Executive Summary:

Coinbase Global Inc. is a leading cryptocurrency exchange platform in the United States. The company aims to be a trusted and regulated gateway for individuals and institutions to engage with crypto assets. Coinbase offers a range of services, including buying, selling, storing, and trading various cryptocurrencies. It has been instrumental in popularizing cryptocurrency adoption and has played a significant role in shaping the regulatory landscape of the industry.

Coinbase Global Inc. reported an EPS of $0.43, surpassing analysts’ expectations of $0.41. Revenue for the quarter reached $1.24 billion, slightly below the projected $1.27 billion.

Stock Overview:

| Ticker | $COIN | Price | $320.43 | Market Cap | $80.22B |

| 52 Week High | $283.48 | 52 Week Low | $88.62 | Shares outstanding | 204.91M |

Company background:

Coinbase Global Inc., a prominent player in the cryptocurrency industry, was founded in 2012 by Brian Armstrong and Fred Ehrsam. They primarily offers a user-friendly platform for buying, selling, storing, and trading a wide range of cryptocurrencies. It also provides additional services like staking, earning rewards, and secure digital wallets.

Coinbase has emerged as one of the largest cryptocurrency exchanges in the United States, with a strong focus on regulatory compliance and security. It faces competition from other major exchanges such as Binance, Kraken, and Gemini. These competitors offer similar services and often compete on factors like fees, trading features, and geographic reach.

Coinbase is headquartered in San Francisco, California, and has offices in various locations worldwide. The company employs a distributed workforce model, allowing employees to work remotely from different parts of the globe. This approach enables Coinbase to tap into a diverse pool of talent and adapt to the evolving needs of the cryptocurrency industry.

Recent Earnings:

Coinbase Global Inc. reported its third-quarter 2024. The company posted an EPS of $0.43, surpassing analysts’ expectations of $0.41. Revenue for the quarter reached $1.24 billion, slightly below the projected $1.27 billion. Revenue fell short of estimates, it still marked a significant 12% increase year-over-year.

Monthly Transacting Users (MTUs) declined slightly compared to the previous quarter, but remained above the 10 million mark. Trading volume also experienced a modest decline. The company’s subscription and services revenue continued to grow, indicating a shift towards a more sustainable revenue model.

The company highlighted the potential impact of regulatory clarity and the increasing institutional adoption of cryptocurrencies as positive factors. They also acknowledged the challenges posed by market volatility and macroeconomic uncertainties. Coinbase remains committed to investing in product innovation and expanding its services to capture new opportunities in the evolving crypto ecosystem.

The Market, Industry, and Competitors:

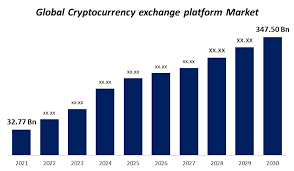

Coinbase Global Inc. operates primarily within the cryptocurrency exchange market, which has experienced growth in recent years due to increasing adoption of digital currencies. Coinbase provides a range of services including trading, storage, and management of various cryptocurrencies. The global cryptocurrency exchange platform market is projected to reach $347.50 billion by 2030, growing at a CAGR of 30.08% from its valuation of $32.77 billion in 2021. This expansion is driven by factors such as heightened public awareness of cryptocurrencies, advancements in blockchain technology, and the rising popularity of digital assets like NFTs.

Coinbase is expected to navigate a rapidly evolving market landscape characterized by technological advancements and regulatory developments. The growth expectations for Coinbase are closely tied to the overall performance of the cryptocurrency market, which is anticipated to grow robustly as more individuals and institutions embrace digital currencies. Analysts predict that Coinbase’s stock could see varied outcomes, with estimates suggesting a potential price range from around $51.10 to $71.45 by 2030, reflecting the inherent volatility and uncertainty within the cryptocurrency sector. Coinbase’s ability to adapt and innovate will be crucial in maintaining its competitive edge amidst emerging players.

Unique differentiation:

Coinbase faces stiff competition from several established and emerging players in the cryptocurrency exchange market. One of its major competitors is Binance, a global cryptocurrency exchange known for its wide range of trading pairs and lower fees. Binance has a significant global user base and offers a comprehensive platform for both retail and institutional investors.

Another notable competitor is Kraken, which is particularly popular among experienced traders. Kraken offers advanced trading features, a strong focus on security, and a user-friendly interface. Gemini, founded by the Winklevoss twins, is another prominent exchange known for its regulatory compliance and focus on institutional investors. It offers a range of services, including trading, custody, and lending.

Coinbase also competes with a number of smaller exchanges that cater to specific niches or geographic regions. These exchanges often offer unique features or lower fees to attract users. The competitive landscape in the cryptocurrency exchange industry is constantly evolving, with new players emerging and existing ones expanding their offerings.

Regulatory Compliance and Trust: Coinbase has been a pioneer in complying with regulatory standards, particularly in the United States. This emphasis on regulatory compliance has earned it a reputation for trust and security among users.

Diverse Product Offerings: Coinbase offers a range of products and services beyond basic trading. These include staking, earning rewards, and secure digital wallets, providing a comprehensive platform for users to engage with cryptocurrencies.

Focus on Institutional Investors: Coinbase has actively pursued institutional investors, offering tailored solutions and services to meet their specific needs. This focus on institutional clients has contributed to its growth and diversification.

Management & Employees:

Brian Armstrong: Co-founder, CEO, and Chairman of the Board. He oversees the overall strategy and direction of the company.

Emilie Choi: President and COO. She is responsible for the company’s day-to-day operations and strategic initiatives.

Paul Grewal: Chief Legal Officer. He oversees the company’s legal affairs and regulatory compliance.

Financials:

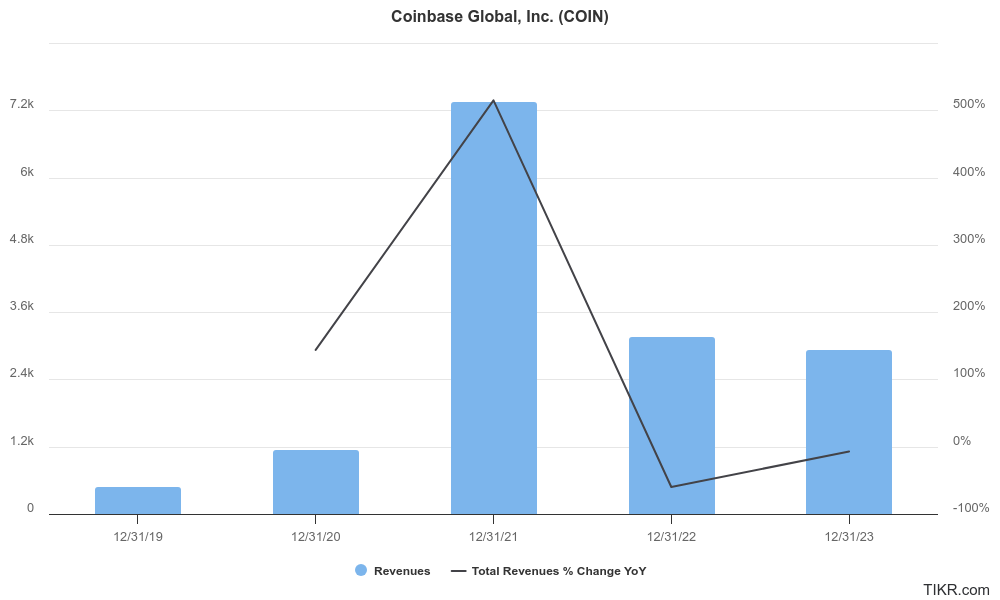

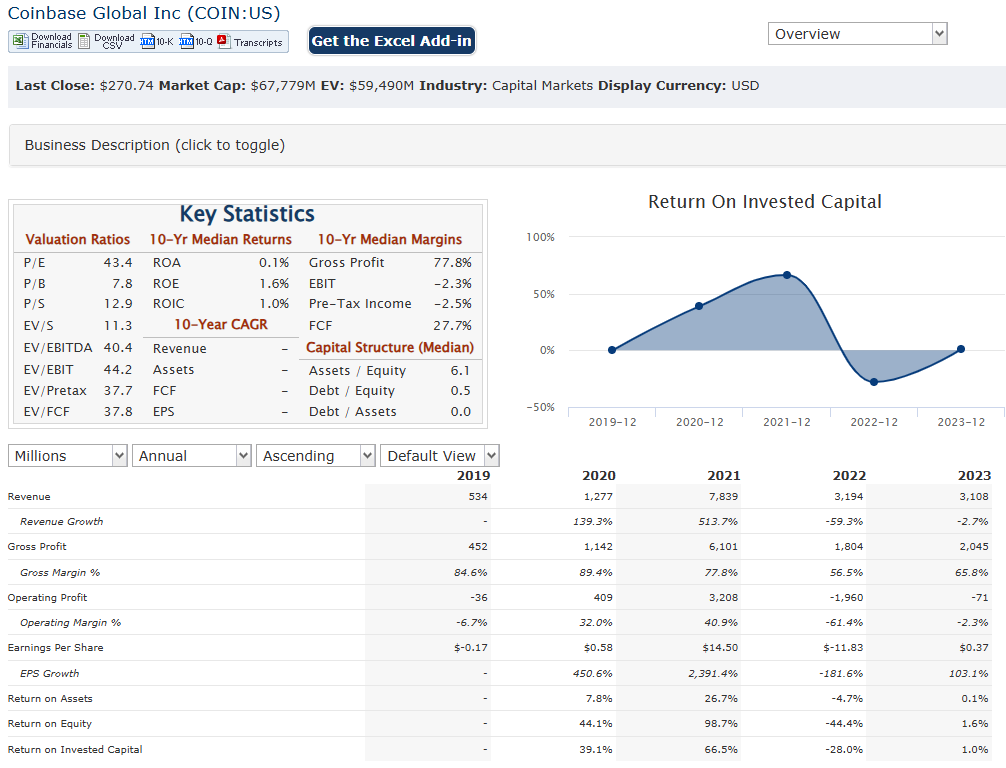

Coinbase Global Inc. has achieved a remarkable revenue of $7.8 billion, largely driven by the cryptocurrency market’s explosive growth during that period. This was followed by a sharp decline in 2022, where revenue fell to $3.1 billion, reflecting the broader downturn in cryptocurrency valuations and trading volumes. Coinbase reported a slight further decline to $2.9 billion, indicating a compounded annual growth rate (CAGR) of approximately -7% from 2021 to 2023.

Earnings have mirrored this volatility, peaking in 2021 with a net income of $3.1 billion before plunging into a loss of $2.6 billion in 2022. Coinbase rebounded in 2023, achieving a net profit of $95 million, which represents a turnaround and showcases the company’s efforts to streamline operations and reduce costs amid challenging market conditions. The CAGR for earnings over this five-year span reflects an overall decline, but the recent profit indicates potential stabilization as the company adapts to the evolving landscape of digital assets.

Coinbase has maintained a robust asset base, with total assets reported at $101 billion in 2023. This illustrates an increase from previous years but remains below the peak levels seen in 2021 when total assets reached approximately $278 billion. The company’s liquidity position has improved as it navigated through losses, indicating effective cash management strategies aimed at sustaining operations during downturns.

Coinbase with revenue anticipated to grow at a modest rate of 1.4% per year over the next few years while earnings are expected to decline at an annual rate of 24.1%. TheY challenges that Coinbase faces in a rapidly changing market where competition is intensifying and regulatory pressures are mounting.

Technical Analysis:

A cup and handle on the monthly chart followed by a strong green bullish candle on the weekly chart means this should head higher, but will consolidate and move to $274 before it heads higher. The short term outlook is to move to $363 before it heads lower to $274 and then back again to $400s

Bull Case:

1. Diversification of Revenue Streams:

- Subscription and Services: Coinbase is expanding its offerings beyond trading fees to include subscription services, staking rewards, and other value-added services. This diversification can help stabilize revenue and reduce reliance on trading fees.

- Blockchain Infrastructure: The company is investing in blockchain infrastructure and exploring new opportunities in decentralized finance (DeFi) and other emerging areas of the crypto ecosystem.

2. Potential Regulatory Clarity:

- Favorable Regulations: Clear and supportive regulations can boost investor confidence and accelerate the adoption of cryptocurrencies.

- Industry Leadership: Coinbase can play a significant role in shaping the regulatory landscape and advocating for policies that promote innovation and protect consumers.

Bear Case:

1. Volatility of the Cryptocurrency Market:

- Price Fluctuations: The cryptocurrency market is highly volatile, with significant price swings that can impact trading volumes and, consequently, Coinbase’s revenue.

- Regulatory Uncertainty: Changes in regulations can create uncertainty and impact the company’s operations.

2. Dependence on Trading Fees:

- Revenue Concentration: A significant portion of Coinbase’s revenue comes from trading fees. If trading volumes decline, it could negatively impact the company’s financial performance.

3. Security Risks and Hacking Threats:

- Cybersecurity Challenges: The cryptocurrency industry is a target for cyberattacks, and any security breaches could damage Coinbase’s reputation and lead to financial losses.