Executive Summary:

Broadridge Financial Solutions Inc. is a global fintech leader that provides essential infrastructure for the investment industry. The company offers technology-driven solutions that enable corporate governance, power capital markets, and facilitate growth in wealth and investment management. By delivering solutions that drive digital transformation, Broadridge helps its clients stay ahead of industry challenges and capitalize on future opportunities.

Broadridge Financial Solutions Inc. reported earnings per share (EPS) of $1.25, which was higher than the consensus estimate of $1.08. Revenue for the quarter reached $1.94 billion, up from $1.83 billion in the previous year.

Stock Overview:

| Ticker | $BR | Price | $217.21 | Market Cap | $25.39B |

| 52 Week High | $224.32 | 52 Week Low | $166.73 | Shares outstanding | 116.89M |

Company background:

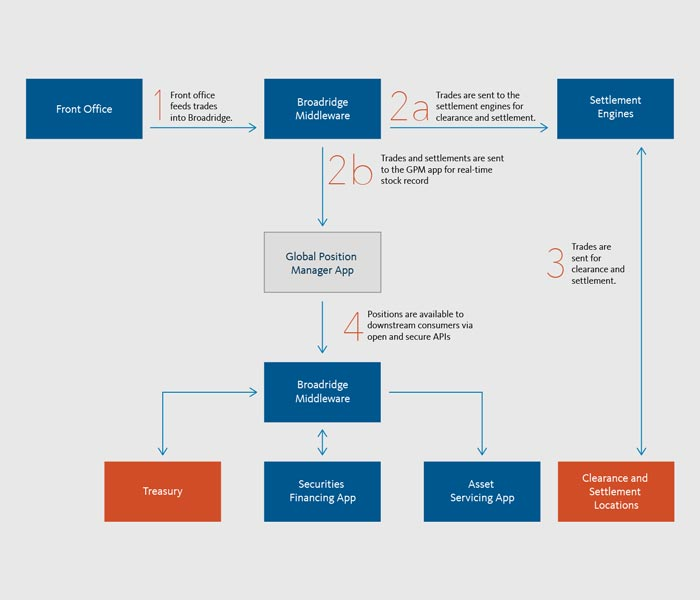

Broadridge Financial Solutions Inc. is a global leader in providing essential infrastructure and technology solutions to the investment industry. Founded in 1962 as ADP Brokerage Services Group. Broadridge’s diverse range of products includes solutions for corporate governance, capital markets, wealth and investment management, and data and analytics.

The company’s offerings encompass a wide range of capabilities, such as proxy voting, dividend processing, shareholder communications, mutual fund accounting, and transfer agency services. Broadridge’s technology platforms and data analytics tools enable clients to streamline operations, reduce costs, and make informed investment decisions. With a strong focus on innovation, Broadridge has been at the forefront of technological advancements in the financial services industry.

Broadridge competes with other leading fintech companies, including SS&C Technologies, Computershare, and State Street Corporation. These competitors offer similar products and services, making the market highly competitive. Broadridge’s extensive experience, global reach, and strong client relationships have enabled it to maintain a leading market position.

Headquartered in New York City, Broadridge has a global presence with offices in major financial centers around the world. The company serves a diverse client base, including investment banks, asset managers, mutual fund companies, insurance companies, and corporations.

Recent Earnings:

Broadridge Financial Solutions Inc. reported earnings per share (EPS) of $1.25, which was higher than the consensus estimate of $1.08. Revenue for the quarter reached $1.94 billion, up from $1.83 billion in the previous year, primarily driven by growth in recurring revenue.

This solid performance reflects Broadridge’s continued success in providing essential infrastructure solutions to the investment industry. The company’s revenue growth was driven by strong organic growth in all business segments, as well as contributions from recent acquisitions. Recurring revenue, which accounted for approximately 85% of total revenue, grew at a healthy rate, indicating a stable and predictable revenue stream.

The company’s profitability benefited from higher revenue, improved operating margins, and lower interest expenses. The company’s operational metrics were also strong, with operating margins expanding and cash flow from operations remaining healthy.

The company expects to continue to invest in its technology platform, expand its product offerings, and pursue strategic acquisitions to drive growth.

The Market, Industry, and Competitors:

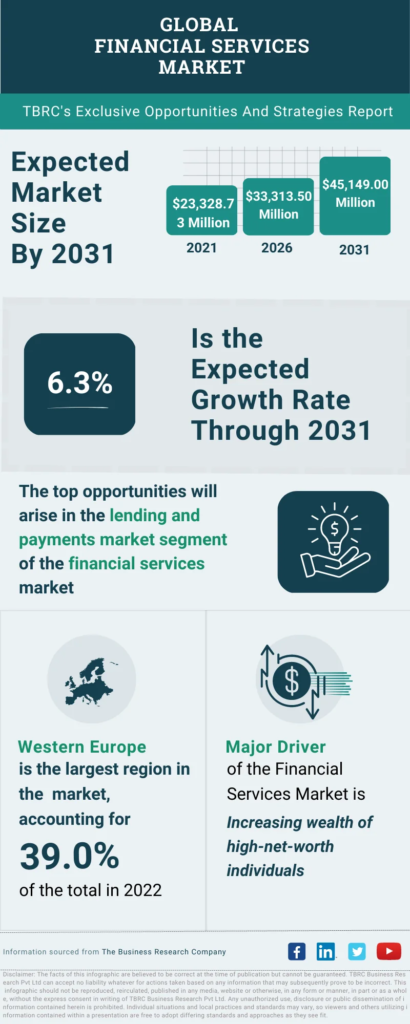

Broadridge Financial Solutions Inc. operates in the global financial services industry, providing essential infrastructure and technology solutions to a wide range of clients, including investment banks, asset managers, mutual fund companies, insurance companies, and corporations. The market for financial services is vast and diverse, with ongoing growth driven by factors such as increasing globalization, technological advancements, and changing investor preferences.

Broadridge is well-positioned to capitalize on the growth opportunities within the financial services industry. The company’s strategic focus on innovation, coupled with its strong client relationships and global reach, positions it to deliver value-added solutions that meet the evolving needs of its clients. They are expected to benefit from increased demand for its products and services, particularly in areas such as digital transformation, data analytics, and regulatory compliance.

Broadridge could achieve a compound annual growth rate (CAGR) of approximately 5-7% between 2024 and 2030. This growth is expected to be driven by factors such as organic revenue growth, acquisitions, and increased market penetration.

Unique differentiation:

SS&C Technologies: SS&C is a leading global provider of financial services software and technology-enabled services. The company offers a broad range of solutions for investment management, fund administration, and asset servicing. SS&C has a strong market presence and competes directly with Broadridge in many areas, including corporate governance, transfer agency, and fund accounting.

Computershare: Computershare is a global market leader in share registration, employee benefits, and capital markets solutions. The company provides a wide range of services to corporations, investors, and governments. Computershare competes with Broadridge in the areas of share registration, transfer agency, and employee benefits administration.

State Street Corporation: State Street is a leading provider of financial services, including investment management, investment servicing, and asset custody. The company offers a range of solutions for institutional investors, including fund administration, securities lending, and risk management. While State Street is primarily focused on investment management, it also competes with Broadridge in certain areas, such as transfer agency and fund accounting.

Broadridge also faces competition from smaller, more specialized fintech companies that offer targeted solutions to specific segments of the investment industry. The competitive landscape for Broadridge is dynamic and constantly evolving, with new competitors emerging and existing players expanding their product offerings.

Deep industry expertise: Broadridge has a long history of serving the investment industry, providing it with a deep understanding of the unique challenges and opportunities faced by its clients. This expertise allows Broadridge to develop tailored solutions that meet the specific needs of its clients.

Comprehensive product suite: Broadridge offers a comprehensive suite of products and services, covering a wide range of areas such as corporate governance, capital markets, wealth and investment management, and data and analytics. This breadth of offerings enables Broadridge to provide end-to-end solutions to its clients, simplifying their operations and reducing costs.

Management & Employees:

Timothy J. Brennan: President and Chief Executive Officer

Kevin J. Callahan: Chief Financial Officer

James A. Corsini: President, Global Technology and Operations

Joseph J. Moloney: Executive Vice President, General Counsel and Secretary

Financials:

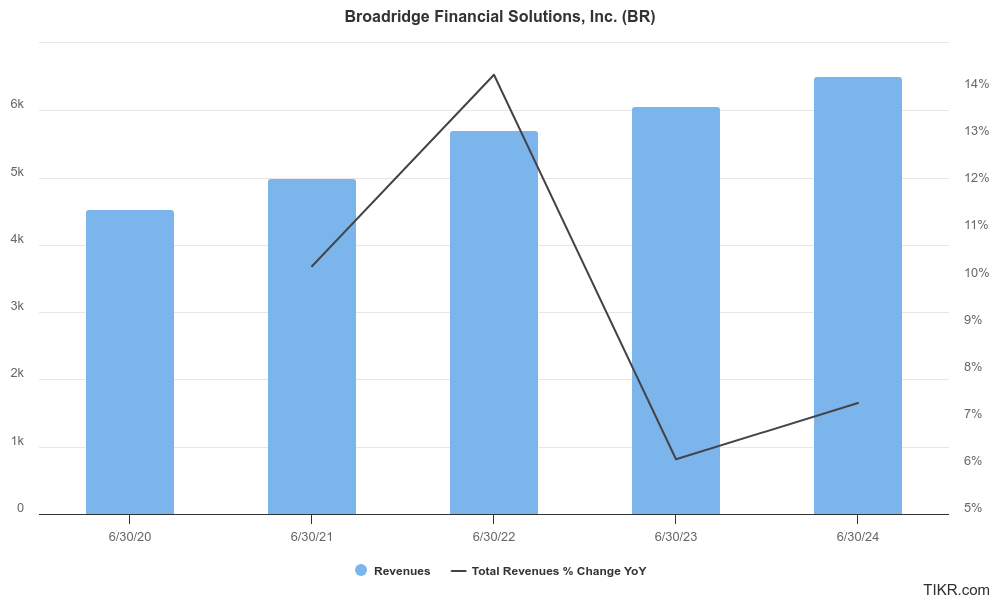

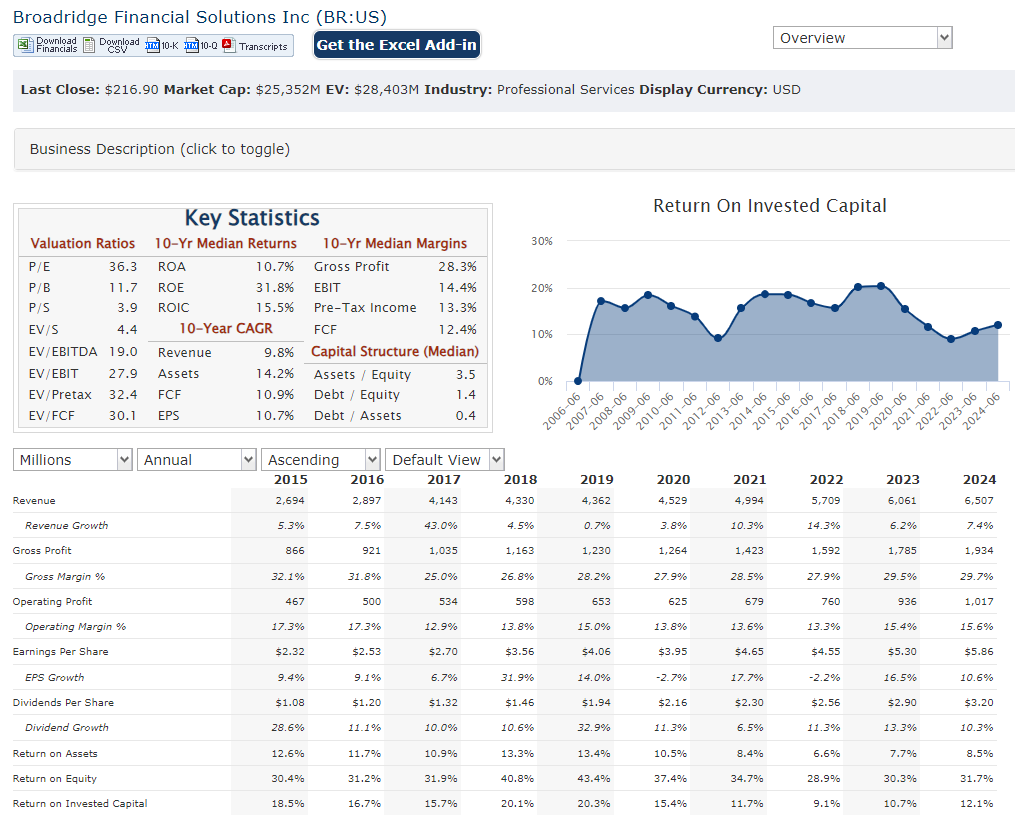

Broadridge Financial Solutions Inc. has reported total revenues of approximately $4.2 billion, reflecting a 6% increase from the previous year. This growth was primarily driven by recurring revenues, which also grew by 6%, bolstered by strong internal growth and new business acquisitions. They have achieved a compound annual growth rate (CAGR) of around 7% in recurring revenues, showcasing its ability to maintain a robust revenue stream through its diversified service offerings in financial technology and communications.

Adjusted earnings per share (EPS) reached $7.73 in fiscal 2024, representing a 10% increase year-over-year. The company has consistently delivered strong EPS growth, achieving a CAGR of approximately 12% over the last five years. This growth can be attributed to effective cost management and operational efficiencies, which have allowed Broadridge to enhance its profitability margins while investing in strategic initiatives for future expansion. The adjusted operating income margin improved to 20%, indicating effective management of operating expenses relative to revenue growth.

Broadridge remains financially stable, with significant liquidity and manageable debt levels. The company reported an increase in operating income to $1.017 billion for fiscal 2024, up from $936 million in the previous year. This improvement is indicative of strong operational performance and effective capital allocation strategies. Broadridge’s commitment to returning value to shareholders is evident through its 18th consecutive annual dividend increase, which rose by 10% to $3.52 per share.

Broadridge has set ambitious targets for fiscal year 2025, projecting recurring revenue growth of 5-7% and adjusted EPS growth of 8-12%. The company’s strategic focus on organic growth and targeted acquisitions positions it well for sustained success in the evolving financial services landscape.

Technical Analysis:

The stock is on a monthly stage 2 (markup), bullish trend and similarly on the weekly trend as well. The daily trend is short term bearish however with a reversal likely at the $206- $214 level. The stock has been a consistent performer however, which indicates that level would be a good area for a entry long term – 6-12 months.

Bull Case:

Unique differentiation: Broadridge differentiates itself from its competitors through its deep industry expertise, comprehensive product suite, global reach, strong technology platform, and customer focus. These differentiators enable the company to provide valuable solutions to its clients and maintain a competitive advantage.

Favorable industry trends: The financial services industry is undergoing significant transformation, with trends such as digitalization, data analytics, and regulatory compliance driving demand for innovative solutions. Broadridge is well-positioned to benefit from these trends, as its products and services are aligned with the evolving needs of the industry.

Bear Case:

Regulatory risks: The financial services industry is subject to a complex regulatory environment, with frequent changes and increasing scrutiny. Non-compliance with regulatory requirements could result in fines, penalties, and reputational damage.

Economic downturn: A global economic downturn could negatively impact the demand for financial services, leading to reduced revenue and profitability for Broadridge.

Client concentration risk: Broadridge’s business is concentrated in a relatively small number of large clients. The loss of a significant client or a decline in client spending could have a material impact on the company’s financial performance.