Executive Summary:

DocuSign Inc. is a global technology company that provides electronic signature and agreement management solutions. The company’s primary product is an e-signature platform that allows users to legally sign documents digitally. DocuSign has expanded its offerings to include contract lifecycle management, payment processing, and other related services.

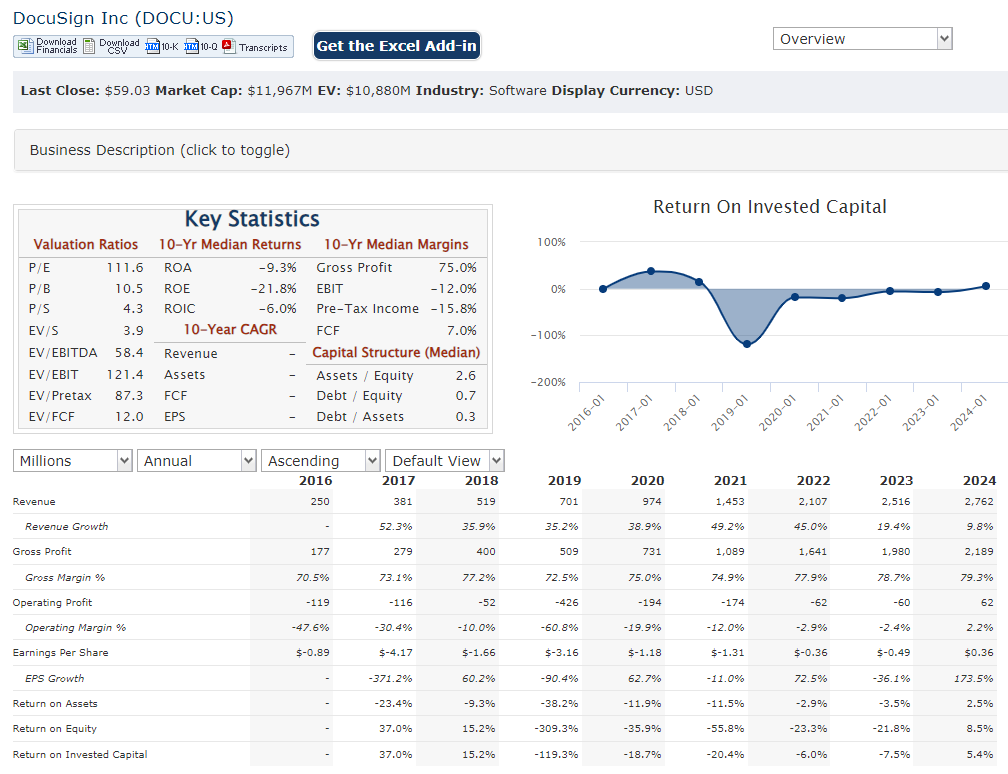

DocuSign Inc. reported with revenue reaching $712.4 million, a year-over-year increase of 8%. Earnings per share (EPS) came in at $0.13.

Stock Overview:

| Ticker | $DOCU | Price | $59.03 | Market Cap | $12.08B |

| 52 Week High | $64.76 | 52 Week Low | $38.11 | Shares outstanding | 204.72M |

Company background:

DocuSign Inc., a pioneer in the electronic signature and agreement management industry, was founded in 2003 by Tom Glavine, Keith Krach, and Ron Burg. The company’s headquarters are currently located in San Francisco, California.

DocuSign’s journey began with a simple yet innovative idea: to revolutionize the way people sign documents. The founders realized the inefficiencies and complexities associated with traditional paper-based signatures and set out to create a digital solution that would streamline the process. With initial funding from venture capital firms like Accel Partners and Sequoia Capital, DocuSign developed its flagship e-signature platform, which allows users to legally sign documents electronically from any device with an internet connection.

DocuSign has expanded its product offerings beyond e-signatures to include contract lifecycle management solutions. These solutions help organizations manage the entire lifecycle of contracts, from creation and negotiation to execution and renewal. DocuSign’s comprehensive platform has resonated with businesses of all sizes across various industries.

Key competitors in the electronic signature and agreement management market include Adobe Acrobat Sign, HelloSign, and RightSignature. DocuSign differentiates itself through its user-friendly interface, robust features, and strong brand recognition.

DocuSign’s success has been fueled by its ability to adapt to changing market dynamics and leverage technological advancements. The company’s vision is to simplify the way people agree to things, making agreements more efficient and secure. With a strong foundation and a commitment to innovation, DocuSign is well-positioned to continue its growth and leadership in the electronic signature and agreement management space.

Recent Earnings:

DocuSign Inc. reported revenue reached $712.4 million, a year-over-year increase of 8%, surpassing the consensus estimate of $705.7 million. Earnings per share (EPS) came in at $0.13, beating the expected EPS of $0.09.

DocuSign’s total revenue, grew 8% year-over-year to $695.7 million. Professional services and other revenue increased 5% to $16.7 million. The company’s billings represents the total value of contracts reached $833.1 million, a 13% increase from the prior year period.

The company’s customer base expanded during the quarter, with approximately 1.51 million paying customers. DocuSign expects revenue in the range of $725 million to $735 million, representing year-over-year growth of 6% to 7%. EPS is projected to be in the range of $0.10 to $0.12.

The Market, Industry, and Competitors:

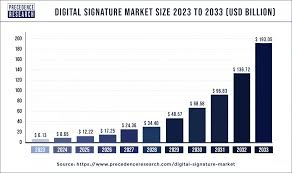

The electronic signature and agreement management market, in which DocuSign operates, is experiencing significant growth driven by the increasing adoption of digital technologies and the need for more efficient business processes. The market is projected to reach $8.4 billion by 2030, growing at a CAGR of 16.2% during the forecast period (2024-2030). This growth is fueled by several factors, including the rising demand for remote work solutions, the increasing focus on improving operational efficiency, and the growing regulatory requirements for electronic signatures.

DocuSign is well-positioned to capitalize on the growth opportunities in this market. The company’s strong brand recognition, extensive product portfolio, and global presence give it a competitive advantage. As the market continues to evolve, DocuSign is expected to play a significant role in shaping the future of electronic signatures and agreement management.

Unique differentiation:

Adobe Acrobat Sign: Adobe’s e-signature solution is part of its broader Acrobat suite of PDF tools. It offers a wide range of features and integrates seamlessly with other Adobe products.

HelloSign: HelloSign is a popular e-signature platform known for its simplicity and ease of use. It provides a basic set of features at competitive prices.

RightSignature: RightSignature is another established player in the market, offering a variety of e-signature and contract management tools. It focuses on providing a secure and compliant platform.

Other notable competitors include PandaDoc, Eversign, and OneSpan Sign. These companies offer varying levels of features and pricing options to cater to different customer needs.

Comprehensive Platform: DocuSign offers a more comprehensive platform than many of its competitors, encompassing not only e-signatures but also contract lifecycle management (CLM) tools. This allows businesses to manage the entire contract process, from creation and negotiation to execution and renewal, within a single platform.

Global Presence: DocuSign operates in a global market, offering its services in multiple languages and complying with various legal and regulatory requirements. This makes it a preferred choice for businesses with international operations.

API Integration: DocuSign provides robust APIs that allow for seamless integration with other business applications, such as CRM systems, HR platforms, and payment gateways. This flexibility enhances its value proposition for businesses seeking to streamline their operations.

Management & Employees:

- Allan Thygesen: Chief Executive Officer, oversees the strategy and direction

- Paula Hansen: President and Chief Revenue Officer, leading sales and partnerships.

- Maggie Wilderotter: Chairman of the Board, providing strategic guidance.

Financials:

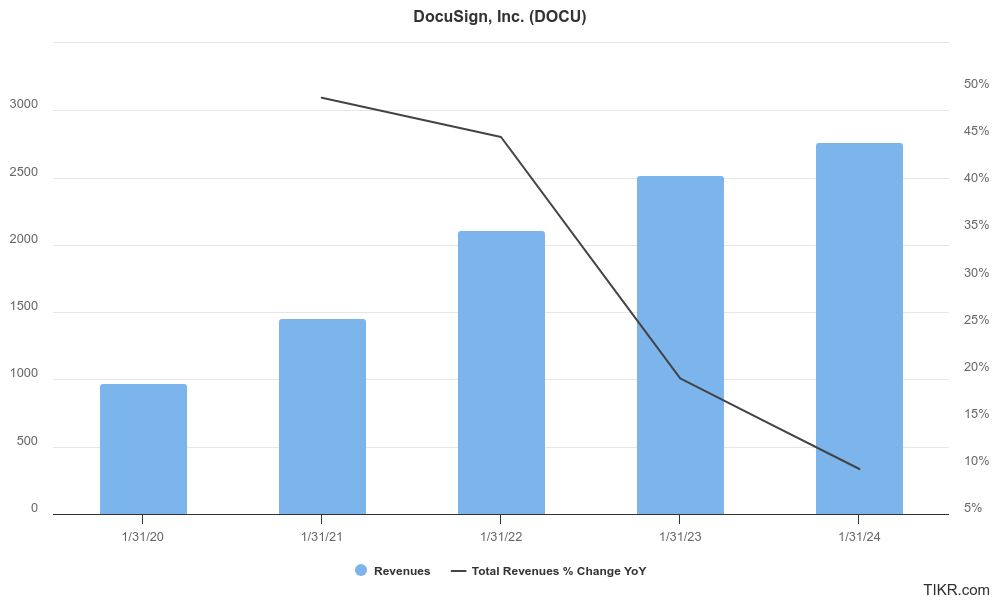

DocuSign Inc. has driven by increased adoption of its electronic signature and agreement lifecycle management solutions. Revenue has grown steadily, with a compound annual growth rate (CAGR). This growth has been fueled by factors such as the shift towards remote work, the increasing demand for digital transformation, and the company’s successful product expansion.

The company has experienced both periods of profitability and losses. This variability can be attributed to factors such as investments in research and development, sales and marketing efforts, and the timing of certain expenses.

DocuSign has maintained a healthy financial position. The company has consistently generated positive cash flow from operations, allowing it to invest in growth initiatives and reduce debt.

Technical Analysis:

A stage 1 base building in the monthly and weekly charts indicates a neutral position. On the daily chart, the stock is in a stage 2 markup (Bullish), but not as strong on other indicators which shows a move to $61 with a lot of resistance in that zone and then a fall back to retest $57 zone.

Bull Case:

Strong Market Growth: The electronic signature and agreement management market is experiencing significant growth, driven by the increasing adoption of digital technologies and the need for more efficient business processes. DocuSign is well-positioned to benefit from this market expansion.

Strategic Partnerships: DocuSign has formed strategic partnerships with other technology companies to expand its reach and integrate its solutions with other business applications. These partnerships can drive additional growth opportunities.

Bear Case:

Intensifying Competition: The electronic signature and agreement management market is becoming increasingly competitive, with new players and innovative solutions emerging regularly. This could lead to increased price pressure and reduced market share for DocuSign.

Security Risks: Data breaches and security vulnerabilities pose a risk to DocuSign’s business. Any significant security incident could damage the company’s reputation and lead to financial losses.

Product Dependence: DocuSign’s success is heavily reliant on its e-signature platform. If the company fails to introduce new products or services or if its existing products become less competitive, it could face challenges in maintaining its growth trajectory.