Executive Summary:

Super Micro Computer Inc. is a leading provider of high-performance computing solutions, specializing in servers, storage systems, and networking equipment. Known for its innovative and energy-efficient designs, the company caters to a wide range of industries, including cloud computing, data centers, artificial intelligence, and 5G networks.

Super Micro Computer Inc. reported net sales of $14.94 billion. Earnings per share (EPS) for the fiscal year reached $20.09.

Stock Overview:

| Ticker | $SMCI | Price | $47.80 | Market Cap | $27.99B |

| 52 Week High | $122.90 | 52 Week Low | $22.66 | Shares outstanding | 585.56M |

Company background:

Super Micro Computer Inc., a leading provider of high-performance computing solutions, was founded in 1993 by Charles Liang, a visionary entrepreneur with a passion for technology. Starting with a focus on server motherboards, the company quickly expanded its product offerings to include complete server systems, storage solutions, and networking equipment. Super Micro’s innovative approach and commitment to quality have propelled its growth and solidified its position in the industry.

Super Micro Computer Inc. achieved significant milestones without relying on external funding. This self-sufficiency allowed the company to maintain control over its direction and focus on delivering exceptional products. As the company expanded its operations and pursued aggressive growth strategies, it secured strategic investments from prominent venture capital firms and private equity funds.

Super Micro Computer Inc. offers a comprehensive range of products designed to meet the diverse needs of customers across various industries. The company’s server systems are renowned for their performance, efficiency, and scalability, making them ideal for data centers, cloud computing environments, and high-performance computing applications. Super Micro’s storage solutions provide reliable and scalable storage capacity, catering to the increasing demand for data management and analytics. The company’s networking equipment offers high-speed connectivity and advanced features, enabling seamless communication and data transfer within complex IT infrastructures.

Super Micro Computer Inc. faces competition from several established players in the high-performance computing market, including Dell Technologies, Hewlett Packard Enterprise (HPE), and Lenovo. These companies have strong brand recognition and extensive customer bases, making them formidable competitors. Super Micro differentiates itself by focusing on innovation, customization, and customer support. The company’s ability to deliver tailored solutions and provide exceptional service has helped it gain a loyal customer base and carve out a niche in the industry.

Headquartered in San Jose, California, Super Micro Computer Inc. has a global presence with offices and manufacturing facilities worldwide. Super Micro Computer Inc. is well-positioned to continue its growth and leadership in the high-performance computing industry.

Recent Earnings:

Super Micro Computer Inc. reported revenue surged to $14.94 billion, representing a remarkable 110% year-over-year growth, driven by robust demand for its high-performance computing solutions, particularly in the areas of artificial intelligence and cloud computing. Earnings per share (EPS) for the fiscal year reached $20.09, surpassing analyst estimates by a wide margin. This impressive performance reflects Super Micro’s strong execution, technological leadership, and ability to capitalize on the growing market for advanced computing infrastructure.

The company’s gross margin expanded to 46.1%, reflecting its ability to optimize costs and leverage its manufacturing expertise. Super Micro’s cash flow from operations remained robust, providing ample resources for future investments and growth initiatives. The company’s forward guidance is encouraging, with management projecting revenue in the range of $26 billion to $30 billion for the full fiscal year 2025. This outlook suggests continued strong growth momentum driven by the increasing adoption of AI and other emerging technologies.

The Market, Industry, and Competitors:

Super Micro Computer Inc. operates in the dynamic and rapidly growing market for high-performance computing (HPC) solutions. This market encompasses a wide range of applications, including data centers, cloud computing, artificial intelligence, scientific research, and financial modeling. The demand for HPC solutions is driven by the increasing need for data processing, analysis, and storage capabilities across various industries.

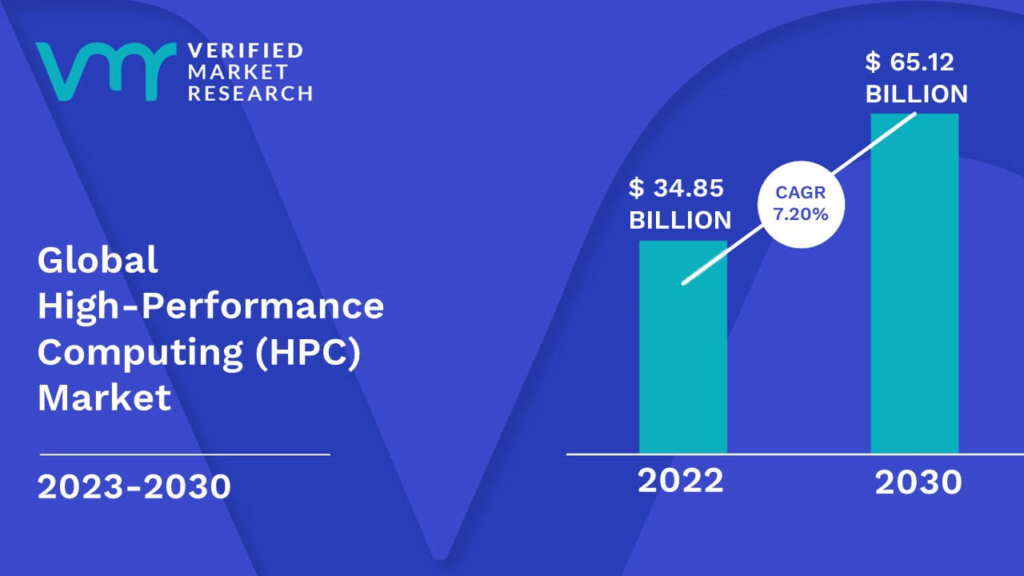

The global HPC market is anticipated to reach a value of $62.2 billion by 2030, exhibiting a Compound Annual Growth Rate (CAGR) of 7.20-8.6% during the forecast period (2023-2030). This growth is attributed to several factors, including the proliferation of data centers, the rising adoption of cloud computing services, advancements in artificial intelligence and machine learning, and the increasing use of HPC for scientific research and simulations. Super Micro Computer Inc., with its strong product portfolio, technological expertise, and focus on innovation, is well-positioned to capitalize on the growth opportunities.

Unique differentiation:

Dell Technologies: Dell is a global leader in IT infrastructure, offering a wide range of servers, storage systems, and networking equipment. The company has a strong brand presence and a broad customer base.

Hewlett Packard Enterprise (HPE): HPE is another major player in the HPC market, known for its enterprise-class servers and storage solutions. The company has a long history in the IT industry and a strong focus on innovation.

Lenovo: Lenovo is a global technology company that offers a diverse range of products, including servers, storage, and networking equipment. The company has a significant presence in the consumer market and is expanding its enterprise business.

Inspur: Inspur is a Chinese technology company that specializes in servers, storage, and cloud computing solutions. The company has a growing presence in the global market and competes with Super Micro in terms of price and performance.

Customization and Flexibility: Super Micro offers a high degree of customization and flexibility in its products, allowing customers to tailor their solutions to specific needs and requirements. This is particularly valuable for industries with unique workloads or demanding performance requirements.

Energy Efficiency: Super Micro is known for its energy-efficient designs, which help customers reduce their operational costs and environmental impact. The company’s focus on sustainability aligns with the growing demand for green IT solutions.

Vertical Integration: Super Micro has a strong vertical integration model, meaning it designs, manufactures, and distributes its products in-house. This enables the company to have greater control over quality, cost, and delivery times.

Management & Employees:

Charles Liang: As the Chairman and CEO, Charles Liang has been instrumental in guiding Super Micro’s growth and success. With a deep understanding of the technology industry, he has led the company to become a leading provider of high-performance computing solutions.

Simon Li: As the Chief Operating Officer, Simon Li is responsible for Super Micro’s day-to-day operations, including manufacturing, supply chain management, and quality control. His leadership has helped the company achieve operational excellence.

Stephen Chen: As the Chief Technology Officer, Stephen Chen drives Super Micro’s technological innovation and product development. His expertise in engineering and technology has enabled the company to stay at the forefront of the industry.

Financials:

Super Micro Computer Inc. (SMCI) has reported revenues of approximately $3.34 billion, which grew to about $7.12 billion by fiscal year 2023, marking a compound annual growth rate (CAGR) of approximately 49%. The projected revenues reached around $14.94 billion, further emphasizing the company’s strong market position and demand for its products.

SMCI’s net income rose from approximately $58.6 million in 2020 to about $761 million in 2023, yielding a CAGR of approximately 104%. This increase reflects not only higher sales but also improved operational efficiency and cost management, as evidenced by a growing gross profit margin from 15.7% in 2020 to 18% in 2023.

Super Micro Computer has total assets were approximately $6.36 billion, up from around $1.92 billion in 2020. The company’s total liabilities also increased but at a manageable rate, resulting in a healthy equity position that supports ongoing investments and growth initiatives.

Super Micro Computer Inc.’s strong revenue and earnings growth rates alongside a robust balance sheet, the company is poised for continued success in the rapidly evolving technology landscape. Its strategic focus on high-performance computing solutions aligns well with market demands, providing a solid foundation for future expansion and profitability.

Technical Analysis:

The stock is on a downturn Stage 4 (markdown) bearish stage on the monthly chart and also very bearish on the weekly chart. The daily chart however is more bullish and a move to $52 is likely with a pullback to the $42 range on the bull flag. The long term range bound nature of this stock however, gives us pause on a large position.

Bull Case:

Energy Efficiency and Sustainability: Super Micro’s emphasis on energy-efficient designs aligns with the growing demand for sustainable IT solutions. This can provide a competitive advantage and attract environmentally conscious customers.

Customization and Flexibility: The company’s ability to offer highly customized solutions can meet the specific needs of various industries and customers, potentially leading to increased market share and customer loyalty.

Favorable Industry Trends: The increasing adoption of cloud computing, artificial intelligence, and big data analytics are driving demand for HPC solutions, creating favorable market conditions for Super Micro.

Bear Case:

Supply Chain Risks: The company’s operations are subject to supply chain risks, including component shortages, disruptions in manufacturing, and geopolitical factors. These risks could impact production costs, lead times, and overall profitability.

Economic Downturn: A slowdown in the global economy could reduce demand for HPC solutions, impacting Super Micro’s revenue and profitability.

Regulatory Risks: The company operates in a highly regulated industry, and changes in government policies or regulations could have a negative impact on its business.