Executive Summary:

Warner Bros. Discovery Inc. is a leading global media and entertainment company that creates and distributes a wide range of content across various platforms. The company boasts a diverse portfolio of iconic brands, including Warner Bros., Discovery Channel, HBO, HGTV, Food Network, and CNN. It produces and distributes films, television shows, documentaries, and other content through its various divisions. Warner Bros. Discovery is committed to providing high-quality entertainment to audiences worldwide and is continually innovating to adapt to the evolving media landscape.

Warner Bros. Discovery Inc. reported an EPS of -$4.50, significantly missing analyst expectations of -$4.47. Revenue for the quarter came in at $9.71 billion, down 6% year-over-year.

Stock Overview:

| Ticker | $WBD | Price | $7.60 | Market Cap | $18.63B |

| 52 Week High | $12.70 | 52 Week Low | $6.64 | Shares outstanding | 2.45B |

Company background:

Warner Bros. Discovery Inc., a global media and entertainment conglomerate, was formed in 2022 through the merger of WarnerMedia and Discovery, Inc. This merger brought together a diverse range of iconic brands and content under one roof. The company’s roots trace back to the founding of Warner Bros. Pictures in 1923 by the Warner brothers, and Discovery Communications in 1985 by John Hendricks.

Warner Bros. Discovery boasts a vast portfolio of products and services, including film and television production, cable networks, streaming platforms, and gaming. The company’s content spans a wide range of genres, from blockbuster films and critically acclaimed television series to reality shows, documentaries, and news programming.

Warner Bros. Discovery faces competition from other major media companies such as Disney, Comcast, and Netflix. These companies compete for audiences, advertising revenue, and content rights. It remains a significant player in the global media industry, leveraging its extensive library of content and strong brand recognition to attract viewers and advertisers. The company’s headquarters are located in New York City, New York.

Recent Earnings:

Warner Bros. Discovery Inc. released its second-quarter earnings, It reported a net loss of $10.0 billion, primarily due to a significant $9.1 billion non-cash goodwill impairment charge from its Networks segment. Excluding this charge, the adjusted net loss was $966 million.

On the revenue front, the company generated $9.71 billion in revenue, down 6% year-over-year. This decline was attributed to lower advertising revenue and a decrease in affiliate fees. The company’s direct-to-consumer (DTC) business, including HBO Max, showed growth in subscribers, but it was not enough to offset the declines in other segments.

Warner Bros. Discovery maintained its focus on cost-cutting measures and content strategy. The company reiterated its commitment to reducing costs by $3 billion and generating $1 billion in free cash flow in 2024. It highlighted its efforts to invest in high-quality content and expand its DTC offerings.

Warner Bros. Discovery faces several challenges, including a competitive media landscape, economic uncertainty, and ongoing cord-cutting trends. The company remains optimistic about its long-term growth prospects, driven by its strong brand portfolio, diverse content offerings, and strategic initiatives.

The Market, Industry, and Competitors:

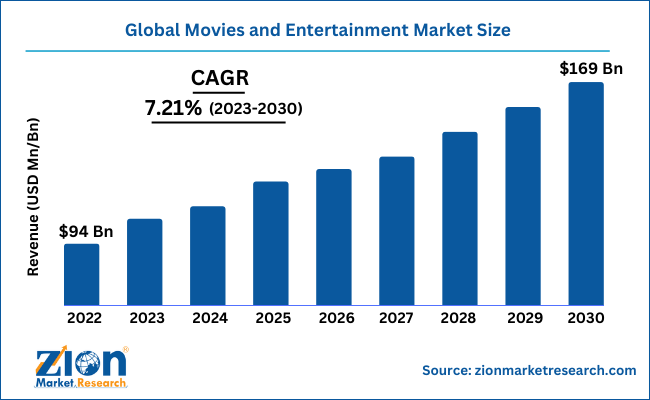

Warner Bros. Discovery Inc. operates in the highly competitive media and entertainment industry, encompassing television, film, and streaming services. The company has integrated a diverse portfolio that includes prominent brands like HBO, CNN, and Warner Bros. Pictures. The market it operates in is characterized by rapid technological advancements and changing consumer preferences, particularly with the shift from traditional cable to direct-to-consumer (DTC) streaming platforms. This transition is critical as more viewers abandon cable subscriptions in favor of on-demand services, impacting revenue streams from traditional networks.

Goldman Sachs projects that the company’s revenue will increase from an estimated $42 billion in 2024 to $46 billion by 2030, resulting in a compound annual growth rate (CAGR) of approximately 1%. This growth is primarily driven by the DTC segment, which is expected to grow at a rate of 7%, while traditional network revenues may decline by about 3% due to ongoing cord-cutting trends. Some analysts predict a more optimistic CAGR of around 3% for distribution revenue.

Contraction in EBITDA at a CAGR of 5% from 2024 to 2030. The rising costs associated with content acquisition, particularly sports rights, are expected to exert pressure on profit margins. While there are opportunities for growth through innovative content creation and international expansion of streaming services.

Unique differentiation:

Warner Bros. Discovery faces stiff competition from several major media and entertainment companies. One of its primary competitors is The Walt Disney Company. Disney boasts a vast library of iconic franchises, including Marvel, Star Wars, and Pixar. Its streaming service, Disney+, has rapidly gained popularity, offering a wide range of family-friendly content.

Another significant competitor is Comcast. Through its NBCUniversal division, Comcast owns a diverse portfolio of cable networks, film studios, and theme parks. Its streaming service, Peacock, is expanding its content library to compete with other platforms.

Netflix and Amazon are also major players in the streaming industry. Netflix, known for its original series and films, continues to invest heavily in content production. Amazon, with its Prime Video service, offers a mix of original content, licensed titles, and live sports. These companies are constantly innovating and expanding their offerings to attract and retain subscribers.

Diverse Content Portfolio: The company boasts a vast and diverse content library spanning various genres, including movies, TV shows, documentaries, and reality programs. This diverse offering caters to a wide range of audiences and allows the company to leverage cross-promotion opportunities.

Integration of Traditional and Digital: The company effectively combines traditional media with digital platforms. It has a strong presence in linear television, while also investing heavily in streaming services like HBO Max. This integrated approach allows it to adapt to changing consumer preferences and maximize its reach.

Synergies and Cost-Cutting: The merger of WarnerMedia and Discovery has created opportunities for cost-cutting and synergies. By combining resources and operations, the company can reduce expenses and improve efficiency.

Management & Employees:

David Zaslav: President and CEO

JB Perrette: CEO and President, Global Streaming and Games

Kathleen Finch: Chairman and Chief Content Officer, US Networks Group

Casey Bloys: Chairman and CEO, HBO & Max Content

Financials:

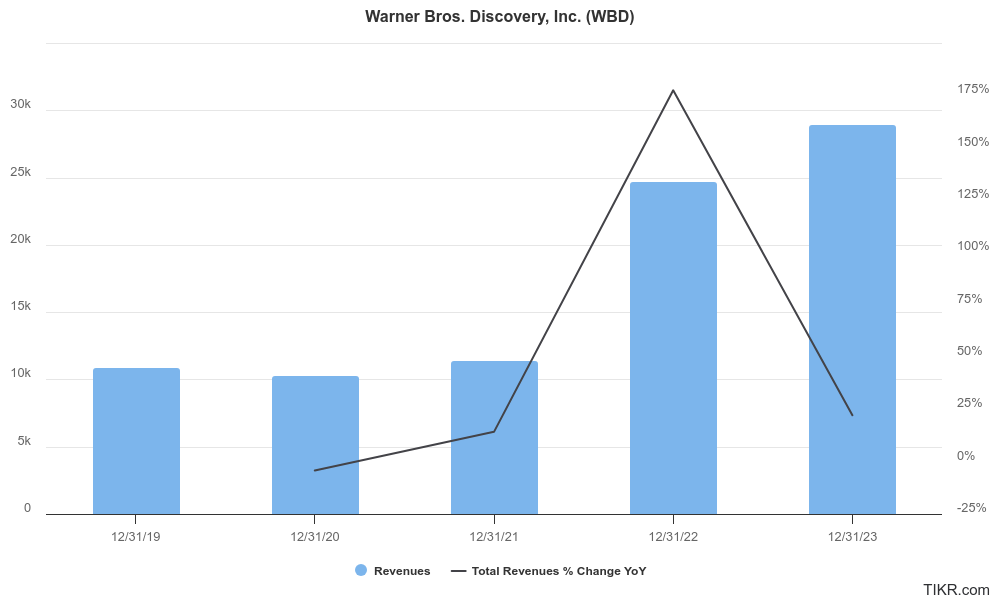

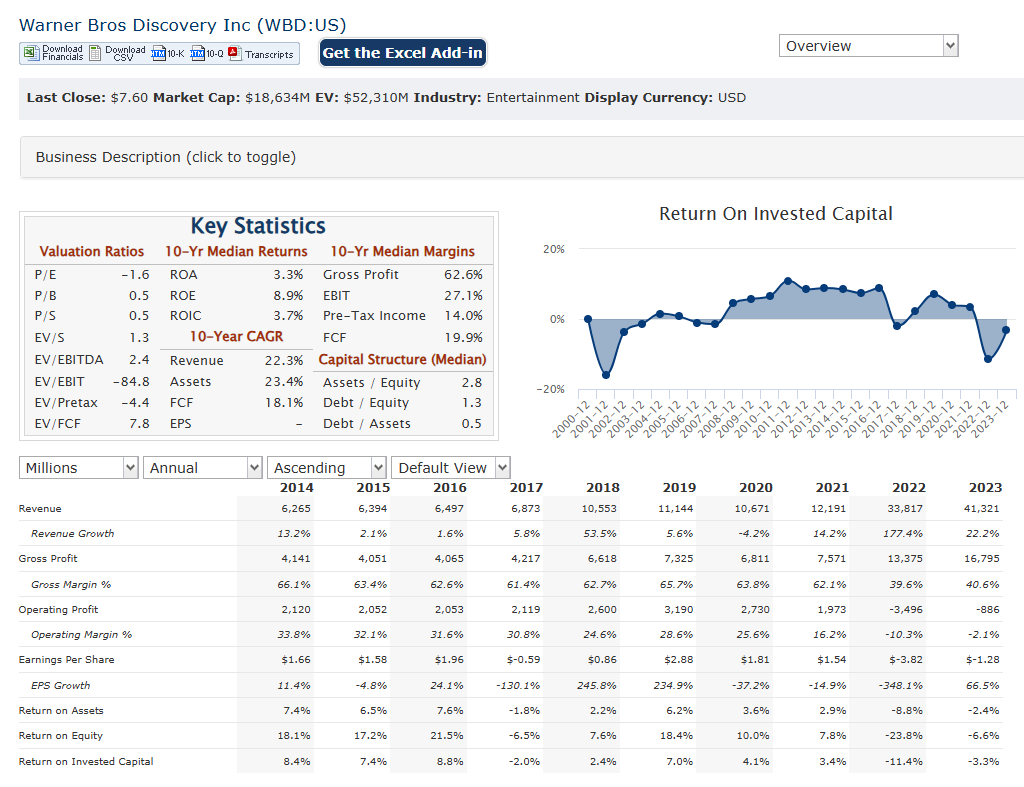

Warner Bros. Discovery Inc. has revenue of approximately $41.32 billion, marking a substantial increase of 22.19% from the previous year. This surge followed a remarkable 177.39% growth in 2022, when revenues reached $33.82 billion, driven by the consolidation of assets from both legacy companies. Before the merger, revenues were more modest, with 2021 showing $12.19 billion, reflecting a 14.24% increase from 2020’s $10.67 billion.

The compound annual growth rate (CAGR) for revenue from 2019 to 2023 stands at about 21%, primarily due to the merger’s impact and the expansion of streaming services amid changing consumer behavior. Analysts project a more tempered revenue growth rate of approximately 1.3% per annum through 2030, as traditional cable subscriptions continue to decline and competition in the streaming market intensifies.

The company reported a net loss of $7.42 billion in 2022, which was a significant downturn compared to earnings of $912 million in 2021. This trend continued into 2023 with a net loss of approximately $3.13 billion, indicating ongoing struggles with profitability amid rising content costs and operational expenses associated with integrating two large media entities. The anticipated earnings growth rate is projected at around 109.8% per annum through 2030; however, this is from a low base as the company works towards returning to profitability.

Warner Bros. Discovery faces challenges related to high debt levels resulting from the merger and ongoing operational losses. Revenue potential through its diverse content portfolio—including HBO Max and various cable networks—the rising costs associated with content acquisition, particularly sports rights, may hinder its ability to improve profit margins.

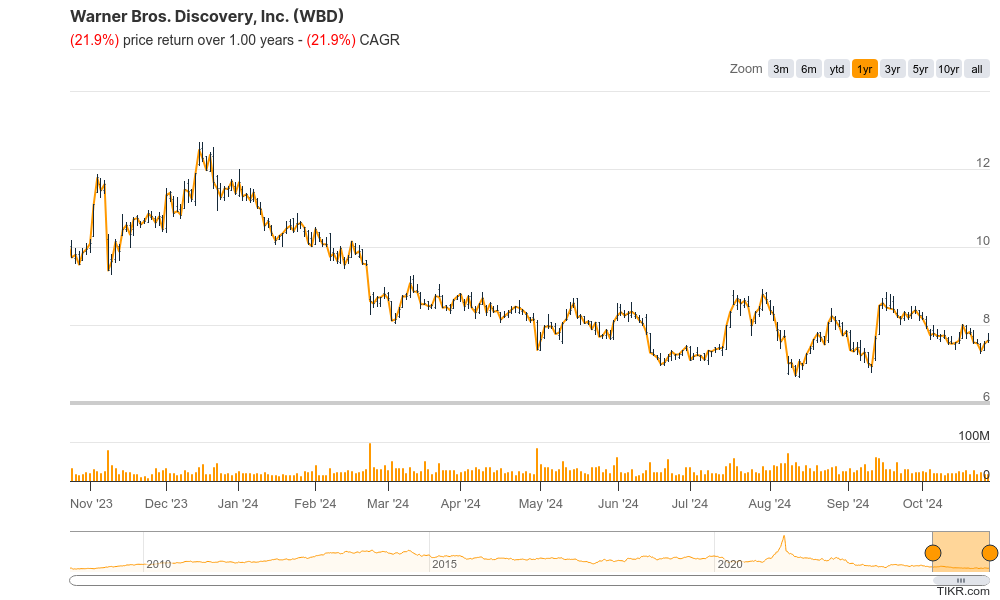

Technical Analysis:

The stock is in a stage 4 markdown (bearish) on the monthly chart, consolidating stage 1 (neutral) on the weekly chart and stage 4 markdown (bearish) on the daily chart. There seems to be some support in the $6.65 range, which seems to be where the stock is headed in the short term. We would avoid this stock for now.

Bull Case:

Streaming Growth Potential:

- HBO Max: The company’s streaming platform, HBO Max, has the potential to continue growing its subscriber base, especially as it expands its content library and improves its user experience.

- Global Expansion: Expanding HBO Max to new markets and partnering with local distributors can drive significant subscriber growth.

Potential for M&A:

- Strategic Acquisitions: Warner Bros. Discovery could pursue strategic acquisitions to strengthen its position in the market and expand its content library.

- Consolidation Opportunities: The media industry is ripe for consolidation, and the company could benefit from further mergers or acquisitions.

Bear Case:

Heavy Debt Load:

- Financial Burden: The company carries a significant amount of debt, which increases its financial risk and limits its flexibility to invest in growth initiatives or weather economic downturns.

- Interest Expense: High debt levels can lead to substantial interest expenses, impacting profitability.

Execution Risk:

- Integration Challenges: The merger of WarnerMedia and Discovery has been complex, and integrating the two companies’ operations and cultures can be challenging.

- Content Strategy: The company’s content strategy needs to be effective in attracting and retaining viewers, which can be a significant challenge in a crowded market.

Legal and Regulatory Risks:

- Antitrust Scrutiny: The company may face increased regulatory scrutiny, particularly in areas like antitrust and content licensing.

- Content Rights Disputes: Legal battles over content rights can be costly and time-consuming.