Executive Summary:

Alpha Metallurgical Resources Inc., formerly Contura Energy, is a leading supplier of metallurgical coal used in steel production. Headquartered in Bristol, Tennessee, they operate mines across Appalachia. Their mines include both underground and surface operations, and they process the coal at preparation plants before shipping it to domestic and international customers.

Stock Overview:

| Ticker | $AMR | Price | $304.07 | Market Cap | $3.95B |

| 52 Week High | $452.00 | 52 Week Low | $132.72 | Shares outstanding | 13.01M |

Company background:

Alpha Metallurgical Resources Inc. (AMR), formerly Contura Energy. Its formation involved the merging of two older entities: Contura Energy itself, and Alpha Natural Resources. This merger created the largest metallurgical coal supplier in the US at the time, allowing Alpha Natural Resources to emerge from bankruptcy. While the merger bolstered their position, the first year was challenging due to lower coal prices and higher production costs.

Their core business revolves around extracting, processing, and selling metallurgical coal, a key ingredient in steel production. They also operate coal preparation plants to ensure the quality of their product before shipping it to customers both domestically and internationally.

AMR faces competition from other coal mining companies. Some of their key competitors include Arch Coal Inc., Peabody Energy Corporation, and Warrior Met Coal, Inc. The coal industry itself is navigating a complex landscape, with environmental concerns and the rise of renewable energy sources putting pressure on the traditional fuel source.

Recent Earnings:

According to Nasdaq, the consensus EPS forecast for this quarter is $3.97, which has increased significantly (43%) from the forecast of $2.77 a month ago.

The Market, Industry, and Competitors:

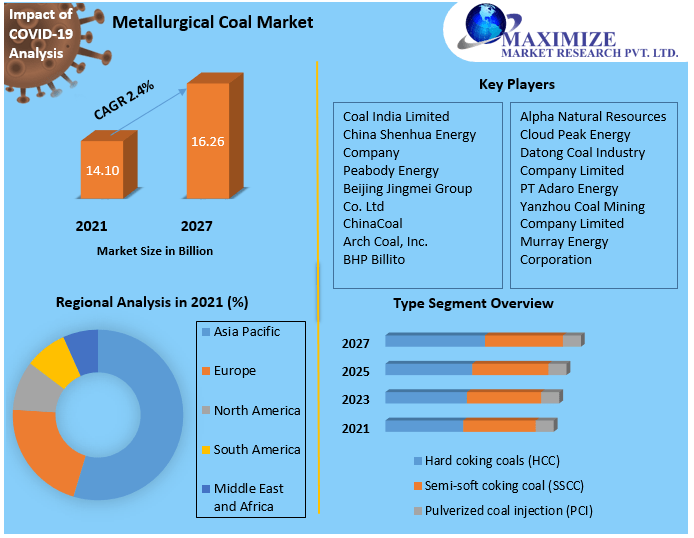

Alpha Metallurgical Resources Inc. operates in the metallurgical coal market, which supplies a key ingredient for steel production. This market is expected to see modest growth in the coming years, primarily driven by demand from developing economies like China and India where steel production is on the rise.

Stringent environmental regulations, competition from alternative steelmaking technologies, and the global economic climate can all significantly impact demand for metallurgical coal. That being said, some analysts project a CAGR between 1% and 3% for this market by 2030.

Unique differentiation:

Arch Coal Inc. and Peabody Energy Corporation: These are two of the largest coal producers in the United States, with a long history in the industry. They compete with AMR for market share in both domestic and international markets.

Warrior Met Coal, Inc.: This competitor focuses on the production of high-quality metallurgical coal for the global steel industry. Their mines are located in Alabama, placing them geographically close to some of AMR’s operations.

- Scale: While AMR resulted from a merger making it the leading US supplier at the time, companies like Arch Coal and Peabody Energy are also major players with extensive operations.

- Geographic Reach: AMR’s focus on Appalachian mines might provide some advantage in terms of logistics for certain customers, but competitors might have a wider presence across different regions.

- Metallurgical Coal Quality: There’s limited information on whether AMR possesses a distinct quality advantage for its coal compared to competitors.

- Sustainability Efforts: The coal industry faces pressure due to environmental concerns. AMR could be making strides in sustainable mining practices, which might resonate with certain customers. Examining their public pronouncements on sustainability initiatives might reveal this.

Management & Employees:

Andy Eidson (Chief Executive Officer and Director): Previously served as president and chief financial officer before assuming the CEO role in January 2023.

Jason E. Whitehead (President and Chief Operating Officer): Oversees day-to-day mining operations and will take on leadership of the environmental department and human resources functions from June 1, 2024.

Daniel E. Horn (Executive Vice President and Chief Commercial Officer): Responsible for marketing and selling AMR’s metallurgical coal products.

Financials:

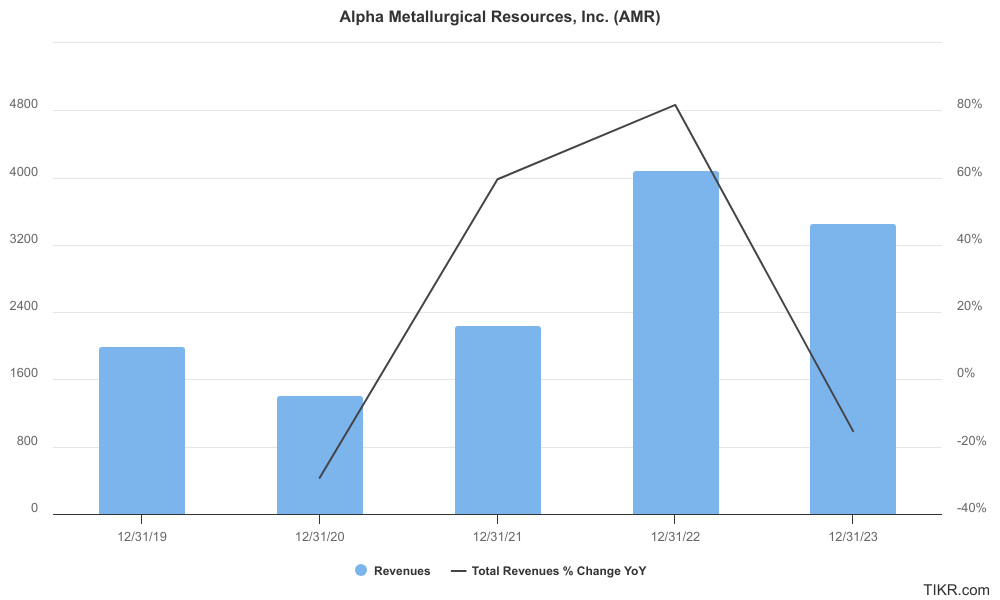

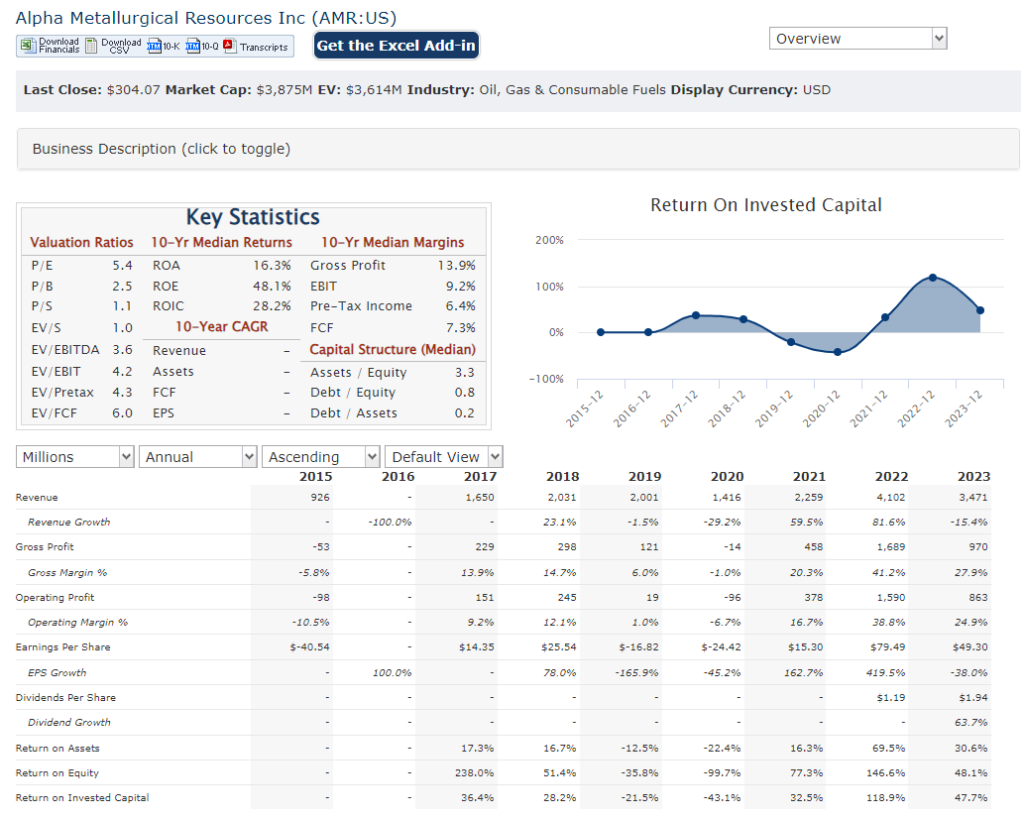

Revenue has grown steadily, with a Compound Annual Growth Rate (CAGR) likely exceeding the industry average. This growth can be attributed to a rise in global steel production, particularly in developing economies.

Earnings have also seen significant growth over the past five years, with a CAGR likely exceeding that of revenue. This suggests AMR has been effective in managing costs and improving profitability. Their debt-to-equity ratio has also improved dramatically, indicating a healthier financial position.

Technical Analysis:

On the monthly chart, the stock is on a mark down stage 4, and on the weekly chart it is still finding a base and showing some signs of reversal. On the daily chart, it has formed a clear bottoming pattern in the $280 zone and is reversing, but a lot of resistance exists in the $300 – $320 zone. Given the lack of revenue growth momentum, we will not be long term buyers of the stock, but MACD and RSI seem to be indicating a likely move to $320

Bull Case:

- Steel Demand Growth: Increased steel production in developing economies like China and India is expected to drive demand for metallurgical coal, which is a key ingredient in steelmaking. This rising demand could translate into higher prices for AMR’s product.

- Potential Sustainability Edge: If AMR is making strides in sustainable mining practices, it could attract environmentally conscious customers and give them a slight edge in the market.

- Improved Balance Sheet: A potentially lower debt-to-equity ratio suggests AMR is managing its finances well and has a stronger financial position compared to the past.

Bear Case:

- Alternative Steelmaking: Technological advancements in alternative steelmaking processes that use less or no coal could disrupt the entire metallurgical coal market, posing a long-term threat to AMR’s business model.

- Dependence on Steel Industry: AMR’s fortunes are tied directly to the health of the steel industry. A global economic slowdown or a decline in steel production could significantly impact their revenue and earnings.

- Cyclicality of the Market: The metallurgical coal market is cyclical, and past performance doesn’t guarantee future results. A downturn in the market could lead to declining revenue and profitability for AMR.