Executive Summary:

Affirm Holdings Inc. is a financial technology company that provides buy now, pay later (BNPL) services. Affirm offers consumers flexible payment options for online and in-store purchases. The company’s technology assesses creditworthiness without relying on traditional credit scores, making it accessible to a wider range of customers.

Stock Overview:

| Ticker | $AFRM | Price | $31.46 | Market Cap | $9.72B |

| 52 Week High | $52.48 | 52 Week Low | $15.97 | Shares outstanding | 263.84M |

Company background:

Affirm Holdings Inc., a leading financial technology company, was founded in 2012 by Max Levchin, a co-founder of PayPal. The company’s mission is to revolutionize the way people pay by offering flexible and transparent payment options. Affirm’s initial funding came from venture capital firms like Founders Fund, Andreessen Horowitz, and Khosla Ventures. The company has raised significant capital through multiple funding rounds, including a successful IPO in 2021.

Affirm’s primary product is a buy now, pay later (BNPL) service that allows consumers to split their purchases into interest-free monthly installments. The company’s proprietary technology assesses creditworthiness without relying on traditional credit scores, making it accessible to a wider range of customers. Affirm partners with major retailers to offer its BNPL service at checkout, providing a seamless and convenient experience for consumers.

Affirm’s key competitors in the BNPL market include Klarna, Afterpay, and PayPal’s own BNPL service. These companies offer similar products and compete for market share. Affirm differentiates itself through its focus on transparency, responsible lending practices, and a commitment to building long-term relationships with its customers.

Affirm Holdings Inc. is headquartered in San Francisco, California, and has a growing global presence. The company’s success can be attributed to its innovative approach to payments, strong partnerships with retailers, and a dedicated team focused on providing exceptional customer service.

Recent Earnings:

Affirm Holdings Inc. reported revenue for the quarter reached $576.2 million, representing a substantial year-over-year increase of 33%. This growth was driven by a rise in active consumers and increased transaction volume.

Affirm’s earnings per share (EPS) came in at -$0.43 for Q3 2024. The company continues to invest in growth initiatives and faces ongoing challenges related to the economic environment.

The company exceeded revenue estimates, its EPS fell short of forecasts. This discrepancy can be attributed to factors such as higher credit losses and increased operating expenses.

Affirm’s active consumer base grew to 17.3 million, and gross merchandise volume (GMV) reached $24 billion. These metrics demonstrate Affirm’s ability to attract and retain customers while expanding its market reach.

The Market, Industry, and Competitors:

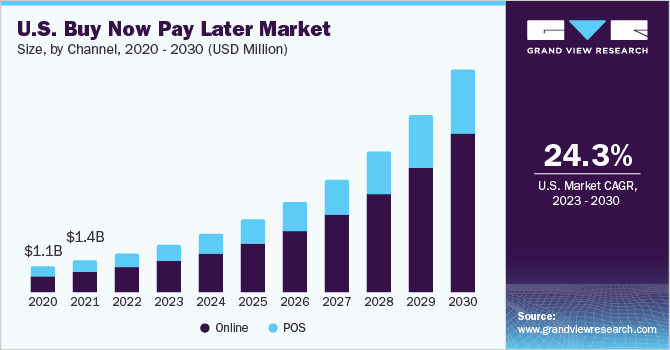

Affirm Holdings Inc. operates in the rapidly growing buy now, pay later (BNPL) market. BNPL services offer consumers flexible payment options for online and in-store purchases, allowing them to spread the cost of their purchases over time. The BNPL market has experienced significant growth in recent years, driven by factors such as the rise of e-commerce, increased consumer demand for convenience, and the availability of innovative technological solutions.

Affirm is well-positioned to capitalize on the growth opportunities in the BNPL market. The company’s strong brand recognition, partnerships with major retailers, and focus on responsible lending practices give it a competitive advantage.

Affirm is expected to continue its growth trajectory. The BNPL market will experience expansion in increasing consumer adoption, technological advancements, and favorable regulatory developments. Affirm is well-positioned to benefit from this growth, with analysts projecting a compound annual growth rate (CAGR) of around 30% for the company’s revenue.

Unique differentiation:

Klarna: A Swedish fintech company that offers a range of BNPL and payment services. Klarna has a strong presence in Europe and is expanding its operations globally.

Afterpay: An Australian BNPL provider that has gained significant traction in the United States and other markets. Afterpay focuses on younger consumers and offers interest-free installment plans.

PayPal: A leading online payments platform that has recently entered the BNPL market with its own installment financing options. PayPal’s extensive user base and established brand give it a competitive advantage.

Zip: An Australian BNPL company that offers flexible payment options for both online and in-store purchases. Zip has a growing presence in the United States and other markets.

Transparency and Responsible Lending: Affirm is committed to providing transparent payment terms and responsible lending practices. The company avoids hidden fees and provides clear information about interest rates and repayment schedules. This approach builds trust with customers and helps them make informed financial decisions.

Creditworthiness Assessment: Affirm’s proprietary technology assesses creditworthiness without relying solely on traditional credit scores. This enables the company to offer BNPL services to a wider range of customers, including those with limited or no credit history.

Focus on Long-Term Relationships: Affirm aims to build long-term relationships with its customers rather than focusing solely on short-term transactions. This approach involves providing excellent customer service and personalized support.

Management & Employees:

Max Levchin: Co-founder and Chief Executive Officer, Max Levchin is a prominent figure in the fintech industry, known for his co-founding of PayPal. He brings his expertise in payments and technology to Affirm.

Sarah Cohen: Chief Marketing Officer, Sarah Cohen leads Affirm’s marketing efforts, including brand building and customer acquisition. She has experience in digital marketing and consumer behavior.

Brian O’Connor: Chief Technology Officer, Brian O’Connor oversees Affirm’s technology infrastructure and development. He has extensive experience in software engineering and technology leadership.

Financials:

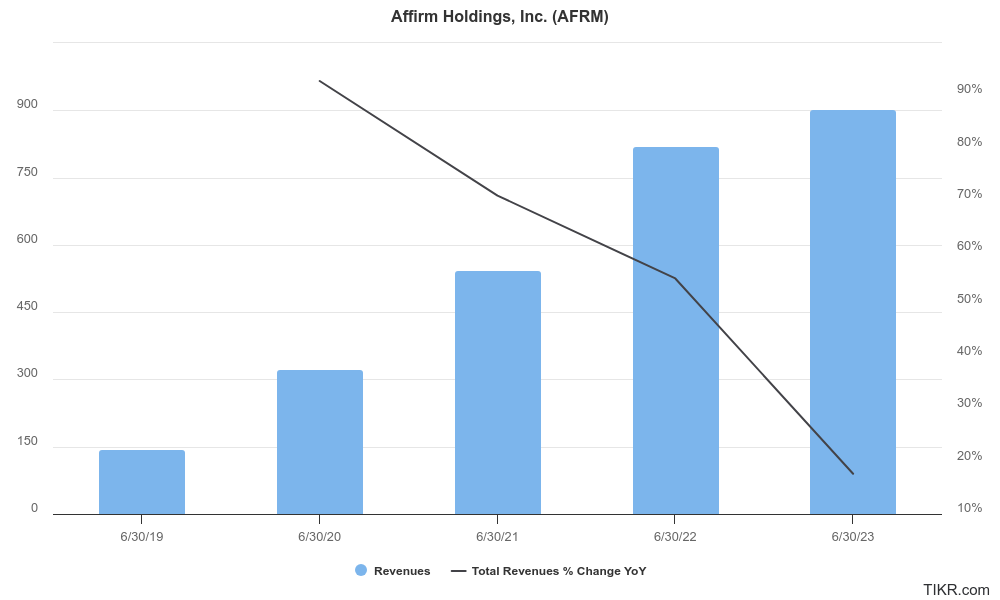

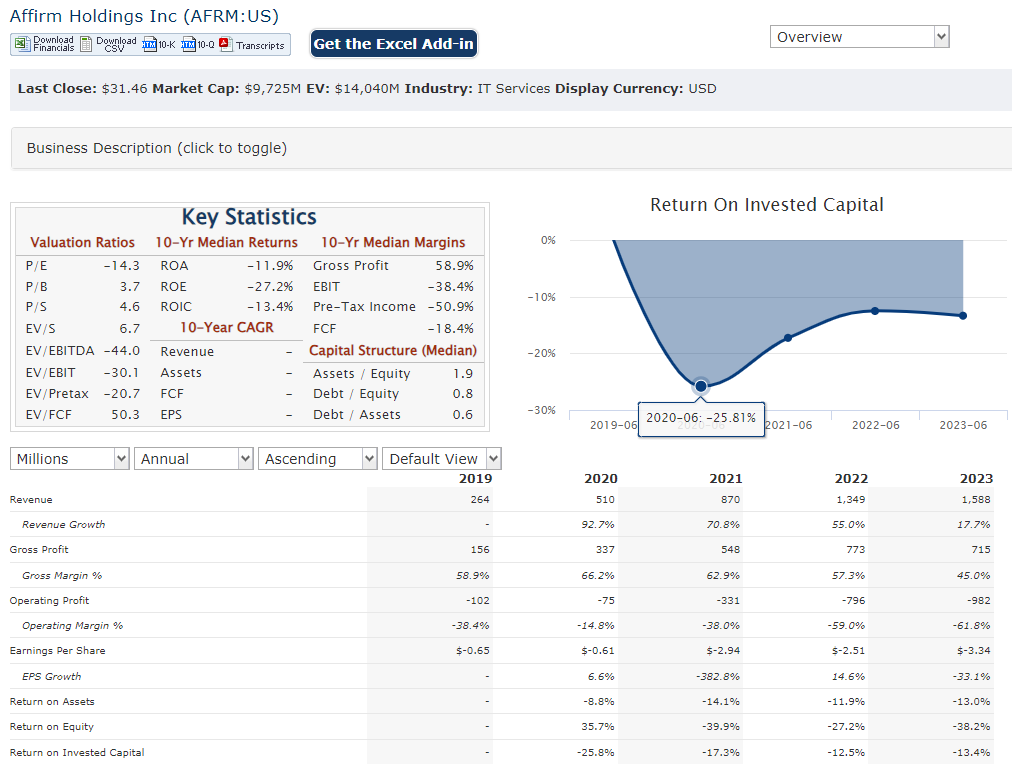

Affirm Holdings Inc. has consistent revenue growth and expanding market share in the buy now, pay later (BNPL) industry. Affirm has achieved a healthy compound annual growth rate (CAGR) for its revenue during this period.

Affirm has achieved impressive revenue growth, its earnings have been impacted by factors such as investments in growth initiatives, credit losses, and operating expenses. The company’s earnings growth has been more volatile compared to its revenue growth. Affirm has made strides in improving its profitability through cost-saving measures and strategic investments.

The company has maintained adequate levels of cash and cash equivalents to support its operations and growth initiatives. Affirm has managed its debt levels prudently, ensuring a healthy debt-to-equity ratio.

Technical Analysis:

The stock is on a stage 4 decline on the monthly chart, but a reversal Stage 2 on the weekly chart and on a stage 2 markup on the daily chart as well. This stock should get to $34 range in the short term, at which point there is a lot of resistance.

Bull Case:

Expanding Product Offerings and Partnerships: Affirm has been actively expanding its product offerings and partnerships to reach a wider range of customers and generate additional revenue streams. This diversification can enhance the company’s resilience and growth potential.

Favorable Regulatory Environment: The regulatory environment for BNPL services has been generally supportive, with many jurisdictions adopting frameworks that promote responsible lending and consumer protection. A favorable regulatory environment can provide a positive backdrop for Affirm’s growth.

Bear Case:

Regulatory Risks: The BNPL industry is subject to increasing regulatory scrutiny, with regulators in various jurisdictions expressing concerns about potential risks to consumers. Changes in regulations could negatively impact Affirm’s operations and profitability.

Credit Risk: Affirm’s business model involves extending credit to consumers, which exposes the company to credit risk. Economic downturns or changes in consumer behavior could lead to higher credit losses, impacting Affirm’s profitability.

Economic Uncertainty: The global economy is facing uncertainty due to factors such as geopolitical tensions, inflation, and interest rate hikes. Economic downturns could negatively impact consumer spending and reduce demand for BNPL services.