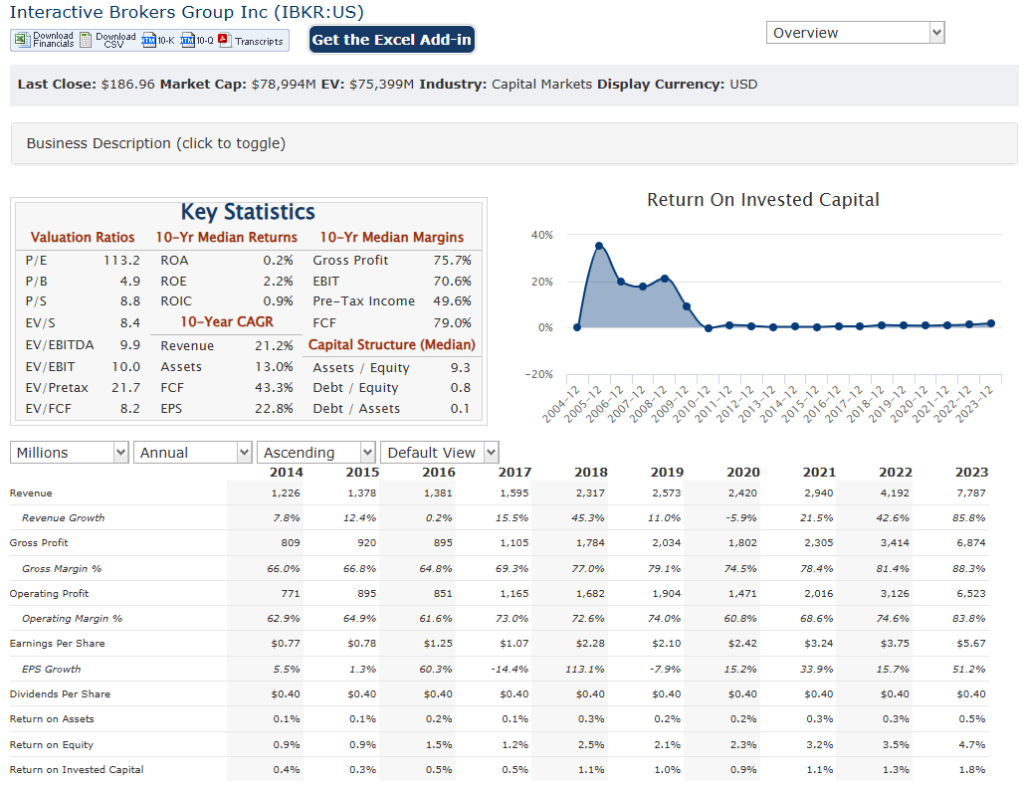

Interactive Brokers Group Inc. (IBKR) has reported revenues of approximately $1.94 billion, which increased to around $4.34 billion in 2023, reflecting a compound annual growth rate (CAGR) of about 41.51% during this period. The growth trajectory continued into 2024, with revenues reaching approximately $4.94 billion for the twelve months, marking an 18.19% increase year-over-year. This consistent upward trend in revenue can be attributed to higher trading volumes and an expanding customer base, particularly in options and futures trading.

Earnings growth has also been impressive, with diluted earnings per share (EPS) rising from $1.29 in 2019 to approximately $5.00 in 2023, indicating a CAGR of about 50%. In the third quarter of 2024 alone, IBKR reported a diluted EPS of $1.81, up from $1.56 in the same quarter of the previous year. This increase is largely driven by enhanced net interest income and commission revenues resulting from increased customer trading activity. The company’s ability to maintain high profit margins—around 72%—demonstrates its operational efficiency and effective cost management strategies.

The total assets have grown substantially, supported by a robust increase in client equity, which reached approximately $575.9 billion—a 42% increase compared to the previous year. Client margin loan balances also rose to about $60.2 billion, reflecting a healthy demand for margin trading among clients. The company’s focus on maintaining a strong capital position while managing risk effectively has allowed it to navigate market fluctuations successfully and capitalize on growth opportunities within the electronic brokerage space. As it continues to innovate and adapt to market demands, the company is well-positioned for sustained growth in the years ahead.

Technical Analysis:

The stock is on a stage 2 markup on the monthly chart (Bullish) with a bull flag on the weekly chart. The near term move to $170 range is showing consolidation on the daily chart, but this stock should head higher to the $200 range before next earnings (on 21st Jan).

Bull Case:

Strong Financial Performance: IBKR has consistently delivered strong financial results, with increasing revenue and earnings over time. This strong financial performance can lead to higher stock valuations.

Growth Opportunities: The online brokerage industry is expected to continue growing, driven by factors such as increasing internet penetration, rising disposable incomes, and the democratization of finance. IBKR is well-positioned to capitalize on this growth.

Bear Case:

Regulatory Risks: The financial industry is subject to stringent regulations, and changes in regulations could impact IBKR’s business model and operations. Increased regulatory costs or restrictions could negatively impact profitability.

Market Volatility: Market volatility can impact trading volumes and revenue for brokerage firms. Periods of low market volatility or economic downturns could lead to reduced trading activity and lower revenue for IBKR.

Cybersecurity Risks: As a financial services company, IBKR is a potential target for cyberattacks. A successful cyberattack could damage the company’s reputation, lead to financial losses, and erode investor confidence.