Executive Summary:

Monday.com Ltd., that offers a cloud-based Work OS platform. This platform allows users to build custom applications and project management software to fit their specific needs. Their user-friendly platform empowers teams to manage tasks, workflows, and projects seamlessly, ultimately aiming to improve overall efficiency and transparency within organizations.

Monday.com Ltd. reported revenue of $216.91 million, a 7.08% increase compared to the previous quarter and a 33.69% jump year-over-year. Earnings per share (EPS) also rose significantly, reaching $0.61, which is a 335.71% increase year-over-year.

Stock Overview:

| Ticker | $MNDY | Price | $229.81 | Market Cap | $11.44B |

| 52 Week High | $251.48 | 52 Week Low | $122.13 | Shares outstanding | 49.77M |

Company background:

Monday.com Ltd., often styled as monday.com, is a cloud-based software company headquartered in Tel Aviv, Israel. Founded in 2012 by Roy Mann and Eran Zinman. A user-friendly platform dubbed monday.com Work OS.

This platform offers a low-code/no-code approach, allowing teams to build custom applications and project management software tailored to their specific needs. Launched in 2014, monday.com has seen impressive growth, boasting over 225,000 customers across various industries. In June 2021, the company successfully completed an Initial Public Offering (IPO), solidifying its position as a major player in the work management software space.

monday.com’s user-centric design empowers teams to manage tasks, workflows, and projects seamlessly. This translates to improved efficiency, transparency, and ultimately, increased productivity within organizations. monday.com faces stiff competition from established players like Asana, Trello, and Microsoft Teams, all vying for a piece of the ever-evolving work management software market.

Recent Earnings:

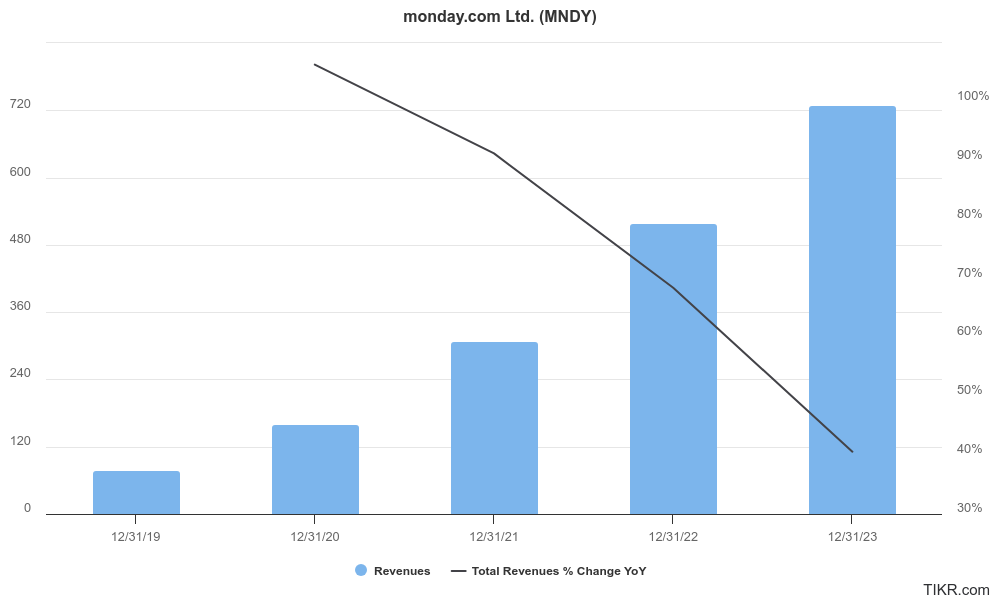

Monday.com Ltd. reported a revenue reached $216.91 million, reflecting a healthy 33.69% year-over-year growth. This increase also marks a 7.08% jump compared to the previous quarter.

Earnings per share (EPS) rising to $0.61. This represents a remarkable 335.71% increase year-over-year, profitability. Monday.com also reported positive operational metrics. Gross margin remained strong at 90%, reflecting the company’s efficiency in converting revenue into profit. The company boasts a high net dollar retention rate of 110%, signifying continued customer spending and loyalty. They project revenue to fall within the range of $942 million to $948 million, representing a solid 29% to 30% year-over-year growth.

The Market, Industry, and Competitors:

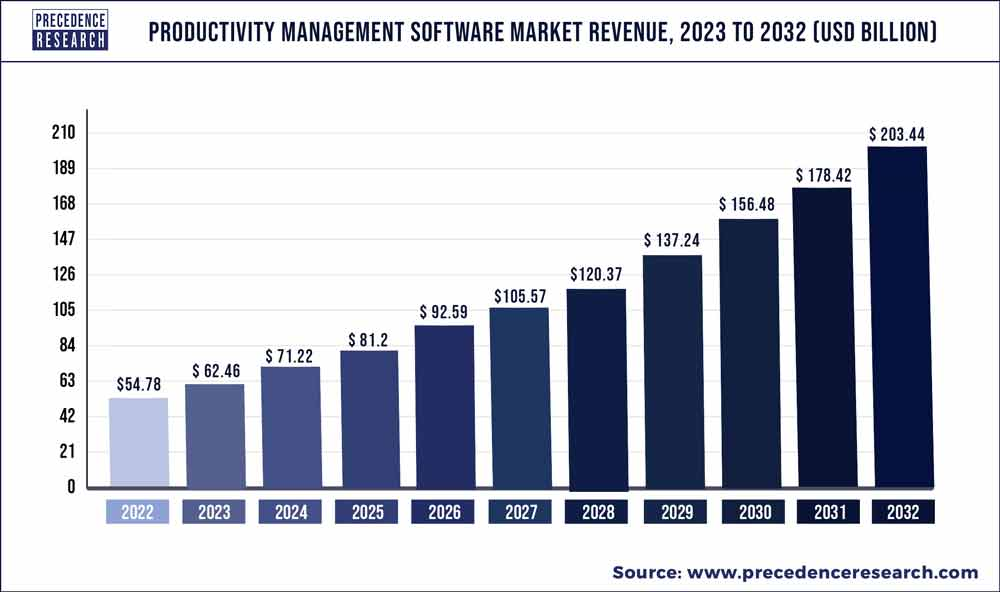

Monday.com Ltd. operates in the booming Work Management Software market. This market caters to the ever-increasing need for organizations to streamline workflows, improve collaboration, and enhance project visibility. Factors like remote work adoption and the rise of complex business processes are fueling significant growth in this sector. The Work Management Software market to reach a staggering $18.8 billion by 2030, reflecting a Compound Annual Growth Rate (CAGR) of 14.2%.

Monday.com is well-positioned to capitalize on this growth. Their user-friendly, low-code platform caters to a broad range of businesses, from small startups to large enterprises. Additionally, their focus on customization and integrations allows them to adapt to diverse industry needs. With a strong brand presence and a loyal customer base, Monday.com is expected to maintain its growth trajectory within this expanding market. While specific CAGR predictions for Monday.com itself are not readily available, the overall market growth of 14.2% provides a strong benchmark for the company’s potential in the coming years.

Unique differentiation:

- Established Giants: Asana and Trello are well-established players offering a strong foothold in the market. Asana provides a structured approach to task management, while Trello utilizes a Kanban board system for visualizing workflows. Both have loyal user bases and offer robust features, making them significant competitors for Monday.com. Microsoft Teams, with its integrated work management capabilities within the familiar Microsoft ecosystem, poses a serious threat, especially for companies heavily reliant on Microsoft products.

- Emerging Challengers: ClickUp is a rising star, offering a comprehensive platform with project management, CRM, and task management functionalities. It competes directly with Monday.com’s all-in-one approach and boasts a strong focus on customization and automation. Wrike, another established player, provides powerful project management tools for large-scale projects and creative teams.

The Competitive Landscape: Monday.com differentiates itself with its user-friendly interface, low-code/no-code approach, and focus on customization. The market is dynamic, with new players constantly emerging. Staying ahead of the curve by anticipating customer needs and offering unique solutions will be crucial for Monday.com’s long-term success.

Low-Code/No-Code Customization: Monday.com offers a low-code/no-code approach, allowing users to customize their workspaces and workflows without needing extensive programming knowledge. This flexibility empowers teams to tailor the platform to their specific needs and processes.

High Degree of Customization: Beyond low-code/no-code functionality, monday.com offers a broad range of customization options. Users can create different views (Kanban boards, tables, timelines, etc.) and utilize various automations to streamline processes. This adaptability caters to diverse workflows across various industries.

Focus on Collaboration: Monday.com emphasizes collaboration with built-in features like team communication tools and real-time updates. This fosters a more transparent and connected work environment, crucial for efficient teamwork.

Integration Capabilities: Monday.com integrates with a wide range of popular business applications, allowing users to streamline data flow between monday.com and their existing tools. This eliminates the need for manual data entry and promotes a unified work ecosystem.

Management & Employees:

Roy Mann (Co-Founder and Co-CEO): Roy co-founded Monday.com and currently serves as Co-CEO. He brings experience in technology vision and operations, having previously led companies like SaveAnAlien.com and ntt.co.il.

Eran Zinman (Co-Founder and Co-CEO): Eran co-founded Monday.com alongside Roy and currently shares the Co-CEO role. His background lies in technology, having served as Monday.com’s Chief Technology Officer before transitioning to Co-CEO. He possesses expertise in software development and innovation.

Shiran Nawi (Chief People and Legal Officer): Shiran oversees all aspects of Human Resources and legal affairs at Monday.com. She joined the company in 2018 and has since risen to the position of Chief People and Legal Officer. Her experience lies in talent management, legal strategy, and ensuring company compliance.

Financials:

Revenue Growth: Monday.com reported revenue of $216.91 million.

Earnings Growth: Monday.com reported EPS of $0.61 for Q1 2024, a substantial increase year-over-year. Monday.com that prioritize reinvesting profits, it does indicate their path towards profitability.

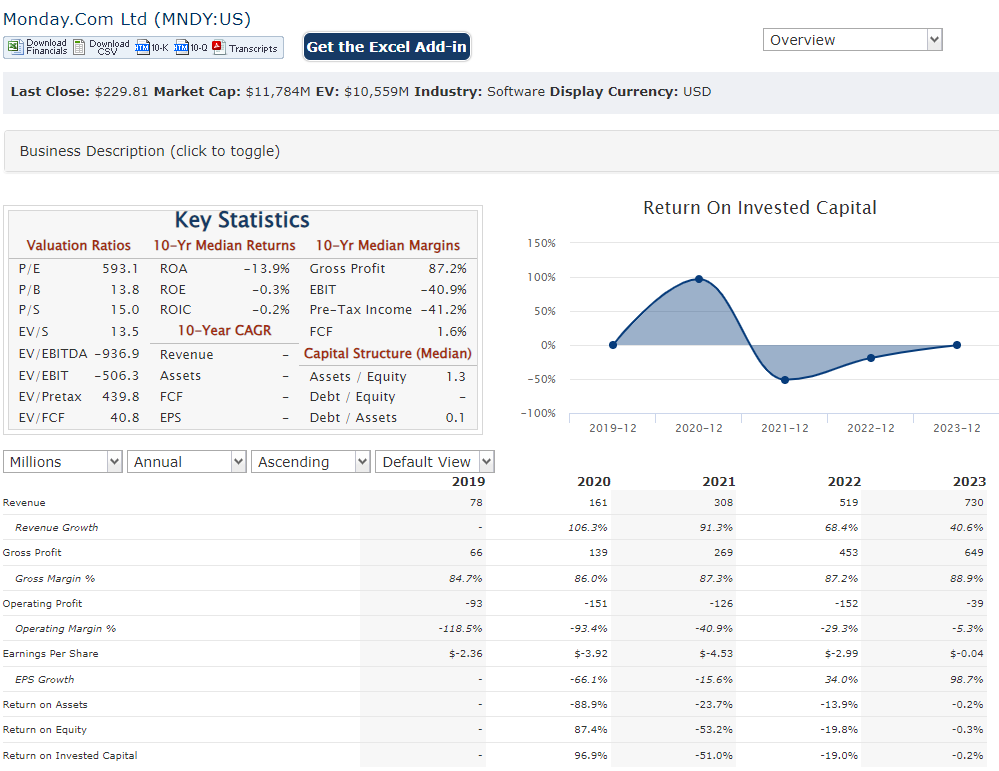

Balance Sheet: Their focus on growth suggests they might have a higher debt-to-equity ratio compared to established companies. Their high net dollar retention rate (110%) suggests a healthy customer base and recurring revenue stream.

Overall Performance: Monday.com Ltd. demonstrates strong growth potential. Their focus on customer acquisition and retention, coupled with a user-friendly platform and innovative features, positions them well in the expanding Work Management Software market.

Technical Analysis:

A strong bullish cup and handle on the monthly chart, and a stage 4 decline on the weekly chart, but a touch back to the 200 day moving average (bearish) on the daily chart, with RSI and MACD lower means this stock should get to the $180 – $190 range which would be a great entry for the medium term. Earnings are on Aug 12th

Bull Case:

Unique Differentiation: Monday.com sets itself apart with a focus on usability, low-code/no-code customization, collaboration features, and seamless integrations. This combination attracts businesses seeking a flexible and adaptable work management solution.

Innovation and Expansion: Monday.com continuously expands its feature set, like their recent focus on monday sales CRM. This dedication to innovation ensures they stay relevant in a dynamic market.

IPO Success and Valuation: Monday.com’s successful IPO in 2021 demonstrates investor confidence in the company’s future. While the stock price might fluctuate, the overall market outlook for the company remains positive.

Bear Case:

High Valuation: Despite strong growth, Monday.com trades at a high price-to-sales (P/S) ratio. This could indicate the stock price is inflated compared to its current revenue. If future revenue growth doesn’t meet expectations, the stock price could experience a correction.

Macroeconomic Risks: A broader economic downturn could impact business spending on software solutions, potentially slowing down Monday.com’s customer acquisition and revenue growth.

Uncertain Future Acquisitions: Monday.com might need to make acquisitions to expand its market reach or feature set. These acquisitions could be expensive and might not deliver the expected returns, impacting the company’s financial health.