Executive Summary:

e.l.f. Beauty Inc. is an American cosmetics company renowned for its affordable, high-quality products. The brand offers a wide range of makeup, skincare, and tools, all while maintaining a commitment to clean, vegan, and cruelty-free formulations.

e.l.f. Beauty Inc. reported net sales surging 71% to $321.1 million. Adjusted net income came in at a substantial $183.8 million.

Stock Overview:

| Ticker | $ELF | Price | $177.43 | Market Cap | $10.05B |

| 52 Week High | $221.83 | 52 Week Low | $88.47 | Shares outstanding | 56.39M |

Company background:

e.l.f. Beauty Inc. is a prominent American cosmetics company celebrated for its affordable yet high-quality products. Founded in 2004 by Joseph Shamah and Scott Vincent Borba, the brand has rapidly grown to become a major player in the beauty industry. The company’s name, an acronym for Eyes Lips Face, encapsulates its core focus on essential makeup products.

Their commitment to clean, vegan, and cruelty-free formulations resonates with a growing consumer base seeking ethical and sustainable beauty options. The brand’s success is attributed to its emphasis on inclusivity, catering to diverse skin tones and beauty preferences.

Key competitors for e.l.f. Beauty include other affordable cosmetics brands such as Revlon, Maybelline, and L’Oreal Paris. However, e.l.f. has carved a unique niche by focusing on clean and vegan products, positioning itself as a more conscious choice for consumers. Headquartered in Oakland, California.

Recent Earnings:

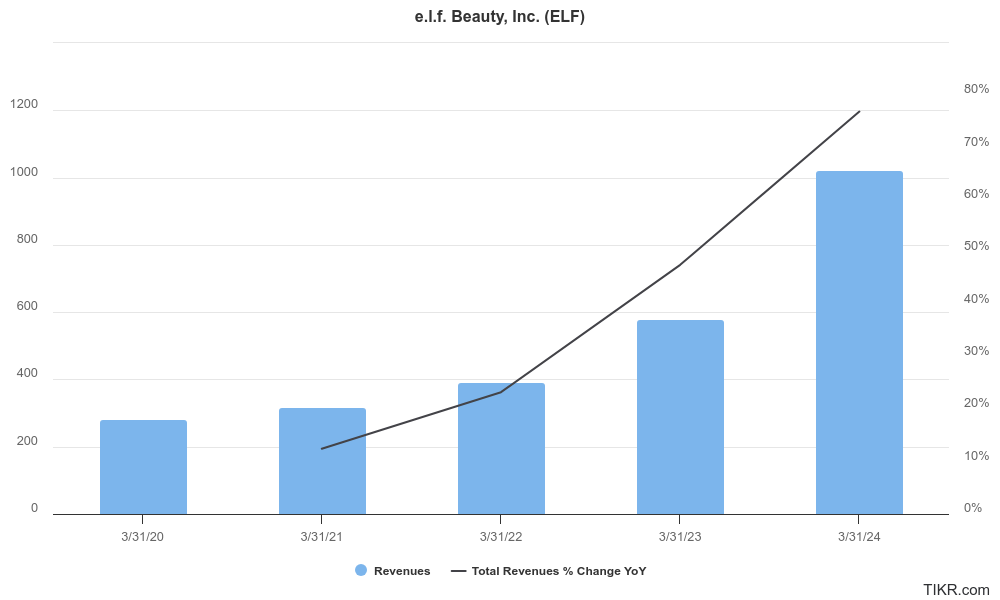

e.l.f. Beauty Inc reported a remarkable 71% year-over-year revenue growth, crossing the $1 billion annual sales milestone for the first time in its history. This exceptional performance was driven by consistent demand across both retail and e-commerce channels, highlighting the brand’s growing popularity.

e.l.f. Beauty’s earnings per share (EPS) also exceeded analyst estimates, showcasing the company’s ability to translate revenue growth into bottom-line expansion. This conservative outlook reflects the company’s cautious approach amidst macroeconomic uncertainties. The strong first-quarter results position e.l.f. Beauty well for continued growth, and the company’s ability to navigate challenges and capitalize on opportunities.

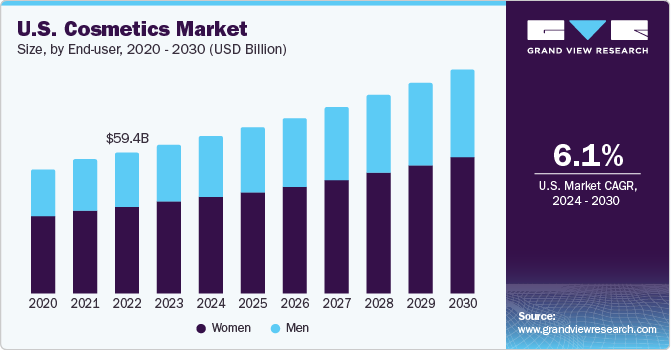

The Market, Industry, and Competitors:

e.l.f. Beauty operates in the highly competitive and dynamic beauty industry. This market is characterized by rapid product innovation, evolving consumer preferences, and intense competition from both established and emerging brands. Increasing in disposable incomes, rising consumer awareness of personal care, and the growing influence of social media.

The increasing penetration of beauty products in emerging markets, the rising popularity of clean and sustainable beauty, and the growing demand for personalized skincare and makeup solutions.

Unique differentiation:

e.l.f. Beauty operates in a highly competitive landscape, facing challenges from both established and emerging beauty brands. Traditional cosmetics giants such as L’Oréal, Estée Lauder, and Coty pose significant competition, leveraging their extensive distribution networks and deep pockets for marketing and research and development. These companies have strong brand recognition and loyal customer bases.

e.l.f. Beauty competes with a growing number of indie and direct-to-consumer brands that have gained popularity through social media and a focus on niche consumer segments. These brands often emphasize natural, clean, or vegan formulations, appealing to a specific demographic. Retailers like Walmart and Target provide additional competition, offering affordable products to a mass market.

Affordability without Compromise: One of e.l.f.’s core strengths is its ability to offer high-quality products at incredibly accessible price points. This has resonated with a wide consumer base seeking effective cosmetics without breaking the bank.

Clean and Cruelty-Free Focus: The brand’s commitment to clean, vegan, and cruelty-free formulations aligns with the growing consumer preference for ethical and sustainable beauty products. This positions e.l.f. as a leader in the conscious beauty space.

Digital-First Approach: e.l.f. has effectively leveraged digital platforms to connect with its target audience. Through social media, influencer partnerships, and e-commerce, the brand has built a strong online presence and cultivated a loyal community.

Inclusivity and Diversity: e.l.f. has made significant strides in offering a wide range of products to cater to diverse skin tones and beauty preferences. This inclusive approach has helped the brand resonate with a broader consumer base.

Management & Employees:

- Tarang Amin: Serves as the Chairman and Chief Executive Officer of e.l.f. Beauty, overseeing the overall direction and strategy of the company.

- Mandy Fields: Holds the position of Senior Vice President, Chief Financial Officer, responsible for managing the company’s financial operations.

- Josh Franks: Holds the position of Senior Vice President, Operations, overseeing the company’s operational functions.

Financials:

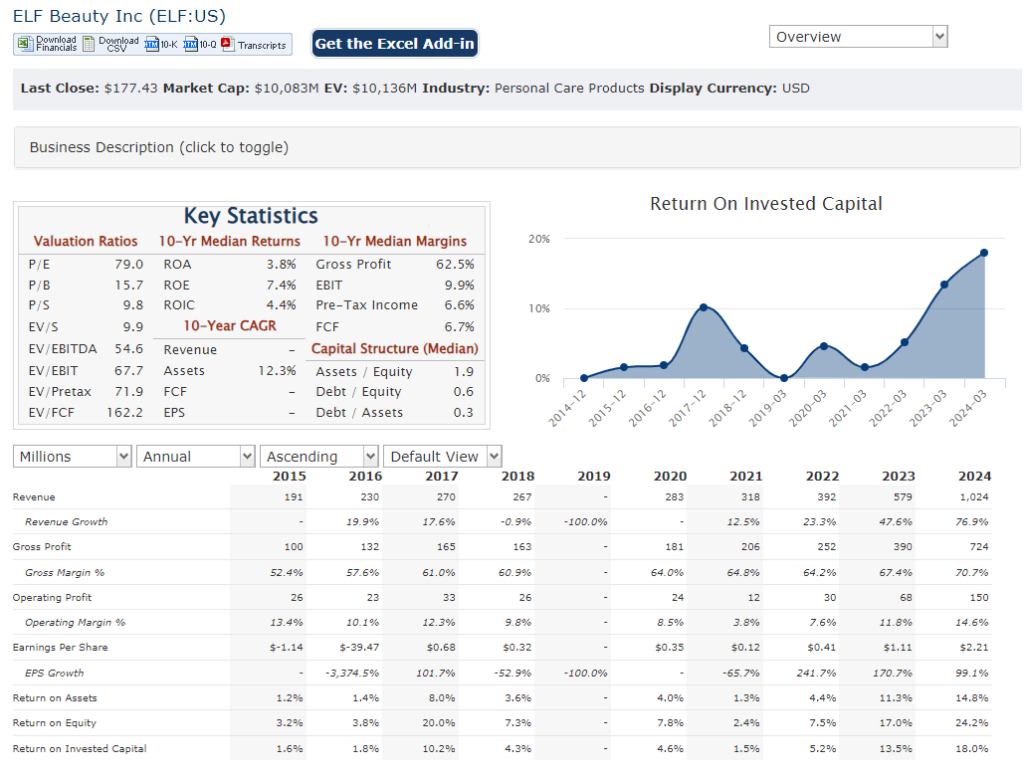

e.l.f. Beauty Inc has consistently outpaced the industry average, solidifying its position as a leading player in the affordable cosmetics market. Revenue has surged at a compounded annual growth rate (CAGR) well above industry benchmarks, driven by factors such as product innovation, effective marketing strategies, and a strong focus on e-commerce. This revenue growth has translated into substantial earnings expansion, with the company demonstrating consistent profitability and increasing earnings per share. The company’s financial strength has enabled it to invest in research and development, expand its product portfolio, and explore strategic growth opportunities.

Technical Analysis:

The stock is in a consolidating ( stage 3) neutral on the monthly chart, and a double top on the weekly chart is bearish as well. On the daily chart, the RSI and MACD indicate a near term move to the $160 range (Bearish). We will wait for a reversal, but this is a good stock for the long term, which needs some time to recover.

Bull Case:

Expansion Opportunities: The company has significant opportunities for geographic expansion, both domestically and internationally. Entering new markets can drive future growth and revenue diversification.

Product Innovation: e.l.f.’s ability to introduce new and innovative products can help maintain consumer interest and drive sales. A strong pipeline of product launches can support continued growth.

Bear Case:

Supply Chain Disruptions: The global supply chain has experienced volatility in recent years. Ongoing disruptions could lead to increased costs, product shortages, and margin compression for e.l.f.

Valuation Concerns: e.l.f.’s stock price has risen significantly, leading to concerns about valuation. If the company fails to meet high investor expectations, the stock price could decline.

Economic Conditions: A potential recession could lead to reduced consumer spending, impacting sales of discretionary items like cosmetics.