Executive Summary:

Pinterest Inc. is a popular image-based social media platform that allows users to discover and share visual content. Users create pinboards, or collections of images, on various topics like recipes, fashion, home decor, and travel. The platform functions as a visual search engine, enabling users to find inspiration and ideas through image-based searches. Pinterest has evolved into a platform for e-commerce, with businesses using it to showcase products and drive online sales.

Pinterest Inc. reported earnings per share (EPS) of $0.29, surpassing the consensus estimate of $0.23. Revenue for the quarter reached $854 million, also surpassing analyst projections of $845 million.

Stock Overview:

| Ticker | $PINS | Price | $32.52 | Market Cap | $22.31B |

| 52 Week High | $45.19 | 52 Week Low | $27.00 | Shares outstanding | 603.57M |

Company background:

Pinterest Inc., a popular image-based social media platform, was founded in 2009 by Ben Silbermann, Paul Sciarra, and Evan Sharp. The company’s headquarters are located in San Francisco, California. Users can create pinboards, or collections of images, on various topics like fashion, food, home decor, and travel.

Pinterest has secured substantial funding from prominent investors, including Andreessen Horowitz, Bessemer Venture Partners, and Fidelity Investments. This funding has enabled the company to expand its operations, enhance its platform, and explore new opportunities.

Pinterest’s primary product is its image-sharing platform, which allows users to discover and share visual content. The platform’s focus on visual search and discovery has made it a popular destination for users seeking inspiration and ideas. Pinterest faces competition from other social media platforms like Instagram, TikTok, and Snapchat. These platforms offer similar features, such as image and video sharing, and have a large user base.

Recent Earnings:

Pinterest Inc. reported revenue of $854 million, exceeding the consensus estimate of $845 million. It reported an EPS of $0.29, surpassing the consensus estimate of $0.23. This positive earnings surprise can be attributed to the company’s strong user growth and increasing engagement with its platform.

The company reported a significant increase in monthly active users, indicating strong user growth. Average revenue per user (ARPU) also increased, driven by higher advertising revenue and e-commerce activity on the platform. The company expects revenue to be in the range of $860 million to $880 million, indicating continued growth momentum.

The company’s ability to capitalize on the growing trend of visual search and discovery, coupled with its strong user engagement, positions it well for future growth.

The Market, Industry, and Competitors:

Pinterest Inc. operates within the social media and digital advertising market, focusing on visual discovery and social commerce. The platform allows users to create and share pinboards of images, videos, and links, which makes it particularly appealing for users seeking inspiration for various projects, from home decor to fashion. This unique positioning differentiates Pinterest from other social media platforms by emphasizing user-driven content and shopping experiences. As businesses increasingly recognize the value of targeted advertising based on user interests, Pinterest’s revenue model, primarily derived from advertising, is expected to benefit significantly from this trend.

Pinterest is projected to experience substantial growth, with stock price forecasts suggesting an average of $86.06 per share by that year, reflecting a 12% growth from 2029. The company is anticipated to leverage advancements in AI and machine learning, enhancing its content recommendation systems and expanding its e-commerce capabilities. Analysts expect Pinterest’s revenue to grow at a CAGR of 17% from 2023 to 2026, with long-term projections indicating a potential revenue generation of approximately $141 billion by 2050 if it maintains its competitive edge in the rapidly expanding social shopping market.

Unique differentiation:

Instagram: Owned by Meta, Instagram is a popular photo and video-sharing platform that has increasingly focused on visual search and discovery features. It has a massive user base and strong brand recognition, making it a formidable competitor.

TikTok: This short-form video sharing app has gained immense popularity, especially among younger demographics. While its primary focus is on video content, TikTok has also introduced features like image-based search, posing a potential threat to Pinterest’s user base.

Other Competitors: Other social media platforms like Snapchat, Twitter, and Reddit also offer visual content sharing capabilities, albeit to a lesser extent. These platforms can indirectly compete with Pinterest by capturing user attention and time.

It focus on visual search and discovery, coupled with its strong community and user engagement, gives it a competitive edge. As the company continues to innovate and adapt to evolving consumer preferences, it can maintain its position in the market.

Visual Search Engine: Pinterest is a visual search engine, allowing users to find inspiration and ideas through image-based searches. This unique approach helps users discover new things and plan future projects, which sets it apart from traditional social media platforms.

Positive and Creative Community: Pinterest fosters a positive and creative community where users can share and discover ideas. This positive environment encourages user engagement and loyalty, differentiating it from platforms that can be more contentious or negative.

E-commerce Integration: Pinterest has effectively integrated e-commerce features, allowing users to directly purchase products from the platform. This seamless shopping experience enhances user convenience and drives revenue for businesses, giving it a competitive edge.

Management & Employees:

Bill Ready: Chief Executive Officer

Matt Madrigal: Chief Technology Officer

Andréa Mallard: Chief Marketing and Communications Officer

Wanji Walcott: Chief Legal and Business Affairs Officer

Financials:

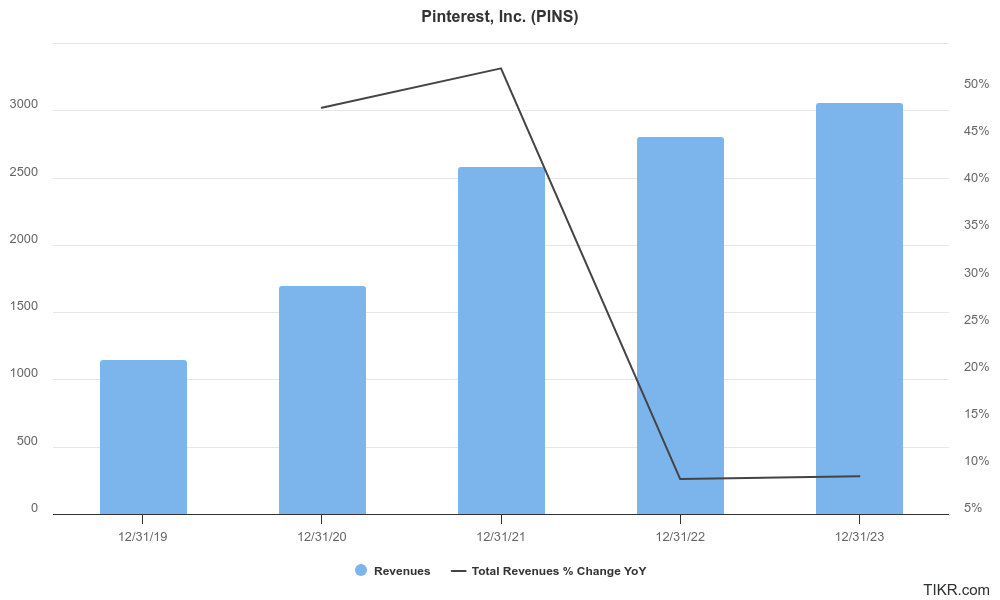

Pinterest Inc. has revenue grew at a compound annual growth rate (CAGR) of 28%, reflecting a robust expansion in its user base and monetization strategies. Pinterest’s revenue increased from approximately $1.14 billion in 2019 to around $2.5 billion in 2023. This growth was driven by an increase in monthly active users (MAUs), which rose from 335 million to nearly 498 million during the same period.

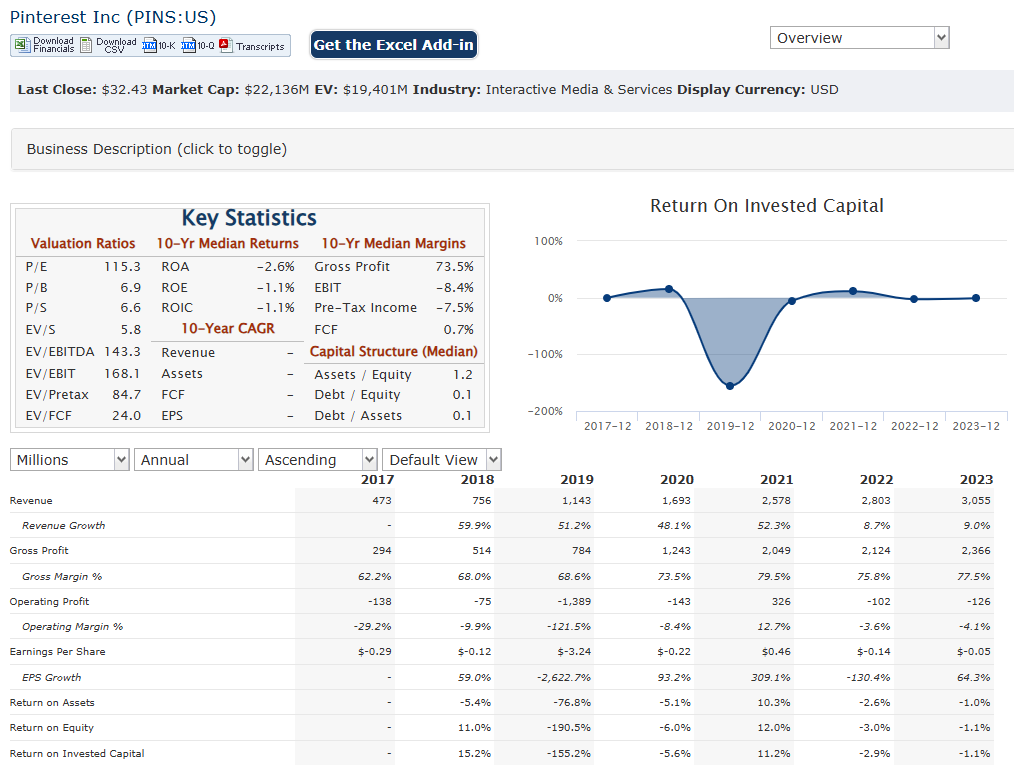

The company reported a net loss of $208.6 million in Q1 2023, which improved to a loss of just $24.8 million by Q1 2024, marking an impressive 88% reduction year-over-year. Analysts project that Pinterest will return to profitability in 2024, with earnings expected to grow at a CAGR of 57% from 2024 to 2026 as the company capitalizes on its investments in artificial intelligence and enhanced advertising capabilities.

As of mid-2024, the company reported total assets exceeding $2 billion against total liabilities of approximately $1 billion, indicating a healthy asset-to-liability ratio. This balance allows Pinterest to invest further in product development and marketing initiatives while maintaining sufficient liquidity for operational needs. With a market capitalization of around $22 billion, Pinterest is positioned well within the digital advertising landscape, allowing it to compete effectively against larger entities like Meta and Google. Pinterest’s financial trajectory appears promising as it continues to innovate and adapt within the competitive social media market.

Technical Analysis:

The stock is in a stage 1 consolidation (neutral) on the monthly chart, but the bear flag (Bearish) is visible which indicates a move lower to the $28 – $30 range in the short to medium term on the weekly chart. The daily chart confirms the lower move to the support in the $27 – $30 zone.

Bull Case:

E-commerce Potential: Pinterest has emerged as a powerful platform for e-commerce, driving significant online sales. The company’s visual search capabilities and user-friendly interface make it an ideal platform for product discovery and purchase. As e-commerce continues to grow, Pinterest is well-positioned to capitalize on this trend.

Valuation Opportunity: Despite its strong fundamentals, Pinterest’s stock valuation may be undervalued compared to its peers. The company’s focus on long-term growth and its potential to disrupt the e-commerce industry could lead to significant upside in the future.

Bear Case:

Advertising Revenue Uncertainty: Pinterest’s revenue is heavily reliant on advertising. Economic downturns or changes in the advertising market could negatively impact the company’s revenue and profitability.

Monetization Challenges: While Pinterest has made progress in monetizing its user base, it faces challenges in balancing user experience with advertising revenue. Excessive advertising could alienate users and harm the platform’s appeal.

Regulatory Risks: Increased regulatory scrutiny over social media platforms, including data privacy and content moderation, could impact Pinterest’s operations and financial performance.