Executive Summary:

Paycom Software Inc. is a leading provider of cloud-based human capital management (HCM) software, specializing in payroll, HR, benefits, and talent management solutions. The company offers a single database system that integrates all HR functions into one platform, eliminating the need for multiple software applications. With a focus on employee self-service and data accuracy, Paycom aims to streamline HR processes, reduce administrative burdens, and empower businesses to make data-driven decisions.

Paycom Software Inc. reported earnings per share (EPS) of $1.62, surpassing analyst expectations by $0.02. Total revenue reached $437.5 million, marking a 9.1% increase.

Stock Overview:

| Ticker | $PAYC | Price | $155.17 | Market Cap | $8.91B |

| 52 Week High | $299.00 | 52 Week Low | $139.50 | Shares outstanding | 57.43M |

Company background:

Paycom Software Inc. is a prominent player in the human capital management (HCM) software industry, offering cloud-based solutions for payroll, HR, benefits, and talent management. Founded in 1998, the company has grown significantly to become a leading provider of HCM solutions. Paycom’s core product is a single database system that integrates all HR functions into one platform, eliminating the need for multiple software applications. This unified approach streamlines HR processes, improves data accuracy, and empowers businesses to make informed decisions.

Paycom’s growth has been fueled by its focus on employee self-service and a user-friendly interface. The company has achieved substantial growth organically, without relying on external funding. Paycom’s key competitors in the HCM market include ADP, Paychex, and Workday. While these competitors offer similar services, Paycom distinguishes itself by its single database architecture and emphasis on employee self-service.

Headquartered in Oklahoma City, Oklahoma, Paycom has established a strong presence in the United States and continues to expand its reach across the country. The company’s success is attributed to its innovative technology, commitment to customer satisfaction, and ability to adapt to the evolving needs of businesses.

Recent Earnings:

Paycom Software Inc. reported revenue for the quarter reached $437.5 million, signifying a solid 9.1% year-over-year increase. Paycom’s consistent ability to expand its customer base and drive top-line growth.

Paycom impressed with earnings per share (EPS) of $1.62, surpassing analyst estimates by a narrow margin. This outperformance highlights the company’s efficient operations and cost management.

Operational metrics for Paycom remained strong, with key indicators such as customer retention and new client acquisition demonstrating resilience. The company’s focus on employee self-service and its unified HR platform continued to resonate with businesses seeking to streamline operations and enhance HR efficiency. The company expressed confidence in its ability to sustain growth momentum driven by its strong product suite and expanding market opportunity.

The Market, Industry, and Competitors:

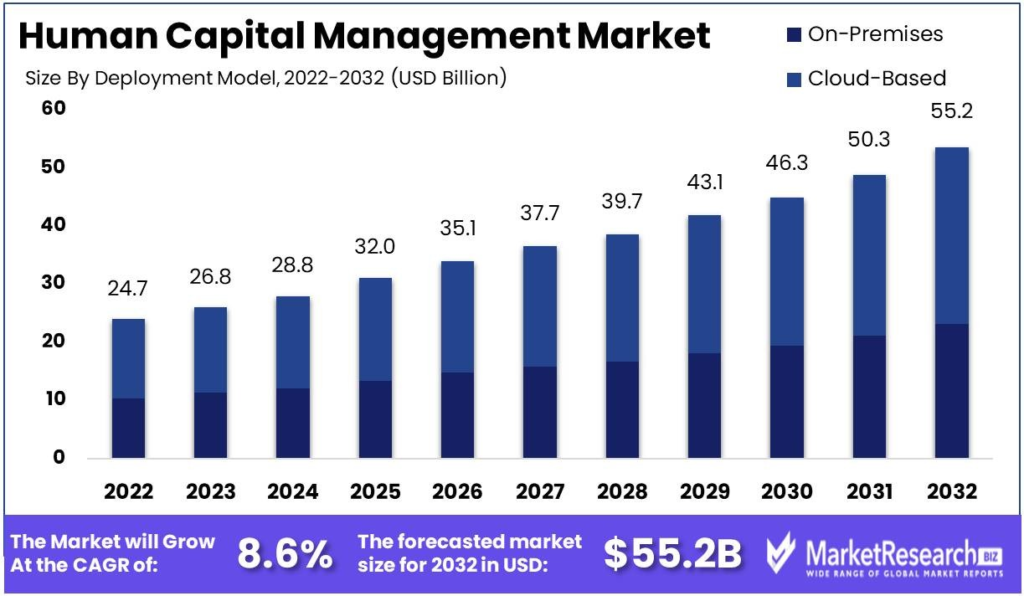

Paycom Software Inc. operates in the highly competitive Human Capital Management (HCM) software market. This industry encompasses a broad range of solutions, including payroll, HR, benefits, and talent management. The HCM market has witnessed significant growth in recent years, driven by factors such as increasing regulatory compliance, the need for efficient HR processes, and the growing adoption of cloud-based solutions. Key players in this space, including Paycom, are continually innovating to offer comprehensive and user-friendly platforms that cater to businesses of all sizes.

Growth expectations for the HCM market, and by extension for Paycom, are robust. The industry is projected to expand at a healthy Compound Annual Growth Rate (CAGR) in the coming years. Several factors are expected to contribute to this growth, including the increasing adoption of cloud-based HCM solutions, the growing focus on employee experience, and the expanding use of data analytics in HR. As a leading player in the HCM market, Paycom is well-positioned to capitalize on these growth opportunities.

Unique differentiation:

Paycom Software Inc. operates in a highly competitive HCM software market. Notable competitors include ADP, Paychex, and Workday, which offer comprehensive HCM solutions with a strong market presence. These companies have established themselves as industry leaders and compete aggressively on factors such as product features, pricing, customer service, and market reach.

Emerging players like Gusto, BambooHR, and Paylocity are gaining traction, particularly in specific market segments. These companies often focus on providing specialized HCM solutions or targeting niche markets. The competitive landscape in the HCM industry is dynamic, with companies continuously investing in research and development to enhance their offerings and stay ahead of the curve.

HCM providers that rely on multiple systems to manage different HR functions, Paycom offers a unified platform that integrates all HR data into one central location. This approach eliminates the need for manual data entry, reduces errors, and provides a comprehensive view of the workforce.

Paycom’s emphasis on employee self-service is a key differentiator. By empowering employees to manage their personal information, benefits, and time-off requests through a user-friendly portal, Paycom frees up HR staff to focus on strategic initiatives. This focus on efficiency and employee engagement sets Paycom apart from its competitors.

Management & Employees:

Chad Richison serves as the Chief Executive Officer, President, and Chairman of the Board. He is the founder of Paycom and has been instrumental in its growth and success.

Randy Peck holds the position of Chief Operating Officer. With extensive experience in operations, client service, and product management, Peck contributes significantly to Paycom’s operational efficiency.

Financials:

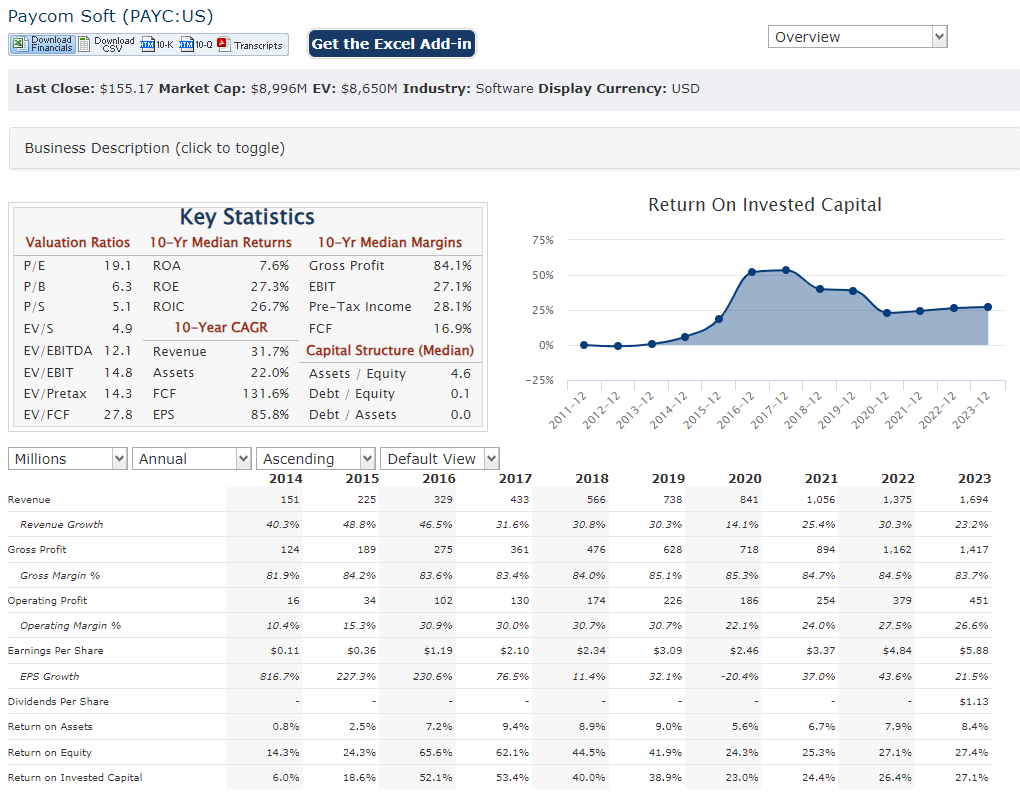

Paycom Software Inc. has characterized by consistent revenue and earnings growth. The company’s revenue has exhibited a strong upward trajectory, driven by increasing demand for cloud-based HCM solutions. This consistent top-line growth has translated into impressive revenue CAGR, showcasing Paycom’s ability to expand its market share and customer base.

The company’s focus on operational efficiency and cost management has contributed to expanding profit margins. Paycom’s earnings CAGR has been notably strong, reflecting the company’s ability to convert revenue into profits effectively. Paycom maintains a sound financial position. The company’s balance sheet typically reflects healthy cash reserves, manageable debt levels, and a robust asset base.

Technical Analysis:

The stock is still consolidating (neutral, stage 1) on the monthly chart and is range bound, between $139 and $180. On the daily chart the bottom and reversal seem possible, but clearing $180s range would be a good first step.

Bull Case:

Large Addressable Market: The HCM software market is vast and continues to expand. As businesses grow and become more complex, the need for robust HR solutions increases, presenting significant growth opportunities for Paycom.

Efficient Operations: Paycom’s focus on operational efficiency has resulted in strong profit margins. This ability to convert revenue into profits is a key driver of shareholder value.

Bear Case:

Execution Risk: Successfully executing on growth strategies, such as expanding into new markets or introducing new products, can be challenging. Failure to execute could hinder revenue growth and profitability.

Cybersecurity Threats: As a software company handling sensitive employee data, Paycom is vulnerable to cyberattacks. A successful data breach could damage the company’s reputation and lead to significant financial losses.