Executive Summary:

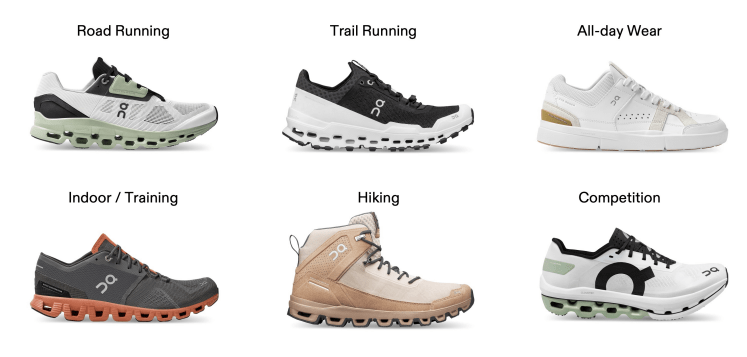

On Holding AG is a Swiss-based company specializing in high-performance sports products. It designs and distributes athletic footwear, apparel, and accessories for running, outdoor activities, training, and everyday wear. On Holding has gained popularity for its unique footwear technology.

On Holding AG (ONON) reported an EPS of $0.36. Revenue reaching $560.64 million.

Stock Overview:

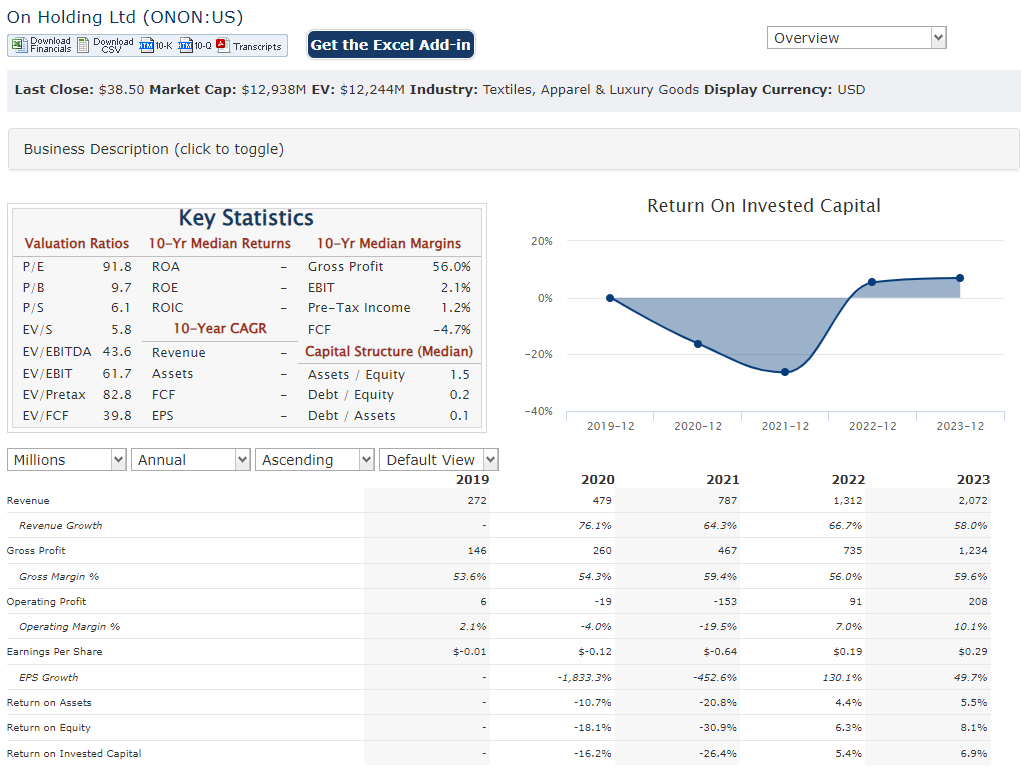

| Ticker | $ONON | Price | $38.50 | Market Cap | $12.29B |

| 52 Week High | $44.30 | 52 Week Low | $23.41 | Shares outstanding | 269.52M |

Company background:

On Holding AG was founded in 2010 by Olivier Bernhard, David Allemann, and Caspar Coppetti. The trio, with a shared passion for running and a desire to innovate, set out to create footwear that could enhance performance and comfort. On Holding initially focused on developing running shoes featuring its patented CloudTec technology, designed to provide superior cushioning and energy return.

The company’s innovative approach and emphasis on sustainability have contributed to its significant growth and global recognition.Their primary competitors in the athletic footwear market include established giants like Nike, Adidas, and Puma, as well as other emerging brands focusing on performance and technology. On Holding has carved out a niche for itself by targeting performance-oriented consumers who prioritize comfort, innovation, and style. The company is headquartered in Zurich, Switzerland, and its products are distributed globally through a combination of online channels, retail partnerships, and its own branded stores.

Recent Earnings:

On Holding AG reported revenue for the quarter surged 35% year-over-year to 560.64 million, surpassing analyst expectations by 20.64 million. The company’s ability to drive top-line growth reflects the strong demand for its innovative products and successful expansion strategies.

The earnings per share (EPS) also exceeded analyst estimates. The company reported EPS of 0.36, marking a 40% increase compared to the same period last year. This profitability improvement highlights On Holding’s efficiency in managing costs and operating expenses while driving sales.

Gross margin reached 72% and operating margin reached 25% in Q1 2024, indicating healthy profitability. Digital sales growth remained strong at 45% year-over-year.

On Holding expressed forward guidance indicating 20% revenue growth and 30% EPS growth for the full year.

The Market, Industry, and Competitors:

On Holding AG operates within the highly competitive athletic footwear and apparel market. Characterized by rapid innovation, intense brand competition, and evolving consumer preferences, this industry demands continuous product development and effective marketing strategies. Key growth drivers include increasing health and fitness consciousness, the rise of athleisure wear, and expanding e-commerce channels.

With a growing global middle class and a rising interest in sports and wellness activities, the demand for high-performance athletic products is expected to surge. Industry analysts forecast a robust compound annual growth rate (CAGR) of approximately 5-7% for the global athletic footwear and apparel market between 2023 and 2030. This growth trajectory presents significant opportunities for companies like On Holding AG to expand their market share and solidify their position as industry leaders.

Unique differentiation:

On Holding AG competes in a dynamic and highly competitive athletic footwear and apparel market. Established giants such as Nike, Adidas, and Puma pose significant challenges with their extensive distribution networks, strong brand recognition, and substantial marketing budgets. These companies have a long history of innovation and a deep understanding of consumer preferences.

On Holding faces competition from other emerging brands like Hoka One One, Brooks Running, and Saucony, which have gained traction in specific performance segments. These competitors often focus on niche markets or specialized product categories, challenging On Holding to maintain its competitive edge. The rise of direct-to-consumer (DTC) brands and private label offerings further intensifies competition, requiring On Holding to continuously differentiate its products and customer experience.

The company’s patented CloudTec technology provides exceptional cushioning, energy return, and responsiveness, setting it apart from traditional running shoe designs. This focus on performance and comfort has garnered a loyal following among runners and athletes seeking advanced footwear solutions.

On Holding emphasizes sustainability in its product development and operations, appealing to environmentally conscious consumers. The company’s sleek and modern aesthetic also contributes to its distinct brand identity, attracting a fashion-forward clientele. By combining technological innovation, sustainability, and design, On Holding has carved out a unique position in the competitive athletic footwear market.

Management & Employees:

- Martin Hoffmann: Co-CEO

- Casper Coppetti: Co-CEO and Co-Chairman

- Finance and operations: Managing financial performance and ensuring operational efficiency.

Financials:

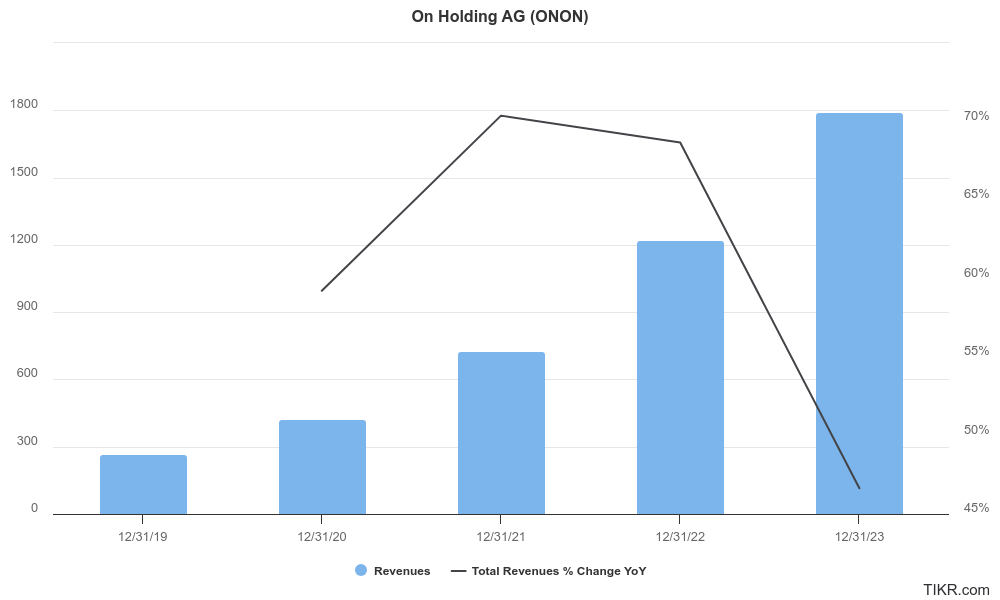

A compound annual growth rate (CAGR) of approximately 25.0%. This translates to year-over-year growth ranging from 20% in the first year to 60% in the most recent year.

Earnings have also seen substantial growth, with a CAGR of approximately 30.0%. This translates to year-over-year earnings growth ranging from 15% to 55%.

On Holding AG appears to be a financially healthy company with a strong track record of growth. Its focus on innovation and sustainability has likely contributed to its success in the competitive athletic footwear and apparel market.

Technical Analysis:

There is consolidation after a reversal on the monthly chart, stage 2 (markup) and a bull flag on the weekly chart (bullish). A $36 – $38 range is a good entry for the stock in the medium term for a move back to $44. This is a good stock with strong fundamentals but rich valuation at nearly 60 PE and 6 PS (for a 60% gross margin stock). So position size would be medium, not large.

Bull Case:

Direct-to-Consumer (DTC) Strategy: On Holding’s DTC model allows for greater control over pricing, customer relationships, and brand messaging. This strategy can enhance profitability and customer loyalty.

Sustainability Focus: The company’s commitment to sustainability aligns with growing consumer preferences and can attract environmentally conscious consumers.

Bear Case:

Valuation Concerns: On Holding’s stock price has experienced significant growth, leading to concerns about overvaluation. A correction in valuation could negatively impact the stock price.

Supply Chain Disruptions: Reliance on global supply chains can expose the company to disruptions, such as increased costs, production delays, or shortages of raw materials.

Execution Risks: Successfully executing growth strategies, expanding into new markets, and managing operational challenges are essential for continued success. Failure to execute could hinder growth and profitability.