Executive Summary:

FTAI Aviation Ltd. is a company that specializes in supplying and leasing high-quality jet engines and commercial aircraft. They focus on making the aircraft maintenance process easier for their clients by offering solutions that control costs and minimize downtime. Their “Module Factory” is a dedicated center that repairs and refurbishes CFM56 jet engines. They are headquartered in the United States and are a subsidiary of Fortress Transportation.

FTAI Aviation Ltd.’s EPS of $0.44, which is a 4.76% increase over analyst expectations.

Stock Overview:

| Ticker | $FTAI | Price | $78.48 | Market Cap | $7.87B |

| 52 Week High | $81.40 | 52 Week Low | $27.29 | Shares outstanding | 100.25M |

Company background:

FTAI Aviation Ltd. isn’t an independently founded company, but rather a subsidiary of Fortress Transportation and Infrastructure Investors (FTII). FTII, a US-based corporation founded in 2011, owns and operates various subsidiaries across transportation and infrastructure sectors, with FTAI Aviation being their aviation branch.

FTAI Aviation itself wasn’t founded in the traditional sense, its operations began in December 2022 through a merger between FTII and another company. Their core business focuses on supplying and leasing high-quality jet engines, specifically the CFM56 model, to airlines.

FTAI Aviation operates through two segments: Aviation Leasing and Aerospace Products. Leasing allows airlines to access the engines they need without the high upfront costs of purchase. The Aerospace Products segment involves repairs, sales, and even some development of aircraft engine parts through collaborations. Their main competitors would likely be other companies specializing in jet engine leasing and maintenance services.

Recent Earnings:

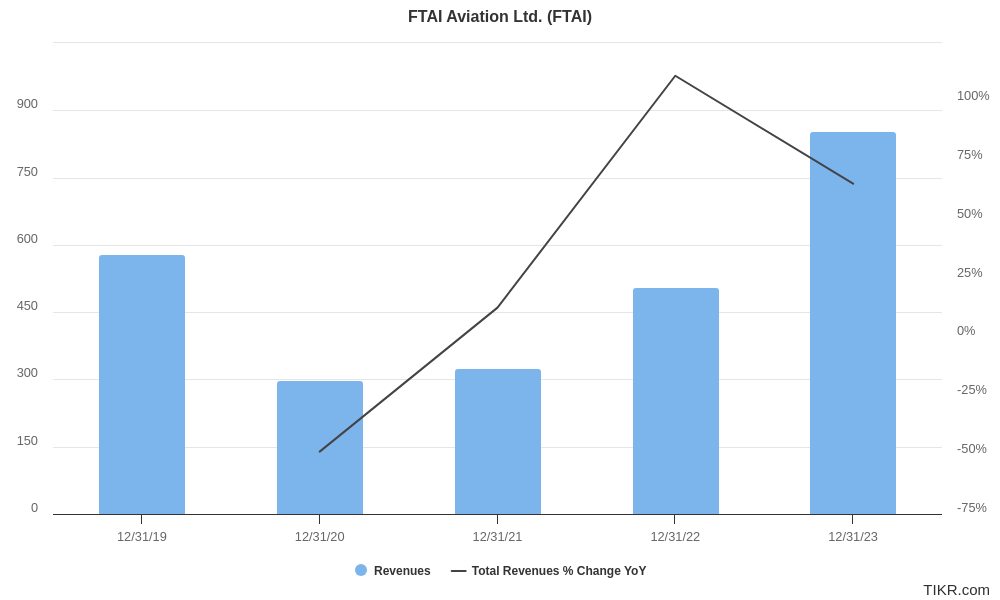

FTAI Aviation’s EPS (earnings per share) reached $0.44 for the quarter, exceeding analyst expectations by 4.76%. This represents a significant increase year-over-year as well, with Q4 2023’s EPS hitting $1.09.

The Market, Industry, and Competitors:

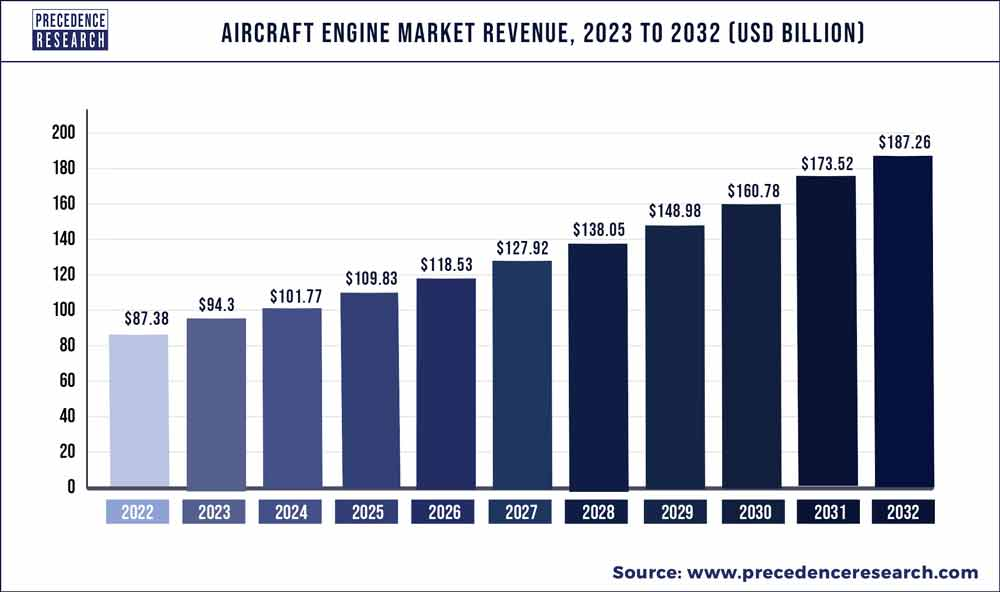

FTAI Aviation Ltd. operates in the commercial jet engine leasing and maintenance market. The rise in global air travel is a major driver, as airlines require more engines to service their routes. This demand is coupled with a preference for leasing over outright purchase, due to the cost-effectiveness and flexibility it offers.

Industry analysts predict a healthy Compound Annual Growth Rate (CAGR) for this market and CAGR around 5.8% by 2030. This growth reflects the overall health of the commercial aviation industry and the increasing role leasing plays within it.

Unique differentiation:

Large, Diversified Aerospace Companies: These include companies like CAE Inc. (CAE) and Leonardo DRS (DRS) who offer a broader range of aerospace products and services beyond just engines. They may have an advantage in terms of brand recognition and established customer relationships, but FTAI Aviation might counter with a focus on efficiency and cost-control specifically for engine leasing and maintenance.

Specialized Leasing Companies: FTAI Aviation also competes with companies like AerSale Corporation (AER) and Avolon Aerospace Leasing Limited (AVOL) whose core business directly parallels theirs. These companies focus solely on leasing jet engines and related components, making them direct competitors for contracts with airlines.

Manufacturers: Engine manufacturers like Rolls-Royce Holdings plc (RYCEY) and Pratt & Whitney (UTX) might also be considered competitors, although not in the traditional sense. While airlines can potentially purchase engines directly from them, FTAI Aviation offers leasing as an alternative, potentially undercutting manufacturer sales and influencing airline decisions.

Focus on Efficiency and Cost-Control: While larger competitors might offer a wider range of aerospace services, FTAI Aviation appears to specialize in streamlining the jet engine leasing and maintenance process for airlines. This focus could translate into cost-effective solutions for airlines, making FTAI Aviation an attractive option.

“Module Factory” for Engine Maintenance: FTAI Aviation boasts a dedicated center, the “Module Factory”, specifically designed for repairing and refurbishing CFM56 jet engines. This in-house expertise might allow them to deliver faster turnaround times and potentially lower maintenance costs for airlines compared to competitors who outsource such services.

Management & Employees:

Joseph P. Adams Jr.: Chairman of the Board and Chief Executive Officer. He also holds these positions at FTAI Infrastructure Inc. (Nasdaq: FIP), a sister company. Adams brings extensive experience in the transportation industry, having served on the boards of directors for various transportation companies and previously working in investment banking focused on transportation.

Eun (Angela) Nam: Chief Financial and Accounting Officer. Nam’s background lies in private equity and investment banking. Before joining FTAI Aviation, she held a senior role at Fortress Investment Group, the parent company of FTAI Aviation, where she was involved in mergers and acquisitions within the transportation sector.

Financials:

FTAI Aviation seems to be experiencing positive earnings growth. Their Q1 2024 EPS of $0.44 exceeded analyst expectations and signifies a significant year-over-year increase compared to Q4 2023.

The commercial jet engine leasing and maintenance market, which FTAI Aviation operates in, is anticipated to have a healthy Compound Annual Growth Rate (CAGR) of around 5.8% by 2030. This industry growth, coupled with FTAI Aviation’s focus on cost-effective leasing and their dedicated “Module Factory” for engine maintenance.

Technical Analysis:

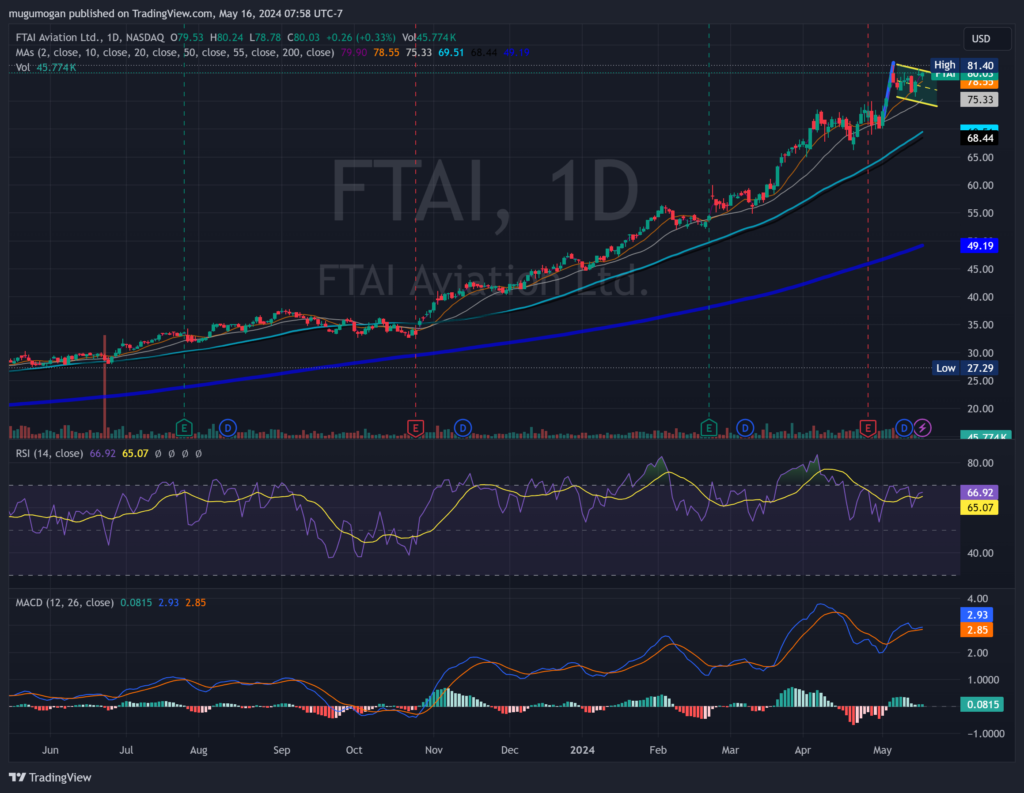

The stock has been on a stage 2 markup for the longest time and has been a terrific stock to own long term. It has little volatility, compounds over time and is consistent. On the daily chart a pullback to the 20 day Moving average at $75 would be a great entry for the long term.

Bull Case:

Industry Growth: The commercial jet engine leasing and maintenance market is expected to experience significant growth in the coming years, driven by rising global air travel and a preference for leasing over purchasing engines [MARKET FOR COMMERCIAL JET ENGINES, ADVANTAGES OF LEASING JET ENGINES]. This rising tide could lift all boats, including FTAI Aviation.

Analyst Optimism: Recent analyst ratings, such as RBC Capital assigning an “Outperform” rating and a price target of $85, suggest confidence in the company’s future.

Bear Case:

Hidden Costs: While FTAI Aviation emphasizes cost-control, there might be hidden fees or additional expenses associated with their leasing and maintenance services that could negate the initial perceived advantage for airlines.

Dependence on “Module Factory”: Their “Module Factory” seems to be a key differentiator, but any disruptions or delays within that facility could significantly impact their engine maintenance turnaround times and potentially damage their reputation with airlines.

Parent Company Reliance: As a subsidiary of Fortress Transportation and Infrastructure Investors, FTAI Aviation’s success is somewhat tied to the parent company’s overall performance and strategic decisions.