Executive Summary:

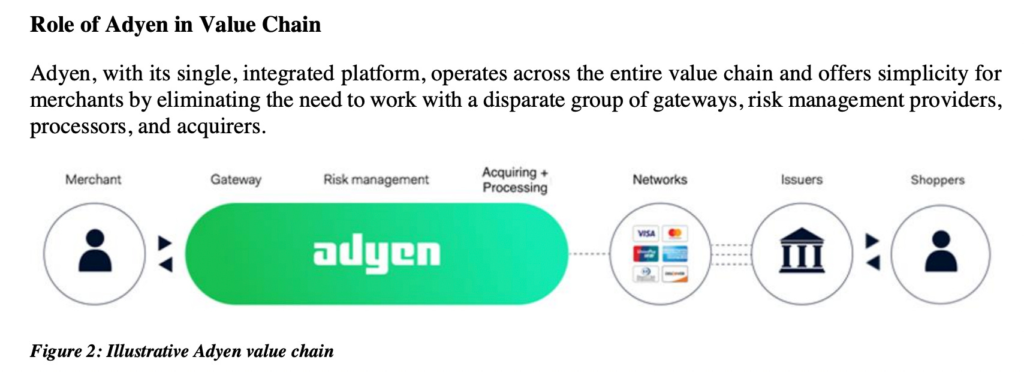

Adyen N.V. is a Dutch multinational financial technology company focused on payment processing. They provide end-to-end payment solutions for businesses, enabling them to accept various payment methods across multiple channels. The company’s technology platform handles everything from card processing and fraud prevention to issuing and acquiring services. Adyen serves a diverse range of clients, including major international brands and high-growth businesses.

Adyen N.V. reported net revenue of €913.4 million, marking a 24% year-over-year (YoY) increase. This growth was primarily driven by the expansion of its platform business and increased processing volumes. The overall positive revenue growth and strategic focus on platform expansion indicate strong financial performance.

Stock Overview:

| Ticker | $ADYEY | Price | $14.57 | Market Cap | $45.73B |

| 52 Week High | $17.27 | 52 Week Low | $10.78 | Shares outstanding | 3.15B |

Company background:

Adyen N.V. is a prominent Dutch multinational financial technology company specializing in payment processing. Founded in 2006 by Pieter van der Does and Arnout Schuijff, Adyen’s innovative approach to payment solutions has garnered attention in the industry. While the company’s early stages were bootstrapped, its subsequent growth and success have led to substantial investments and a successful IPO on Euronext Amsterdam.

Adyen offers a comprehensive suite of payment products and services, including payment processing, fraud prevention, and issuing and acquiring services. Its platform enables businesses to accept various payment methods, such as credit cards, debit cards, digital wallets, and mobile payments, across multiple channels, including online, mobile, and in-store.

Adyen’s primary competitors in the global payments industry include traditional payment processors like Visa, Mastercard, and PayPal, as well as emerging fintech companies like Stripe. Adyen differentiates itself by offering a more integrated and innovative platform, focusing on a seamless user experience and advanced technology.

Adyen’s headquarters are located in Amsterdam, the Netherlands. This strategic expansion has allowed Adyen to serve a diverse clientele, ranging from small businesses to multinational corporations.

Recent Earnings:

Adyen N.V. reported net revenue of €910.85 million, reflecting a 24% year-over-year increase. This growth was primarily driven by the expansion of its platform business and increased processing volumes.

Earnings per share (EPS) from continuing operations reached €13.19, a 45% increase compared. This robust EPS growth underscores Adyen’s ability to generate strong profits while investing in future growth initiatives. The company’s operational metrics, including processing volumes and customer acquisition, remained healthy, further solidifying its leadership in the payments industry.

Adyen expects to continue investing in its platform, expanding its product offerings, and entering new markets.

The Market, Industry, and Competitors:

Adyen N.V. operates within the financial technology (fintech) sector, providing a comprehensive payments platform that facilitates seamless transactions across various channels and geographies. The company serves a diverse clientele, including online and offline merchants, and supports multiple payment methods to enhance customer experiences. Adyen’s revenue is distributed primarily across Europe, the Middle East, and Africa (55.94%), followed by North America (26.4%), Asia/Pacific (11.2%), and Latin America (6.5%). The global payment processing industry is increasingly driven by the demand for integrated solutions that streamline financial transactions.

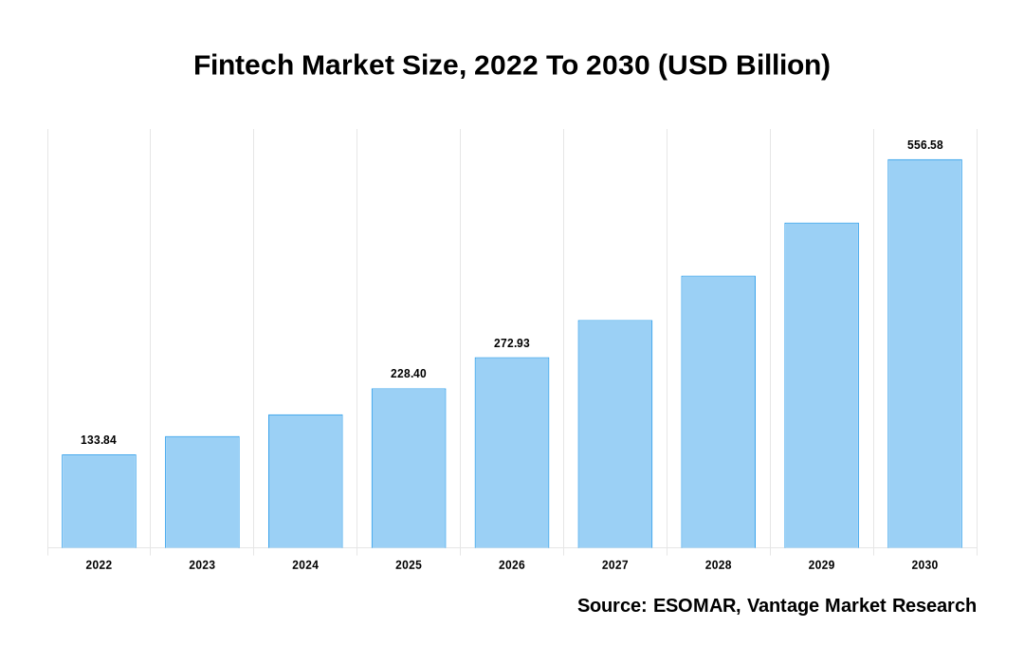

Adyen is poised for substantial growth, with expectations of expanding its market share as digital payments continue to rise globally. Analysts project a compound annual growth rate (CAGR) of approximately 20% for the fintech sector, driven by increasing e-commerce activity, advancements in payment technologies, and a growing preference for contactless payments. This growth trajectory is supported by Adyen’s strategic focus on enhancing its platform capabilities and expanding into new markets, which aligns with the broader trends in consumer behavior and technological innovation within the payments landscape. As businesses increasingly seek integrated solutions to manage their payment processes efficiently, Adyen’s offerings are likely to attract more clients, further solidifying its position in the market.

Unique differentiation:

Adyen N.V. faces competition from various players in the global payments industry. Traditional payment processors like Visa and Mastercard remain significant competitors, leveraging their extensive networks and established brand recognition. However, Adyen differentiates itself by offering a more comprehensive and integrated platform, catering to the evolving needs of modern businesses.

Emerging fintech companies like Stripe pose a strong competitive threat, particularly in the high-growth segment of online and mobile payments. Stripe’s user-friendly interface and focus on developer-friendly APIs have attracted a large customer base. Other notable competitors include PayPal, which has a strong presence in online payments, and Square, which focuses on small and medium-sized businesses.

While Adyen competes with these established players, it also faces competition from regional payment providers and specialized fintech solutions. The competitive landscape is dynamic, and Adyen’s ability to innovate, adapt to changing market trends, and maintain strong customer relationships will be crucial to its long-term success.

1. Unified Platform:

- End-to-End Solution: Adyen offers a unified platform that handles various payment methods, currencies, and channels, simplifying complex payment operations for businesses.

- Reduced Costs and Complexity: By consolidating multiple payment providers into a single platform, businesses can streamline their operations and reduce costs.

2. Data-Driven Approach:

- Data-Informed Decisions: Adyen leverages data analytics to identify trends, optimize payment flows, and improve overall performance.

- Personalized Experiences: By analyzing customer behavior, Adyen can tailor payment experiences to individual preferences.

Management & Employees:

Pieter van der Does: Co-founder and CEO, oversees the overall strategy and direction of the company.

Ingo Uytdehaage: Co-CEO, responsible for driving the company’s growth and operations.

Roelant Prins: Chief Commercial Officer, leads the company’s global sales and business development efforts.

Tom Adams: Chief Technology Officer, leads the technology and product development teams.

Financials:

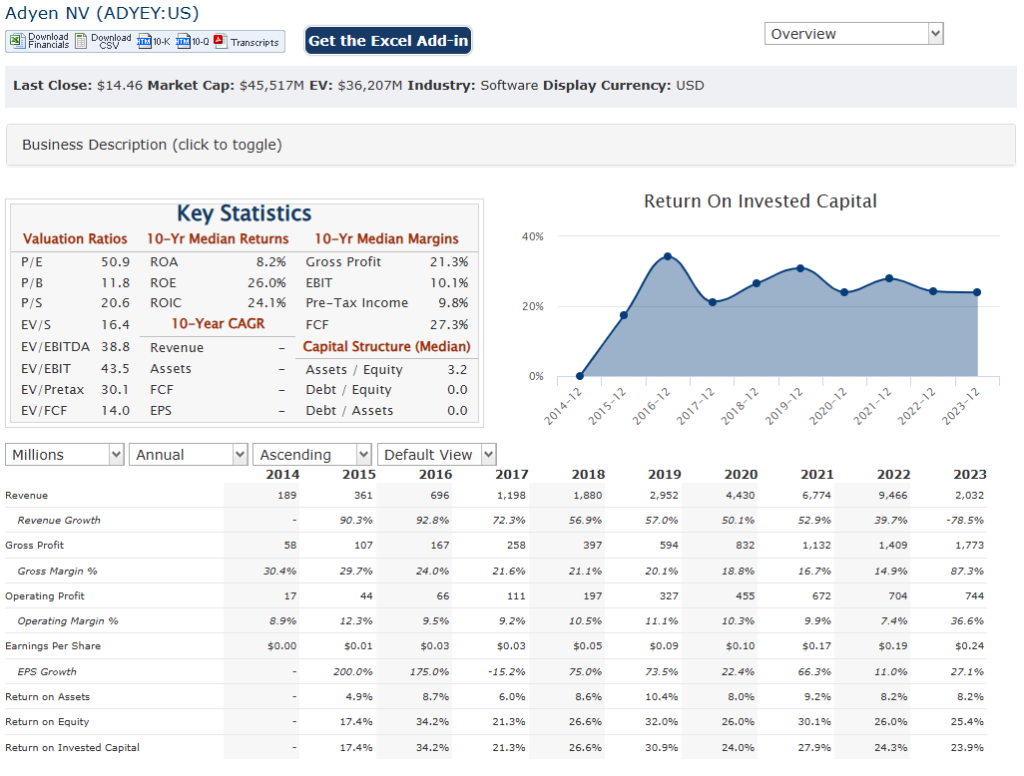

Adyen’s revenue increased from approximately €1 billion to €1.626 billion, reflecting a compound annual growth rate (CAGR) of about 27.3%. This growth trajectory has been fueled by the company’s ability to capture a larger share of the digital payments market, driven by its innovative payment solutions and expansion into new geographical regions. Adyen reported net revenue of €1.626 billion, marking a 22% year-on-year increase, which indicates continued momentum despite a challenging macroeconomic environment.

Earnings before interest, taxes, depreciation, and amortization (EBITDA) also showcased strong performance, growing from around €470 million in 2018 to €743 million in 2023. This translates to an impressive CAGR of approximately 27.9% over the same period. The EBITDA margin saw a decline from 55% in 2022 to 46% in 2023, primarily due to increased investments in team expansion and operational capabilities. The company’s net profit margins remained healthy at around 45.6%, reflecting its efficient cost management and strong market position.

The company has consistently generated positive free cash flow, with a conversion ratio of 93% in 2023, indicating effective cash management practices. Adyen’s capital expenditures (CapEx) represented 4% of net revenue in 2023, down from 7% in the previous year, suggesting a strategic shift towards optimizing existing resources rather than aggressive expansion spending. The company’s return on equity (ROE) stands at an impressive 23.1%, underscoring its ability to generate substantial returns for shareholders.

Adyen with expectations of a 20% CAGR for revenue over the next three years and a 29% CAGR for net income. Adyen continues to innovate and expand its offerings globally, it is well-positioned to capitalize on emerging opportunities within the fintech sector while navigating potential challenges in the broader economic landscape.

Technical Analysis:

The stock is in a stage 1 consolidation (neutral) on the monthly and weekly chart and is looking weak overall. The daily chart is in a stage 4 markdown (bearish) and should move to $13 range in a few weeks. We would wait for a reversal and a cross over $17 range for clear signs of going long for the investment. Until then, this is a poor stock to invest in.

Bull Case:

Strong Growth Potential:

- Global E-commerce Boom: The continued growth of e-commerce and digital payments presents significant opportunities for Adyen to expand its market share.

- Rising Digital Payments: The increasing adoption of digital payment methods, such as mobile wallets and contactless payments, aligns with Adyen’s core business.

Strong Financial Performance:

- Consistent Revenue Growth: Adyen has demonstrated a consistent track record of revenue growth, driven by its strong market position and innovative offerings.

- High Profit Margins: The company’s high-margin business model and efficient operations contribute to its strong profitability.

Bear Case:

Regulatory Risks:

- Changing Regulatory Landscape: The global regulatory environment for the payments industry is constantly evolving, and stricter regulations could increase compliance costs and limit growth opportunities.

- Data Privacy Concerns: Adyen handles sensitive customer data, and any data breaches or privacy violations could damage its reputation and lead to significant financial penalties.

Economic Downturns:

- Economic Slowdown: Economic downturns can negatively impact consumer spending and business investment, leading to reduced payment volumes and lower revenue for Adyen.

- Currency Fluctuations: Fluctuations in foreign exchange rates can impact Adyen’s financial performance, especially for international transactions.

Technology Disruptions:

- Rapid Technological Advancements: The rapid pace of technological change can make it challenging for Adyen to keep up with the latest trends and maintain its competitive edge.

- Cybersecurity Threats: Adyen’s business relies heavily on technology, and any cyberattacks or data breaches could have severe consequences.