Executive Summary:

Capri Holdings Limited is a global fashion holding company known for its luxury brands. Founded in 1981 by Michael Kors, the company owns the Michael Kors brand alongside Versace and Jimmy Choo. They design high-end clothing, shoes, handbags and accessories and operate a network of retail stores worldwide. The company is also currently in the process of being acquired by Tapestry, owner of Coach and Kate Spade, for $8.5 billion.

In August 2023, Tapestry, Inc. (TPR), the parent company of Coach, Kate Spade, and Stuart Weitzman, announced plans to acquire Capri Holdings Limited (CPRI), the parent company of Michael Kors, Jimmy Choo, and Versace, for $8.5 billion. The deal would combine three close competitors and put six major brands under one company. The combined company was expected to generate over $12 billion in global annual sales and create cost synergies. However, on April 22, 2024, the U.S. Federal Trade Commission (FTC) sued to block the acquisition, arguing that it would eliminate direct competition between the brands.

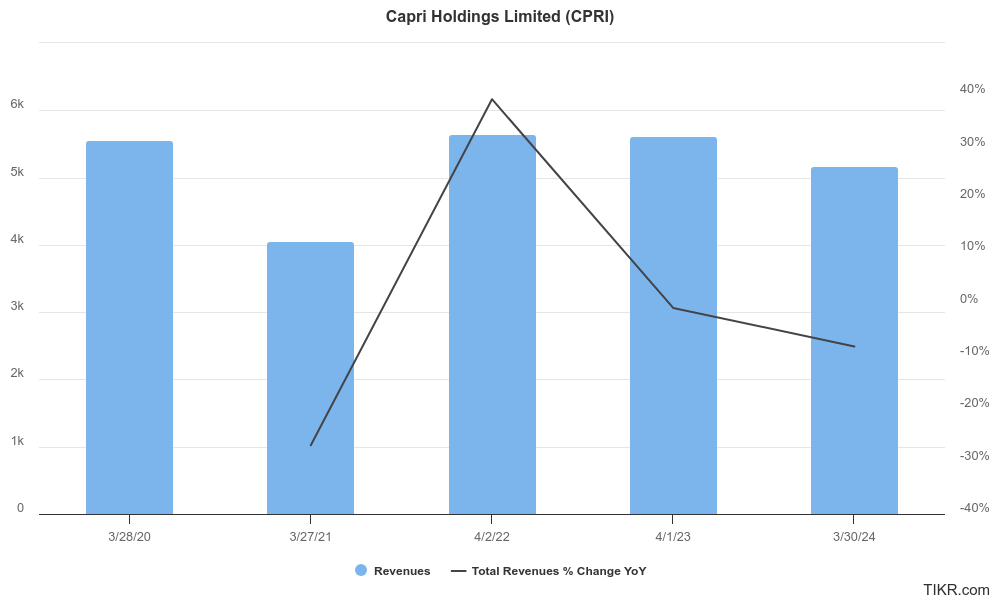

Capri Holdings Limited revenue for the quarter was $1.223 billion, an 8.4% decrease compared to the same period last year. Earnings per share (EPS) were a loss of $4.03, significantly lower than analyst expectations of $0.65.

Stock Overview:

| Ticker | $CPRI | Price | $34.02 | Market Cap | $3.96B |

| 52 Week High | $54.52 | 52 Week Low | $33.76 | Shares outstanding | 116.56M |

Company background:

Capri Holdings Limited is a multinational fashion holding company founded by American designer Michael Kors. Though headquartered in London, with executive offices there and operational offices in New York, Capri Holdings is a global company. They sell these products through their own retail stores around the world, as well as through wholesale channels.

Capri Holdings is the parent company to three luxury brands: Michael Kors, Versace, and Jimmy Choo. Each brand retains its own unique identity and design aesthetic, but all share a focus on luxury and glamour.

Recent Earnings:

Capri Holdings Limited reported revenue came in at $1.223 billion, reflecting an 8.4% decrease compared to the prior year. Earnings per share (EPS) were a significant disappointment, landing at a loss of $4.03 per share. This stands in stark contrast to analyst expectations of $0.65 EPS, highlighting a substantial miss.

Capri Holdings’ gross margin remained relatively stable at 62.7%, compared to 64.9% in the previous year. This suggests some ability to maintain profitability on their sales.

The Market, Industry, and Competitors:

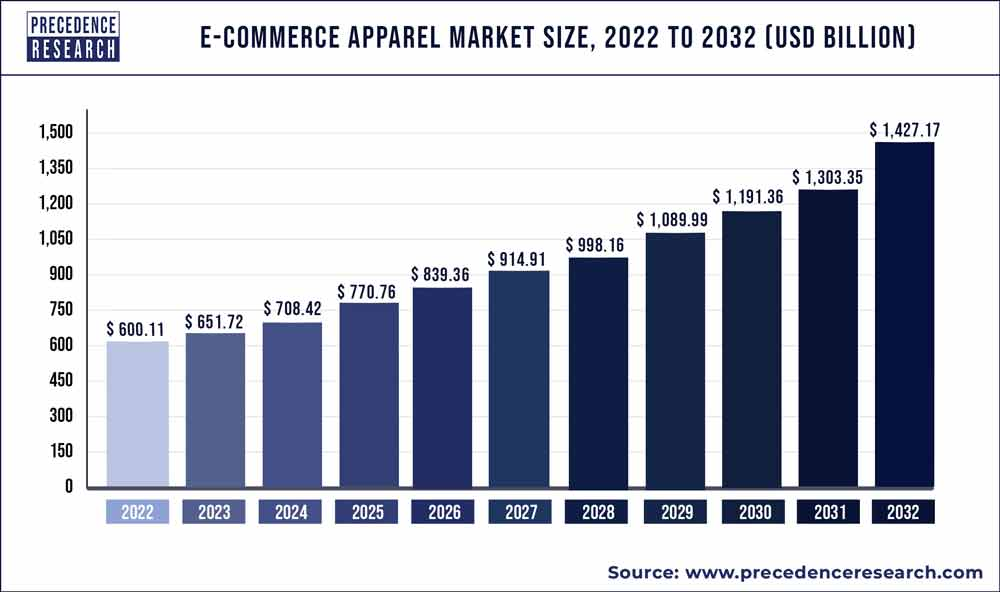

Capri Holdings Limited operates in the global luxury fashion market. This market is characterized by high-end products, brand prestige, and a focus on wealthy consumers. The market has seen strong growth in recent years, driven by factors such as rising disposable income in emerging economies, increasing demand for online luxury goods, and a growing millennial and Gen Z consumer base with a taste for luxury. Analysts expect this trend to continue, with the global luxury fashion market projected to grow at a Compound Annual Growth Rate (CAGR) of around 5-7% in the coming years.

The company’s future performance will likely be influenced by its ability to capitalize on the growth trends in the broader luxury fashion market. Success will depend on factors such as effectively marketing to younger demographics, leveraging e-commerce channels, and maintaining a strong brand image. The upcoming acquisition by Tapestry presents both opportunities and challenges.

Unique differentiation:

Large luxury conglomerates: These include giants like LVMH (Moët Hennessy – Louis Vuitton), Kering, and Richemont. These conglomerates own a vast portfolio of luxury brands across various fashion categories, footwear, jewelry, and accessories. Their size and brand portfolio allow for economies of scale and a wider customer reach.

Direct brand competitors: Companies like Ralph Lauren, Burberry, and Moncler compete directly with Capri Holdings’ brands in specific segments. Ralph Lauren might be a competitor for Michael Kors in the menswear category, while Burberry could compete with Jimmy Choo in luxury shoes.

Emerging competitors: Selain similar brands targeting a similar customer demographic, Capri Holdings needs to be mindful of rising stars and niche players in the luxury space. These could be smaller, digitally native brands that resonate with younger consumers or established fashion houses expanding their luxury offerings.

Multi-brand portfolio: Unlike conglomerates with a wider range of luxury goods, Capri focuses on a curated selection of strong brands with distinct identities. Michael Kors offers accessible luxury, Versace delivers Italian glamour, and Jimmy Choo specializes in high-end footwear. This allows them to cater to a broader range of luxury preferences within a specific price segment.

Heritage and craftsmanship: While some competitors might emphasize trendsetting designs, Capri leverages the heritage and design legacy of acquired brands like Versace and Jimmy Choo. This focus on heritage and craftsmanship can position them as purveyors of timeless luxury pieces.

Global reach with operational focus: Headquartered in London with operational centers in major fashion hubs like New York, Capri benefits from a global presence. However, compared to some sprawling conglomerates, their operational focus might be more streamlined, allowing for faster decision-making and potentially better control over brand consistency.

Management & Employees:

John D. Idol (Chairman and Chief Executive Officer): Since 2003, Idol has been the driving force behind Capri Holdings’ growth, having previously held leadership positions at Donna Karan and Ralph Lauren.

Thomas J. Edwards Jr. (Executive Vice President, Chief Financial Officer and Chief Operating Officer): Edwards brings extensive financial expertise to the table, with prior experience at Wyndham Worldwide and Brinker International.

Jenna A. Hendricks (Senior Vice President, Chief People Officer): Hendricks has climbed the ranks within Capri Holdings since 2004, overseeing human resources functions and leading the people strategy.

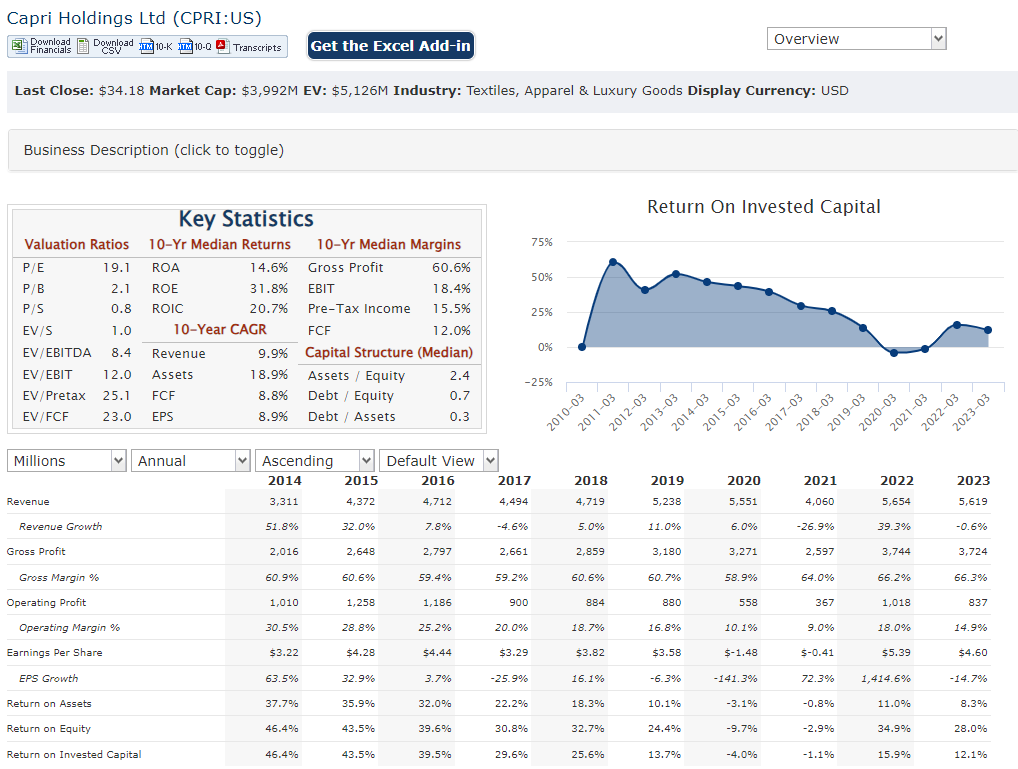

Financials:

Reports indicate a decline in revenue for the most recent fiscal year ending. Looking at analyst reports, it appears Capri Holdings experienced some growth years, but the overall Compound Annual Growth Rate (CAGR) for revenue might be in the low single digits.

Earnings growth has been more volatile. The company did experience profitable years, but also reported net losses, particularly in the most recent quarter. Calculating a CAGR for earnings would likely be difficult due to the fluctuations.

The company’s balance sheet might show some fluctuations in assets and liabilities, potentially reflecting acquisitions or impairments.

Capri Holdings appears to be a company navigating a competitive landscape. Their ability to maintain revenue growth and improve profitability will be key factors in their future success.

Technical Analysis:

On the monthly and weekly chart, the stock is on a downtrend and markdown phase (stage 4 decline, bearish). While there was the formation of a bull flag, it broke down in the $44 range, and now is looking for support and reversal at athe $25 – $30 range. We would not be buyers yet, given the FTC has sought to block the merger with Coach.

Bull Case:

Growth Potential in Luxury Market: The global luxury fashion market is expected to keep growing in the coming years, driven by factors like rising disposable income and a growing millennial/Gen Z luxury consumer base. Capri Holdings is well-positioned to benefit from this trend with its strong brands.

Tapestry Acquisition Potential: The merger with Tapestry, owner of Coach and Kate Spade, could create a stronger competitor with a wider brand portfolio and economies of scale. This could lead to increased profitability and market share.

Undervalued Potential: Some analysts believe Capri Holdings might be undervalued, especially considering the potential of the Tapestry merger. If the company can deliver on its growth prospects, the stock price could rise.

Bear Case:

Brand Fatigue: Some argue that Capri Holdings’ brands, particularly Michael Kors, might be facing fatigue among luxury consumers. They might need to innovate and refresh their brand image to stay relevant.

Vulnerability to Economic Downturn: Luxury goods are often seen as non-essential purchases. If there’s an economic downturn, consumers might tighten their belts, leading to a decline in sales for Capri Holdings.

Dependence on Wholesale Channel: Capri Holdings relies heavily on the wholesale channel for sales. However, this channel is facing pressure from online retailers and could become less profitable in the future.