Executive Summary:

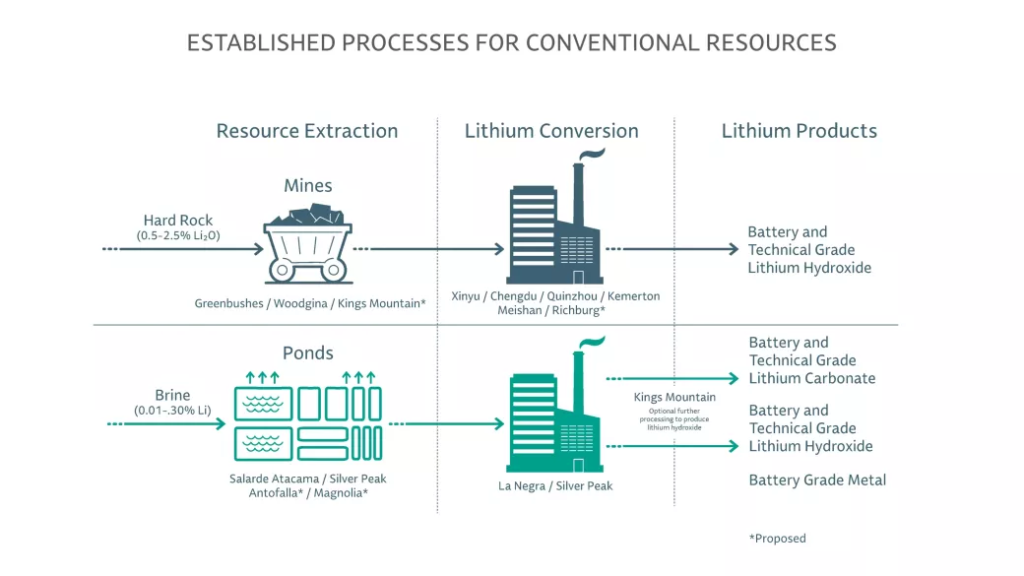

Albemarle Corporation is a global leader in specialty chemicals, specializing in lithium, bromine, and catalysts. With a focus on sustainability and innovation, Albemarle plays a crucial role in enabling technologies for mobility, energy, connectivity, and health. Their products are essential components in electric vehicles, renewable energy storage, electronics, and pharmaceuticals.

Albemarle Corporation reported earnings per share (EPS) of $0.26. Revenue for the quarter was $1.43 billion, down 39.7% year-over-year.

Stock Overview:

| Ticker | $ALB | Price | $78.41 | Market Cap | $9.22B |

| 52 Week High | $189.19 | 52 Week Low | $71.97 | Shares outstanding | 117.53M |

Company background:

Albemarle Corporation was founded in 1887 in Richmond, Virginia. Its rich history is rooted in the production of bromine. The company has become a global leader in specialty chemicals, specializing in lithium, bromine, and catalysts.

Albemarle’s journey has been fueled by its commitment to innovation and product development. The company’s core products, lithium and bromine, are essential components in a wide range of industries, including electric vehicles, renewable energy, pharmaceuticals, and electronics. Lithium, in particular, has gained significant attention due to its role in lithium-ion batteries, a key technology for electric vehicles and energy storage systems.

Albemarle faces competition from other global chemical companies, including FMC Corporation, Tronox, and Livent Corporation. These companies offer similar products and services, making the competitive landscape for specialty chemicals highly competitive. Albemarle has maintained a strong market position through its focus on research and development, strategic acquisitions, and a global footprint.

Albemarle Corporation is headquartered in Charlotte, North Carolina, United States. With a global network of manufacturing facilities and research centers, the company serves customers in over 100 countries.

Recent Earnings:

Albemarle Corporation reported its revenue of $1.43 billion, which represents a significant decline of 39.7% compared to the same quarter in the previous year. Which resulted in a revenue shortfall against analysts’ expectations that had projected revenues closer to $1.5 billion. The earnings per share (EPS) came in at $0.26, slightly below the consensus estimate of $0.27, reflecting a year-over-year decrease.

Albemarle’s adjusted EBITDA for the quarter was $220 million, down from $450 million a year earlier, indicating a 51.1% decline. The gross profit margin also suffered, with a negative gross profit reported due to increased costs associated with production and supply chain disruptions. These factors contributed to a net loss of $603 million for the quarter, a stark contrast to the net income of $1.16 billion reported in the same quarter last year.

Albemarle management emphasized their commitment to operational excellence and cost reduction strategies, with plans to achieve over $280 million in productivity benefits in 2024. They also highlighted their strong liquidity position, with approximately $3.7 billion. The company remains focused on long-term growth strategies and maintaining financial flexibility.

The Market, Industry, and Competitors:

Albemarle operates in the dynamic and rapidly growing market for specialty chemicals, which includes products used in a wide range of industries, from electronics and pharmaceuticals to transportation and renewable energy. The company’s core products, lithium and bromine, are essential components in emerging technologies such as electric vehicles and energy storage systems.

The global lithium market is expected to experience significant growth, with projections indicating a compound annual growth rate (CAGR) of approximately 20% to 25% from 2024 to 2030. This growth is fueled by the increasing adoption of electric vehicles, which are anticipated to dominate the automotive market and the rising demand for energy storage systems. The company’s strategic investments in new lithium extraction projects and its commitment to operational excellence are expected to support its growth trajectory in this dynamic market.

Unique differentiation:

FMC Corporation: FMC is a diversified chemical company with a strong presence in the agriculture, lithium, and specialty chemicals markets. It is a direct competitor to Albemarle in the lithium space and offers similar products and services.

Livent Corporation: Livent is a leading producer of lithium compounds, primarily for use in batteries. The company has a strong focus on the electric vehicle market and is a key competitor to Albemarle.

SQM: Sociedad Química y Minera de Chile (SQM) is a Chilean mining and chemical company with a significant presence in the lithium market. It is one of the world’s largest producers of lithium and a major competitor to Albemarle.

Ganfeng Lithium: Ganfeng is a Chinese lithium company that has rapidly expanded its operations in recent years. It is a major player in the lithium market and a competitor to Albemarle, particularly in Asia.

Sustainable Practices: Albemarle is committed to sustainable practices and has implemented various initiatives to reduce its environmental impact. This focus on sustainability aligns with growing consumer and regulatory demands for environmentally responsible products and processes.

Diversified Product Portfolio: Albemarle’s portfolio includes a wide range of specialty chemicals, including lithium, bromine, and catalysts. This diversification helps to mitigate risks and provides the company with multiple growth opportunities.

Management & Employees:

- Kent Masters: CEO and President

- Bethany McCorkle: Executive Vice President, Global Operations

- Mark McNeely: Executive Vice President, Technology

- Matthew L. Harris: Executive Vice President, General Counsel and Secretary

Financials:

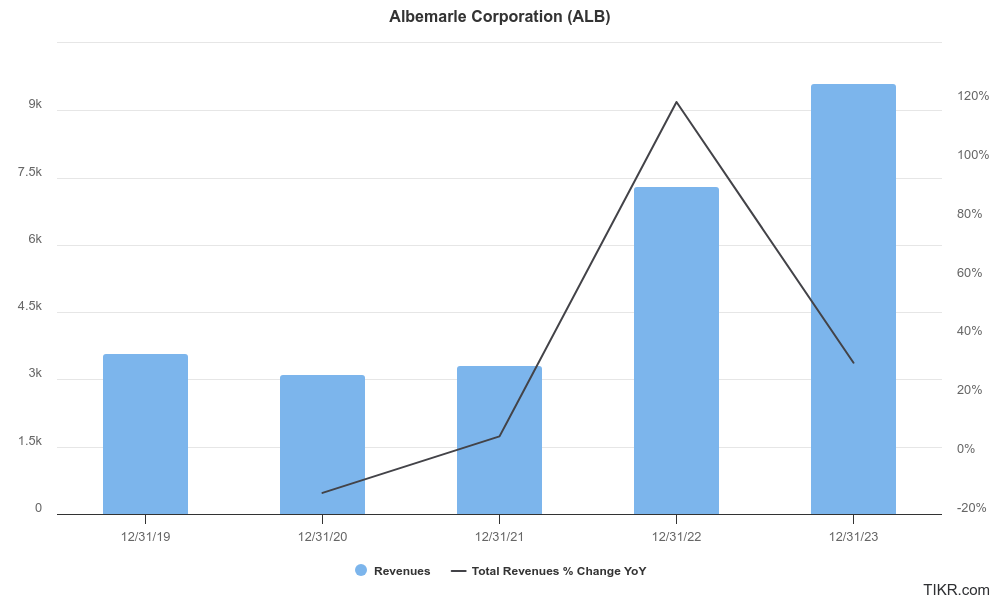

Albemarle Corporation reported revenues of approximately $3.65 billion, which grew to about $6.56 billion in 2022, reflecting a compound annual growth rate (CAGR) of around 22.4%. The revenues decreased to $5.64 billion, marking a decline as the company faced challenges related to lower lithium prices and reduced demand in certain sectors.

Albemarle’s diluted EPS was approximately $5.00, which surged to around $12.00 in 2022, reflecting strong demand for lithium and robust operational performance. The EPS fell sharply to approximately -$5.26 in 2023 due to substantial net losses attributed to market pressures. The company’s ability to recover and return to growth will depend on its strategic initiatives and the stabilization of lithium prices.

Albemarle has maintained a solid financial foundation despite recent challenges. The company’s total assets were approximately $12 billion, with total liabilities around $2.3 billion, resulting in a healthy equity position of about $9.7 billion.

The company’s return on equity (ROE) has been relatively low in recent years, it is expected to improve as the company regains profitability. Albemarle’s revenue will grow at a CAGR of approximately 7.5% through 2030, driven by ongoing demand for lithium and the expansion of electric vehicle markets. An anticipated CAGR of 56.5% for EPS as the company capitalizes on its investments and operational efficiencies.

Technical Analysis:

The stock is in a stage 4 decline on the monthly, weekly and daily charts. This is not a stock worth investing for the long term yet, but a likely bounce to $93 is what’s on the cards.

Bull Case:

- Growing Demand for Lithium: As the world transitions to electric vehicles and renewable energy, the demand for lithium, a crucial component in lithium-ion batteries, is expected to surge. Albemarle’s position as a major producer of lithium positions it well to capitalize on this trend.

- Technological Leadership: Albemarle has a history of innovation and technological advancements. The company’s focus on research and development ensures it remains at the forefront of the specialty chemicals industry.

Bear Case:

Commodity Price Fluctuations: Lithium prices can be volatile, influenced by factors such as supply and demand dynamics, geopolitical events, and technological advancements. A decline in lithium prices could negatively impact Albemarle’s profitability.

Competitive Landscape: The specialty chemicals industry is highly competitive, with numerous players vying for market share. Increased competition could pressure margins and limit Albemarle’s pricing power.

Supply Chain Disruptions: Global supply chain disruptions, such as those caused by pandemics or geopolitical tensions, could impact Albemarle’s operations and financial performance.