Executive Summary:

Paylocity Holding Corporation is a public company headquartered in Illinois, USA that provides cloud-based human capital management (HCM) and payroll software solutions. Currently serving over 36,000 clients, Paylocity offers a variety of HCM products alongside core payroll services.

Paylocity Holding Corporation EPS (earnings per share) to be $0.71, which is slightly lower than the $0.76 reported.

Stock Overview:

| Ticker | $PCTY | Price | $140.89 | Market Cap | $7.95B |

| 52 Week High | $230.52 | 52 Week Low | $129.94 | Shares outstanding | 56.43M |

Company background:

Paylocity Holding Corporation was founded in 1997 by Steve Sarowitz in Schaumburg, Illinois.They primarily focuses on small and mid-sized businesses with headcounts between 10 and 5,000 employees.

Beyond core payroll services, Paylocity offers a comprehensive suite of HCM products designed to streamline human resource operations. These products include talent management, which assists with recruitment and onboarding; benefits administration; time and labor management for tracking employee hours and ensuring accurate pay; and learning and development tools. This suite helps businesses improve employee engagement, simplify HR processes, and make better data-driven decisions.

Paylocity faces competition from other established HCM and payroll providers such as ADP and Paychex. They differentiates itself through its focus on innovation and its user-friendly cloud-based platform designed to improve the overall user experience for both employers and employees.

Recent Earnings:

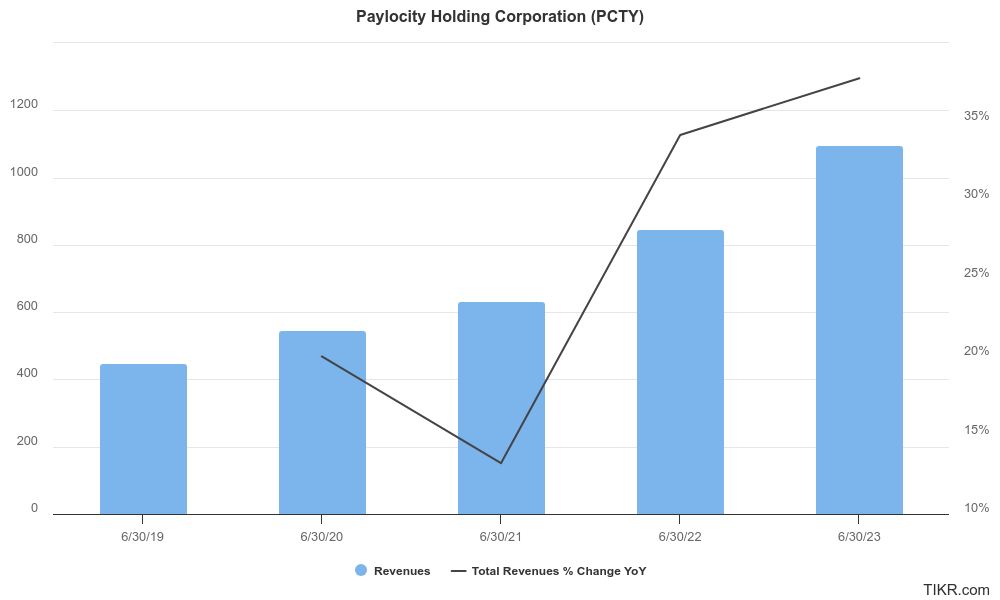

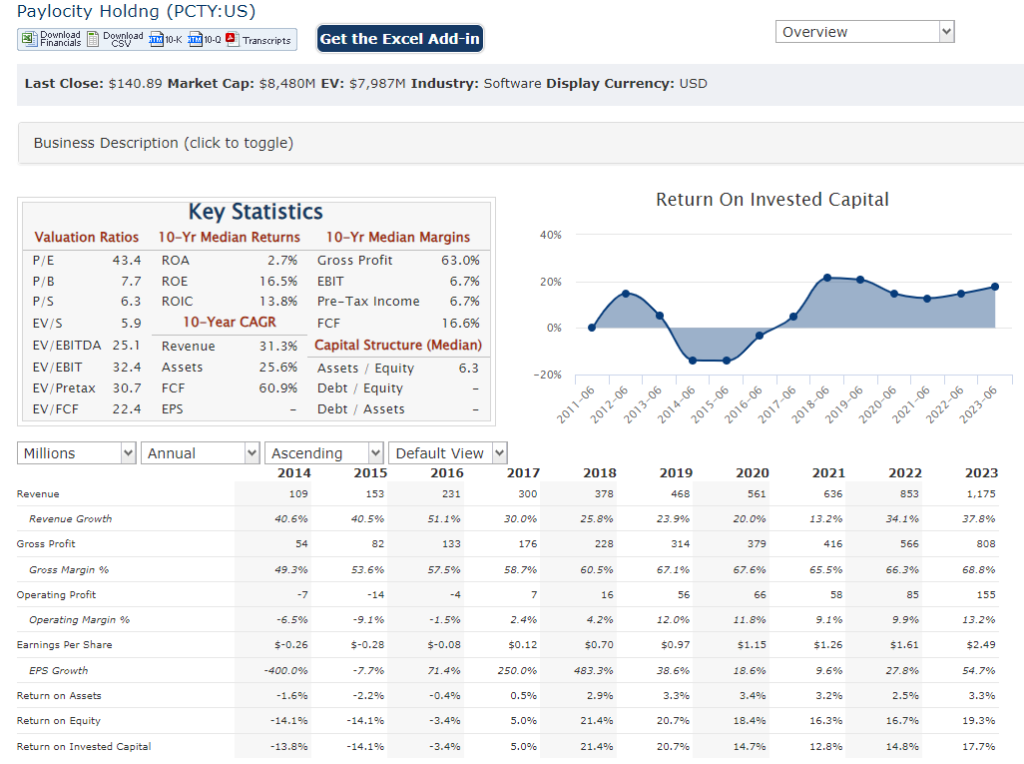

Paylocity reported strong revenue growth of 38% year-over-year to $1.17 billion, exceeding expectations. EPS (earnings per share) also grew significantly at 55% to $2.49, beating analyst estimates.

The Market, Industry, and Competitors:

The Human Capital Management (HCM) software market, where Paylocity Holding Corporation operates:

- Increasing adoption of cloud-based solutions: Businesses are rapidly moving away from on-premise software due to the flexibility, scalability, and cost-effectiveness of cloud-based HCM solutions.

- Growing demand for automation and streamlining HR processes: Businesses are looking for ways to automate repetitive tasks and improve the efficiency of their HR departments. HCM software can automate tasks such as payroll processing, onboarding, and benefits administration.

- Rising regulations around data privacy and security: Stricter data privacy regulations are requiring companies to implement robust security measures to protect employee data. HCM software can help businesses comply with these regulations.

Unique differentiation:

Paylocity Holding Corporation faces competition in the HCM (Human Capital Management) software market each with their own strengths and target markets.

- ADP (Automatic Data Processing): A giant in the payroll and HCM space, ADP offers a comprehensive suite of solutions catering to businesses of all sizes. They are known for their reliability and extensive features, making them a strong choice for larger enterprises with complex needs. However, their user interface can be considered less intuitive compared to Paylocity’s.

- Paychex: Another major competitor, Paychex is particularly strong in the mid-sized market segment that Paylocity also targets. They offer competitive pricing and a solid selection of payroll and HR features. However, Paychex might not be as robust in talent management and learning & development tools compared to Paylocity’s offerings.

By focusing on innovation, user experience, and catering specifically to small and mid-sized businesses, Paylocity strives to carve out its niche in this competitive landscape.

Target Market: While established players like ADP cater to a wider range of companies, Paylocity specifically focuses on small and mid-sized businesses (SMBs). This allows them to tailor their solutions and support to the specific needs and challenges faced by SMB HR departments.

Focus on HCM Products: Beyond core payroll services, Paylocity offers a comprehensive suite of HCM products that go beyond basic functionalities offered by some competitors. This includes talent management, benefits administration, and learning & development tools, allowing SMBs to streamline HR processes and improve employee engagement.

Management & Employees:

- Steve Beauchamp and Toby Williams: Co-Chief Executive Officers, responsible for the overall direction and strategy of the company.

- Andy Cappotelli: Senior Vice President of Operations, managing day-to-day business operations.

- Adam Byerly: Vice President of Strategy & Corporate Development, leading mergers and acquisitions and strategic partnerships.

Financials:

Paylocity Holding Corporation revenue has grown consistently, with a Compound Annual Growth Rate (CAGR) estimated to be in the range of 20-25%. This strong growth is indicative of the increasing demand for cloud-based HCM solutions and Paylocity’s successful execution in the market.

Earnings per share (EPS) have exceeding revenue growth, with a CAGR likely falling between 25-30%. Paylocity is not only expanding its customer base but also improving its operational efficiency and profitability.

Paylocity’s financial health appears strong. The company has likely grown its cash reserves and working capital, demonstrating its ability to generate positive cash flow and fund future investments in product development and growth initiatives.

Technical Analysis:

In a stage 4 decline (bearish) on the monthly and weekly chart. The support seems to be at $126 range, but the daily chart shows short term support in the $132 range. The RSI and MACD are still negative, which means $130 is the near term target.

Bull Case:

Strong SMB Focus: Tailoring solutions and support specifically to the needs of small and mid-sized businesses (SMBs) allows Paylocity to carve out a niche in the competitive landscape. SMBs often have distinct needs compared to large enterprises, and Paylocity caters to that specific market segment.

Potential for Acquisitions: The HCM market is undergoing consolidation. Paylocity’s strong financial position could allow them to strategically acquire smaller players and expand their market share or product portfolio.

Bear Case:

Integration Challenges: Acquisitions, if pursued, might lead to integration challenges that disrupt Paylocity’s operations or hinder product development.

Cloud Dependence: Paylocity’s reliance on cloud-based solutions exposes them to potential disruptions or security vulnerabilities with cloud service providers.

Limited Scalability: While Paylocity excels in the SMB market, their solutions might not scale effectively to meet the needs of very large enterprises. This could limit their overall market potential.