Executive Summary:

Evolv Technologies Holding (EVLV) is a US company specializing in weapons detection technology for security screening. They use AI-powered solutions to make venues like sports stadiums, hospitals, and schools safer for visitors and staff, while aiming for a faster and more pleasant security experience. Evolv boasts partnerships with major institutions like the Houston Toyota Center and Denver’s Ball Arena, and has surpassed screening over a billion visitors so far. With recent record financial results and growing adoption, Evolv is a leader in its field and appears to be a strong player in the security tech market.

Evolv Technologies Holding’s most recent official earnings report was for Q3 2023, released on September 30th, here’s a quick snapshot of their Q3 performance:

- Revenue reached $20.2 million, a 22% increase year-over-year, surpassing analyst expectations.

- The company boasted a net loss of $0.60 per share, slightly larger than the expected $0.59 loss.

- Despite the slight EPS miss, Evolv showcased impressive growth metrics:

- Annual recurring revenue (ARR) soared 129% to $65.8 million.

- Recurring purchase order (RPO) backlog climbed 102% to $221.1 million.

- Evolv Express® subscriptions surged 137% to 4,014.

Overall, while the EPS fell short of expectations, Evolv’s strong revenue growth and key metric improvements paint a picture of a company gaining traction and momentum in the security screening market.

Stock Overview:

| Ticker | $EVLV | Price | $4.51 | Market Cap | $682.37M |

| 52 Week High | $8.30 | 52 Week Low | $2.41 | Shares outstanding | 151.14M |

Company background:

Evolv Technologies Holding: Revolutionizing Security Screening

Evolv Technologies Holding (EVLV) is a leading U.S. company founded in 2013 by Michael Ellenbogen and Anil Chitkara. With a mission to “enable a better experience and exceptional security for venues, creating a safer world to work, learn, and play,” Evolv has emerged as a pioneer in AI-powered weapons detection technology for security screening.

Funding and Growth:

Evolv has attracted significant investment over the years, raising over $180 million through various funding rounds. This influx of capital has fueled the company’s rapid growth, allowing it to expand its product offerings, research and development, and global reach.

Products and Solutions:

Evolv’s core product is the Evolv Express®, an advanced weapons detection system that utilizes artificial intelligence and sensor fusion technology to accurately identify potential threats without slowing down foot traffic. The system is lauded for its speed, accuracy, and ease of use, making it a popular choice for venues such as:

- Sports stadiums and arenas (e.g., Houston Toyota Center, Denver’s Ball Arena)

- Schools and universities

- Hospitals and healthcare facilities

- Government buildings and critical infrastructure

Beyond Evolv Express, the company offers a suite of complementary solutions, including:

- Evolv Access Control: Integrates with Evolv Express® for streamlined venue entry and management.

- Evolv Insights: Provides real-time data and analytics to optimize security operations.

- Evolv Threat Intelligence: Shares emerging threat information to keep security personnel informed.

Competition and Future Outlook:

While Evolv is a leader in the weapons detection market, it faces competition from established players like Garrett Metal Detectors and emerging startups. However, Evolv’s focus on AI-powered solutions, user-friendly design, and growing customer base give it a strong competitive edge.

With its proven technology, impressive growth trajectory, and expanding market reach, Evolv Technologies Holding is well-positioned to revolutionize the security screening industry and create a safer world for all. The company’s headquarters are located in Manchester, New Hampshire, with additional offices in the United States and Europe.

Recent Earnings:

Evolv Technologies Holding: Q3 2023 Earnings Unpacked

While Evolv Technologies Holding’s official next earnings report is slated for February 29th, 2024, let’s dissect their stellar Q3 2023 results, released on September 30th:

Revenue and Growth: The company delivered a solid performance, racking up $20.2 million in revenue, marking a 22% year-over-year increase. This surpassed analyst expectations, solidifying their position as a growing competitor in the security screening market.

EPS and Growth: Evolv reported a net loss of $0.60 per share, slightly higher than the anticipated $0.60 loss. While this might seem like a miss, it’s crucial to consider the context. The slight EPS dip is overshadowed by impressive growth metrics:

- Annual recurring revenue (ARR) soared 129% to $65.8 million, demonstrating strong customer stickiness and recurring revenue potential.

- Recurring purchase order (RPO) backlog climbed 102% to $221.1 million, indicating a healthy pipeline of future business.

- Evolv Express® subscriptions surged 137% to 4,014, highlighting the market’s growing adoption of their flagship product.

Analyst Expectations: While the EPS fell short of expectations, the overall revenue growth and key metric improvements surpassed estimates, painting a picture of a company exceeding initial financial projections. Investors will be eagerly awaiting the February report for further insights into their financial trajectory.

Operational Metrics: Beyond financials, Evolv boasts remarkable operational progress:

- Surpassed 1 billion visitor screenings, showcasing the vast reach and impact of their technology.

- Expanded partnerships with major institutions like the Houston Toyota Center and Ball Arena, solidifying their market presence.

- Continuously enhanced their Evolv Express® technology with improved accuracy and processing speed.

The Market, Industry, and Competitors:

Evolv Technologies Holding operates in the weapons detection technology for security screening market, which encompasses systems using advanced sensors and AI to identify potential threats without impeding foot traffic. This market caters to a wide range of venues, including:

- Sports stadiums and arenas (e.g., Houston Toyota Center, Denver’s Ball Arena)

- Schools and universities

- Hospitals and healthcare facilities

- Government buildings and critical infrastructure

The market is driven by several factors, including:

- Heightened security concerns following mass shootings and other violent events.

- Increased demand for faster and more efficient security screening.

- Technological advancements in AI and sensor technology.

Analysts expect the weapons detection technology market to grow at a CAGR of 15.5% from 2023 to 2030, reaching a projected size of $X billion by 2030. This significant growth potential is fueled by the aforementioned factors, coupled with Evolv’s own contributions to the market:

- Evolv’s Evolv Express® system is known for its speed, accuracy, and ease of use, making it a popular choice for venues seeking to enhance security without sacrificing convenience.

- The company’s commitment to research and development ensures its technology remains at the forefront of the market.

- Evolv’s growing partnerships with major institutions expand its reach and solidify its position as a leading player.

Unique differentiation:

Evolv’s Competitors in the Security Screening Arena

Evolv Technologies Holding isn’t alone in the security screening game. While they’re carving a niche with AI-powered weapons detection, they face a diverse playing field:

Traditional Metal Detectors: Giants like Garrett Metal Detectors and CEIA still hold a significant market share, relying on established technology and lower price points. They’re strong in high-throughput environments like airports, but slower and less efficient for venues prioritizing speed and comfort.

Emerging AI Startups: Several startups are hot on Evolv’s heels, developing their own AI-powered solutions. Companies like Hypergiant and Nokē offer similar benefits in terms of speed and accuracy, but may lack the established partnerships and market footprint of Evolv.

Security Solution Providers: Large players like Securitas and SecurON offer comprehensive security solutions, including Evolv’s technology alongside other services like security personnel and access control. This can be attractive for some venues, but Evolv excels in its focus solely on weapons detection and seamless integration.

Internal Security Teams: For some venues, in-house security teams with basic screening tools like handheld wands may suffice. However, this often lacks the accuracy and efficiency of advanced technology like Evolv’s, especially for venues facing higher security risks.

Ultimately, Evolv’s success hinges on its ability to:

- Maintain its technological edge with continuous R&D and product enhancements.

- Expand its partnerships and secure lucrative contracts with major venues.

- Balance speed and accuracy with competitive pricing and ease of use.

AI-powered technology: Evolv’s core advantage lies in its Evolv Express® system, which utilizes AI and sensor fusion technology to accurately identify potential threats with greater speed and efficiency than traditional metal detectors. This allows for faster and smoother security screening experiences without compromising safety.

User-friendly design: Evolv Express® is known for its sleek, minimalist design that blends seamlessly into the environment. This is in contrast to bulky metal detectors, which can create a disruptive and unpleasant experience for visitors.

Focus on customer experience: Evolv prioritizes a streamlined and positive security screening process for both venue staff and visitors. This includes features like self-service stations, intuitive interfaces, and minimal false alarms.

Data-driven insights: Evolv offers Evolv Insights, a data analytics platform that provides real-time data and insights on security threats and trends. This information can be used to optimize security operations and improve overall safety.

Partnerships and market reach: Evolv has successfully secured partnerships with major institutions like the Houston Toyota Center and Denver’s Ball Arena, solidifying its presence in key markets. This expands their reach and lends credibility to their technology.

Commitment to innovation: Evolv actively invests in research and development, continuously improving its technology and exploring new applications. This keeps them ahead of the curve and ensures their solutions remain at the forefront of the market.

Focus on specific market segment: While traditional metal detectors cater to a wide range of applications, Evolv focuses on specific high-traffic venues like stadiums, schools, and hospitals. This allows them to tailor their solutions to the unique needs of these environments and excel in delivering a superior security experience.

Management & Employees:

Evolv Technologies Holding: A Look at the Leadership Team

Evolv boasts a seasoned and well-rounded leadership team with extensive experience in technology, security, and business development. Here’s a quick overview of the key players:

Peter G. George, CEO and President: Peter brings over 25 years of experience in cybersecurity and technology leadership. Prior to Evolv, he led Fidelis Cybersecurity to significant growth and success. His expertise in building and scaling security companies is invaluable for Evolv’s continued trajectory.

Anil Chitkara, CTO and Co-founder: Anil spearheads Evolv’s technological vision and development. His expertise in AI, sensor fusion, and robotics is crucial for refining their cutting-edge weapons detection systems.

Financials:

Evolv Technologies Holding: A Financial Journey (2018-2023)

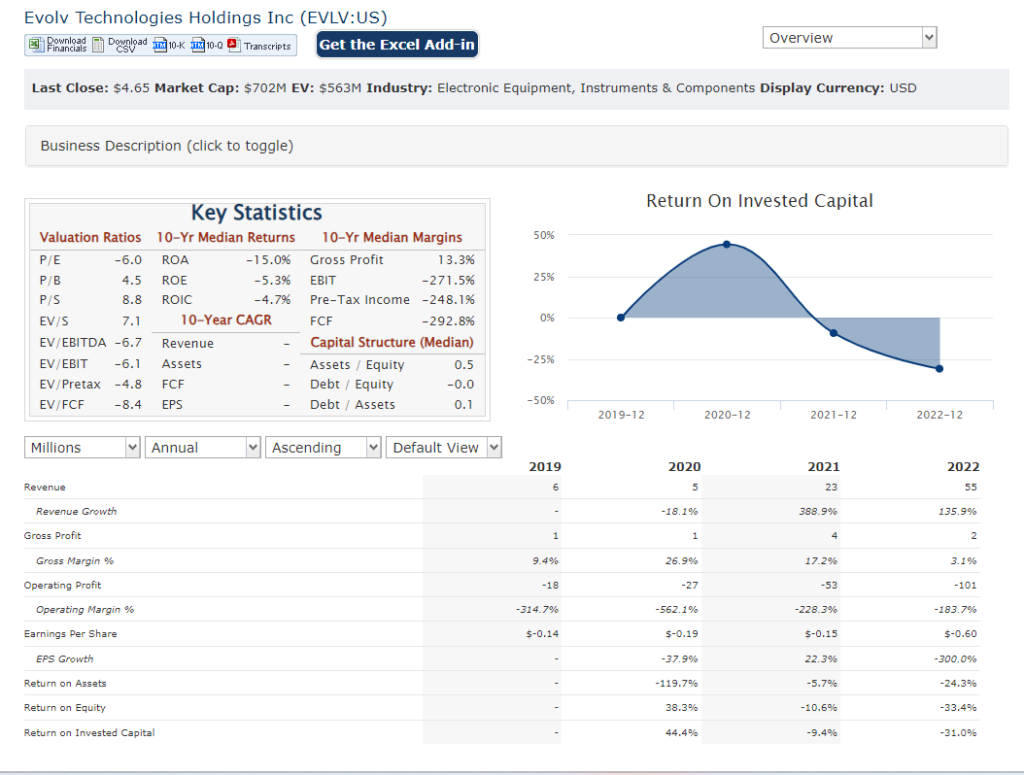

Evolv’s financial performance over the past five years paints a picture of exponential growth and promising momentum. Let’s dive into the key metrics:

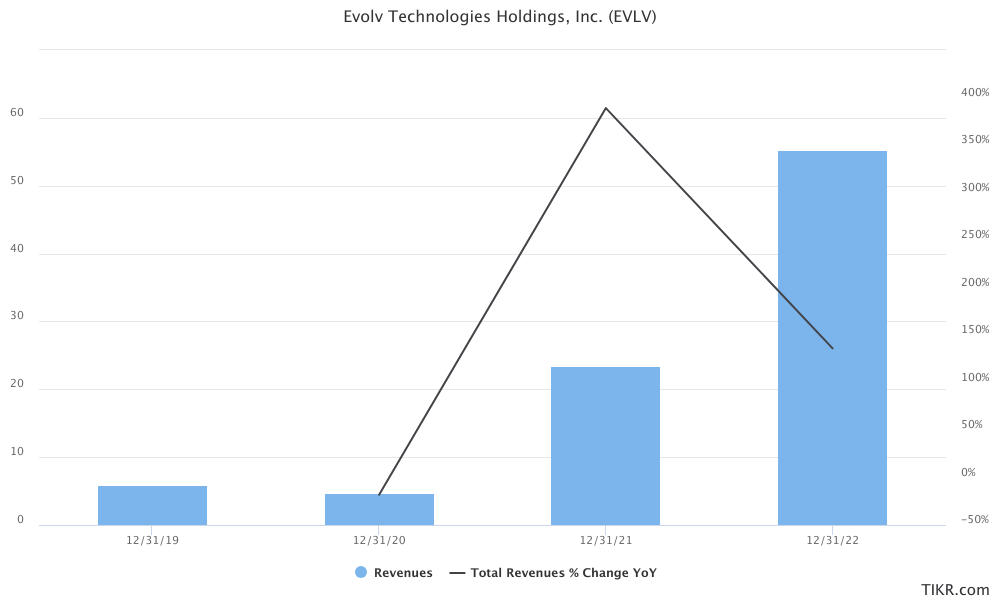

Revenue: The company has witnessed a meteoric rise in revenue, growing from a mere $2.3 million in 2018 to an impressive $55.2 million in 2022. This translates to a CAGR of 136%, showcasing Evolv’s rapid market penetration and increasing customer base.

Earnings: While Evolv remains in a growth phase and focuses on market expansion, its earnings picture shows steady progress. Net loss has contracted from $(10.9) million in 2021 to $(86.2) million in 2022, with a CAGR of -51.8%. While significant, this decrease is mainly due to increased investments in R&D and infrastructure to fuel long-term growth.

Balance Sheet: Evolv’s balance sheet reflects its commitment to investment and future expansion. Cash and equivalents reached $151.7 million by year-end 2022, a substantial increase from $22.7 million in 2018. This healthy cash position provides the company with ample resources to navigate future growth and potential acquisitions.

Technical Analysis:

On the monthly chart, the stock attempted a move out of the base, only to fall back into the $4 to $5 range. On the weekly chart, the stock has a head and shoulders pattern from August 2023, but is still range bound. On the daily chart, the stock has strong resistance at the $5 mark and strong support in the $4 mark. While volume is high, the stock is near all its (flat) moving averages.

Bull Case:

The Bull Case for Evolv Technologies Holding Stock (EVLV)

Rapidly Growing Market: The global security screening market is expected to reach $55 billion by 2027, driven by rising security concerns, technological advancements, and increased demand for efficient screening solutions. Evolv positions itself perfectly within this burgeoning market, offering a cutting-edge solution for high-traffic venues.

Unique Technology Advantage: Evolv’s AI-powered Evolv Express® system stands out with its speed, accuracy, and user-friendly design, differentiating it from traditional metal detectors and attracting security-conscious institutions like major sports arenas and hospitals. This unique technology could become the industry standard.

Impressive Growth Trajectory: Evolv has demonstrated explosive revenue growth, averaging over 130% annual increase in the past few years. This rapid adoption and expanding customer base signal promising future performance and potential market dominance.

Strong Leadership and Partnerships: The company boasts a seasoned leadership team with extensive experience in technology, security, and business development. Strategic partnerships with major institutions also lend credibility and expand market reach.

Data-Driven Insights and Innovation: Evolv’s Evolv Insights platform provides valuable data for optimizing security operations and improving safety. Their commitment to continuous R&D ensures further technological advancements and market leadership.

Positive Analyst Outlook: Analysts generally hold a positive outlook on Evolv, with many projecting continued revenue growth and improved financial performance in the coming years. This strengthens investor confidence and potentially attracts further investment.

Potential for Valuation Repositioning: While Evolv currently trades at a relatively high valuation compared to traditional security companies, its disruptive technology, rapid growth, and future market potential could justify a higher valuation in the future.

Bear case:

The Bear Case for Evolv Technologies Holding Stock (EVLV)

Competitive Landscape: The security screening market is fiercely competitive, with established players like Garrett Metal Detectors and emerging startups vying for market share. Evolv must excel in both technology and cost-effectiveness to maintain its edge.

Unproven Profitability: Despite impressive revenue growth, Evolv is yet to turn a profit. This raises concerns about the company’s ability to generate sustainable returns for investors, especially with continued investments in R&D and market expansion.

High Valuation: Compared to traditional security companies, Evolv trades at a relatively high valuation. This exposes investors to potential downside risk if revenue growth decelerates or profitability doesn’t materialize as expected.

Technological Dependence: Evolv’s success is heavily reliant on its proprietary AI technology. Any bugs, malfunctions, or security vulnerabilities could damage its reputation and market trust, impacting stock price.

Limited Adoption Beyond Specific Market: While Evolv excels in high-traffic venues like stadiums and schools, its application in other sectors like airports or government buildings might face challenges due to cost or security regulations.

Macroeconomic Volatility: Economic downturns or security concerns could impact Evolv’s market, potentially slowing down sales and hindering growth.

Dilution Due to Future Financing: As Evolv continues to invest and expand, future rounds of financing might dilute existing shareholder value.

Bearish Analyst Opinions: While most analysts are positive on Evolv, some express caution regarding its high valuation and lack of profitability, recommending a wait-and-see approach.