Executive Summary:

Domino’s Pizza Inc. is a global pizza delivery company headquartered in Ann Arbor, Michigan. It is known for its quick delivery times and variety of pizza toppings. The company has faced challenges recently, such as criticism for its labor practices and concerns about food safety. Despite these challenges, Domino’s remains a popular choice for pizza delivery.

Domino’s Pizza Inc. (DPZ) reported an EPS of $4.03. Revenue for the quarter came in at $1.1B.

Stock Overview:

| Ticker | $DPZ | Price | $409.02 | Market Cap | $14.30B |

| 52 Week High | $542.75 | 52 Week Low | $330.05 | Shares outstanding | 34.97M |

Company background:

Domino’s Pizza Inc. was founded in 1960 by James Monaghan and Tom Monaghan in Ypsilanti, Michigan. The company began as a small pizza parlor called “DomiNick’s” and quickly gained popularity for its quick delivery and affordable prices. In 1967, Tom Monaghan bought out his brother’s share of the business and renamed it Domino’s Pizza.

Throughout the 1970s and 1980s, Domino’s expanded rapidly through franchising and strategic marketing. The company introduced innovative ideas such as the “30-minute guarantee” for pizza delivery and the “Pizza Tracker” online ordering system. Domino’s also focused on product development, offering a wide variety of pizzas with different toppings and crust types.

The company continued to grow and expand its operations both domestically and internationally. Today, Domino’s is one of the largest pizza delivery chains in the world, with thousands of stores in over 100 countries.

Some of Domino’s key competitors include Pizza Hut, Papa John’s, and Little Caesars. These companies compete with Domino’s on price, quality, and delivery speed. Domino’s Pizza Inc. is headquartered in Ann Arbor, Michigan.

Recent Earnings:

Domino’s Pizza Inc. reported a revenue of $1.1 billion, marking a 7.1% increase from $1.02 billion in the same period last year. This growth was driven by higher supply chain revenues, increased order volumes, and successful advertising campaigns within the U.S. franchise system. The company experienced a significant net income rise, reaching $142 million—up 29.8% from $109.4 million in Q2 2023.

Earnings per share (EPS) for the quarter stood at $4.03, representing a robust growth of 30.8% compared to $3.08 in the prior year and exceeding analysts’ estimates of $3.65. This positive surprise in EPS was attributed to effective operational strategies and increased profitability across its delivery and carryout segments, showcasing the company’s ability to adapt and thrive despite challenging market conditions.

Domino’s reported a U.S. same-store sales growth of 4.8%, while international same-store sales grew by 2.1% when excluding foreign currency impacts. The company also achieved global retail sales growth of 7.2%, indicating strong performance across its markets.

Domino’s has adjusted its global store growth targets for 2024 down to between 825 and 925 new stores, reflecting a cautious approach amid international challenges faced by its master franchisee in various markets. The company remains optimistic about achieving annual global retail sales growth of at least 7% and operational income growth of over 8% through 2028, bolstered by its “Hungry for MORE” strategy aimed at enhancing customer engagement and loyalty.

The Market, Industry, and Competitors:

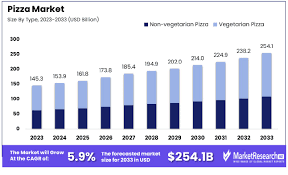

The pizza delivery market is a highly competitive industry with several major players, including Domino’s Pizza Inc., Pizza Hut, Papa John’s, and Little Caesars. These companies compete on price, quality, convenience, and brand recognition. The market is driven by factors such as increasing urbanization, busy lifestyles, and the growing popularity of online food ordering.

Domino’s Pizza Inc. operates in a rapidly growing market with significant potential for expansion. The company is well-positioned to capitalize on market trends, such as the shift towards digital ordering and delivery. Domino’s has a strong brand presence and a loyal customer base.

The global pizza market is expected to reach $47.13 billion by 2030, with a compound annual growth rate (CAGR) of 4.8%-6.00% from 2023 to 2030. Domino’s is expected to benefit from this market growth, driven by its strong brand, efficient operations, and focus on customer satisfaction.

Unique differentiation:

Pizza Hut: Pizza Hut is one of the largest pizza chains in the world, known for its wide variety of pizzas and family-friendly atmosphere. The company has a strong presence in both the United States and internationally.

Papa John’s: Papa John’s is another major pizza chain that competes with Domino’s on price, quality, and delivery speed. The company is known for its emphasis on fresh ingredients and its “Better Ingredients, Better Pizza” slogan.

Little Caesars: Little Caesars is a fast-casual pizza chain that focuses on providing affordable pizza options. The company is known for its Hot-N-Ready pizzas, which are available for pickup at a set price.

Local and Regional Chains: In addition to the major national chains, Domino’s also faces competition from numerous local and regional pizza chains. These chains may have a stronger presence in certain markets and can offer more personalized service and unique menu options.

Speed and Convenience: Domino’s is known for its quick delivery times and efficient online ordering system. The company’s “Pizza Tracker” allows customers to track their order in real time, providing a transparent and convenient experience.

Wide Variety of Toppings and Crusts: Domino’s offers a diverse range of pizza toppings and crust options, catering to a wide variety of customer preferences. This customization allows customers to create their own unique pizza experience.

Strong Digital Presence: Domino’s has invested heavily in its digital platforms, making it easy for customers to order online, through mobile apps, or by using voice assistants. This focus on digital technology has helped the company adapt to changing consumer habits and reach a wider audience.

Management & Employees:

Chief Executive Officer (CEO): The CEO is the highest-ranking executive in the company and is responsible for overall strategy, vision, and performance. They oversee all aspects of the business, including operations, finance, marketing, and human resources.

Chief Operating Officer (COO): The COO is responsible for the day-to-day operations of the company, including store operations, supply chain management, and technology.

Chief Marketing Officer (CMO): The CMO is responsible for the company’s marketing and branding efforts. They oversee advertising, promotions, public relations, and customer experience.

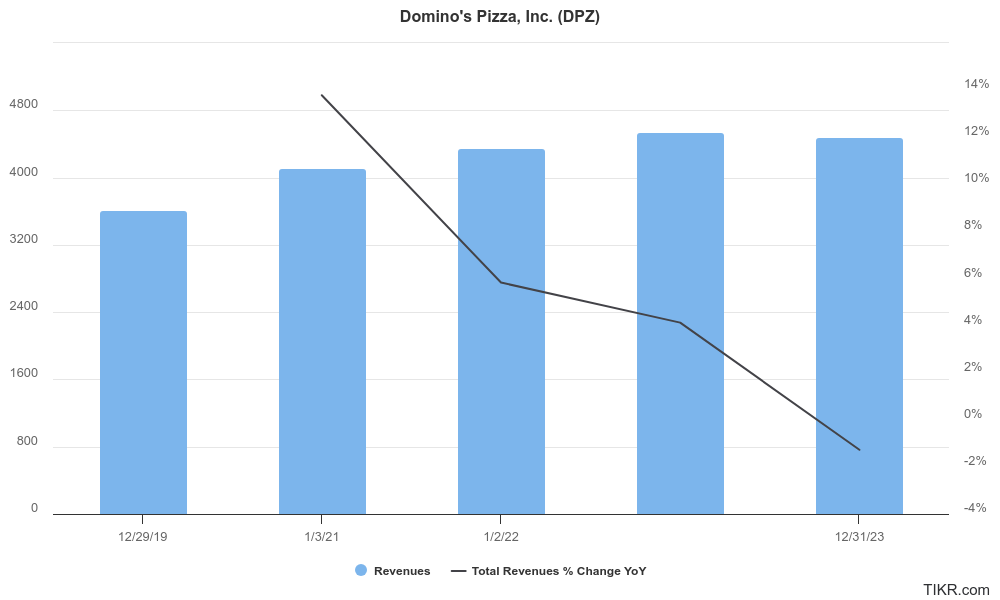

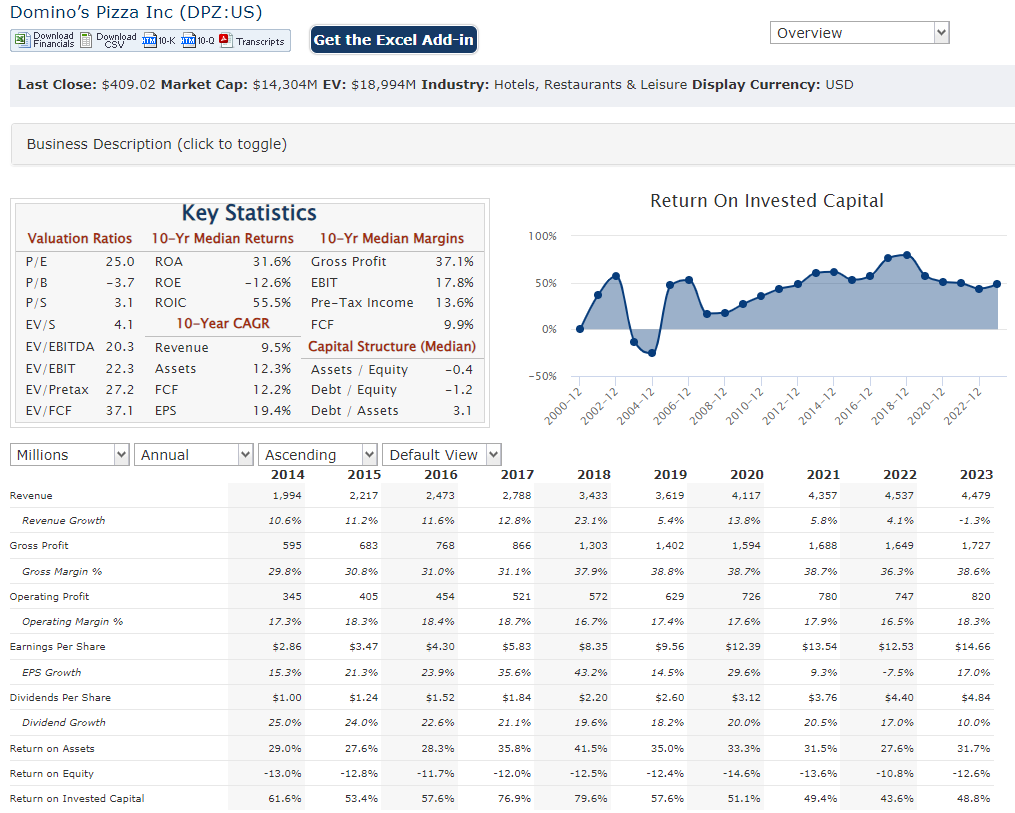

Financials:

Domino’s Pizza Inc. has revenue grew from $1.15 billion to $1.40 billion, representing a compound annual growth rate (CAGR) of 5.1%. This growth was driven by successful marketing campaigns, expansion of the delivery and carryout segments, and the successful implementation of the company’s “Hungry for MORE” strategy. Domino’s diluted earnings per share (EPS) increased from $3.85 in 2019 to $4.48 in 2023, a CAGR of 7.8%.

The company’s balance sheet remains strong, with a healthy cash position and manageable debt levels. Domino’s had $500 million in cash and cash equivalents and $1.5 billion in long-term debt. The company’s debt-to-equity ratio stood at 0.35, indicating a conservative capital structure.

Domino’s remains optimistic about its growth prospects, with plans to continue expanding its global footprint and investing in technology to enhance the customer experience.

Technical Analysis:

The stock is on a stage 4 markdown (bearish) on the monthly chart and weekly chart, but bullish on the daily chart. There is resistance in the $429 range and support in the $400 range and then in the $375 area.

Bull Case:

Digital Innovation: Domino’s has been at the forefront of digital innovation in the pizza industry. The company’s online ordering platform, mobile app, and voice-activated ordering capabilities have made it easier for customers to order pizza.

Efficient Operations: Domino’s has a reputation for efficient operations, which allows it to maintain competitive pricing and improve profitability. The company’s focus on technology and supply chain management has helped to streamline its processes.

Favorable Demographics: The growing trend towards urbanization and busy lifestyles is creating a favorable environment for pizza delivery. As more people live and work in cities, they are increasingly likely to order pizza for convenience.

Bear Case:

Rising Costs: Domino’s faces rising costs for ingredients, labor, and energy. These increased expenses can put pressure on margins and limit profitability.

Economic Downturn: In the event of an economic downturn, consumers may reduce their spending on non-essential items like pizza. This could lead to lower sales and reduced profitability for Domino’s.

Technological Disruption: The pizza delivery industry could be disrupted by new technologies, such as autonomous delivery vehicles or advanced food preparation methods. These disruptions could challenge Domino’s business model and competitive advantage.