Executive Summary:

Li Auto Inc. is a prominent player in China’s electric vehicle market, specializing in the design, development, and manufacturing of premium smart electric vehicles. The company is particularly known for its pioneering work in commercializing extended-range electric vehicles (EREVs) in China, a technology that combines electric power with a gasoline-powered range extender to offer longer driving ranges. Li Auto aims to provide families with safe, convenient, and comfortable mobility solutions by focusing on innovation in product design, technology integration, and business models. The company’s current product lineup includes a range of SUVs and MPVs, catering to different family needs and preferences.

Li Auto Inc. reported earnings per share (EPS) of $3.63, higher than the consensus estimate of $3.02. Revenue for the quarter reached $42.9 billion, exceeding analysts’ projections of $40.9 billion.

Stock Overview:

| Ticker | $LI | Price | $22.60 | Market Cap | $24.41B |

| 52 Week High | $46.44 | 52 Week Low | $17.44 | Shares outstanding | 814.93M |

Company background:

Li Auto Inc., founded in 2015 by Li Xiang, is a prominent Chinese electric vehicle (EV) manufacturer. The company is headquartered in Beijing, with manufacturing facilities in Changzhou. Li Auto has gained significant attention for its innovative approach to electric vehicles, particularly its focus on extended-range electric vehicles (EREVs).

Li Auto has secured substantial funding through various rounds, enabling it to invest in research and development, production facilities, and expansion strategies. Their product lineup primarily consists of premium SUVs and MPVs. These vehicles are designed to offer a balance of electric driving range and fuel efficiency, addressing range anxiety concerns commonly associated with pure electric vehicles. The company’s key competitors in the Chinese EV market include NIO, Xpeng, and BYD.

Recent Earnings:

Li Auto Inc. reported strong third-quarter 2024 earnings. The revenue for the quarter reached $42.9 billion, an increase compared to the previous quarter. This growth can be attributed to increased vehicle deliveries and strong demand for Li Auto’s premium electric vehicles.

Li Auto’s earnings per share (EPS) for the quarter amounted to $3.63, higher than the consensus estimate of $3.02. This impressive EPS growth reflects the company’s strong operational performance and cost management.

The company delivered a substantial number of vehicles during the quarter, demonstrating strong market demand for its products. Li Auto indicates continued optimism, with expectations of further growth in vehicle deliveries and revenue. The company’s focus on innovation, coupled with its unique EREV technology, positions it well to capitalize on the growing electric vehicle market in China.

The Market, Industry, and Competitors:

Li Auto Inc. operates primarily in the rapidly growing electric vehicle (EV) market in China, which is currently the largest EV market globally. The company specializes in premium smart electric SUVs, focusing on extended-range electric vehicles (EREVs) that combine traditional internal combustion engines with electric power to enhance driving range and efficiency. Li Auto has established itself as a significant player, having reported substantial growth in vehicle deliveries and profitability, becoming the first major Chinese EV startup to turn a profit with a net income of approximately $1.7 billion. The competitive landscape features intense rivalry from established brands like BYD and Tesla, which are also targeting premium segments.

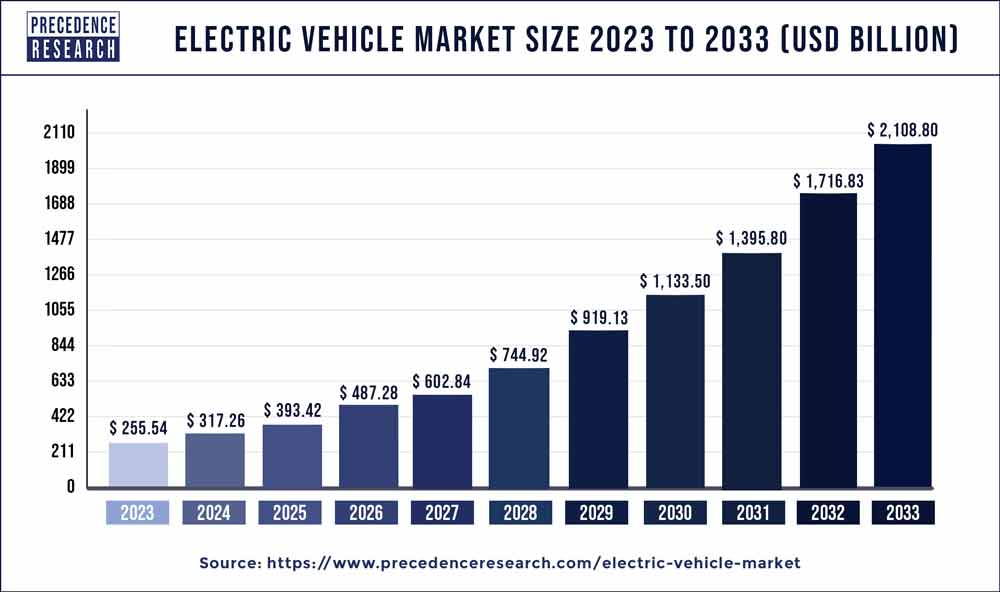

The Global market for electric vehicles is expected to expand, with projections indicating a compound annual growth rate (CAGR) of approximately 17.15% for China’s EV market from 2024 to 2030. Li Auto is well-positioned to capitalize on this growth due to its focus on innovation, including advancements in battery technology and autonomous driving capabilities. Li Auto’s stock could reach an average price of around $61.36, reflecting a potential increase of over 159% from current levels. The company’s strategy includes not only enhancing its product lineup but also exploring international markets.

Unique differentiation:

- NIO: Known for its premium electric vehicles and innovative battery swap technology, NIO is a direct competitor to Li Auto, particularly in the high-end EV segment.

- Xpeng: Another major player in the Chinese EV market, Xpeng focuses on autonomous driving technology and smart electric vehicles. The company competes with Li Auto in the mid-to-high-end EV segment.

- BYD: As one of the world’s largest EV manufacturers, BYD offers a wide range of electric vehicles, including passenger cars and commercial vehicles. While BYD competes with Li Auto in the broader EV market, its focus on a wider range of products and lower-priced options differentiates it from Li Auto.

- Other emerging players: Several other emerging Chinese EV companies, such as Leapmotor, WM Motor, and Hozon Auto, are also competing with Li Auto in the Chinese market. These companies are often backed by significant investments and are rapidly gaining market share.

Li Auto has successfully differentiated itself by focusing on its unique EREV technology and premium positioning. The company’s strong brand reputation, innovative products, and strong financial backing have enabled it to compete effectively in the Chinese EV market.

Li Auto’s unique differentiation lies in its focus on extended-range electric vehicles (EREVs). This technology combines the benefits of pure electric vehicles (EVs) with the convenience of a gasoline engine range extender.

- Longer Range: EREVs provide significantly longer driving ranges compared to pure EVs, especially on long journeys.

- Reduced Charging Anxiety: The gasoline engine acts as a backup power source, reducing the need for frequent charging.

- Faster Refueling: Refueling the gasoline tank is much quicker than charging an EV battery.

- Enhanced Performance: EREVs often offer impressive acceleration and driving dynamics.

Management & Employees:

- Xiang Li: Founder, Chairman, and Chief Executive Officer. A seasoned entrepreneur with extensive experience in the internet and automotive industries.

- Donghui Ma: Executive Director and President. Oversees the company’s overall operations, including product development, manufacturing, and sales.

- Yan Xie: Chief Technology Officer. Leads the company’s technology and product development efforts, including autonomous driving and intelligent vehicle technologies.

Financials:

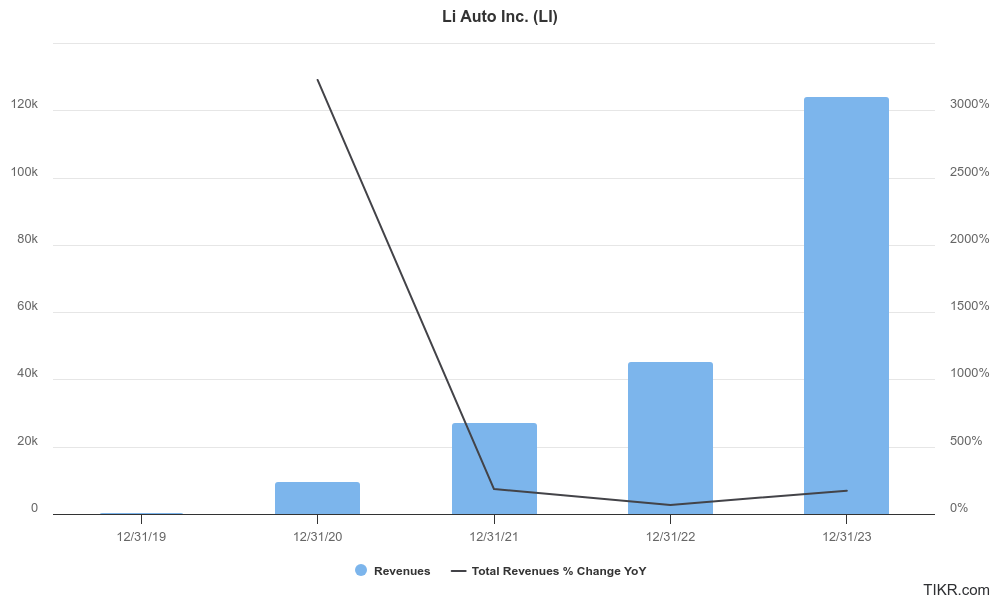

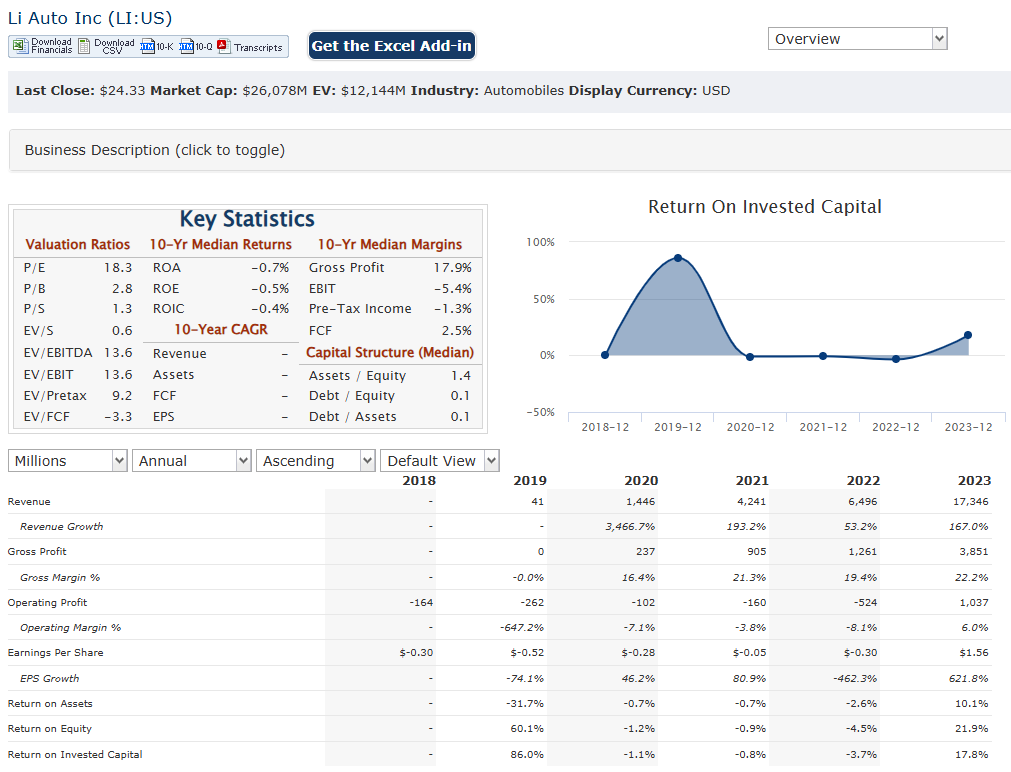

Li Auto Inc. has reported revenue saw substantial growth, surging from approximately RMB 7.8 billion to around RMB 123.9 billion. This represents a compound annual growth rate (CAGR) of approximately 90%, driven by increasing vehicle deliveries and a growing consumer preference for electric mobility. Li Auto delivered 376,030 vehicles, a increase from 133,246 in 2022.

The company achieved a net income of about RMB 11.8 billion (approximately $1.7 billion) in 2023, marking it as the first major Chinese EV startup to turn a profit. This turnaround reflects an earnings growth rate that has accelerated, with forecasts suggesting a future CAGR of around 25% for earnings through 2030. The company’s focus on premium smart electric SUVs and extended-range electric vehicles has helped it maintain healthy vehicle margins, which reached 21.5% in 2023, up from 19.1% in the previous year.

Li Auto has increased a cash reserves and manageable debt levels. The company reported total assets exceeding total liabilities, indicating strong liquidity and financial stability. This solid foundation allows Li Auto to invest in research and development as well as expand its production capabilities.

Li Auto’s financial outlook remains positive, with analysts projecting continued revenue growth driven by increasing demand for electric vehicles in China and potential international expansion. The company’s commitment to technological advancements and customer-centric strategies positions it well for sustained growth as it navigates the evolving landscape of the automotive industry.

Technical Analysis:

A broken Cup and Handle pattern on the monthly chart and a stage 4 decline on the daily chart with support in the $20 zone in the long term. The daily chart is in a bearish stage 4 decline as well, which means the stock will head to between $18 and $20.

Bull Case:

1. Strong Product Differentiation:

- EREV Technology: Li Auto’s unique extended-range electric vehicle (EREV) technology addresses the range anxiety issue that plagues many pure electric vehicles. This technology offers a compelling solution for consumers who desire the benefits of electric driving without the limitations of battery range.

- Premium Positioning: Li Auto focuses on the premium end of the Chinese EV market, where consumers are willing to pay a premium for high-quality, feature-rich vehicles.

2. Attractive Valuation:

- Relative Valuation: Compared to other EV companies, Li Auto’s valuation may appear attractive, especially considering its strong growth prospects and unique business model.

Bear Case:

1. Economic Uncertainty:

- Global Economic Slowdown: A global economic slowdown could dampen consumer demand for luxury EVs, impacting Li Auto’s sales and revenue.

- Geopolitical Risks: Geopolitical tensions and trade disputes could disrupt supply chains and increase costs, affecting Li Auto’s operations.

2. Regulatory Risks:

- Government Policies: Changes in government policies, such as subsidies and regulations, could impact Li Auto’s business model and financial performance.

- Intellectual Property: Protecting intellectual property rights in a rapidly evolving industry can be challenging, and potential legal disputes could impact the company’s operations.