Executive Summary:

Enphase Energy Inc. is a leading provider of solar microinverters and energy storage systems. The company’s microinverters optimize solar panel performance, ensuring maximum energy production. Enphase also offers smart batteries for storing excess solar energy, enabling homeowners to use clean energy even when the sun isn’t shining. With a focus on innovation and sustainability, Enphase is empowering individuals to harness the power of the sun and reduce their reliance on fossil fuels.

Enphase Energy Inc. reported revenue reaching $303.5 million. Earnings per share (EPS) came in at $0.43.

Stock Overview:

| Ticker | $ENPH | Price | $109.45 | Market Cap | $14.82B |

| 52 Week High | $141.63 | 52 Week Low | $73.49 | Shares outstanding | 135.42M |

Company background:

Enphase Energy Inc. is a leading global provider of solar microinverters and energy storage systems. Founded in 2006 by Paul Gregory, Tom Pollak, and Ajeet Goyal, the company pioneered the development of microinverters, which revolutionized the solar industry by optimizing energy production at the individual panel level. Enphase has secured significant funding through various rounds, including investments from prominent venture capital firms like Kleiner Perkins Caufield & Byers and Venrock.

The company’s core products include microinverters, which convert DC power from solar panels into AC power for use or export to the grid. These products are designed to work seamlessly together, providing a comprehensive solution for residential solar energy systems.

Enphase faces competition from other solar inverter manufacturers, such as SolarEdge Technologies and SMA Solar Technology. The company has established a strong market presence through its innovative technology, high-quality products, and extensive global distribution network. Enphase’s headquarters are located in Fremont, California, and it has operations in various countries worldwide.

Recent Earnings:

Enphase Energy Inc. reported revenue of $303.5 million, a substantial increase of 43.7% compared to last year. This growth was driven by robust demand for Enphase’s microinverters and energy storage systems, fueled by the ongoing transition to clean energy solutions.

Earnings per share (EPS) for the quarter came in at $0.43, surpassing the consensus estimate of $0.38. This represents a remarkable growth rate of 107.1% compared to the previous year. The company’s ability to deliver consistent top-line and bottom-line growth reflects its strong market position, innovative product offerings, and effective operational execution.

The company achieved a gross margin of 47.5%, slightly higher than the previous quarter. This improvement was attributed to a favorable product mix and ongoing cost management initiatives. Enphase generated $122 million in free cash flow during the quarter, further strengthening its financial position.

They expect to continue to grow in both revenue and earnings for the remainder of the year, driven by strong demand for its products and ongoing investments in research and development.

The Market, Industry, and Competitors:

Enphase Energy Inc. operates in the rapidly growing solar energy market, specifically focusing on microinverters and energy storage systems. Their innovative technology and product offerings position the company well to capitalize on this favorable market environment.

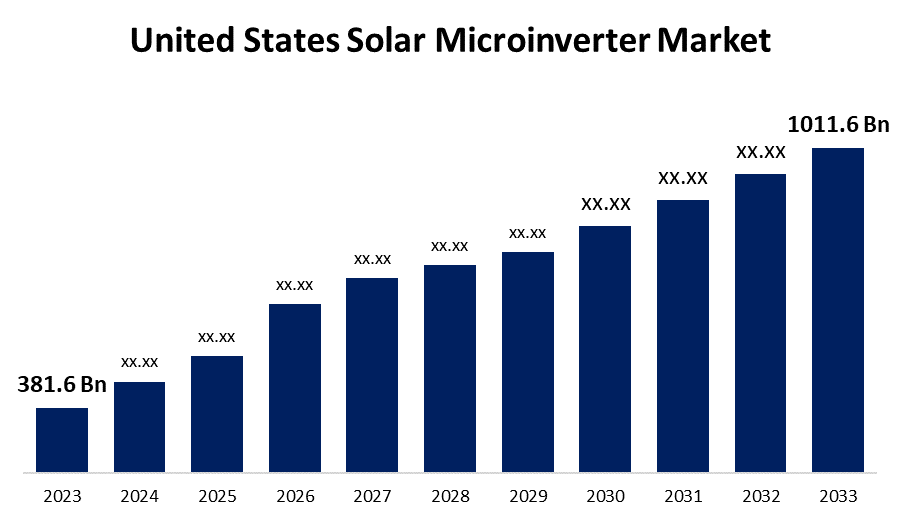

The market for solar microinverters is expected to witness substantial growth in the coming years, driven by the increasing preference for distributed solar systems and the advantages offered by microinverters in terms of performance optimization and reliability. The company’s energy storage systems are also gaining traction as homeowners and businesses seek to store excess solar energy for use during off-peak hours or grid outages.

The company’s focus on research and development, strategic partnerships, and global market expansion will be key drivers of its success. Analysts project a CAGR (Compound Annual Growth Rate) for Enphase’s revenue in the range of 15-20% over the next several years, reflecting the company’s strong competitive position and favorable market dynamics.

Unique differentiation:

SolarEdge Technologies: SolarEdge is a leading provider of solar inverters and power optimizers. The company offers a wide range of products for both residential and commercial applications. SolarEdge has a strong market presence and competes with Enphase in terms of product features, efficiency, and pricing.

SMA Solar Technology: SMA is a global leader in the solar inverter market, offering a diverse range of products for various applications. The company has a long history in the solar industry and is known for its reliability and quality. SMA competes with Enphase in both residential and commercial markets.

Delta Electronics: Delta is a multinational electronics company that also offers solar inverters and energy storage solutions. The company has a strong presence in the industrial and commercial sectors and competes with Enphase in these markets.

Other notable competitors include Huawei Technologies, Fronius International, and ABB. Enphase competes with these companies on various fronts, including product features, pricing, brand recognition, and distribution channels.

Energy Storage Solutions: Enphase offers a comprehensive range of energy storage systems, including batteries and software, that complement its microinverters. This integrated solution enables homeowners to store excess solar energy and use it during off-peak hours or grid outages, providing greater energy independence and resilience.

Smart Grid Integration: Enphase’s products are designed to seamlessly integrate with the smart grid, allowing homeowners to participate in demand response programs and contribute to grid stability. This feature positions Enphase as a key player in the transition to a decentralized and renewable energy-powered future.

Software and Analytics: Enphase provides advanced software and analytics tools that enable homeowners to monitor their solar system performance, track energy consumption, and optimize energy usage. This data-driven approach helps customers maximize the benefits of their solar investment and make informed decisions about their energy consumption.

Management & Employees:

- Badri Kothandaraman: President and Chief Executive Officer

- Raghu Belur: Senior Vice President, Co-founder, Chief Products Officer

- Lisan Hung: Senior Vice President, General Counsel, and Corporate Secretary

Financials:

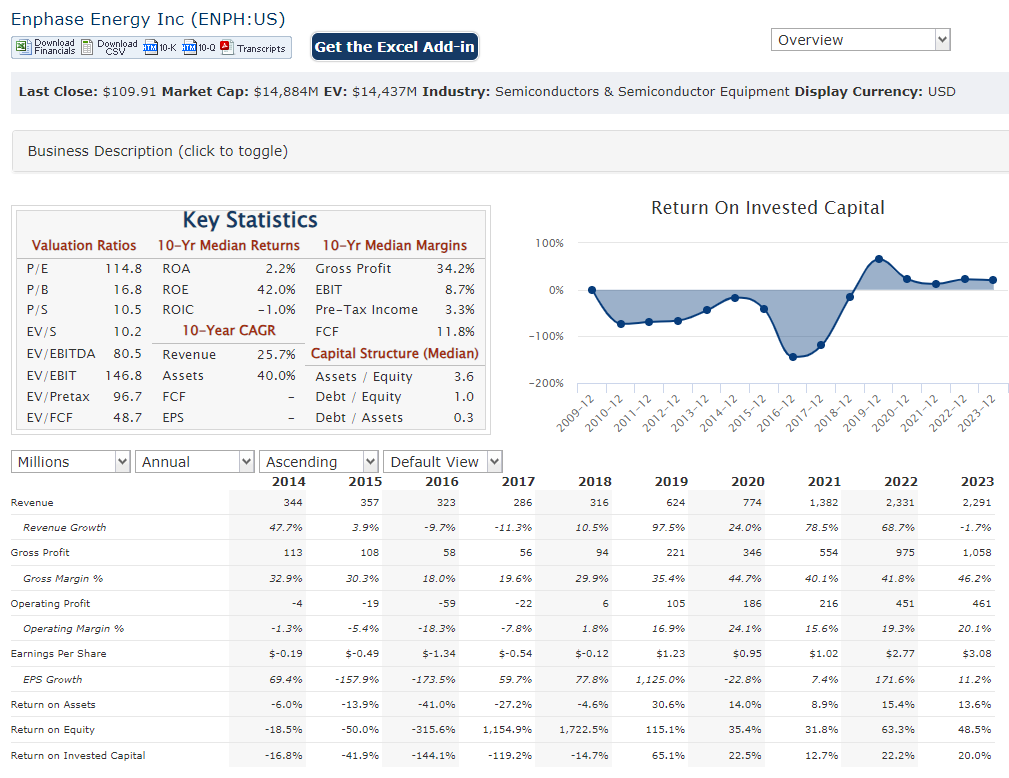

Enphase Energy Inc. has achieved an average revenue growth rate of approximately 29.7% per year, with a compound annual growth rate (CAGR) of 48.6% over this period. This impressive growth trajectory reflects Enphase’s strong position within the semiconductor and clean energy sectors, driven by increasing demand for solar energy solutions and innovative technologies.

The company’s quarterly reports indicate a decline in revenue, with a 57.33% drop year-over-year in Q2 2024, highlighting potential volatility in the market. Enphase Energy has experienced a significant growth rate of 29.3% annually over the last five years, although the company faced challenges recently, including a negative earnings growth of 77.4% in the past year.

The earnings per share (EPS) CAGR over the same five years has been reported at -1.63%, indicating fluctuations that may affect investor confidence. Despite these challenges, the company’s return on equity stands at 14.7%, suggesting that it has been effective in generating profits from its equity base, although this figure is relatively low compared to industry peers.

The company has a current ratio of 4.23, indicating strong short-term liquidity, which is favorable for meeting its short-term obligations. The debt-to-equity ratio is reported at 1.36, suggesting a relatively high level of debt compared to equity, which could pose risks in a rising interest rate environment or during economic downturns. The net profit margin has decreased to 9.1%, down from previous levels, indicating that while revenues have increased, profitability has faced pressures. The company’s strong liquidity position and return on equity are positive indicators, but the high debt levels and declining profit margins warrant careful monitoring by investors and stakeholders as the company navigates the evolving energy landscape.

Technical Analysis:

The stock is in stage 1 consolidation zone ($95 to $132) on the monthly and weekly chart. The daily chart should get it to $119 and then fall again to the $100 zone.

Bull Case:

Strong Market Fundamentals: The global solar energy market is experiencing rapid growth due to increasing concerns about climate change, rising energy costs, and government incentives promoting renewable energy adoption. Enphase’s innovative microinverters and energy storage solutions position the company well to capitalize on this favorable market environment.

Competitive Advantage: Enphase’s microinverter technology, energy storage solutions, and software platform provide a competitive advantage over traditional string inverters and other solar energy solutions. The company’s focus on innovation and customer satisfaction differentiates it from its competitors.

ESG and Sustainability: Enphase’s products and solutions contribute to a more sustainable future by enabling homeowners and businesses to reduce their carbon footprint and reliance on fossil fuels. This aligns with the growing focus on environmental, social, and governance (ESG) factors in investment decisions.

Bear Case:

Regulatory Changes: Government policies and regulations supporting solar energy adoption can change over time, potentially affecting demand for Enphase’s products. Adverse regulatory changes could create challenges for the company’s growth.

Product Risks: There is always a risk of product defects, recalls, or performance issues that could damage Enphase’s reputation and negatively impact sales.