Executive Summary:

UiPath Inc. is a global software company that specializes in robotic process automation (RPA). The company’s technology enables businesses to automate repetitive tasks, freeing up human employees to focus on more strategic and creative work. UiPath’s platform combines artificial intelligence and automation to deliver efficient and scalable solutions.

Stock Overview:

| Ticker | $PATH | Price | $12.96 | Market Cap | $7.42B |

| 52 Week High | $27.87 | 52 Week Low | $10.37 | Shares outstanding | 490.32M |

Company background:

UiPath Inc. is a global software company that specializes in robotic process automation (RPA), a technology that enables businesses to automate repetitive tasks. Founded in 2005 in Bucharest, Romania, by Daniel Dines and Marius Tîrcă, UiPath has grown rapidly to become a leading player in the automation industry. The company’s headquarters are now in New York City.

It has secured funding through various rounds, including a $225 million Series D funding in 2018 from investors like Accel, CapitalG, and Sequoia Capital. This investment fueled the company’s growth and expansion.

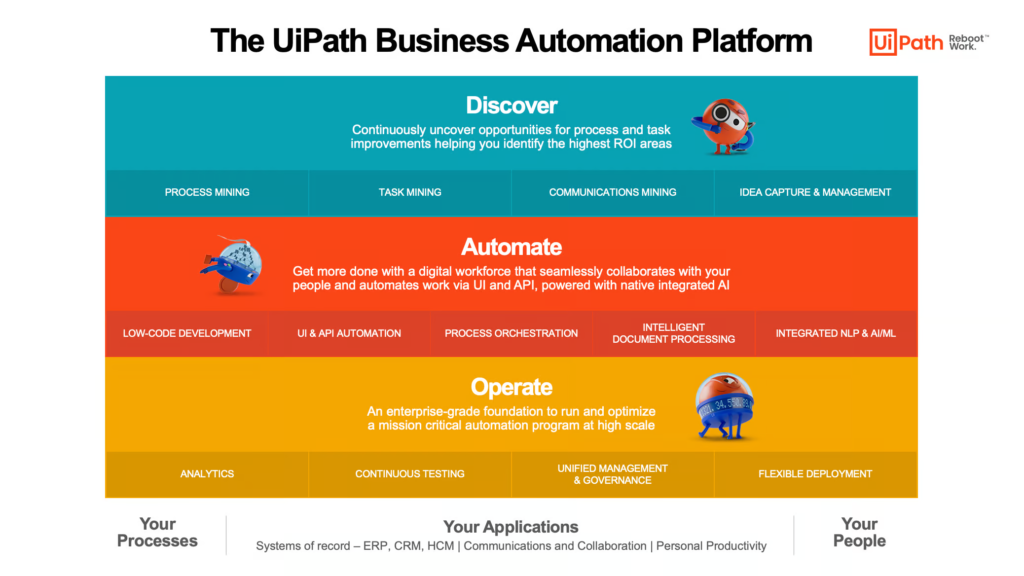

UiPath’s primary product is the UiPath Platform, a comprehensive suite of tools for building, managing, and scaling automation projects. The platform includes features like process discovery, recording, and automation development, as well as AI-powered capabilities for intelligent automation. UiPath also offers pre-built automation solutions for specific industries and processes.

Key competitors of UiPath in the RPA market include Automation Anywhere, Blue Prism, and WorkFusion. These companies offer similar products and services, though they may have different strengths and focuses.

UiPath’s success is driven by its innovative technology, strong customer focus, and strategic partnerships. The company has a large customer base, including organizations of all sizes across various industries. With its continued growth and commitment to automation, UiPath is well-positioned to shape the future of work.

Recent Earnings:

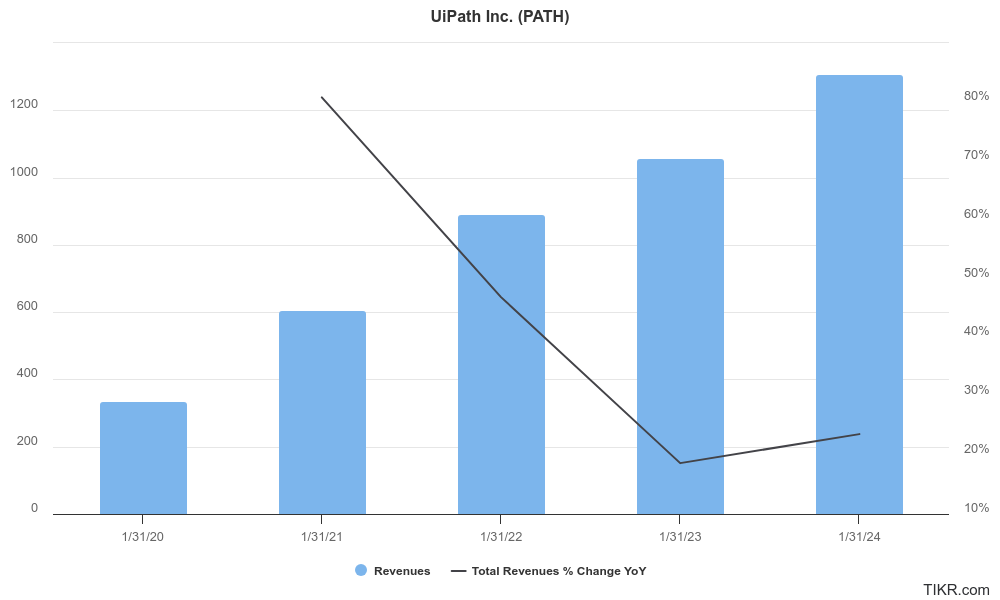

UiPath Inc. reported revenue for the quarter came in at $405 million, representing a 31% increase year-over-year. This growth was driven by strong demand for UiPath’s automation platform across various industries.

Earnings per share (EPS) for the quarter were -$0.09, compared to -$0.07 in the same period last year. UiPath’s non-GAAP operating income was $111 million, up from $50 million in the prior-year quarter.

UiPath’s management expressed optimism about the company’s future, citing continued strong demand for automation solutions and the successful execution of its growth strategy. Its annual recurring revenue (ARR) reached $1.464 billion, up 22% year-over-year. The company’s dollar-based net retention rate was 119%, demonstrating high customer satisfaction and renewal rates.

The company expects revenue in the range of $1.405 billion to $1.410 billion, representing a growth rate of 19% to 20%. UiPath also forecasts non-GAAP operating income of approximately $145 million for the year.

The Market, Industry, and Competitors:

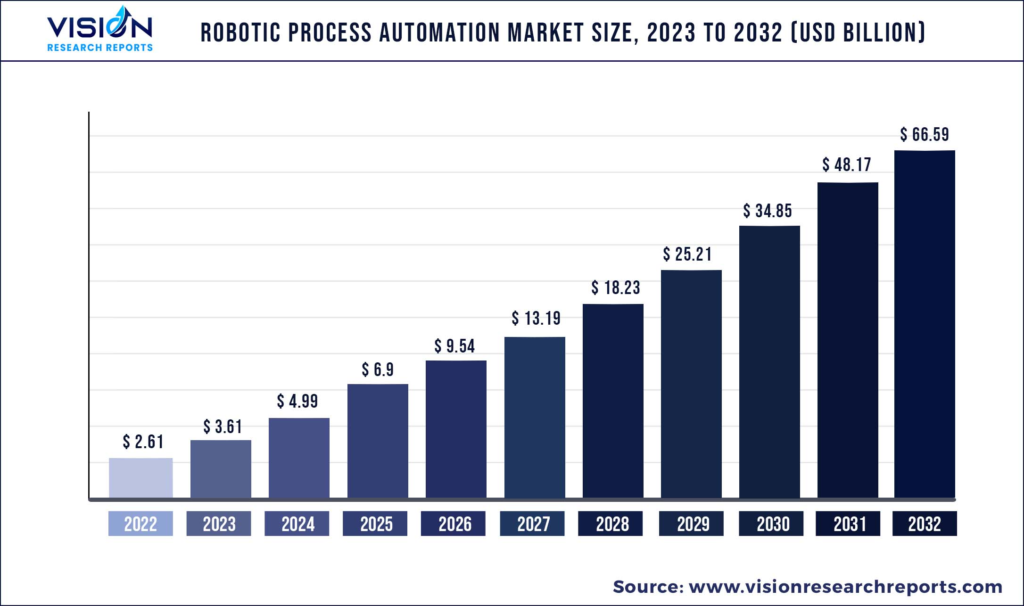

UiPath RPA technology enables businesses to automate repetitive and rule-based tasks, improving efficiency, reducing costs, and enhancing accuracy. The market is driven by factors such as the increasing adoption of digital technologies, the need for process optimization, and the growing shortage of skilled labor.

The global RPA market size is projected to reach $35.8 billion by 2030, growing at a compound annual growth rate (CAGR) of 23.7% from 2023 to 2030. This growth is fueled by the increasing adoption of RPA across various industries, including finance, healthcare, manufacturing, and retail.

The company has a strong product portfolio, a large customer base, and a focus on innovation. UiPath’s platform offers a comprehensive set of tools for building, managing, and scaling automation projects, making it attractive to businesses of all sizes. As the RPA market continues to expand.

Unique differentiation:

- Automation Anywhere: Automation Anywhere is a global leader in RPA, offering a comprehensive platform for automating business processes. The company has a strong presence in the market and competes with UiPath across various industries.

- Blue Prism: Blue Prism is another major player in the RPA space, providing a platform for automating tasks and workflows. The company focuses on delivering scalable and secure automation solutions.

- WorkFusion: WorkFusion offers an integrated platform for intelligent automation, combining RPA with artificial intelligence and machine learning capabilities. The company competes with UiPath in the market for advanced automation solutions.

- Pegasystems: Pegasystems is a software company that specializes in business process management and customer engagement. The company also offers RPA capabilities as part of its platform, competing with UiPath in certain market segments.

- NICE: NICE is a technology company that provides software solutions for customer experience, workforce optimization, and compliance. The company’s RPA offerings compete with UiPath in the market for process automation solutions.

Pre-built automations: UiPath offers a library of pre-built automations for common tasks, which can be customized and deployed with minimal effort. This accelerates the automation process and reduces the need for extensive development.

A strong ecosystem: UiPath has built a robust ecosystem of partners, including consulting firms, technology providers, and training organizations. This ecosystem provides businesses with additional resources and support for their automation initiatives.

A commitment to innovation: UiPath is constantly investing in research and development to stay ahead of the competition. The company has introduced innovative features such as AI-powered automation and process mining, which provide additional value to its customers.

Management & Employees:

Chief Executive Officer (CEO): The CEO is the highest-ranking executive and is responsible for the overall direction and strategy of the company.

Chief Technology Officer (CTO): The CTO is responsible for the company’s technology strategy and development.

Chief Operating Officer (COO): The COO is responsible for the day-to-day operations of the company, including production, logistics, and customer service.

Financials:

UiPath revenue has consistently increased, with a strong compound annual growth rate (CAGR) over the past few years. This growth has been fueled by factors such as the expansion of its customer base, the adoption of its platform in various industries, and the company’s strategic acquisitions.

While UiPath has experienced substantial revenue growth, it has also faced challenges in achieving profitability. The company has reported losses in recent years, primarily due to investments in research and development, sales and marketing, and expansion initiatives. UiPath has made progress in improving its financial performance, with a focus on cost management and operational efficiency.

Technical Analysis:

In a long term consolidation stage 1 (neural) on the monthly and weekly charts, but in a stage 2 markup (Bullish) on the daily chart. The stock has a lot of resistance at the $13.24 range, which it might cross given that earnings are in a few days (Sep 5th), but at this point, it is best to watch the stock and not take a position yet.

Bull Case:

Strategic Acquisitions: UiPath has made strategic acquisitions to enhance its capabilities and expand its market reach. These acquisitions have helped the company strengthen its product offerings and enter new markets.

Scalability: UiPath’s platform is highly scalable, allowing it to handle large-scale automation projects and support the growth of its customers. This scalability is a key advantage in a market where businesses are increasingly seeking automation solutions to improve their efficiency and competitiveness.

Bear Case:

Market Saturation: As the RPA market matures, there may be a risk of market saturation, which could lead to increased price competition and slower growth rates. The ability of UiPath to differentiate its offerings and maintain its market share in a competitive environment will be crucial.

Economic Uncertainty: Economic downturns can impact businesses’ spending on technology, including RPA solutions. If the global economy experiences a significant slowdown, UiPath’s growth could be affected.