Executive Summary:

HubSpot, Inc. is an American software company that provides cloud-based marketing, sales, and customer service software solutions. HubSpot’s platform is designed to help businesses attract, engage, and delight customers through inbound marketing, sales, and service strategies. The company offers a range of tools and features, including CRM, marketing automation, email marketing, content management, sales tools, and customer service support.

HubSpot, Inc. reported total revenue of $669.7 million, a 20% increase compared to the same period last year. This beat the analyst consensus estimate of $647 million. Non-GAAP earnings per share (EPS) came in at $2.27, also surpassing analyst expectations of $2.10.

Stock Overview:

| Ticker | $HUBS | Price | $647.76 | Market Cap | $33.26B |

| 52 Week High | $693.85 | 52 Week Low | $413.07 | Shares outstanding | 51.35M |

Company background:

HubSpot, Inc., a prominent player in the software industry, was founded in 2006 by Brian Halligan and Dharmesh Shah. The company’s inception was rooted in the belief that businesses could thrive by adopting inbound marketing strategies. HubSpot’s journey has been marked by significant growth and innovation, fueled by substantial funding from venture capital firms.

HubSpot offers a suite of cloud-based software solutions designed to streamline marketing, sales, and customer service processes. These products empower businesses to attract, engage, and delight customers throughout their entire journey. Key offerings include marketing automation, CRM, sales tools, and customer service software. HubSpot’s platform is renowned for its user-friendly interface and comprehensive feature set, making it accessible to businesses of all sizes.

HubSpot faces stiff competition from several established players. Notable competitors include Salesforce, Adobe Marketo, and Zoho. These companies offer similar products and services, vying for market share in the CRM and marketing automation space. HubSpot has carved a niche for itself by focusing on inbound marketing principles and providing a seamless user experience.

HubSpot’s headquarters are located in Cambridge, Massachusetts, USA. The company has a global presence with offices in various countries, including Ireland, Singapore, and Australia.

Recent Earnings:

HubSpot, Inc. reported its total revenue for the quarter reached $669.7 million, marking a 20% year-over-year increase. This surpassed the analyst consensus estimate of $647 million. Non-GAAP earnings per share (EPS) came in at $2.27, also outperforming analyst expectations of $2.10.

HubSpot’s subscription revenue, which accounts for the majority of its business, grew by 20% to $654.7 million. This robust growth was driven by increased demand for its platform, fueled by continuous product innovation and the adoption of AI-powered features. The company’s customer base expanded to 238,128, reflecting a 23% year-over-year increase.

The company expects total revenue to be in the range of $2.597 billion to $2.599 billion, with non-GAAP operating income projected to be between $455 million and $456 million. Non-GAAP net income per share is estimated to be between $7.98 and $8.00.

The Market, Industry, and Competitors:

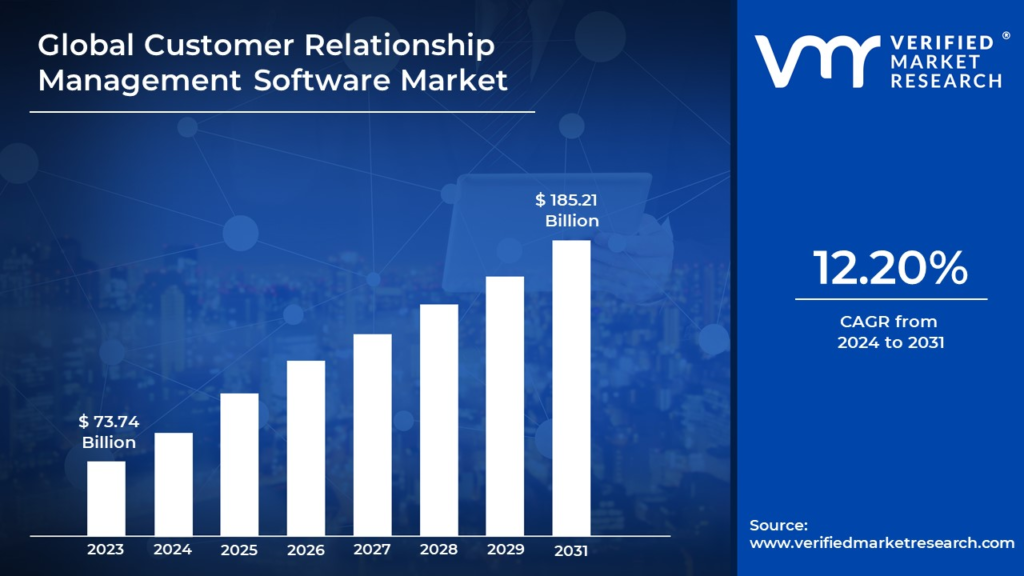

HubSpot operates primarily in the Customer Relationship Management (CRM) and marketing automation software market. This market is characterized by increasing demand for efficient tools to manage customer interactions, streamline sales processes, and optimize marketing campaigns. The market is driven by factors such as the growing adoption of cloud-based solutions, the increasing complexity of customer relationships, and the need for data-driven decision-making.

HubSpot’s revenue including market dynamics, technological advancements, and competitive landscape, the overall trend for the CRM and marketing automation market is positive. The market is expected to continue growing at a healthy pace, driven by factors such as increasing digitalization, the rise of e-commerce, and the growing importance of customer experience.

The Compound Annual Growth Rate (CAGR) for the global CRM market is projected to be around 12% during the forecast period 2024-2030. This indicates significant growth potential for HubSpot and other players in the market. HubSpot’s ability to innovate, adapt to changing market dynamics, and deliver value to its customers will be crucial in determining its future growth trajectory.

Unique differentiation:

Salesforce: A major player in the CRM market, Salesforce offers a comprehensive suite of CRM and marketing automation tools. It has a strong brand reputation and a large customer base, making it a formidable competitor.

Adobe Marketo: Adobe Marketo specializes in marketing automation and engagement solutions. It provides robust features for lead generation, email marketing, and campaign management.

Zoho: Zoho offers a comprehensive suite of cloud-based business applications, including CRM, marketing automation, and sales tools. It is known for its affordable pricing and user-friendly interface, making it a popular choice for small and medium-sized businesses.

HubSpot differentiates itself through its focus on inbound marketing, user-friendly interface, and strong customer support.

Inbound Marketing Philosophy: HubSpot is a pioneer in promoting inbound marketing, a strategy that attracts customers through valuable content and organic search. This approach aligns with modern marketing trends and helps businesses build trust and credibility.

All-in-One Platform: HubSpot offers a comprehensive suite of tools for marketing, sales, and customer service, all integrated into a single platform. This eliminates the need for multiple tools and streamlines workflows.

Continuous Innovation: HubSpot is committed to innovation and regularly releases new features and updates to its platform. This keeps the platform relevant and competitive in a rapidly evolving market.

Management & Employees:

Yamini Rangan: Chief Executive Officer

Brian Halligan: Co-Founder, Executive Chairperson

Alison Elworthy: Chief of Staff to the CEO and Executive Vice President of Central Strategy.

Financials:

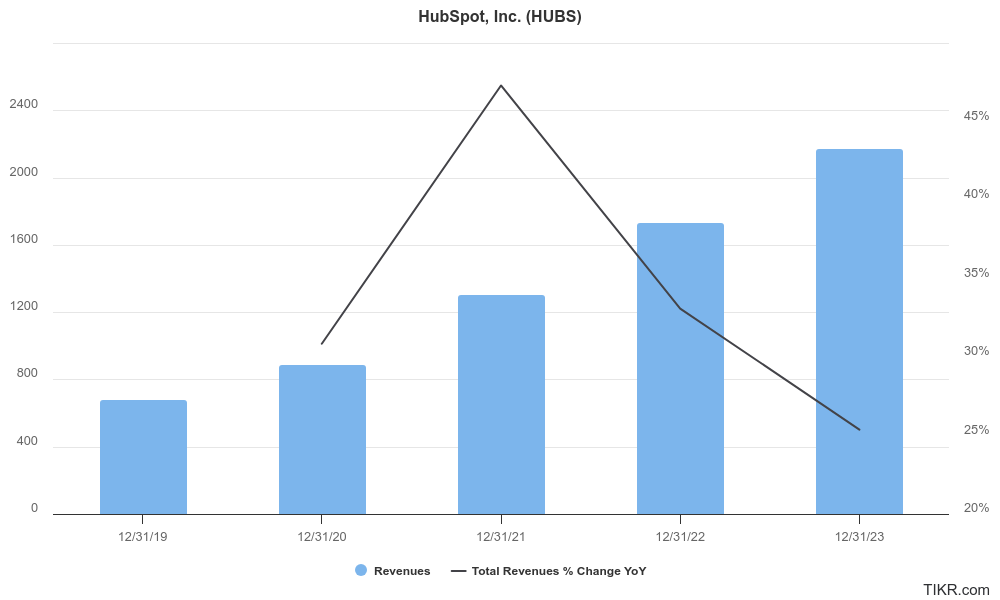

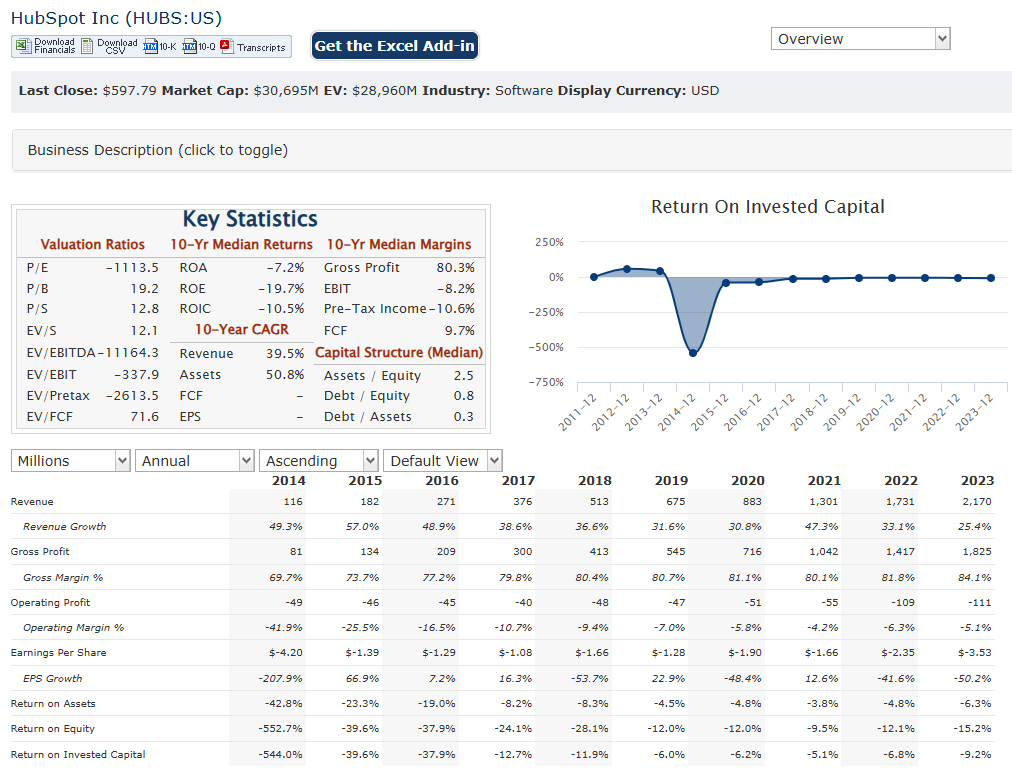

HubSpot Inc. has reported a revenue of approximately $2.4 billion in 2024, reflecting a five-year CAGR of around 32%. This growth trajectory is indicative of HubSpot’s effective strategies in expanding its customer base and enhancing its product offerings within the competitive customer relationship management (CRM) sector. HubSpot’s revenue growth has consistently outpaced industry averages, with a reported annual growth rate of 23% for the last year alone.

HubSpot has also seen commendable growth, with earnings increasing at a CAGR of approximately 34% over the past five years. The company’s focus on operational efficiency and strategic investments in research and development have contributed to this positive earnings trend. HubSpot’s free cash flow (FCF) has been impressive, growing at a CAGR of 31%. This robust FCF allows HubSpot to reinvest in key areas such as product development and marketing, further fueling its growth.

The company reported total debt averaging around $741 million over the past five years, which is notably higher than the industry average but manageable given its revenue growth rates. HubSpot’s debt-to-equity ratio indicates a more aggressive use of leverage than competitors, suggesting it is pursuing an ambitious growth strategy.

Its strong revenue and earnings growth, effective cash flow management, and a proactive approach to leveraging debt suggest that HubSpot is well-equipped to navigate the challenges of an evolving industry landscape while capitalizing on emerging opportunities.

Technical Analysis:

The stock is on a stage 2 markup (bullish) on the monthly chart and weekly chart as well. There is some resistance in the $695 area however, and the near term outlook is bullish to the $690+ mark. The stock is stretched on the Moving averages, which indicates the stock will move lower to $574 range, which might be a better long term buying option.

Bull Case:

Large and Growing Market: The CRM and marketing automation market is vast and continues to expand. As businesses increasingly adopt digital tools to engage with customers, HubSpot is well-positioned to capitalize on this growth.

Strong Customer Base and Retention: HubSpot has a loyal customer base and high customer retention rates. This reflects the value that the company’s products deliver to its customers. As customers grow and expand, they are likely to increase their spending on HubSpot’s platform, driving revenue growth.

Bear Case:

Economic Slowdown: An economic downturn could negatively impact businesses’ spending on software solutions, including HubSpot’s products. Reduced demand could slow revenue growth and profitability.

Rapid Technological Change: The technology landscape is constantly evolving, and companies that fail to adapt to new trends and technologies may struggle. HubSpot must continue to invest in research and development to maintain its competitive edge.