Executive Summary:

Tractor Supply Company is a prominent rural lifestyle retailer in the United States. With a focus on serving farmers, ranchers, homeowners, and pet owners, the company offers a wide range of products including agricultural supplies, pet food, and home improvement items. The company is committed to providing legendary service and affordable prices to its customers, allowing them to pursue their passions and enjoy a rural lifestyle. Tractor Supply also owns and operates Petsense by Tractor Supply, a smaller pet specialty retailer.

Tractor Supply Company reported a net sales of $3.47 billion, a slight increase of 1.6%. Diluted earnings per share (EPS) came in at $2.24.

Stock Overview:

| Ticker | $TSCO | Price | $271.67 | Market Cap | $29.31B |

| 52 Week High | $307.64 | 52 Week Low | $186.06 | Shares outstanding | 107.87M |

Company background:

Tractor Supply Company, a prominent rural lifestyle retailer, traces its roots back to 1938 when it was founded by Charles E. Schmidt Sr. in Chicago as a mail-order tractor parts business. The company expanded its product offerings and retail presence, evolving into a major player in the rural retail market.

The company’s product range caters to a diverse customer base, including farmers, ranchers, homeowners, and pet owners. It offers a wide array of products such as agricultural supplies, livestock feed, pet food, clothing, footwear, tools, hardware, and more. Tractor Supply’s extensive product selection, coupled with its knowledgeable staff and convenient store locations, has contributed to its success.

Key competitors in the rural retail market include Farm & Fleet, Orscheln Farm & Home, and Rural King. These companies offer similar products and services, competing for market share with Tractor Supply. Tractor Supply’s strong brand recognition, extensive store network, and customer loyalty have enabled it to maintain a leading position in the industry. Tractor Supply Company is headquartered in Brentwood, Tennessee, where it oversees its operations and strategic initiatives.

Recent Earnings:

Tractor Supply Company reported its third quarter 2024, achieved net sales of $3.47 billion, a slight increase of 1.6% compared to the same period last year. Diluted earnings per share (EPS) came in at $2.24. Its comparable store sales experienced a slight decrease of 0.2%.

Tractor Supply’s gross margin for the quarter was 36.3%, reflecting a slight decrease compared to the previous year. The company’s operating margin remained strong at 10.0%. They also repurchased 0.6 million shares of its common stock and paid quarterly cash dividends, returning a total of $267.6 million of capital to shareholders.

The company plans to open 90 new stores in 2025 and is focused on expanding its online presence. Additionally, the acquisition of Allivet, a leading online pet pharmacy, is expected to contribute to the company’s growth in the pet care market. Tractor Supply’s strong financial performance, strategic initiatives, and commitment to serving its customers position.

The Market, Industry, and Competitors:

Tractor Supply Company (TSCO) operates primarily in the rural lifestyle retail market, providing a range of products including farm supplies, pet and livestock products, hardware, and outdoor living essentials. This sector caters to farmers, ranchers, and rural homeowners, which has positioned TSCO as a leading player in the U.S. market.

The company operates over 2,200 stores across 49 states and has been recognized for its rapid growth, having joined the Fortune 500 list in 2014. The rural lifestyle market is expected to continue expanding due to increasing consumer interest in sustainable living and agricultural practices, alongside a growing trend towards e-commerce which TSCO is actively embracing.

TSCO’s stock price could range from approximately $437 to $562 by 2030, reflecting an expected increase of 65% to over 100% from current levels. The compound annual growth rate (CAGR) for TSCO from now until 2030 is anticipated to be robust, with estimates suggesting a CAGR of around 14% based on projected stock performance and market conditions. This growth is underpinned by the company’s strategic investments in technology and sustainability initiatives, positioning it well to capitalize on evolving consumer preferences and market opportunities.

Unique differentiation:

Traditional Retailers:

- Farm & Fleet: A regional retailer offering a wide range of products, including farm supplies, automotive parts, and home goods.

- Orscheln Farm & Home: A family-owned retailer with a focus on farm, home, and auto supplies.

- Rural King: A large rural retailer offering a diverse product assortment, including farm supplies, pet food, and hardware.

Online Retailers:

- Amazon: A major online retailer that offers a vast selection of products, including many items typically found at Tractor Supply.

- Chewy: A leading online retailer specializing in pet food and supplies.

Tractor Supply Company differentiates itself through its strong brand recognition, extensive store network, knowledgeable staff, and unique product assortment.

Deep Understanding of Rural Lifestyle: Tractor Supply has a deep understanding of the needs and preferences of its rural customer base. The company offers a curated product assortment that caters to the specific needs of farmers, ranchers, and homeowners, including specialized tools, equipment, and supplies.

Extensive Store Network: With a vast network of stores located in rural and suburban areas, Tractor Supply offers convenient access to its products for customers. This extensive footprint allows the company to reach a wider customer base and build strong local relationships.

Unique Product Assortment: Tractor Supply offers a unique product assortment that combines essential items for rural living with lifestyle products like clothing, footwear, and home décor. This diverse range of offerings attracts a broader customer base beyond traditional farmers and ranchers.

Management & Employees:

Gregory Sandfort: CEO and President

Steve K. Barbarick: President and Chief Merchandising Officer

Colin Yankee: Executive Vice President, Chief Supply Chain Officer

Noni Ellison: Senior Vice President, General Counsel and Corporate Secretary

Financials:

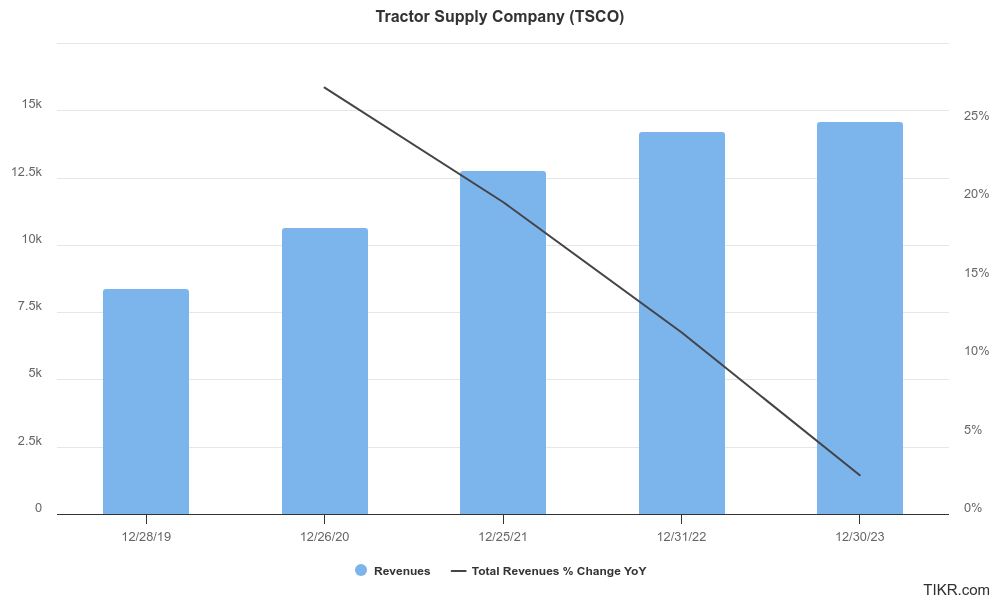

Tractor Supply Company (TSCO) has revenue grew from approximately $8.3 billion to around $12.5 billion, reflecting a compound annual growth rate (CAGR) of about 10.9%. This growth can be attributed to the company’s strategic focus on expanding its product offerings and enhancing customer experience, particularly through the development of its e-commerce platform. The rural lifestyle market has seen increasing demand, and TSCO has effectively capitalized on this trend by broadening its reach and improving store formats.

Earnings per share (EPS) have also shown impressive growth, increasing from about $4.50 in 2019 to approximately $10.28 in 2023. This translates to an annual EPS growth rate of around 19%, closely aligning with the stock price appreciation of about 160% over the same timeframe.

Tractor Supply Company has maintained a robust financial position, with total assets rising from approximately $7.1 billion in 2019 to $9.19 billion in 2023. Liabilities increased correspondingly, reaching around $7.04 billion, but the company has managed its debt effectively, resulting in a solid equity base of approximately $2.15 billion. The working capital position of $1.09 billion suggests good short-term liquidity, while net tangible assets of $1.88 billion reflect a substantial physical asset base that supports ongoing operations.

Tractor Supply Company’s financial performance highlights its successful strategy in navigating the rural lifestyle retail market, achieving both revenue and earnings growth while maintaining a strong balance sheet. TSCO is well-positioned for future growth in the evolving retail landscape.

Technical Analysis:

The stock is on a stage 2 markup (bullish) trend on the monthly chart, and on a stage 2, bullish on the weekly chart as well. The daily chart is stage 4 bearish (markdown), however, so the near term likely support for a reversal should be $255 – $266 range. It should be a good entry for the medium term to the $290 range again.

Bull Case:

Robust Financial Performance:

- Strong Balance Sheet: The company maintains a solid financial position with ample liquidity, allowing it to invest in growth initiatives and return capital to shareholders.

- Dividend Growth: TSCO has a track record of increasing its dividend, making it an attractive investment for income-oriented investors.

E-commerce Growth:

- Expanding Online Presence: TSCO’s growing online presence is attracting new customers and driving sales growth.

- Enhanced E-commerce Platform: The company continues to invest in its e-commerce platform to improve customer experience and drive online sales.

Diversified Revenue Streams:

- Multiple Revenue Streams: TSCO generates revenue from various sources, including retail sales, e-commerce, and pet specialty stores, reducing its reliance on any single segment.

Bear Case:

Economic Downturn:

- A significant economic downturn, especially in rural areas, could negatively impact consumer spending on discretionary items like pet supplies, gardening tools, and other non-essential goods.

- A decrease in disposable income could lead to reduced foot traffic and lower sales.

Supply Chain Disruptions:

- Supply chain disruptions, such as those caused by global trade tensions or natural disasters, could lead to increased costs, product shortages, and delayed deliveries.

- These disruptions could negatively impact TSCO’s operations and financial performance.

Valuation Risks:

- If TSCO’s stock price becomes overvalued relative to its earnings and growth prospects, it could be vulnerable to a correction or decline.